Key Takeaways

•In the first edition of our “Macro Thinking” series, we examined the issues associated with stagflation and its impact on growth assets such as cryptocurrencies.

• While there are signs of slowing economic growth and persistent inflation, we believe concerns about stagflation may be exaggerated given strong domestic demand and slowing wage growth.

•There is a non-zero chance that interest rates will rise this year or that the Federal Reserve will not cut them, but these scenarios appear unlikely.

•The recent correction in the crypto market may not be entirely negative as it provides the market with more sustainable growth. Furthermore, despite the correction, the market is still up 38% year to date.

There have been concerns brewing in the market about the potential risk of stagflation in the U.S. Investors believe that persistent inflation and relatively disappointing economic growth indicate that the risk of stagflation is real. Is this a cause for concern?

In the first edition of our “Macro Thoughts” series, we delve into the drivers of economic growth and inflation and detail our thoughts on the impact on growth assets such as cryptocurrencies.

Stagflation 101: A policymaker's nightmare

Stagflation refers to an economic situation characterized by slow economic growth, high unemployment and persistent inflation. This situation is difficult to manage because traditional monetary policy can hardly deal with both inflation and unemployment at the same time. For example, lowering interest rates to stimulate consumer spending and investment usually boosts the economy and creates more jobs, but this can have the unintended consequence of causing inflation to rise further.

Recent economic data has heightened concerns about stagflation.

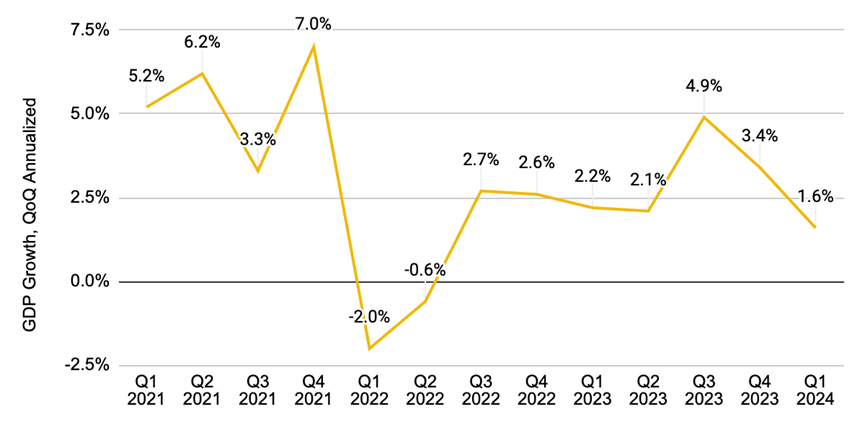

The latest data showed that the U.S. gross domestic product (GDP) grew 1.6% in the first quarter, far below analysts' expectations and close to the lowest level in two years.

Figure 1: US economy grew 1.6% in the first quarter

Source: Bureau of Economic Analysis. Data as of April 25, 2024.

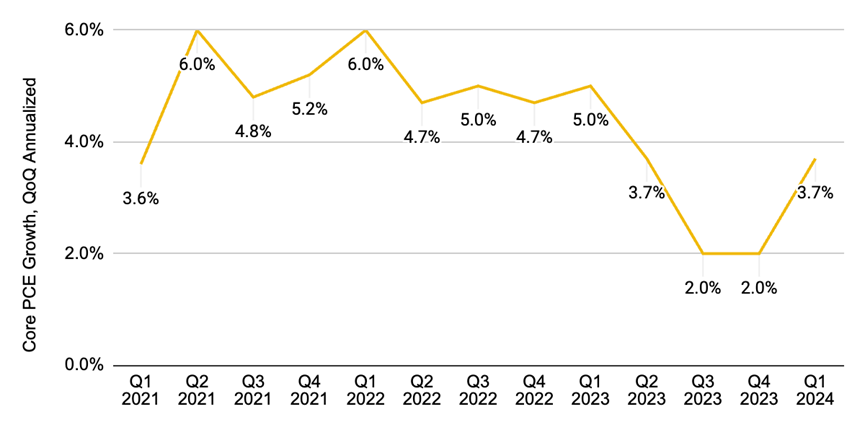

In addition, the core personal consumption expenditures ("PCE") price index, the Federal Reserve's ("Fed") preferred inflation measure, rose 3.7% in the first quarter. This was an acceleration from the 2% pace in the previous quarter and was also above the Fed's 2% target.

Figure 2: Inflation accelerated in the first quarter of this year

Source: Bureau of Economic Analysis. Data through April 26, 2024.

Fears of stagflation may be overblown

While recent economic data show signs of slowing growth and persistent inflation, the data do not tell the whole story.

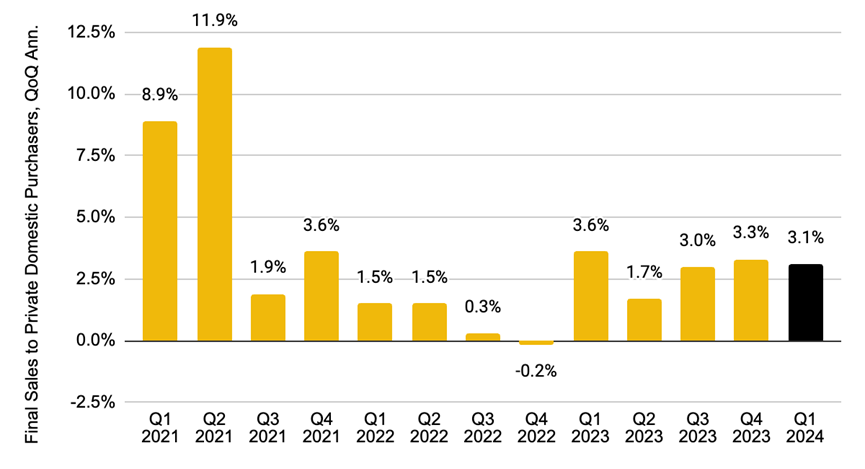

First-quarter GDP was below expectations, mainly due to volatility associated with an inventory build and a surge in imports. Trade and inventories tend to be volatile GDP components that are subject to revisions. However, domestic demand remained resilient - excluding inventories, trade and government spending, the domestic private economy grew 3.1%.

Figure 3: Domestic demand remained resilient in the first quarter

Source: Bureau of Economic Analysis. Data as of April 25, 2024.

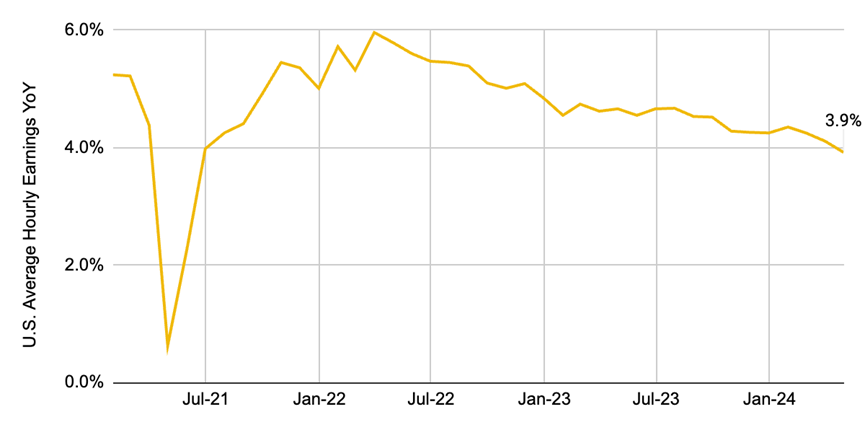

There are also signs that the labor market is cooling. Specifically, the latest jobs report showed average hourly earnings increased 3.9% in the 12 months through April, the slowest wage gain in nearly three years and the first time it has been below 4.0% since June 2021. While the unemployment rate rose slightly to 3.9% in April from 3.8% in March, it remained below 4% for the 27th consecutive month. Overall, the slowing pace of hiring and modest wage growth have reduced inflationary pressures and concerns about a potential wage-price spiral.

Figure 4: Wage growth slowed below 4% for the first time since June 2021

Source: U.S. Bureau of Labor Statistics. Data through May 3, 2024.

Potential signs of a slowing job market have raised hopes that the Fed may succeed in fostering a "soft landing" for the economy and reduce the likelihood of stagflation.

In a recent Fed press conference, Fed Chairman Jerome Powell pushed back on the idea of stagflation, saying he didn’t “really understand where [stagflation] came from” and didn’t “really see stagflation or inflation.”

So, what’s next?

Recent economic growth and inflation data have not been as good as the market initially expected, and some market participants have begun to suspect that the Federal Reserve may not cut interest rates at all this year, or even be forced to consider raising interest rates.

Spoiler alert: While the probability of either of these scenarios is not zero, we think they are impossible right now.

Let’s talk about the low hanging fruit – are rate hikes on the table?

Unlikely. Most Fed members insist that current rates are high enough and expect the next step to be a rate cut. Jerome Powell further reiterated in his latest press conference in May that "the next policy rate move is unlikely to be a rate hike."

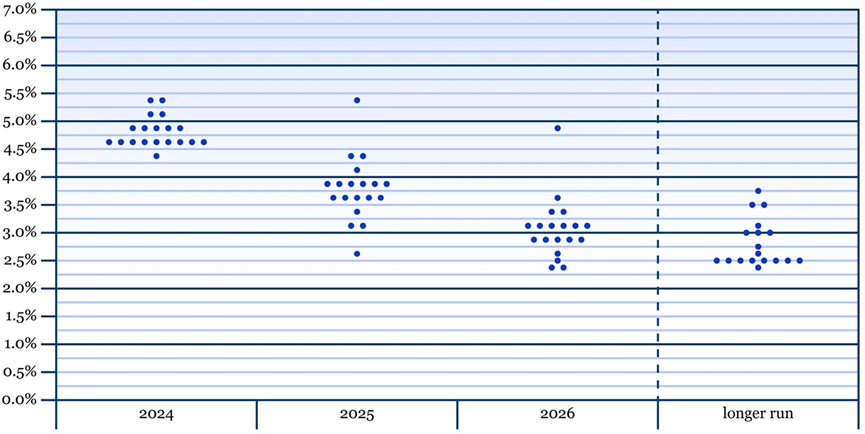

Figure 5: The FOMC dot plot shows that most Fed members expect the federal funds rate to fall this year

Source: Encyclopedia Britannica, Federal Reserve. Data as of March 20, 2024.

What if the rate cut is further delayed or there is no rate cut this year?

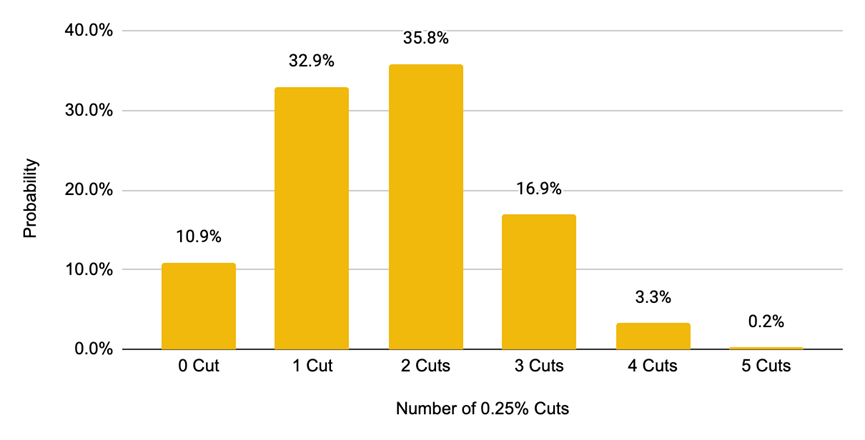

Indeed, traders have become increasingly pessimistic about the prospects for rate cuts. The market is now pricing in two rate cuts this year (assuming each is 0.25 percent), with the first expected in September. This marks a significant shift from earlier this year, when markets were pricing in as many as six rate cuts from the Fed starting in March.

Figure 6: Traders Expect Around Two Rate Cuts in 2024

Source: CME Group, Binance Research. Data as of May 8, 2024.

However, this also means that the threshold has been lowered and the market has digested the risk of delayed rate cuts to a certain extent.

Importantly, if the Fed ends up delaying rate cuts further, we would argue that understanding the “why” they are doing so is more important than the policy action itself. In our view, there are two scenarios that could help achieve this, each with very different implications for growth assets such as stocks and cryptocurrencies:

•If the Fed is delaying rate cuts because economic growth remains strong and inflation just takes time to fall back to 2%, then the overall backdrop remains favorable for growth assets such as cryptocurrencies.

•However, if economic growth continues to slow, inflation accelerates, and wage growth rises, the Fed may even need to consider raising interest rates, which could have a negative impact on growth assets such as cryptocurrencies.

How does the crypto market view it?

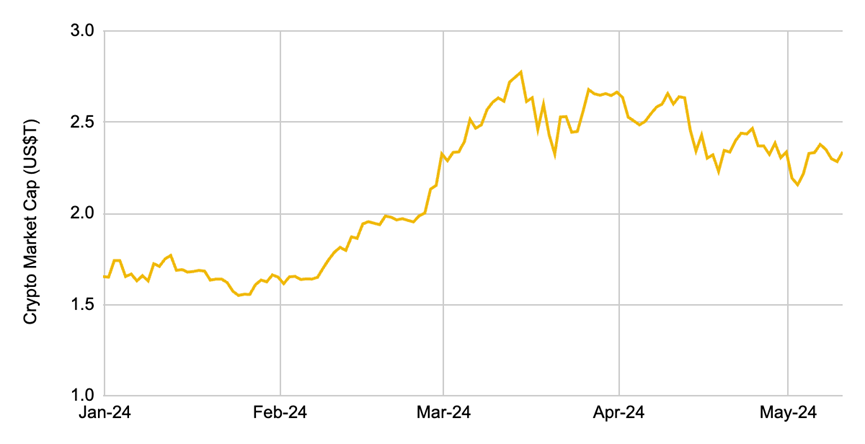

Following strong growth in the first quarter of the year, with the cryptocurrency market value rising by about 60%, the market retreated in April as concerns about the trajectory of interest rates and geopolitical tensions increased. The release of first-quarter economic data on April 25 further dragged down the results - the cryptocurrency market value fell by about 7% in the remaining days of April.

Figure 7: Cryptocurrency market capitalization has fallen from its March peak

Source: Coinmarketcap. Data as of May 10, 2024.

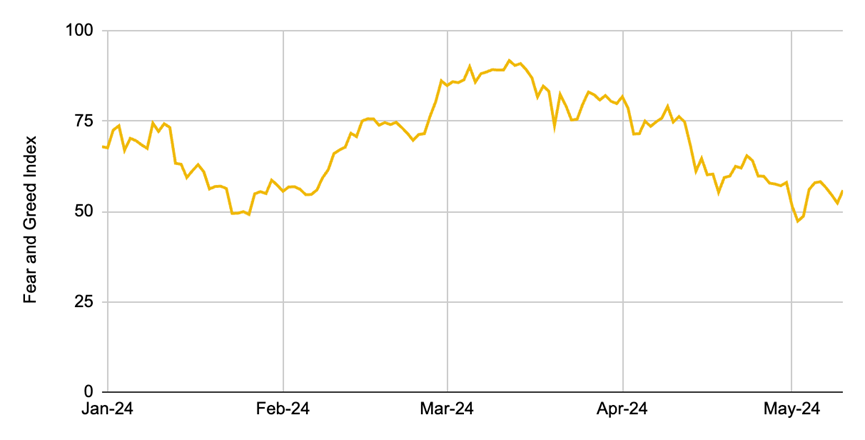

Investor sentiment has also reversed over the past month and become less optimistic. The Fear and Greed Index is currently in "neutral" territory, a sharp contrast to the peak in March, when animal spirits were high and the index was in "extreme greed" territory.

Figure 8: The Fear and Greed Index is now in “Neutral” territory

Source: Coinmarketcap. Data as of May 10, 2024.

Overall, this could be a healthy reset

At first glance, growth appears to have stalled and market sentiment appears to be significantly less optimistic. However, a one-way “up only” market is not possible and is unsustainable in reality.

Pullbacks and range-bound markets provide an opportunity for investors to take a moment to consider fundamentals and valuations, rather than blindly chasing sky-high prices. For project teams, the current environment may help reduce the pressure of fundraising or token issuance, and instead, allow them to focus on building tangible products.

Amid all the negatives, we want to remind everyone that the industry continues to make significant progress. In the past month alone, we have seen:

• Bitcoin network processes its billionth transaction

• Liquidity in the ecosystem expands as stablecoin supply reaches near two-year high

• The unlocking of the new design paradigm goes live in April with the re-staking of Eigenlayer

With the above in mind, the market is still up 38% so far this year, though, suggesting that all may not be bleak.