The previous issue of Dehydrated Views pointed out that due to the positive impact of April CPI, cryptocurrencies are expected to get back on track. But the road back to the rising track is still tortuous. Last week's Fed meeting minutes once again hit the expectation of interest rate cuts, but the Michigan Consumer Confidence Index calmed concerns. Therefore, market sentiment fluctuated last week, and US stocks showed a volatile market. Cryptocurrencies rose first and then fluctuated.

This week, the United States will release PCE data for April. According to experts’ expectations, the data may stabilize, which is conducive to expectations of interest rate cuts and may also bring upside to the crypto market.

01

Industry and Macro

The minutes of the Federal Reserve meeting released on May 22 showed that after the data in the first three months of this year showed that inflation had increased beyond expectations, Fed policymakers were concerned about insufficient progress in reducing inflation, suggesting that the wait-and-see state of maintaining high interest rates should continue for a longer period of time, and that many policymakers intended to raise interest rates further if inflation risks rekindled. Affected by this factor, U.S. stocks fell. The surge driven by the good news of the ETH spot ETF on May 21 also failed to continue, and turned to volatility.

On May 23, the final value of the University of Michigan's one-year inflation forecast for May was 3.3%, lower than the expected 3.4%, and lower than the initial value of 3.5%. The previous value in April was 3.2%. The data eased concerns about inflation and US stocks rose.

In terms of the industry, the most significant news is the ETH spot ETF. On Thursday night, Eastern Time, the SEC approved the 19b-4 forms of eight Ethereum ETF issuers, including BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy and Franklin Templeton. ETF issuers still need to make the S-1 registration statement effective before they can start trading, and some analysts speculate that it may take several weeks.

We believe that this major positive news will continue to ferment for some time, and will drive ETH and the overall crypto market up in a timely manner when macro conditions are favorable.

Another important positive is the passage of the FIT21 cryptocurrency bill by the U.S. House of Representatives. The bill will make the CFTC the primary regulator of digital assets and the regulator of non-securities spot markets, and will more clearly define what makes a crypto token a security or commodity. Although the Democratic-controlled Senate may not fully agree with the bill, the bill itself means that there is a considerable degree of consensus on the regulation of the crypto market.

02

On-chain data

According to Coinglass data, Bitcoin ETF funds showed a net inflow, and the scale of funds appeared relatively large.

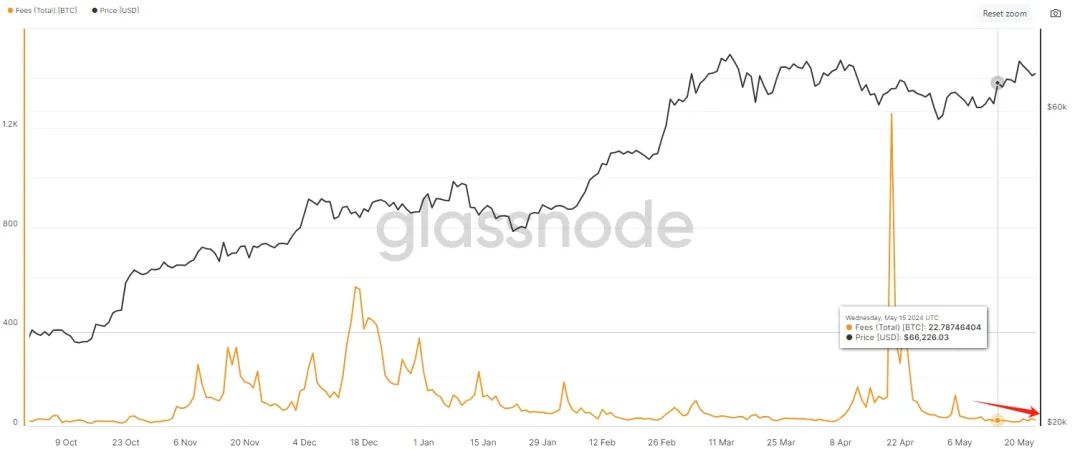

Judging from glassnode data, Bitcoin on-chain activity is still relatively low, and on-chain activity as a whole is still relatively weak.

Overall, the activity on the Bitcoin chain has decreased to a certain extent, but there are signs of an increase in institutional capital inflows. In contrast, Ethereum's trend is relatively strong, and Ethereum's performance is expected to be relatively strong in the future. In the future, it is expected that the passage of the FIT21 bill will have a greater impact on the crypto market.

03

technical analysis

Affected by the positive impact of the approval of the Ethereum ETF, BTC showed a high trend last week, but there was still a certain retracement over the weekend. Judging from the current price, the box area below is still an important support area, and every return to this area will have a supporting effect on the price. In the short term, it is necessary to observe whether there will be a lower low than 66285. If so, the subsequent price will still be priced around the box area, and then the direction will be determined.