Author: Omkar Godbole Source: coindesk Translation: Shan Ouba, Jinse Finance

Summary

Bitcoin (BTC) rose more than 7.5% on Wednesday, marking its best performance since March 20.

Weak U.S. economic data has increased the likelihood that the Federal Reserve will cut interest rates in September.

The Bank of England and the European Central Bank are likely to cut interest rates in June.

Bitcoin posted its biggest one-day gain in nearly two months on Wednesday as weak U.S. economic data raised the odds of a summer interest rate cut by the Federal Reserve. The largest cryptocurrency by market value rose more than 7.5% to $66,250, its biggest percentage gain since March 20, according to data from TradingView and CoinDesk. Like other risk assets, Bitcoin is highly sensitive to expected changes in the monetary policy stance of major central banks and tends to rise when fiat currency borrowing costs are expected to fall.

Data released by the U.S. Labor Department on Wednesday showed that the consumer price index (CPI) rose less than expected in April, showing that the cost of living in the world's largest economy is falling again. The headline CPI rose 0.3% last month, after rising 0.4% in March and February. The core CPI, which excludes food and energy prices, rose 0.3% in April and 0.4% in March.

Other data showed that overall retail sales growth stalled in April, with sales in the "control group" category - which is included in GDP calculations - falling 0.3% from the previous month.

As a result, expectations for rate cuts have shifted significantly. Fed funds futures show traders expect the Fed to make its first 25 basis point rate cut in September. (This summer will begin on June 20 and end on September 22.) The Fed recently said it would reduce the pace of quantitative tightening, also a tool to tighten liquidity, starting in June.

Not only the Fed, the market expects the Bank of England and the European Central Bank to cut interest rates in June. The Swiss National Bank (SNB) and the Swedish Central Bank (Riksbank) have already lowered their benchmark borrowing costs.

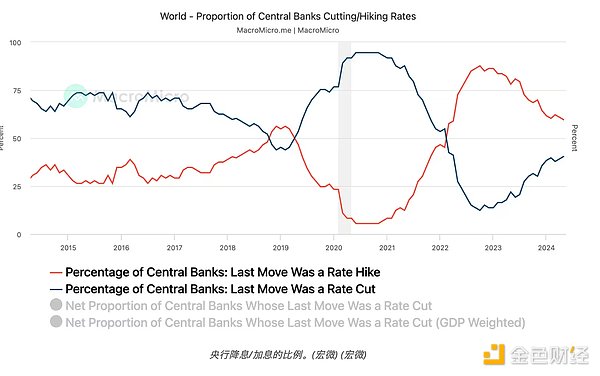

Central banks around the world are shifting toward new monetary or liquidity easing policies, which is a positive sign for risk assets including cryptocurrencies, as can be clearly seen from a chart from data tracking website MacroMicro.

The proportion of global central banks that have recently raised interest rates is falling rapidly, while the proportion of central banks that have recently cut interest rates is rising. In other words, the proportion of central banks that are net rate cutters is rising.

“The higher the ratio, the more central banks are cutting interest rates, which helps improve market liquidity. The lower the ratio, the less market liquidity there is,” MacroMicro said in its explanation.

Brokerage Pepperstone said the prospect of easy liquidity over the summer should support equity markets, giving investors enough confidence to "continue to move forward on the risk curve."