A. Market View

1. Macro liquidity

1. Macro liquidity

Monetary liquidity improved. The US CPI slowed slightly in April, and the year-on-year increase in the core CPI was the smallest in three years since the beginning of 21. The market's expectations for interest rate cuts have rekindled, and it is predicted that by the time of the Federal Reserve meeting in September, the probability of a 25 basis point rate cut will exceed 80%. US stocks soared to a record high, and the US dollar index plummeted. The crypto market rebounded strongly following the US stock market.

2. Market conditions

2. Market conditions

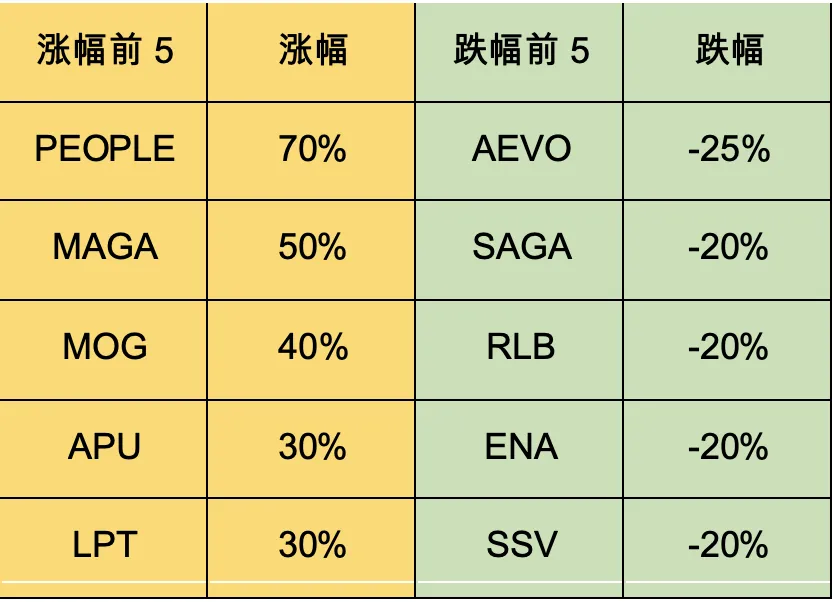

The top 100 companies with the highest market capitalization:

This week, BTC rebounded and ETH/BTC exchange rate reached a new low in 3 years. The main market trend revolved around Meme and AI sectors. GME, the former leader in US retail investor popularity, soared several times, driving the Meme hype sentiment.

1. PEOPLE: Polifi's PEOPLE, MAGA, Jeo Boden, Doland Tremp, etc. have soared. These are all memes of the US election, and there is a high probability that they will be hyped until the November election. Presidential candidate Trump supports Crypto, and the two parties in the United States have obvious differences in their positions. 2. BB: Bouncebit's performance on Binance Exchange is average, and it is the first order of Binance Megadrop launch platform. BB is a BTC re-pledge agreement made by the Auction team. In the future, it will be similar to Ethna's futures arbitrage. The recent BTC ecosystem is generally weaker than the market. 3. NOT: Notcoin is a game meme coin of the TON ecosystem. It is obtained by clicking on mobile phone mining. It has 30 million users and 5 million daily active users. Notcoin is 100% fully circulated when it is listed on Binance Exchange.

3. BTC market

3. BTC market

1) On-chain data

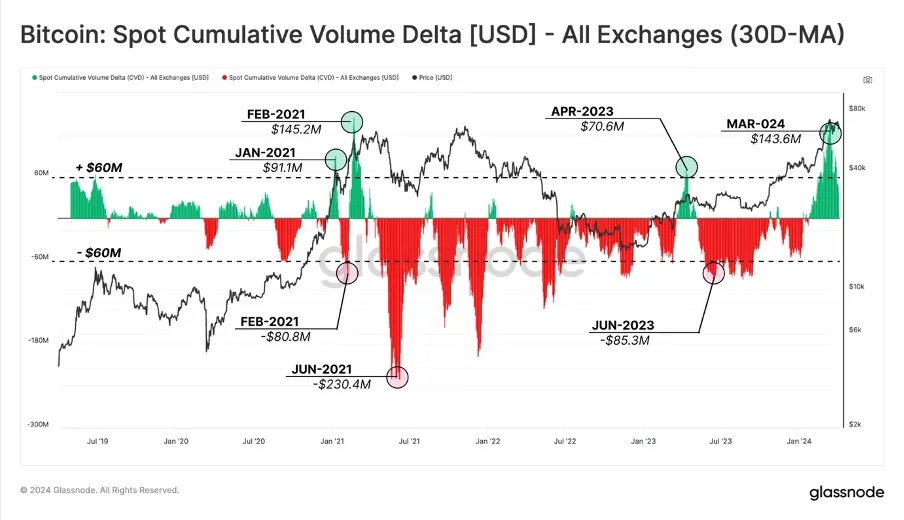

Investment sentiment cooled after the halving. Although BTC halving has historically proven to be a long-term bullish event, it often triggers a sell-off reaction in the market in the short term, with similar events occurring in 2016 and 2020.

The market value of stablecoins remains flat, and long-term funding fundamentals remain positive.

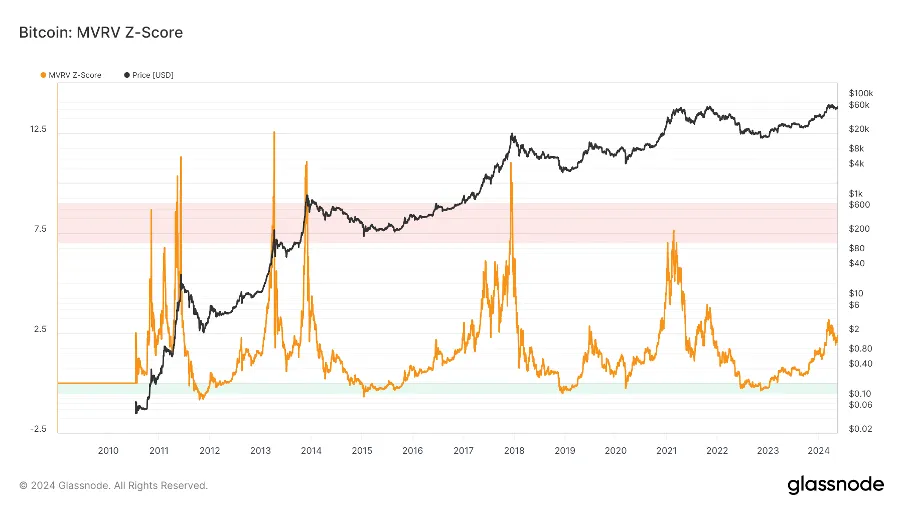

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.4, entering the middle stage.

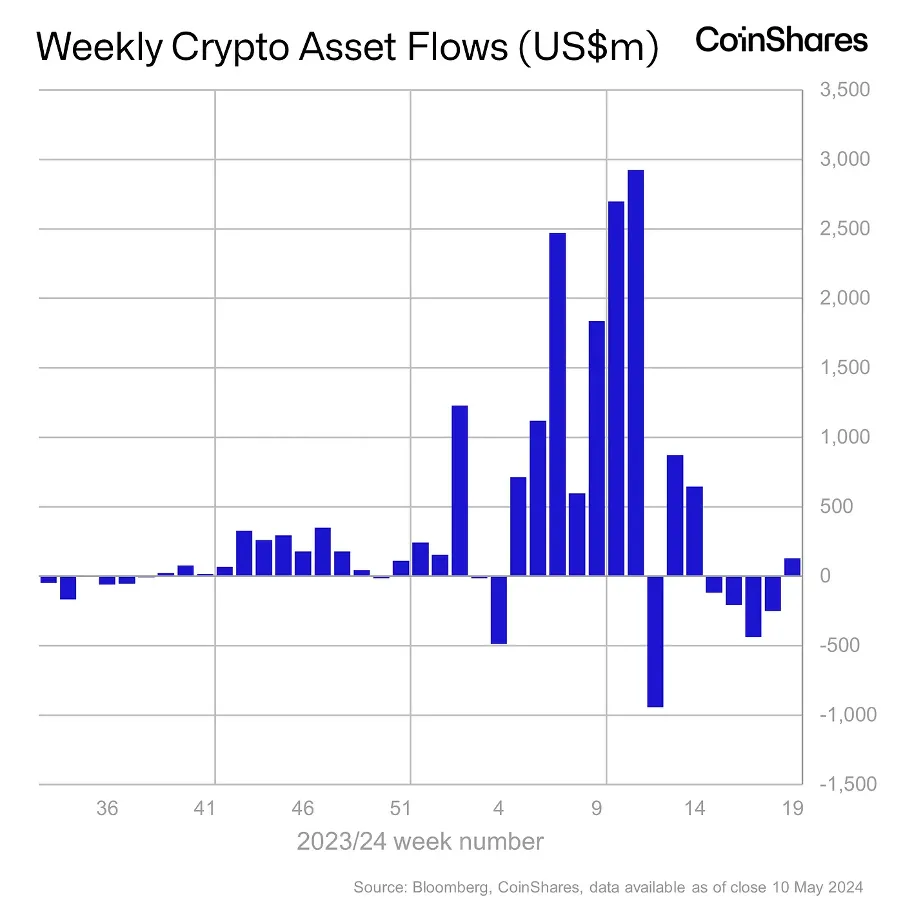

Institutional funds resumed net inflows. However, ETH fund inflows were insufficient, and the market expected that ETH spot ETFs would not be approved soon.

2) Futures market

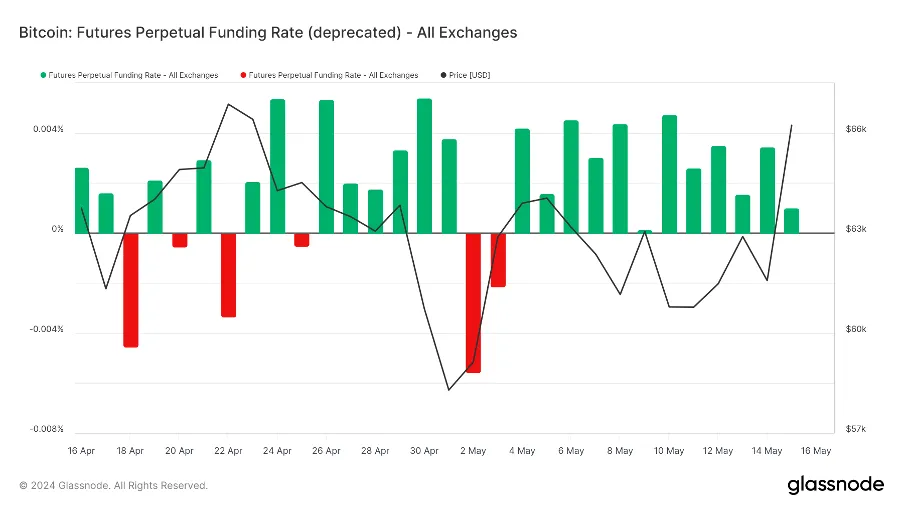

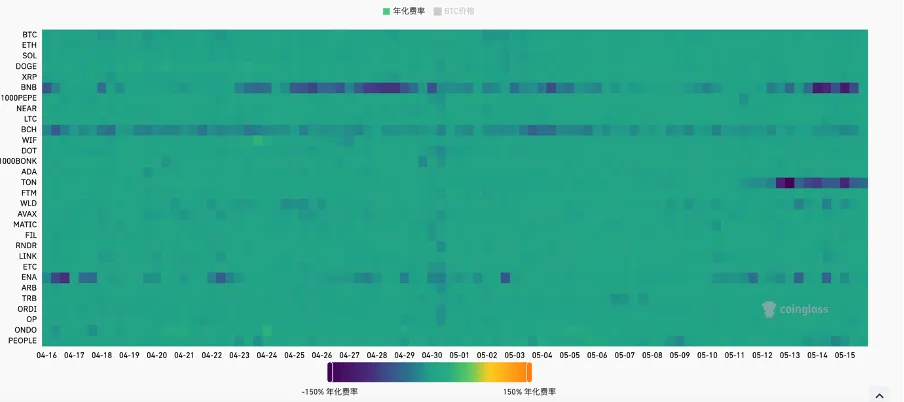

Futures funding rate: This week's rate is close to 0. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

Futures open interest: BTC open interest increased significantly this week, with major market players entering the market.

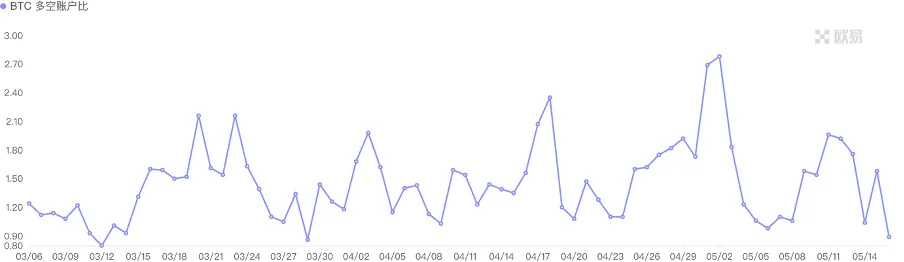

Futures long-short ratio: 0.8, market sentiment is pessimistic. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

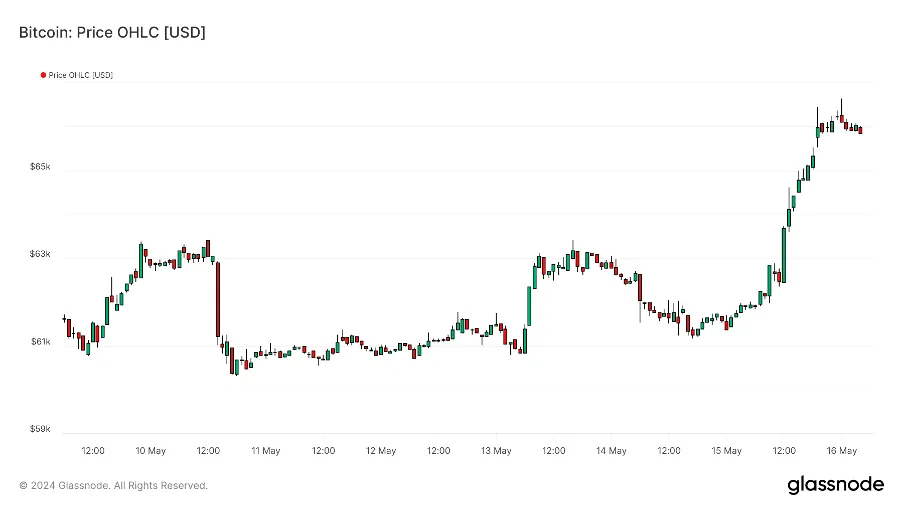

BTC rebounded slightly, and the market is likely to fluctuate widely before the Fed cuts interest rates in September. BTC mining computing power has been declining for two consecutive months, and the current shutdown price is around $55,000. This round of Altcoin has been widely controversial. According to statistics, the circulation rate of new coins in the previous cycle usually exceeded 20%, while the average circulation in this round is only 13%, so Altcoin are easily affected by the negative impact of unlocking chips. Community Meme coins with a chip structure close to full circulation have become the main line of market consensus.

B. Market Data

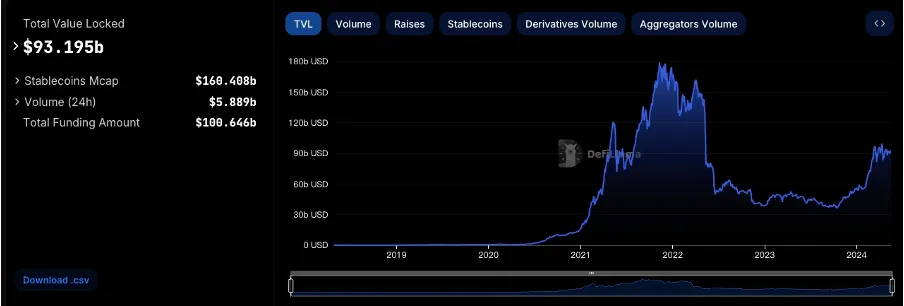

1. Total locked-up amount of public chains

1. Total locked-up amount of public chains

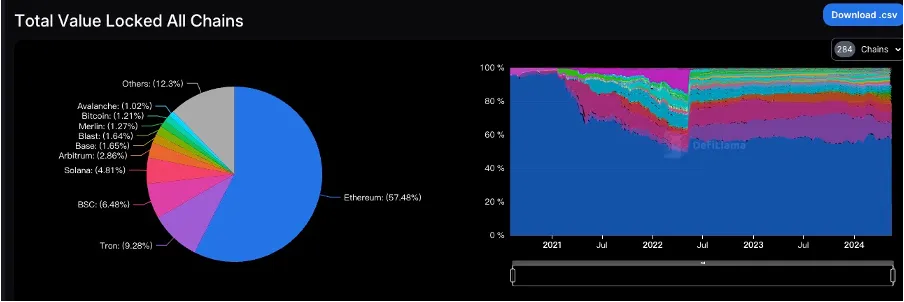

2. TVL Proportion of Each Public Chain

2. TVL Proportion of Each Public Chain

This week, the total TVL is $93.2 billion, up about $2.7 billion, or about 3%. This week, after BTC fell to 60,000, it broke through and rebounded to 66,000 in a short period of time. This week, the TVL of mainstream public chains mainly rose, with ETH chain up 2%, TRON chain up 4%, BSC chain down 2%, SOLANA chain up 11%, ARB chain and MERLIN chain up 5%, BLAST chain up 3%, POLYGON chain up 2%, and OP chain down 7%. The recent performance is relatively sluggish, and the total TVL is less than $800 million, falling to the 12th position. The most eye-catching performance is the MODE chain, with a current TVL of about $500 million and 37 on-chain protocols. It has risen 17% in the past week and 175% in the past month. Among them, iZiSwap, as the protocol with the highest TVL on the MODE chain, has exceeded $200 million and has risen 175,248% in the past month.

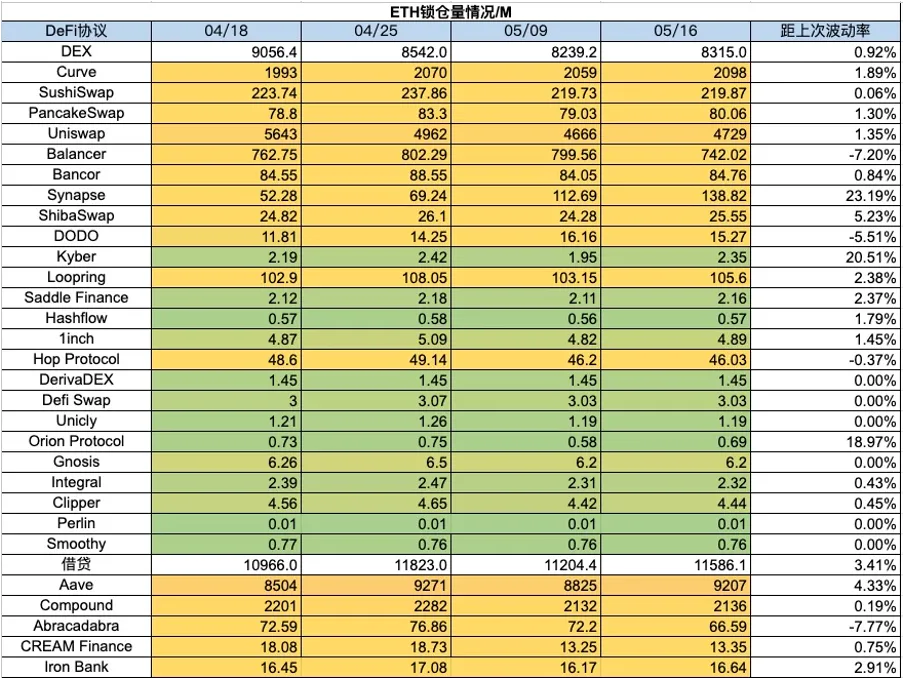

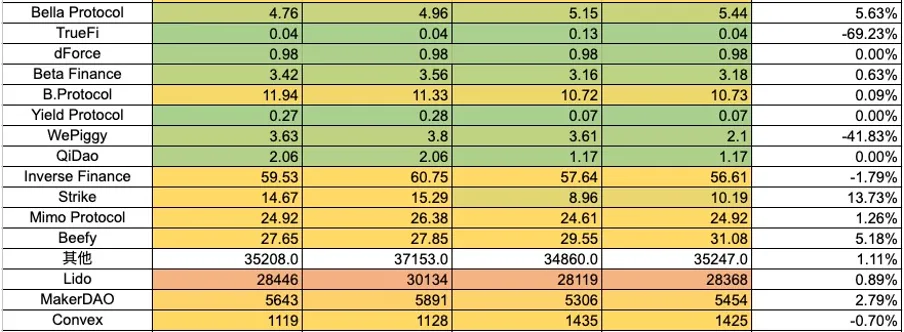

3. Locked Amount of Each Chain Protocol

3. Locked Amount of Each Chain Protocol

1) ETH locked amount

2) BSC locked amount

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism locked amount

6) Base lock-up amount

7) Solana locked amount

4. Changes in NFT market data

4. Changes in NFT market data

1) NFT-500 Index

2) NFT market situation

3) NFT trading market share

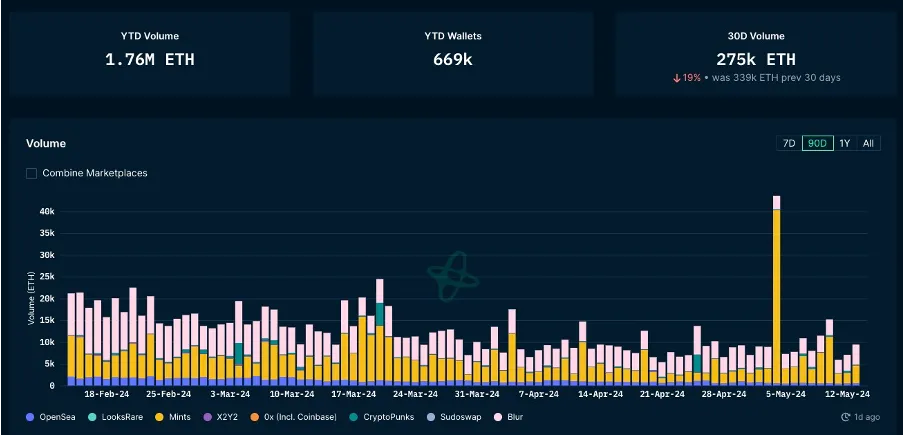

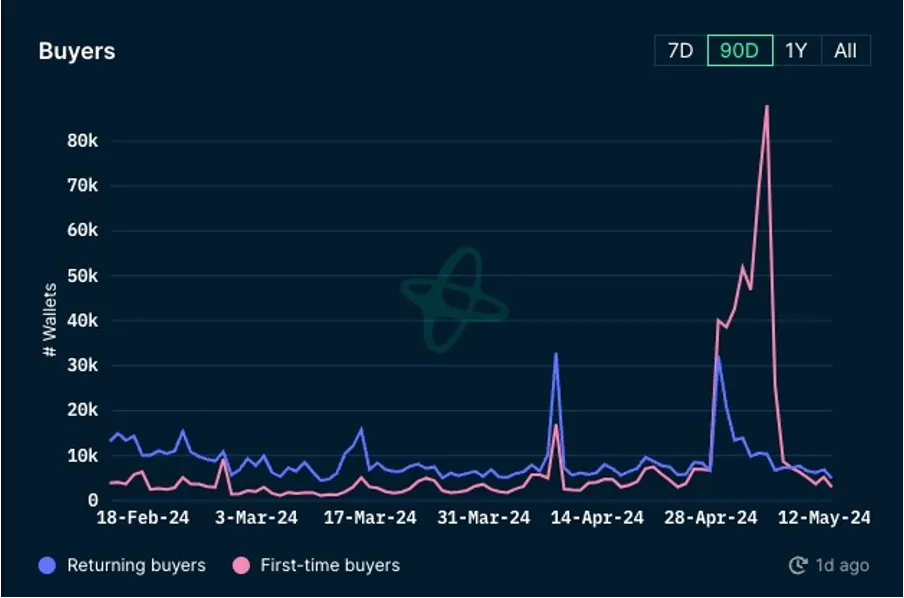

4) NFT Buyer Analysis

This week, the floor prices of blue-chip projects in the NFT market have risen and fallen, and the market continues to trade sideways at a low level, with no signs of recovery. This week, BAYC fell 6%, CryptoPunks rose 3%, Space Doodles rose 2.5%, Milady fell 7%, DeFrogs fell 25%, LilPudgys rose 2%, Pixelmon fell 35%, and CloneX fell 5%. The transaction volume of the NFT market continued to decline, and the number of first-time buyers and repeat buyers continued to decline.

V. Latest project financing situation

6. Post-investment dynamics

1) EthStorage — Infrastructure

EthStorage has successfully received the third grant from Optimism. It is used to expand the availability of EIP-4844 Blobs by integrating OP Stack. The proposal aims to provide a complete long-term data availability (DA) solution for the OP Stack EIP-4844 (Ecotone) upgrade by integrating with EthStorage. With EthStorage's solution, OP Stack Rollups can better obtain Ethereum security.

2) Accseal — ZKP Hardware Acceleration

Accseal has taken a monumental step in the field of zero-knowledge proof (ZKP) hardware acceleration. As one of the pioneers in the early design and development of ZKP application-specific integrated circuit (ASIC) chips, Accseal is committed to promoting the development of ZKP technology, hoping to promote cost reduction and efficiency improvement in the industry at the hardware level and play a global leading role. Accseal plans to expand its business to the field of ZK cloud computing, further reduce computing costs and improve computing performance, and develop a comprehensive solution for ZK cloud computing pools. To this end, Accseal is about to establish a strategic partnership with Ingonyama, an innovator in the field.

3) bitSmiley — BTC native stablecoin

bitSmiley is launched on the Merlin mainnet and will use 1.5% of its total token supply for the Merlin mainnet liquidity reward program. During this period, users can also obtain their Season One bitPoint points by using bitSmiley products. The liquidity rewards and bitPoint points of the Mainnet belong to different reward pools, so that participating users can get double rewards.