Crypto market volatility soared on Friday after the United States approved the Ethereum spot exchange-traded fund (ETF) yesterday. BTC fell to a low of $66,400 during the day, close to the key support level of $65,000, rebounded after the opening of the U.S. stock market, and then went all the way higher, hitting an intraday high of $69,285 in the afternoon. As of press time, BTC was trading at $68,836, up about 2.38% in 24 hours.

ETH surged 27.5% from $3,100 on Monday to $3,950 on Thursday, but its price has fluctuated significantly since the spot ETF was approved. As of writing, ETH is trading at $3,705, down 1.65% in 24 hours. A chart published by analysts at Secure Digital Markets shows that ETH futures liquidations surged to nearly $150 million, with $100 million in long positions, twice the amount of BTC liquidations.

Altcoin had a strong week, with all but 30 of the top 200 tokens by market cap rising. Ondo (ONDO) was the top gainer, up 19.2%; Core (CORE) up 17.6%; and Zcash up 13.2%. Metis had the biggest drop, down 4.2%; Illuvium (ILV) down 3.7%; and Bonk (BONK) down 2.4%.

The current overall market value of cryptocurrencies is $2.56 trillion, and Bitcoin’s market share is 53.2%.

In traditional markets, major US indices opened higher throughout the day, with the S&P and Nasdaq maintaining their positive momentum into the close, while the Dow fell towards the end of trading. By the close of the day, the S&P and Nasdaq were up 0.70% and 1.10% respectively, while the Dow was flat.

$3,800 is a key level for ETH

ETH’s gains this week have outpaced the S&P 500’s gains in a year, and cryptocurrency trader Matthew Hyland believes it’s now crucial for Ethereum to “hold” support around $3,800 to sustain its continued rise.

Blockchain Mane said ETH’s “resistance targets are $5080.60 and $6231.83,” Blockchain Mane noted that if three long-term indicators continue to flash, ETH could surge and retest the $5,000 price mark that it failed to reach in 2021.

Mane said ETH is showing a “bullish trend” along the parabolic and Fibonacci retracement indicators, with three distinct phases: Phase 1, Phase 2, and Phase 3. “The parabolic indicates a continued upward trend, especially after breaking out of the descending wedge.”

BTC expected to consolidate further

Market analyst Caleb Franzen believes that if Bitcoin can break through $69,500, it is very likely to climb above $72,000 in the short term. He said on the X platform: “If Bitcoin breaks through this short-term structure (1-hour candle), then it is assumed that it will set a new short-term high above $72,000.

However, several analysts warned that further consolidation is expected due to the strong resistance level of $71,500.

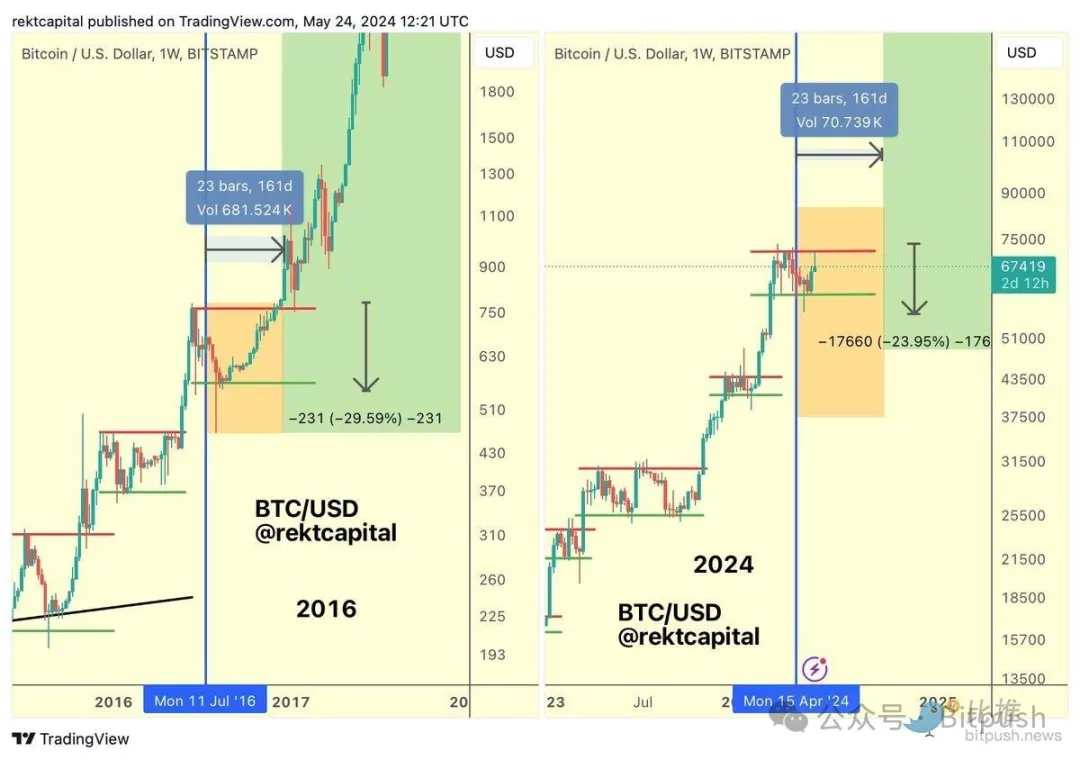

Market analyst Rekt Capital said: "Since the end of the 'danger zone' after Bitcoin's halving, Bitcoin has broken through $71,500. However, around $71,500 is the range high resistance level of the macro re-accumulation range and the starting point for Bitcoin's decline."

“The consolidation continues and history suggests it will continue for several more weeks with prices in the $60,000 to $70,000 range,” he concluded.

Michaël van de Poppe, founder of MN Trading, also warned that prices could fall back to the low $60,000s, but said that this presents a good opportunity for dollar-cost averaging (DCA).

Michaël van de Poppe said on X platform: “Bitcoin is consolidating and is in a range. This consolidation may last longer and I suspect we may even see $ 61,000-63,000 . The rotation from Bitcoin to Ethereum leads to a longer sideways consolidation period. It doesn’t matter, as long as DCA.”

In the long term, market analyst Braver Crypto said he is sticking to his stance that Bitcoin will peak in the range of $180,000 to $210,000 during this cycle.

This is in line with the predictions of Geoff Kendrick, head of emerging markets FX and cryptocurrency research at Standard Chartered Bank, who said in a recent report that the price of Bitcoin could rise to $150,000 by the end of 2024 and $200,000 by 2025.