Long ago, I was a bond and foreign exchange trader. During U.S. Treasury auctions , I remember we would discuss a question every few months: "What is China's bid?" The reference was whether the People's Bank of China (PBOC) would be a buyer at this auction. Looking back, I don't even remember if this actually affected any of the auctions I observed, but the takeaway from it was that there might be a day when the PBOC would not buy at an auction, and at that point the U.S. Treasury might be in trouble.

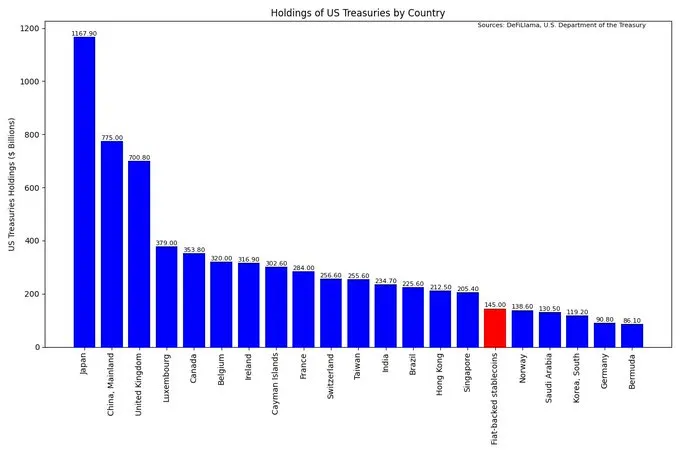

I didn’t think about this question again until I saw the following chart recently:

Source of the chart can be found here .

You don’t need to look far to see what this means. The crypto world may have accidentally designed a system that could strengthen the dollar’s position as a reserve currency. Here’s why.

Bitcoin maximalists often state:

- The US government (and most governments) have borrowed too much and printed too much money.

- This behavior is stealing wealth from the future.

- Ultimately, this behavior will lead to hyperinflation and devalue the dollar.

- When this happens, the dollar will be in free fall.

- Therefore, holding Bitcoin is a hedge against points 1 to 4 above.

I personally think that the USD behaves strangely relative to other currencies due to its reserve currency status and some other factors (e.g., not much else has liquidity comparable to the USD market, so if you're operating at a certain scale, the USD is hard to avoid), but I really don't know much about these dynamics, and I'm not particularly deep into them.

In addition, another macro perspective I learned from the business news is:

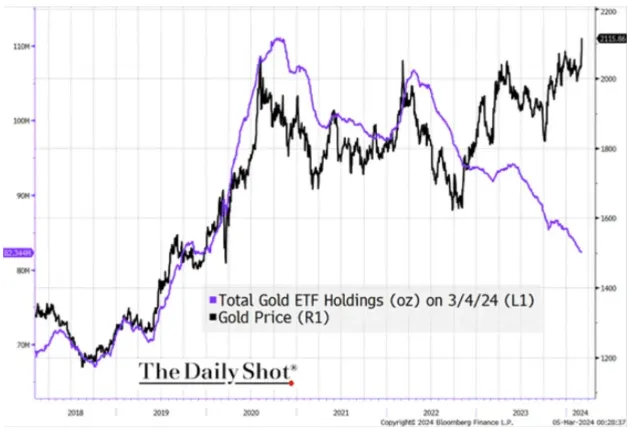

- The world is becoming more multipolar/less integrated every day

- For this reason (and others), China (and probably some other governments) is less interested in holding US Treasuries (and therefore buying more gold), which partly explains why spot gold prices are at all-time highs while ETF gold holdings are falling.

While I don’t have a good argument for why this macro theme is happening, many data points suggest it is true. However, I think there is another interesting thing happening with cryptocurrencies, which is actually a balancing act. Fundamentally, the demand for USD from non-US individuals and businesses far exceeds the supply. For non-US individuals, USD is generally a more stable way to save than local currency, and is difficult to access with local banks. For non-US businesses, about 40% of cross-border trade is still settled in USD. Most wealthy individuals in developing countries generally move their excess savings to the US/UK/Europe. Cities like London, Vancouver, and New York have real estate markets that reflect demand for USD-denominated assets. USD is difficult for non-wealthy individuals in developing countries to access, and this demand has been pent up for decades. I’ve talked about this before.

Stablecoins in emerging markets

The “digital gold” hype of cryptocurrencies (i.e., cryptocurrencies can hedge against inflation, and their permissionless nature allows consumers to protect their wealth from being confiscated by local governments) is more true for stablecoins (a type of cryptocurrency pegged to a reserve currency such as the U.S. dollar) than for Bitcoin. Furthermore, given that the largest proportion of fiat stablecoins are backed by the U.S. dollar, stablecoins are not very useful as an inflation hedge for U.S. citizens.

In a country with poor monetary management, a person might theoretically own Bitcoin for speculative purposes at some stage. However, Bitcoin’s volatility has so far made it impractical as a store of value, because you can’t be sure how much value it will provide you when you actually need to use it. In other words, in emerging markets, ordinary people don’t have enough excess savings to withstand Bitcoin’s volatility in case they need it. This makes Bitcoin a very expensive and inefficient store of value in the short term. In contrast, before the advent of cryptocurrencies, it was (and still is) fairly common for rich people in poor countries to hold foreign currency (usually dollars, pounds, or euros) as a mechanism for saving. As a market maker, I used to think (and still think) that a good heuristic for judging a country’s economic trajectory is “where do the rich in this country put their wealth?” Wherever wealth is exported (for example, if your country’s move after you get rich is to immediately buy real estate in New York or London), it is a signal that citizens are afraid of having their wealth taken away, either explicitly or indirectly through printing money.

Governments hate doing this because it creates natural selling pressure on their currencies and puts assets beyond their reach to some extent. However, fiat-backed stablecoins pegged to the dollar or euro (real assets under management) are permissionless and are actually beyond the ability of local governments to prevent you from buying them, making them an alternative to digital assets with real use cases that already exist. Before stablecoins, you had to buy dollars from a bank and keep them in a bank account (which has its merits), but banks can also

a) refuse to sell it to you;

b) charge you substantial purchase/holding fees;

c) Being forced by the government to trade at a false exchange rate or limit the amount you can buy or own.

Even in today's environment, if you are in the US, you should try going to your local US bank or logging into your Chase mobile app and try to buy some Euros and you will see how unsupported this is.

Basically, everyone around the world wants access to a relatively stable currency to denominate their savings, one that has a predictable exchange rate against the goods and services they buy every day. For most people today (2024), the US dollar and the euro are more stable than their national currencies. Stablecoins backed by dollars (or pounds, euros, take your pick) are a permissionless way to do this. The loudest voices in the crypto space have no incentive to tell you this, because USDC isn’t going to make them rich. Ironically, stablecoins actually help solve runaway hyperinflation scenarios, while Bitcoin simply lets users trade the hyperinflation of their national currency for the volatility of cryptocurrency. This doesn’t mean Bitcoin doesn’t have uses, it just means that if you really need to access your savings at a time you can’t predict, then Bitcoin is a terrible way to save.

The weirdest unintended consequence

Stablecoins are turning retail investors/citizens/savers around the world into implicit buyers of US Treasuries . Here’s why:

- Stablecoins allow people outside the US to hold USD in a permissionless way that their governments can’t control and their banks would never easily provide, and (in some cases) earn interest in USD. The poorer you are, the harder it is to get USD. And this is just the beginning — stablecoins are only beginning to be used for non-crypto use cases, such as replacing SWIFT transactions and other cross-border SME payments (which is what Bridge does). I can only imagine that demand will continue to rise as offline use of stablecoins expands.

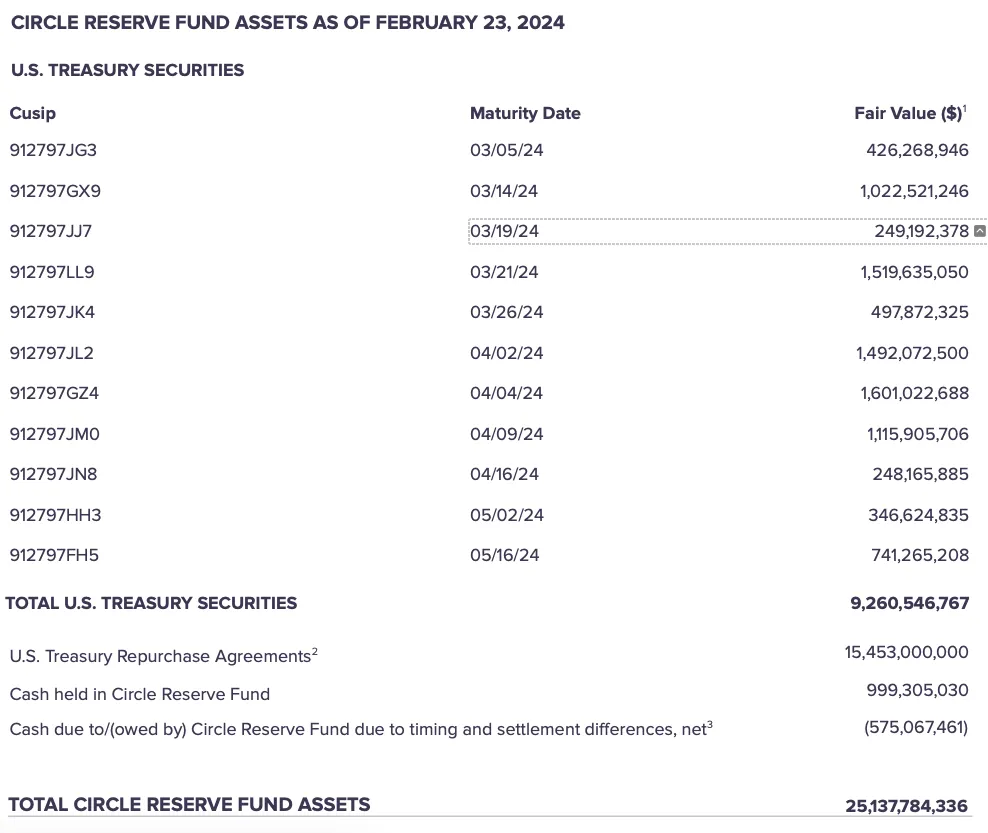

- Well-managed stablecoins basically have to hold the most stable + liquid securities, which are basically US Treasuries. For example, as of February 2024, most of USDC holds US Treasuries + repo + cash:

- Therefore, the demand for treasuries increases linearly due to the demand for stablecoins themselves.

- This basically means that about 90% of the demand for stablecoins will lead to demand for Treasuries in some way.

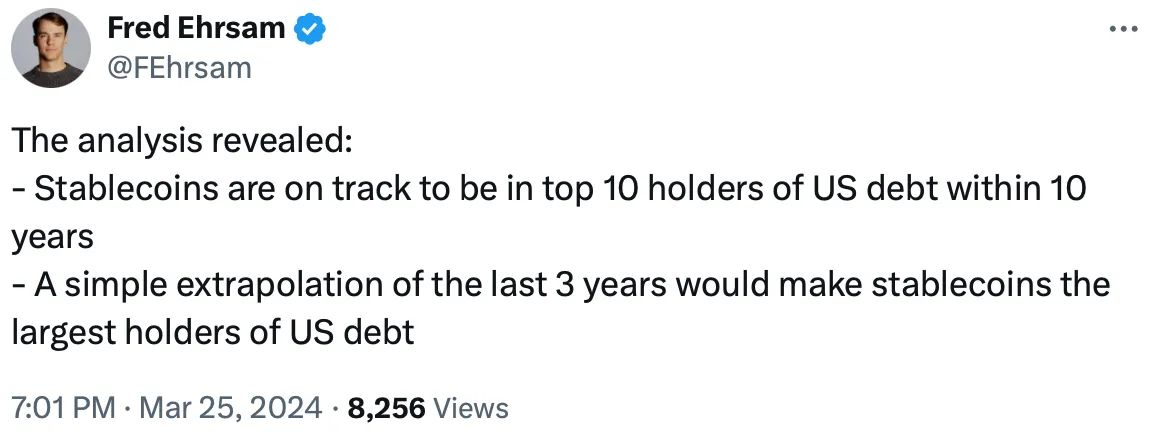

From a weird perspective, it’s almost easier to buy stablecoins that are a layer on Treasuries than to buy the underlying Treasuries themselves. A 3x increase in stablecoins would put them in the top 5 holders of US Treasuries. So it’s not crazy that the growth of cryptocurrencies will help support the dollar as a reserve currency in the next generation.

The impact of these trends continuing or accelerating

If these trends hold, we can think of a few potential implications.

First, given that stablecoins are largely backed by treasuries — there are interesting contagion scenarios that we haven’t experienced before. For example, if retail holders try to redeem en masse, the hyperinflationary events that crypto evangelists fear could destabilize stablecoins and impact the broader cryptocurrency market.

Likewise, we could have a “dollar break” event, where because the stablecoin can be traded 24/7, but because the underlying treasuries are not traded 24/7, the stablecoin manager cannot produce real dollars fast enough (this could manifest as a depeg , resulting in the stablecoin trading at a discount in a panic, such as USDC trading at 85c during the SVB crisis ). Such an event could impact not only the cryptocurrency market, but also the money market fund category.

It's hard to say how this will play out, as the use of stablecoins in general and institutional adoption of cryptocurrencies in particular grows, the mechanisms for transferring assets between them will change. In a crisis, correlations between assets tend to be much higher than we would think in peacetime, and at this scale, by the time we find out how it's happening, it's already happening.

Second, Treasuries held in stablecoins, widely distributed to retail investors and monetized as part of margin by stablecoin “managers,” are far less likely to be used in a weaponized manner than Treasuries held by foreign central banks. As stablecoins grow and hold more Treasuries, they become less likely to be sold off en masse in times of conflict and negatively impact the U.S. government’s ability to fund itself, both because retail investors/savers everywhere are less likely to express their preferences by selling stablecoins (even if they are against USD) since their currencies are just as likely to be volatile, and because for stablecoin managers, earning yield is how they make money (e.g., Tether earned $1 billion in 2023 from Treasury yields ), so they have no inherent incentive to sell unless redemptions occur.

To put it another way, the decoupling of China and the associated restructuring of capital flows is generally considered detrimental to the dominance of the US dollar. However, the emergence of stablecoins runs counter to this trend and may ultimately strengthen the dominance of the US dollar and Treasury bonds. This is entirely due to liquidity and network effects. As the number of fiat-backed stablecoins grows, their liquidity will also increase (and the liquidity of the US dollar will also increase), and as more and more individuals hold US dollars (or US dollar biosimilars), the position of the US dollar will become more difficult to shake.

Third, the "flight to goodness" trade in times of conflict tends to favor reserve currencies (mostly USD in recent decades), but historically this shift has been most pronounced among institutional investors (partly because most market activity is institutional, and partly because bonds are hard for retail to access). In a world where USD is easily accessible to retail investors worldwide (via USDC/USDT), it's not crazy that a retail "flight to goodness" trade would emerge, with retail investors worldwide moving from a) crypto and b) national currencies to USDC because it's the first time ever that they can do so.

Finally, there are risks in emerging economies ceding monetary policy/sovereignty to their own individual savers. Capital controls are a tool often used by governments to combat currency debasement, and this is harder to do if your citizens can buy USDC/USDT directly. This means that if fiat-backed stablecoins continue to gain adoption, governments will eventually start to build some tools into their toolkit to at least track the adoption and use of stablecoins by their citizens, so that their capital controls continue to be effective.