Author: Liu Jiaolian

Overnight, BTC (Bitcoin) hovered around 69k. The ETH ETF noise gradually dissipated and returned to calm. The drama has just begun, and the ending is still suspenseful. $4,000 seems to be a key resistance level for ETH, and the last two sprints have failed to effectively break through.

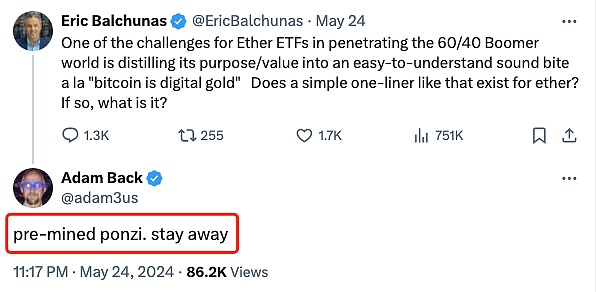

Adam Back, cryptographer, founder of Blockstream, author of the sixth citation in Satoshi Nakamoto's Bitcoin white paper, and inventor of hashcash, responded to Bloomberg ETF analyst Eric Balchunas's comments on the ETH ETF by saying: "Pre-mined Ponzi scheme. Stay away."

What did Eric Balchunas say? Here’s what he said: “One of the challenges for an Ethereum ETF to break into the world of baby boomers with a 60/40 traditional stock/bond allocation is how to distill its purpose/value into a single, easily digestible sentence like “Bitcoin is digital gold.” If so, what is it?”

Some netizens mocked Adam Back, saying, "With the ETF already approved, this guy is still trying to push the 'pre-mined Ponzi scheme' route. Unparalleled response."

Adam Back was not to be outdone and responded: "Am I wrong? Can an ETF negate the facts?"

Netizens responded: "Do you really think a Ponzi scheme can be approved for ETF?"

Adam Back replied: "Yes, it seems that this Ponzi scheme (it is estimated that there will be dozens to hundreds of Ponzi schemes in the future) is indeed working on ETFs. In addition, various high-risk traditional finance (tradfi) also have ETFs :)"

The netizen continued to pursue: "Idiot tradfi may have ETFs, but there is no real Ponzi scheme... because that is too crazy (even tradfi is not that stupid). Whatever half-logic you use to classify ETH as a Ponzi scheme, it also applies to BTC in my opinion, so it feels like you are courting death."

The netizen went on to add: “Personally, I think ETFs should stop at Ethereum, but you may also be right and we may see more ETFs (probably not a good thing, even if it makes my wallet bulge). All evidence shows that Bitcoin and Ethereum have become mainstream, and I think anyone who holds both coins (or both at the same time) should be happy.”

Adam Back responded bluntly: “You need a level playing field, so if they’re offering an ETF to a pre-mine ICO, they need to offer an ETF to everyone else, otherwise it’s a banana republic.”

The "banana republic" mentioned by Adam Back is a political science term.

According to Wikipedia, in political science, the term "banana republic" refers to a country with political and economic instability and an economy dependent on the export of natural resources. In 1904, American writer O. Henry coined the term to describe the economic exploitation of Guatemala and Honduras by American companies such as the United Fruit Company (now Chiquita). Typically, banana republics have extremely divided social classes, usually a large poor working class and a ruling class of plutocrats composed of business, political and military elites. The ruling class controls the primary industry by exploiting the labor force. Therefore, the term "banana republic" is a pejorative description of a slaveholding oligarchy that abets and supports the exploitation of large-scale plantation agriculture, especially banana cultivation, for kickbacks.

A banana republic is a country that practices a state capitalist economy, according to which the state is run as a private commercial enterprise for the exclusive profit of the ruling class. This exploitation is achieved through collusion between the state and favored economic monopolies, where profits from private development of public lands are private property, while the resulting debts are the responsibility of the public treasury. This unbalanced economy, still limited by uneven rural and urban economic development, usually reduces the national currency to a devalued banknote (paper money), making the country ineligible for international development credits.

What Adam Back refers to as "pre-mined ICO" refers to a way of launching blockchain projects that is generally believed to have been pioneered by the advent of Ethereum in 2015. That is, a batch of zero-cost tokens are minted in advance and then sold to the market (called ICO, initial coin offering) to finance the project startup.

Some netizens said, "Bitcoin is also pre-mined." In response, Adam Back laughed and said, "Of course not."

Let me explain a little bit here. Although some people often switch concepts and say that the 1 million BTC mined by (suspected) Satoshi Nakamoto in the early stage is essentially the same as the pre-sale of ETH by the Ethereum team, Satoshi Nakamoto mined BTC at a cost but it was very low. The Ethereum team also put in a lot of effort in the early preparations, so pre-mining ETH is also fair and reasonable. In fact, the key is not the effort behind these BTC or ETH, but whether there is a pre-sale, that is, ICO.

Some people say that this kind of pre-sale is a sales behavior of equal exchange, rather than a financing behavior. Wrong. The pre-sale price includes not only the cost it has incurred plus a reasonable commercial profit, but mainly includes the premium for future expectations, which is created by future efforts. Therefore, the ICO token sale is closer to the company's equity financing behavior, rather than an ordinary commercial sales behavior based on equal exchange, such as selling steamed buns.

Satoshi Nakamoto never conducted an ICO for Bitcoin. Satoshi Nakamoto’s BTC was neither minted at zero cost nor sold. This is the most significant difference between BTC and ETH at the moment of creation.

From the perspective of US securities regulations, ETH pre-sold in ICOs is definitely a security. ETH that earns interest through pledge is also a security. Only ETH mined through PoW mining in the past few years is a commodity. Now that these ETH are mixed together, it has become a muddy water. The US SEC is unable to distinguish between these different types of ETH, and in approving the ETH ETF, it simply made a "misjudgment of the gourd monk" case.

Some netizens advised Adam Back to stop making a fuss, after all, ETH is already the second-best blockchain project.

Adam Back is adamant about this. He said: "In fact, it is a hot piece of junk. But new users often confuse the difference between utility and investability. Bandwidth is useful, but it is cheap, and as technology advances, the price will get lower and lower. Similarly, air is free, and without air you will die. Nothing is more useful than this!"

The original user persisted: “I think if we could find a way to bottle air and sell it, we’d be treating it like water… From what I understand, there are a lot of water ETFs.”

Adam Back responded: “There’s a reason some people call shit coin“air tokens.” They are things that are sold to leeks and have no investment value.”

Another user supported Adam Back: "Bees don't argue with flies about why honey is better than shit. "Silver will never replace gold" - Carnegie, 1891."

Jiaolian searched the sales data of ETH ICO that year. The sales price at that time was in the range of 1 ETH = 0.000508 BTC ~ 0.000746 BTC.

Let’s take a look at the current secondary market. 1 ETH is approximately equal to 0.05456 BTC. In the past 10 years, in terms of BTC, the increase has been nearly 100 times compared to ICO.

However, the current ETH/BTC exchange rate is about the same as it was at the end of 2017, 6 or 7 years ago. It is still a long way from the historical high of 0.1228 at the beginning of 2018.

At the peak of the bull market in 2021, the ETH/BTC exchange rate only returned to a maximum of 0.08836, failing to return to its historical high in early 2018.

Based on today’s BTC price of around 69k, if ETH/BTC returns to its all-time high of 0.1228, its price should be $8473, which is more than double the current price of $3760.

This article is not intended to tell you a simple conclusion about right or wrong, but to inspire readers to think independently.

George Soros is said to have said: "The history of the world economy is a serial drama based on illusions and lies. The way to get rich is to recognize the illusions, invest in them, and then get out of the game before the illusions become known to the public."

“Economic history is a never-ending series of episodes based on falsehoods and lies, not truths. It represents the path to big money. The object is to recognize the trend whose premise is false, ride that trend and step off before it is discredited.”