In the early morning of May 24, with the 19B-4 forms of eight Ethereum spot ETFs approved by the US SEC, it was only a matter of time before they were listed for trading. After the Ethereum spot ETF successfully "passed the test", the price of ETH fell after a brief rise. At the same time, the potential selling pressure of Grayscale, which owns millions of ETH, also caused market concerns.

It may be listed in June, but the scale of funds is limited due to the lack of pledge mechanism

According to Bloomberg ETF analyst James Seyffart, the S-1 approval for the Ethereum spot ETF may be completed in "a few weeks" or it may take longer, a process that usually takes up to five months. Based on the two-week comment period for the S-1 amendment (similar to the feedback provided by the SEC for spot Bitcoin ETF applicants), mid-June is definitely possible.

Cobo co-founder Shenyu also wrote that, referring to the Bitcoin ETF, the S-1 filing approval for the Ethereum spot ETF will take at least two weeks, and the normal pace may take three months. It is expected to be passed in early June and start trading in the middle of that month.

The positive news of Ethereum spot ETF also drives the bullish sentiment in the market. According to Coinglass data, in the past 7 days, the net outflow of ETH spot was nearly 130 million US dollars, of which the net inflow of exchanges in the past 4 days was negative. At the same time, Greeks.live macro researcher Adam posted on the X platform today that 350,000 ETH options are about to expire, with a Put Call Ratio of 0.58, a maximum pain point of 3,200 US dollars, and a nominal value of 1.3 billion US dollars. Inspired by the progress of ETF, ETH took over BTC's rise. The short-term option IV once reached 150%, which is much higher than the current BTC IV in the same period. Judging from the block trading and market trading structure, ETH's bullish sentiment is still strong.

However, many whale and institutions have also started to sell in large quantities. For example, according to the monitoring of on-chain data analyst ai_9684xtpa, a whale /institution that short ETH recharged more than 38,000 ETH borrowed by collateral to the exchange last night and then sold them, which was worth $93.51 million; MEV trading company Symbolic Capital Partners sold 6,968 ETH yesterday, which was worth $27.38 million; Lookonchain monitored that a whale address panic-sold 7,921 ETH last night after the ETH price plummeted, which was worth $29.7 million; Spot On Chain monitored that Ethereum co-founder Jeffrey deposited 10,000 ETH in Kraken, which was about $37.38 million.

Compared with the fund size of Bitcoin spot ETF, the outside world generally believes that the space for Ethereum spot ETF is limited. For example, Bloomberg ETF analyst Eric Balchunas predicts that Ethereum spot ETF may obtain 10% to 15% of the assets obtained by Bitcoin spot ETF, reaching 5 billion to 8 billion US dollars.

Shenyu said that the main capital inflows in the initial listing period between June and December may come from retail investors, accounting for 80% to 90% of the total funds, and institutional users participated less. Considering that ETHE is similar to GBTC, the market may face some arbitrage and selling pressure, and whether it can withstand such selling pressure remains to be seen. After December, institutional investors may gradually enter the market.

In addition, the cancellation of the pledge mechanism due to compliance requirements is also considered to be one of the important reasons for weakening the demand for spot Ethereum ETFs. However, Jeffery Ding, chief analyst of HashKey Group, also predicted that the Ethereum spot ETF is expected to join the pledge mechanism and is expected to achieve a market size of 75% of the Bitcoin spot ETF in the medium term.

Grayscale becomes a weathervane for the probability of ETF approval, and the selling pressure may be absorbed by the market

Grayscale is seen by the outside world as one of the important indicators to measure the probability of ETF approval.

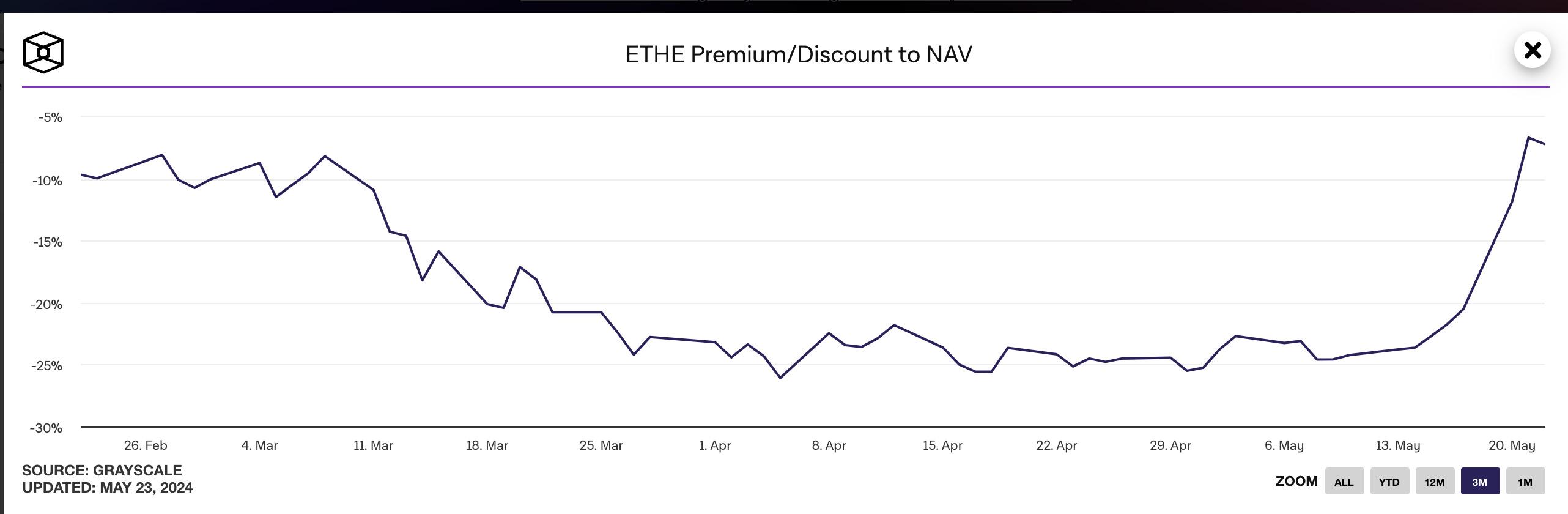

In the previous game of expectations for the listing of Bitcoin spot ETFs, the negative premium of Grayscale GBTC had narrowed all the way. Similarly, as the market's expectations for the approval of Ethereum spot ETFs heat up, investors have also begun to buy a large number of discounted shares of Grayscale Ethereum Trust (ETHE) before the official conversion of the ETF, but unlike GBTC, this optimism started in the past week.

Data from The Block shows that since May 17, the trading volume of Grayscale Ethereum Trust (ETHE) has begun to increase significantly, and on May 21, it achieved a trading volume of over US$687 million, setting a record high since May 2021. In the month before that, ETHE's trading volume was mostly between US$20 million and US$40 million. At the same time, ETHE's discount to its net asset value (NAV) has also narrowed significantly from 20.52% on May 17 to 7.19% today, and the negative premium rate once expanded to 26% last month.

These data also show market confidence to a certain extent. However, once the Ethereum spot ETF is officially listed, Grayscale, which holds a large amount of ETH, is also considered to be at risk of a market crash. Such concerns of investors are not groundless.

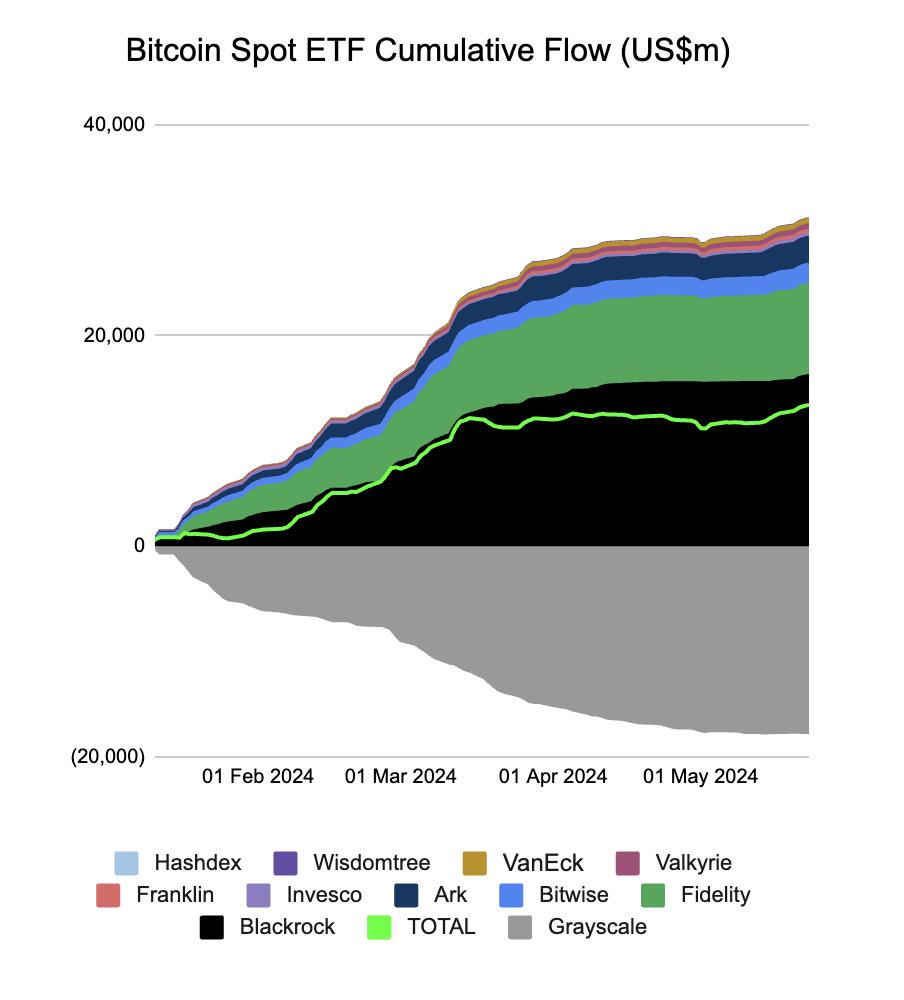

In fact, since Grayscale GBTC was successfully converted into a Bitcoin spot ETF, Farside Investors data showed that GBTC's cumulative net outflow reached US$17.64 billion. It is also the only ETF with such a high outflow and has continued to outflow funds for nearly 4 months. Coinglass data shows that as of May 24, GBTC's asset management scale is US$19.413 billion.

According to Coinglass data, as of May 24, Grayscale held 2.9352 million ETH, worth more than $11.17 billion. Although Grayscale's Bitcoin scale far exceeds that of Ethereum, the flight of arbitrage profits and the lack of a pledge mechanism for ETFs are also believed to have led to capital outflows.

However, judging from the overall change in Bitcoin ETF funds, the outflow of funds from GBTC has been completely covered by other ETFs. According to Farside Investors data, as of May 22, Bitcoin spot ETFs still had a net inflow of more than $13.43 billion. And from the perspective of price performance, the current price of Bitcoin has risen by about 45% compared to when the ETF was launched.

In other words, although the outflow of funds from GBTC has brought certain selling pressure to Bitcoin, it has been absorbed by other Bitcoin ETFs and has not had much impact on the price of Bitcoin. This also has certain reference significance for the impact of the Grayscale Ethereum ETF on the price of ETH after its launch.