This issue contains the following:

•We review what may be the most important two weeks of regulation and legislation for the digital asset industry.

• The SEC suddenly changed its tune and approved 8 spot Ethereum ETFs for trading. We look at the impact and potential timing.

•If an ETH ETF were as popular in proportion as a BTC ETF, one could expect $4.5 billion to flow into the complex, however, the unpopularity of the ETH futures ETF provides a cautionary tale.

A critical moment for crypto politics and regulation

It’s been an eventful two weeks in the context of cryptocurrency regulation in the United States, perhaps the most important in its history. A series of events followed that all seemed positive for the broader crypto ecosystem, marking an abrupt shift in policy ahead of the 2024 presidential election. We break down each event and its impact on the industry.

Senate votes to repeal SAB 121 (5/16)

Staff Accounting Bulletin 121 (SAB 121) is an accounting rule set by the Securities and Exchange Commission (SEC) that came into effect on April 11, 2022, and contains prescriptive rules on how public companies (or their subsidiaries) should account for them. Essentially, it requires these companies, including banks, exchanges, custodians, and any other entity that is entrusted to safeguard cryptocurrencies on behalf of others, to record these assets on their balance sheets (as assets and liabilities). The issue, especially for public banks, is the capital charge, which affects their capital adequacy and leverage ratios, making banks undesirable to hold crypto assets. The House of Representatives has already voted to repeal the rule, but the Senate's decision, which included the help of 12 Democrats, is an important political message. The White House has already issued a strongly worded statement that the President will veto the bill and that he has until next Tuesday to veto it. But given the sudden change in the political climate, it is unclear where the White House stands.

FDIC Chairman resigns (5/18)

On Monday, May 18, embattled FDIC Chairman Martin Gruenberg announced that he would resign following the appointment of a successor. Gruenberg had been under scrutiny following widespread allegations of sexual harassment and misconduct within the agency. While the departure is unrelated to the FDIC’s cryptocurrency policy, the FDIC’s stance on the matter under Gruenberg’s leadership was anything but supportive. The joint statement issued by the FDIC, OCC, and Federal Reserve following the collapse of FTX was particularly memorable, warning banks that issuing or substantially holding digital assets “is highly likely inconsistent with safe and sound banking practices.” While the impact of the change in leadership on the agency’s stance on cryptocurrencies remains uncertain, one thing is certain — there is room for improvement from where things stand.

Trump starts accepting cryptocurrency donations (5/21)

It is worth noting that presidential candidate Donald Trump's change of attitude towards cryptocurrencies coincides with the sudden change in the current administration's attitude towards cryptocurrencies. On May 8, Trump hosted a dinner for buyers of his NFT trading cards at Mar-a-Lago. According to media reports, although Trump was not a fan of cryptocurrencies during his presidency, he actively sought support from cryptocurrency enthusiasts during the event. Then on May 21, Trump's presidential campaign began accepting crypto donations, the first major party candidate to do so.

House of Representatives passed FIT 121 (5/22)

The Financial Innovation and Technology for the 21st Century Act (FIT 21) is a market structure reform bill introduced by the House Agriculture Committee (notably, it was also passed by the Financial Services Committee). It paves the way for a federal regulatory framework for the crypto industry, fulfilling a long-standing industry demand. Importantly, it would allow most cryptocurrencies to be treated as commodities and thus regulated by the CFTC rather than the SEC. On Wednesday, it received bipartisan support in the House of Representatives, including 70 Democrats, roughly three times the support received by the repeal of SAB 121. However, just one day before the bill passed, SEC Chairman Gensler issued a statement expressing displeasure with the bill. On the morning of the vote, the White House issued a statement on the bill that was notably more cooperative in tone than its previous statement on the repeal of SAB 121. While the bill still needs to pass the Senate before becoming law, this statement from the White House is a significant departure from their previous statements on cryptocurrencies, as well as comments from the SEC Chairman.

SEC approves spot ETH ETF (5/23)

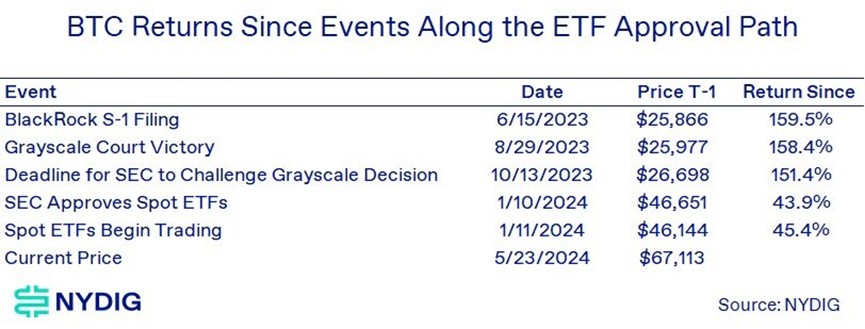

On Thursday afternoon, the SEC approved changes to the Rule 19b-4 application form that will allow exchanges to list and trade eight spot ETH ETFs, making ETH the second cryptocurrency to receive SEC-approved ETFs. This solidifies the SEC’s view that Ether is a commodity rather than a security. It will take some time before trading begins, as the SEC typically takes 30 days to review and approve registration statements. The case of the spot Bitcoin ETF is unique (trading began the next day) because the SEC has already conducted a lot of consultations with issuers, while in this case, the SEC has not yet met with a single issuer.

The approval by the agency is an abrupt turn in its attitude, one that many, including us, had not foreseen a week ago. Notably, the SEC’s commissioners did not vote on the issue as they did with a Bitcoin ETF, with the Division of Trading and Markets being the entity that approves the 19b-4. It may not have done so without the support of the commissioners, though. Our understanding of the situation is that things suddenly changed on Monday (May 20), possibly in response to the changes in the regulatory and legal environment for cryptocurrencies as mentioned above. Prior to this, the SEC had been unwelcoming to cryptocurrencies, allowing a spot Bitcoin ETF only after losing a case in court. Prior to the May 23 spot Ethereum ETF approval deadline, there was no sign that the regulator was inclined to approve it, as it had not held any meetings with potential issuers, whereas it had held 24 such meetings before the spot Bitcoin ETF was approved. Ethereum development firm Consensys even went so far as to sue the regulator, claiming that it was preparing to classify Ethereum’s native asset, ether, as a security, which would effectively end any hopes of a 33-year Act ETF.

When will ETFs start trading?

There is no set time frame for when the SEC deems a registration statement effective, but it typically takes about 30 days for corporate finance departments to review the filings. We’ll likely see meetings between issuers and the SEC (and subsequent amendment filings) as issuers work to get their filings into shape. The controversial issues, physical creation/redemption and staking, at least seem like expected conclusions, as they won’t be considered for any ETH ETF launch. Our guess is that, just like with spot Bitcoin ETFs, the SEC won’t play favorites and allow them to begin trading immediately. All of the top players in the Bitcoin ETF race have returned for another round, with the exception of WisdomTree and Valkyrie, which manage the smallest spot Bitcoin ETF, while Valkyrie was recently acquired.

However, in a significant strategic change, Grayscale has chosen to bring to the forefront its Grayscale Ethereum Mini Trust (ticker ETH), the (expected) lower-cost alternative to Grayscale Ethereum Trust (ticker ETHE), which filed a 19b-4 (but was not part of the initial SEC approval). Our guess is that Grayscale does not want a repeat of the launch of the spot Bitcoin ETF, when the high-cost GBTC drove capital to competitors. However, Grayscale Ethereum Mini Trust still has not begun the formal SEC review process, so it is unclear when it will begin trading, and we do not yet know the fees for ETH or ETHE. The current fee is 2.5%. We expect the fees for the spot ETH ETF to be in the range of the Bitcoin ETF, 20-30bps, with fee reductions based on AUM and duration.

How big can the Ethereum ETF get?

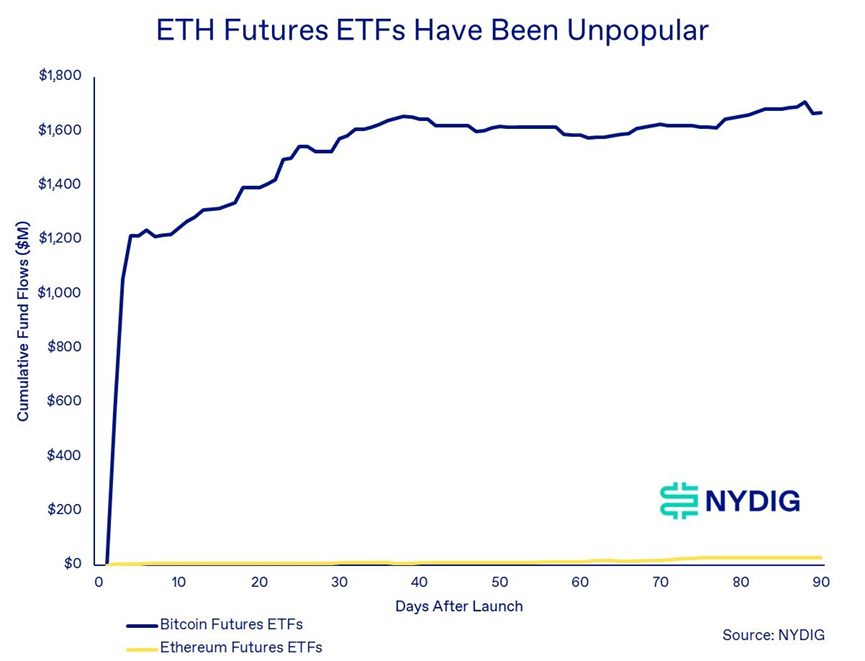

While this game is always a challenge (and the popularity of spot Bitcoin ETFs has certainly exceeded our initial expectations), at this point we have some signposts for Bitcoin ETFs, both spot and futures. However, some of the analogies are very incongruous. For example, the ETH futures ETF, which launched in October last year, has been very unpopular compared to the launch of the BITO Bitcoin Futures ETF, receiving less than 2% of inflows in the first 90 days. A lot of this is likely related to cycle timing, as the launch of BITO marked the peak of the previous cycle, while the launch of the ETH futures ETF coincided with the part of Bitcoin's dominance cycle (which is still the case today).

It could also be that investors simply appreciate ETH’s utility as the native currency of the platforms it builds and creates, rather than its monetary and investment purposes. Locking it up in an ETF could run counter to this utility-driven vision. Bitcoin’s fixed supply vs. Ether’s unlimited supply is a defining characteristic difference that encourages different user behaviors, such as buying and holding vs. using. A few years ago, the Ethereum community tried to portray Ethereum as “ultrasonic money,” which actually missed the point of Ethereum, its flexibility and utility, and instead tried to portray it as a better version of Bitcoin (which swayed few hard currency enthusiasts).

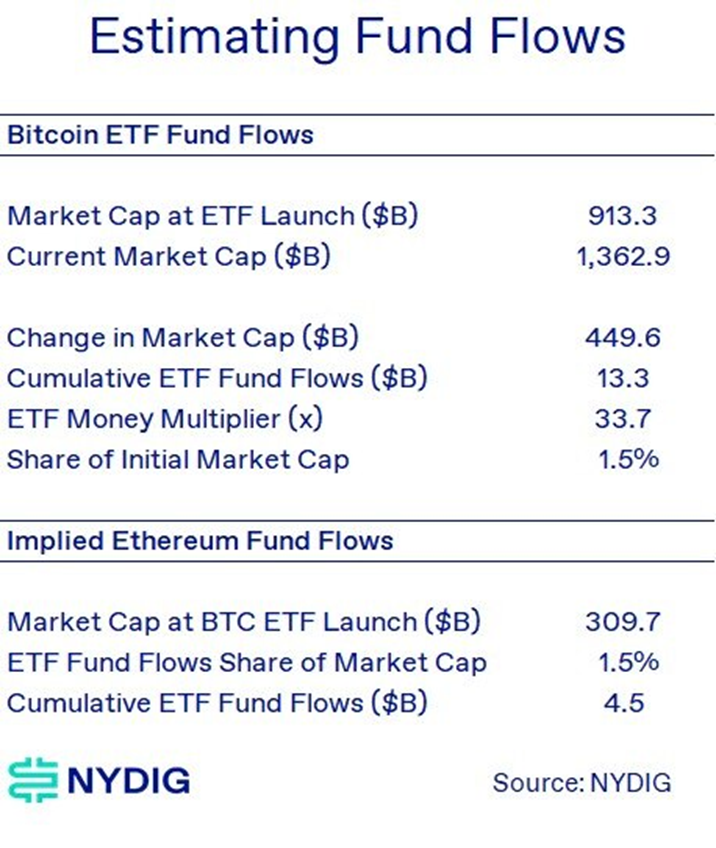

With this in mind, we can make some assumptions about potential demand for an ETH ETF, using the launch of a Bitcoin spot ETF as a guide. Using similar fund flow shares as a percentage of initial market cap, we estimate ETH ETF inflows at $4.5 billion, about one-third of Bitcoin ETF inflows (also a similar market cap ratio).

As for price impact, Bitcoin’s historical guide is an important blueprint. However, it is important to note that the Ethereum ETF has skipped many important steps on the tortuous road that Bitcoin must go through before it is finally approved. The ultimate impact will depend on the funds that flow into the ETF, and given the lack of popularity of the ETH futures ETF compared to the Bitcoin futures ETF, there is a big difference in fund flow results.

Will Other Digital Asset ETFs Follow Suit?

With the question of Ethereum ETF approval behind us, it’s natural to ask, what other cryptocurrencies could be in an ETF? The reality is that no other cryptocurrencies are regulated for derivatives trading on CME like BTC and ETH are. Therefore, it may place a greater burden on applicants to meet the SEC’s requirements for detecting and preventing fraudulent and manipulative trading practices. The SEC has already claimed in various lawsuits that many cryptocurrencies are also securities, such as SOL, ATOM, MATIC, ADA, FIL, and ICP. While a final judgment has not yet been made in favor of these cases, it seems unlikely that the SEC will allow an ETF for one of these assets. The reality is more likely that we see a pause in ETF applications to allow regulators, lawmakers, and the White House to digest all the recent changes.

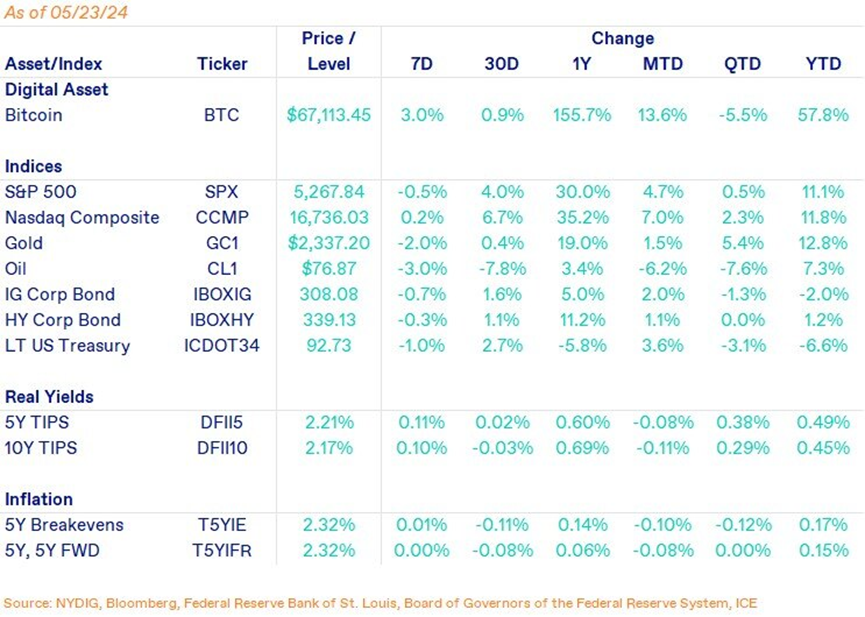

Market Dynamics

Bitcoin is up 3.0% this week, but not without its twists and turns. Bitcoin briefly looked set to hit a new all-time high as the SEC prepared to approve an ETH ETF on Monday. But some of the Bitcoin rotation into Ethereum that began on Tuesday, as well as higher-than-expected PMI (inflation) data on Thursday, thwarted that plan. Thursday saw a sudden reversal in risk markets, including stocks and cryptocurrencies, with Bitcoin particularly volatile at the 4 p.m. close. It's unclear what caused the volatility at the close, as GBTC saw only a small outflow while inflows totaled $108 million across the entire spot ETF complex. The ETHBTC cross was particularly volatile at the close, falling 5.7% before rebounding.

Looking ahead, if Thursday’s price action is any indication, macro-related events are likely to be important market drivers, especially in the short term. The launch of a spot ETH ETF, tentatively scheduled for a month from now, could have an impact on demand for Bitcoin ETFs. While new money may enter the ecosystem, especially given the improving regulatory backdrop, some of the money going into ETH ETFs could come from BTC ETFs, albeit with very different investment propositions.

Important news this week

Regulation, Enforcement and Taxation:

SEC Issues Order Approving Spot ETH ETF - SEC

Coinbase, Kraken, Meta and others form technical alliance to solve "pig killing" scam - CoinDesk

invest:

Bitcoin's share of trading volume surges to record levels during U.S. market hours - Bloomberg

Crypto ETFs: Hong Kong Considers Allowing Ethereum ETF Staking - Bloomberg

Bitcoin Developer Touts 'Programmability' as Catalyst for Next Rally - Bloomberg

industry:

Grayscale Investments Announces CEO Transition - Grayscale

Genesis to return $3 billion in customer assets in final bankruptcy liquidation plan - CoinDesk

This Man Didn't Invent Bitcoin - The New York Times

Court Decision in COPA v. Craig Wright – Source

Bitcoin is coming to Ethereum, MetaMask: Source - CoinDesk

'We heard you': Coinbase resumes XRP trading in New York - Decrypt

No, sponsored hashtag crypto newsletters are not a substitute for editorial coverage - CoinDesk

Upcoming Events

May 31 - CME expiration

June 12 – Federal Reserve interest rate decision

June 12 - May CPI data