Author: Ben Strack Source: blockworks Translation: Shan Ouba, Jinse Finance

The approval of spot Bitcoin and Ethereum ETFs in the U.S. presupposes a regulated futures market—a precedent that could change. Spot crypto ETFs focusing on assets other than Bitcoin and Ethereum could only be launched quickly if the current precedent changes.

In other words, the SEC needs to see a regulated futures market — and a correlation between the futures and spot markets — before it approves an ETF that directly holds cryptocurrencies.

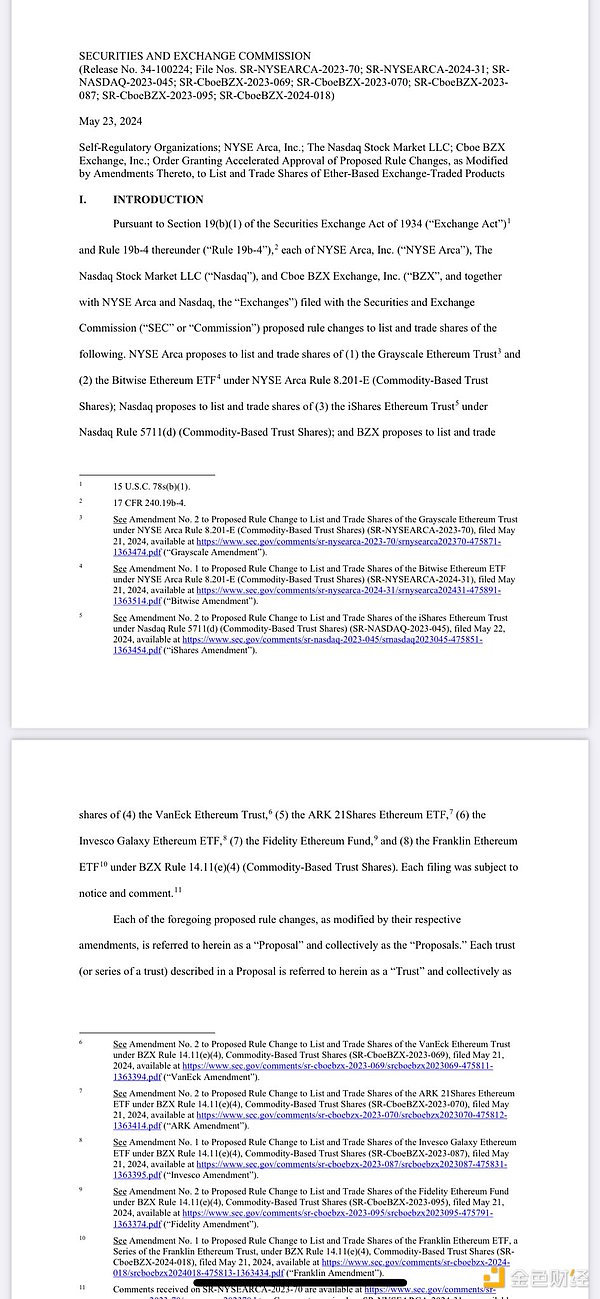

In January, the regulator approved a spot Bitcoin ETF. Last week, the SEC approved a 19b-4 proposal submitted by an exchange that is launching a spot Ethereum ETF — a step toward future trading. While this latest move has fueled optimism about future products that could focus on Solana, XRP, or even Dogecoin, SEC precedent does not support this hope anytime soon.

“Without a functioning regulated market, I don’t see the SEC approving this,” said Bryan Armour, director of passive strategy research at Morningstar. He personally believes that the futures market doesn’t reflect more about what’s happening in the underlying spot market and its potential for manipulation, but that’s where the SEC draws the line.

The process from futures to spot

CME Group launched bitcoin futures in December 2017. SEC Chairman Gary Gensler said at a virtual event in August 2021 that the commission "looks forward" to reviewing documents related to bitcoin futures contracts traded only on CME. About two months later, ProShares launched the first bitcoin futures ETF.

While the launch of a futures fund did not immediately pave the way for the launch of a U.S. spot Bitcoin ETF, it ultimately gave the process a significant boost.

This is because Grayscale Investments sued the SEC in 2022, claiming that the regulator’s decision to approve a Bitcoin futures fund but block a spot Bitcoin product was “arbitrary and capricious.”

Grayscale won the case last year, with the judge stating that “the Commission failed to reasonably explain the obvious financial and mathematical relationship between the spot and futures markets and failed to meet the standard of rational decision-making.”

History was then rewritten, and the SEC approved the first US spot Bitcoin ETF in January this year.

For Ethereum, the story is not much different.

Ethereum futures were launched in February 2021 through CME Group. Despite several failed attempts to launch an Ethereum futures fund, the SEC approved an Ethereum futures fund in October last year. Subsequently, the regulator approved 19b-4 proposals for spot Ethereum products listed on Cboe, NYSE Arca, and Nasdaq.

“Over the past 2.5 years, there has been a high degree of correlation between the CME Ethereum futures market and this subset of the spot Ethereum market,” the SEC noted in its May 23 order.

Using data at hourly intervals, the correlation between markets during the sample period was no less than 96.2% — essentially confirming earlier analysis submitted by Ethereum ETF applicant Bitwise.

Could precedent change?

Armour, Bitwise senior crypto analyst Ryan Rasmussen and others noted that this precedent could change.

“So far, regulated futures markets have been a prerequisite for the approval of spot ETFs for Bitcoin and Ethereum,” Rasmussen told Blockworks. However, there is no guarantee that this prerequisite will be required for the approval of every future cryptocurrency spot ETF.

CME Group currently does not offer futures on cryptocurrencies other than Bitcoin and Ethereum.

Former President Donald Trump has expressed support for the crypto industry if elected, but has yet to detail any specific plans. Recently, more Democratic lawmakers have begun to support the sector, with dozens straying from the party majority to support pro-crypto legislation.

“Things could change very quickly in Congress, especially if they come up with a market structure bill next year and really define what is a commodity and what is a security,” Bloomberg Intelligence analyst James Seyffart said in a conversation with Blockworks co-founder Michael Ippolito.

Another Bloomberg Intelligence analyst, Eric Balchunas, noted in the same podcast that Joe Biden’s reelection as president could mean that other spot crypto ETFs won’t receive SEC approval for a long time.

He said the committee’s attitude toward cryptocurrencies could change significantly if Trump wins — but added that whether Trump would actually support cryptocurrencies remains a “huge variable.”

Possible future crypto products

The unanswered question of whether Ethereum is a security or a commodity is considered a hurdle to approval of an Ethereum fund. Some industry observers point out that the SEC's latest Ethereum ETF order essentially clarifies that Ethereum is not a security. At the very least, it seems to indicate that the agency does not consider uncollateralized Ethereum to be a security, as the planned product will not collateralize its Ethereum holdings.

Gensler has said that most crypto assets are securities, which would make their prospects for inclusion in ETFs questionable.

YouHodler head of markets Ruslan Lienkha said he expects to see applications for XRP and Solana ETFs.

The SEC classified SOL as a security in its lawsuit against Coinbase and Binance last year. Others considered securities include Cardano (ADA), Polygon (MATIC), Filecoin (FIL), and NEAR Protocol (NEAR).

Litecoin (LTC) and Dogecoin (DOGE) are among the top crypto assets that the SEC has not officially called securities.

Last year, a U.S. federal judge ruled that while Ripple’s institutional sales of XRP were deemed to constitute an unregistered securities offering, programmatic sales did not.

Rasmussen said most financial advisors and wealth managers are still struggling to understand Bitcoin. For financial professionals, learning about Ethereum (ETH), Solana (SOL) and other crypto assets is the second or third step in their cryptocurrency journey.

He explained that crypto index ETFs could play an important role in crypto investing as more crypto assets enter the market through ETFs.

Rasmussen said it is difficult to predict the timeline for the launch of these products.

He added: “Crypto index funds are likely to see significant demand from advisors because they allow advisors to provide clients with broad exposure to the fast-growing cryptocurrency space while removing the difficulty of picking winners.”