Macro signals push token prices higher.

Inflation Cools. Crypto assets surged this morning on key inflation signals for April. What does this data tell us, and why is the market interpreting it as a signal to buy?

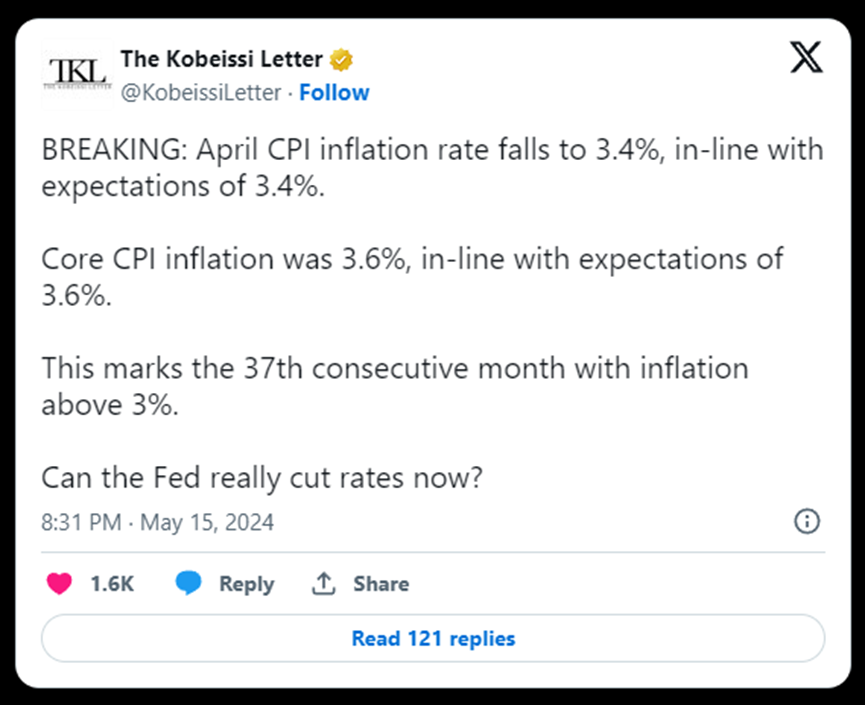

Although the Producer Price Index (PPI) released on Tuesday showed slightly higher-than-expected inflation last month, today's CPI data was in line with analysts' expectations.

Inflation remains thorny, still above the Fed's 2% long-term goal, but this was the first time in the past three months that the CPI has fallen; meanwhile, retail sales showed increasing signs of stagnation.

While there is considerable noise from month-to-month fluctuations in inflation data, it is clear that deflation will continue to occur as rising prices weigh on demand in the economy.

https://x.com/KobeissiLetter/status/1790721548434784602

Following the data release, markets began pricing in a greater likelihood of rate cuts from the Federal Reserve in response to the declining economic situation, pushing U.S. Treasury yields back to their March highs, suggesting that traders are actually positioning for these inevitable rate cuts.

Deflation may exist, but it has not yet reached worrisome levels, allowing market participants to assume that future rate cuts are definitely bullish because they would lower the risk-free rate, theoretically enhancing the relative attractiveness of risky assets.

With further confirmation that the future interest rate path is downward, market participants slammed buying of crypto assets, causing the price of BTC to rise 7% on the day; Bitcoin successfully broke the downward trend that had been hindering prices since April and broke through the $65,000 level that served as weekly resistance!

Unlike range-bound crypto assets, traditional stocks have been climbing steadily over the past two and a half weeks, making today’s CPI data the fuel needed to send the indices to new all-time highs!

The S&P 500 and the tech-heavy Nasdaq 100 both broke records set in March when U.S. cash markets opened and rallied along with other risk assets throughout the morning session.

The Fed can put enormous pressure on the short-term interest rate curve, but fundamentally, these rates are priced in based on a combination of expectations for future economic growth and inflation.

While many market participants generally believe that low interest rates are positive for risky assets, this is only one factor in the overall economic balance, and given that in past economic cycles, the lowest interest rate levels have often coincided with the peak of economic recessions, it remains highly doubtful whether rate cuts will be enough to stimulate weak economic growth.

In the absence of a clear growth catalyst, monetary and fiscal policymakers may once again resort to currency debasement, and while the actual economic impact of such actions is uncertain, they will almost certainly increase the dollar value of hard assets that are not tied to inflationary fiat schedules, such as Bitcoin and gold.