simply put

- Bitcoin ETFs currently hold over 1 million BTC, representing nearly 5% of the total Bitcoin supply.

- Grayscale and BlackRock are the leading Bitcoin ETF holders with large BTC assets.

- U.S. Bitcoin ETFs dominate the market, holding 855,619 BTC, showing strong investor confidence.

Bitcoin exchange-traded funds (ETFs) have reached a major milestone. They now hold over 1 million BTC, or nearly 5% of the total Bitcoin supply.

Grayscale and BlackRock, which own large amounts of BTC assets, are leading the field, highlighting the growing institutional interest in cryptocurrency investments.

Bitcoin ETF holds over 1 million BTC

As of May 23, ETF holdings totaled 1,057,039 BTC. Grayscale’s GBTC leads with over 291,000 BTC, followed closely by BlackRock’s IBIT, which holds 279,500 BTC. The latest data from Arkham Intelligence shows an increase: GBTC now holds 293,000 BTC, while IBIT has 284,526 BTC.

Total Bitcoin held by ETFs. Source: BOLD Report

Total Bitcoin held by ETFs. Source: BOLD Report

Outside the U.S., Germany-based BTC Bitcoin Exchange Traded Crypto (BTCE) is the largest holder, holding 22,490 BTC. Swedish ETFs, Bitcoin Tracker Euro (COINXBE) and Bitcoin Tracker One (COINXBT) manage 17,830 BTC and 14,580 BTC, respectively. Hong Kong's seven newly launched Bitcoin ETFs hold a total of 5,789 BTC, though investors still have to pay interest.

Hashdex, a major player in the ETF market, holds more than 7,900 BTC through its HASH11 fund in Brazil. The company’s Bitcoin ETF DEFI holds 185 BTC, and its influence extends to the United States.

US ETFs dominate the market

The data clearly shows that U.S. ETF issuers lag far behind asset managers in other countries. These holdings were highlighted by Michael Saylor, a well-known Bitcoin advocate. On May 24, U.S. ETFs held 855,619 BTC, while global ETFs held 1,002,343 BTC.

He said : “32 Bitcoin spot ETFs currently hold about 1 Satoshi’s $BTC.”

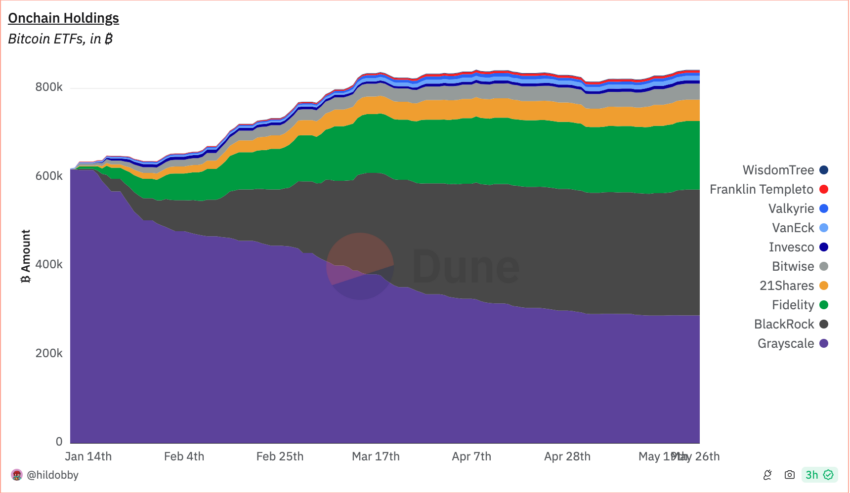

US ETF asset management data shows that Grayscale still dominates despite a slight decline in market share. BlackRock and Fidelity maintain stable market share. Other players such as WisdomTree, Franklin Templeton, Valkyrie, VanEck, Invesco, Bitwise and 21Shares have small market shares with slight changes.

Read more: Bitcoin Price Prediction 2024/2025/2030

Bitcoin ETF Onchain Holdings. Source: Dune Analytics

Bitcoin ETF Onchain Holdings. Source: Dune Analytics

The stability and growth of ETFs are not only an indicator of investor confidence, but also a driver of trading volume. According to Kaiko Research, the launch of spot Bitcoin ETFs has led to a surge in trading volume in the U.S. market, accounting for 46% of the cumulative trading volume from January to April . This trend has continued, and the net flow of ETFs has hit a 10-week high.

The price of Bitcoin is hovering near the psychological mark of $70,000. From January to April 2024, BTC has returned 57% year-to-date, outperforming the S&P 500. The data highlights the growing influence of Bitcoin ETFs on the cryptocurrency market, demonstrating the role they play in driving trading volume and investor interest.