Author:Tina

Editor: Xiaolu

Shilian Niubite (niubite.com) shared that in the field of cryptocurrency, the oracle track is a track that is easily overlooked by users because it is biased towards the backend. As users of encrypted assets, it is difficult for us to directly perceive its value. Therefore, its value is often ignored.

In fact, oracles play a key role in the development of blockchain technology. As a relatively closed system, when blockchain needs to interact with external off-chain data, oracles become an indispensable bridge.

The oracle is not a tool for predicting the future, but a hub that connects off-chain and on-chain data. It can safely and reliably transmit real-time off-chain data (such as stock prices, gold prices, etc.) to the chain. At the same time, it can also transmit on-chain data to off-chain through the oracle, realizing two-way data flow.

Since Chainlink, the importance of oracles in the field of cryptocurrency has become increasingly prominent, especially in this round of crypto market conditions, oracles have become increasingly important.

For example, the explosion of popular tracks such as RWA, AI, and DePIN also require the functions of oracles, and of course, have also promoted the development of the oracle track.

For the RWA track, it is crucial to transmit real-world asset data, such as real estate values, stocks, gold prices, etc., securely and accurately to the chain. This process is inseparable from the participation of oracles, which serve as a bridge between off-chain and on-chain data, ensuring the real-time and reliability of the data.

Similarly, the DePIN project also relies on oracles to transmit critical data, whether it is market data, user behavior data or any other form of off-chain information, oracles can ensure the accuracy and availability of this data on the blockchain.

In addition, AI projects in the crypto market also need access to off-chain data for learning and reasoning. Oracles are key components in this process, allowing AI systems to obtain real-time data from off-chain and perform corresponding operations on the blockchain.

With the development of RWA, AI, DePIN and other tracks, the oracle track has also risen. There are currently projects with a market value of over 10 billion US dollars in the oracle track (such as Chainlink), which undoubtedly opens up the market value space for oracle track projects.

1. PYTH

In the oracle track, what high-quality projects are worth paying attention to?

Chainlink is undoubtedly the leader in the oracle field. It is an old project founded in 2017 and its current market value exceeds US$9.8 billion.

In addition to Chainlink, PYTH and API3 in the oracle track are also worthy of attention. Compared with Chainlink, their market capitalization is still far behind.

PYTH was founded in 2021. Many core members of the team have worked at Jump Trading and Jump Crypto. Investors include Multicoin Capital, Castle Island Ventures, etc.

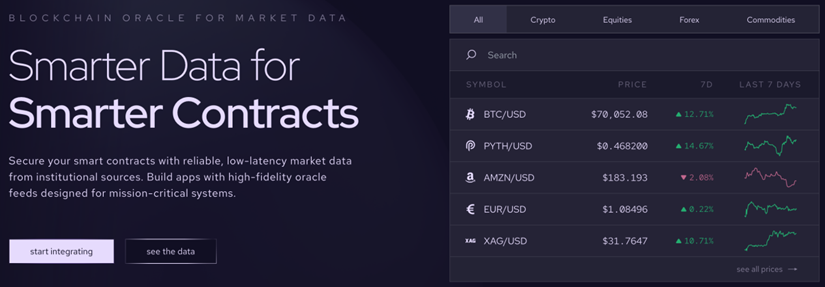

Pyth Network is the Solana version of Chainlink, providing price data oracles and market data to blockchain projects. It provides "mission-critical" price data for various asset classes (such as cryptocurrencies, foreign exchange, commodities, and stocks) in a secure and zero-latency manner.

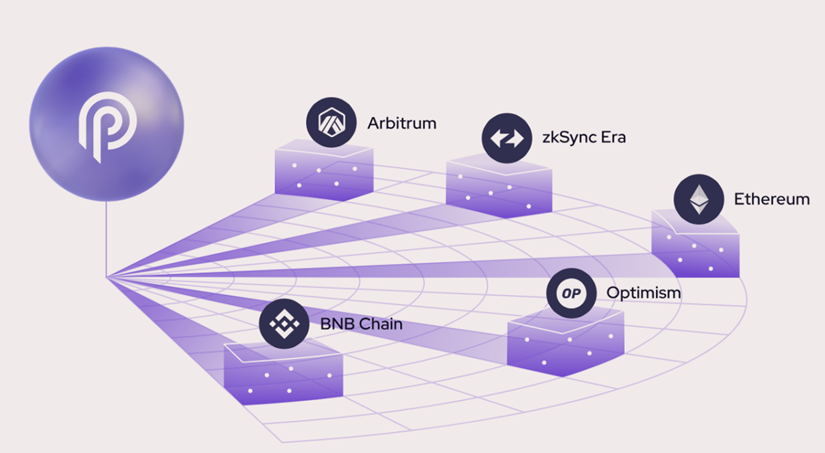

As a star project in the Solana ecosystem, PYTH’s current business scope not only includes the Solana public chain ecosystem, but also provides oracle services for public chain ecosystems such as Ethereum and BNB Chain.

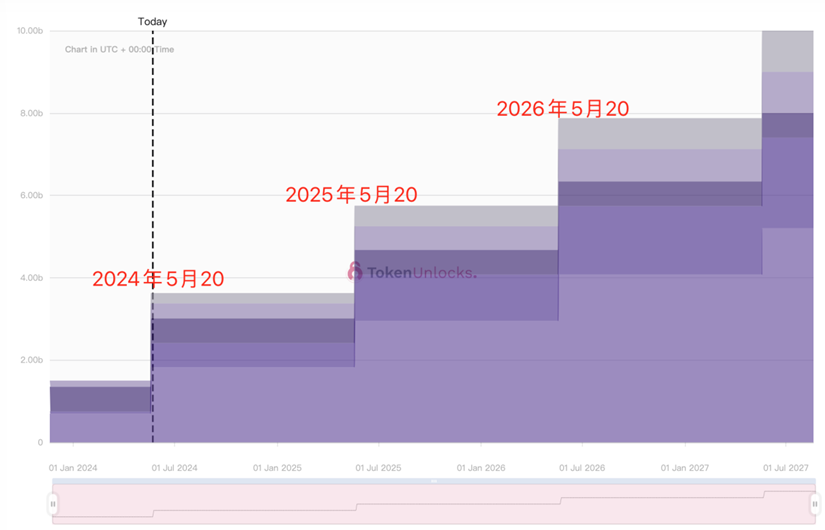

On May 20, PYTH completed the 2024 cliff-style token unlocking. The next large-scale unlocking will not be until May 20, 2025, so there is no need to worry about PYTH's large-scale unlocking and market crash in the past year.

With the large amount of unlocking on May 20, the price of PYTH was once hit to around US$0.35, but it soon bottomed out and rebounded to US$0.42 on the same day, an increase of more than 20%. It can be seen that the consensus on PYTH is still relatively strong. With the support of the Ethereum spot Ethereum ETF, the current price of PYTH tokens is around US$0.47.

Currently, the circulating market value of PYTH is 1.7 billion US dollars, and the token circulation rate is 36%. The circulating market value is nearly 6 times that of Chainlink.

2. API3

API3 was founded in 2020 and received US$3 million in investment in November of the same year, led by Placeholder and participated by CoinFund, DCG and others.

Traditional oracles such as Chainlink use third-party oracle solutions, where third-party operators host oracle nodes, aggregate external data provided by API providers, and input it into smart contracts.

API3 uses a first-party oracle solution, allowing data providers to run their own oracle nodes (Airnode), thereby eliminating middlemen and providing their data directly to users. This approach eliminates redundant data transmission processes, greatly improves data transmission efficiency, and provides greater advantages in data accuracy and latency compared to third-party oracles.

The current market capitalization of API3 is only over 200 million US dollars, which is nearly 50 times larger than that of Chainlink. In addition, API3's basic data has grown well recently, and it has reached cooperation with projects such as Blast and Mantle. It is a low-market-value, high-quality project with potential in the oracle track, and can be called a dark horse in the oracle track.

In short, the connection between blockchain and the real world is getting closer and closer. Blockchain needs to be fed with real-world data. For example, AI, DePIN, RWA, etc. are inseparable from oracles. It can be foreseen that the market space for oracles will become larger and larger in the future. Chainlink, PYTH and API3 in this track are worthy of our attention.

PS This article does not constitute any investment advice