The price of Bitcoin appears to have returned to a volatile market, eliminating any hopes of breaking new highs anytime soon. However, the good news is that the current bull cycle is not over yet, although it will take some time for the premier cryptocurrency to resume its upward momentum.

Specifically, the latest on-chain observations show that Bitcoin has been experiencing a “wave of euphoria” over the past few months

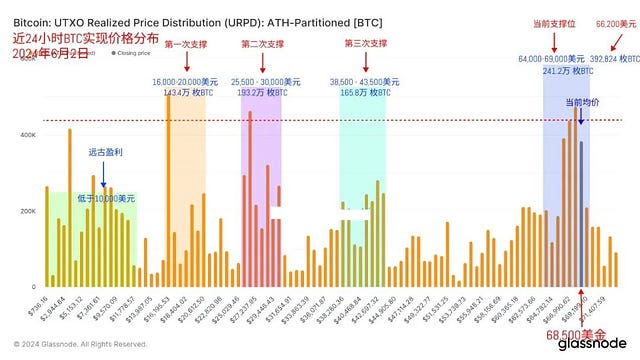

However, the market liquidity has been very poor recently . The last time we saw less than 20,000 BTC changing hands on the chain was in the fourth quarter of 2022. At that time, the BTC price was less than $20,000. Now the price has increased by more than 3 times, but the liquidity has hardly changed. Moreover, the data on Sunday is the most thorough. After abandoning the market makers, it is almost the most realistic turnover of real position holders.

This is what we have been saying all along. Those with money don’t want to buy, and those with coins don’t want to sell . The fluctuations in BTC prices in the past two days are actually telling us this. I can see news reports that BTC prices have fallen below $68,000 almost every few hours, and a few hours later, BTC prices have broken through $68,000. This is the truest portrayal of current investors.

There is nothing much to say. Monday may be the quietest day of the week . The unemployment rate will be a game from Tuesday. There are employment-related data every day on Tuesday, Wednesday, Thursday and Friday, which point step by step to employment, wages and unemployment rate on Friday.

Then the next week is the Fed's June interest rate meeting. Actually, I personally don't think there will be anything new in June. No matter what the data is, it is very likely that the interest rate will remain unchanged. The key is to see whether there will be problems in the US economy in July and August. If there are no problems and it goes smoothly until September before the election, it should not be too bad.

June Outlook: Which Targets Should You Choose?

1. First of all, ETH ETF is great, no need to say more . In addition to leverage, the best Beta of ETH is those with ETH in the name, such as ETHFI, ENS

I personally think that Pendle's indicators in these areas are great . In terms of the correlation between fundamentals and narratives, the initial rise was because Pendle catered to the LSD narrative, and this year Pendle was deeply involved in the LRT narrative, driving prices to continue to rise. However, I have talked about Pendle many times this year, so I won't go into details here.

2. Arbitrum

The Arbitrum community's "200 million ARB game catalyst plan" proposal should be passed. This is definitely good for Arbitrum's game ecosystem (such as TreasureDAO).

MAGIC also has a Layer3 expectation in the future . On April 22, TreasureDAO has launched the Layer3 testnet and is expected to launch the mainnet in Q3 this year. The mainnet supports staking.

3. AI

The AI sector only discusses two targets with confirmed date catalysts:

The FET merger will happen on 6.11/6.13, and will be renamed ASI afterwards

AR and AO related information will be released on June 13. Participants can mine AO through AR.

4.Solana

My initial thought was that SOL might be affected by the strength of ETH (bloodsucking)

Now I have changed my mind: Solana’s attributes as a memecoin casino are there (referring to those celebrity memes, most people will choose to issue memecoin on Solana), and the current market has a rigid demand for memecoin gambling

Therefore, I think SOL will not be sucked too much blood during this period - the current population of ETH and SOL has been divided, and people who play SOL will not easily migrate to ETH. On the contrary, the rise of ETH will raise market expectations and push market sentiment to a high point, and Solana will be the beneficiary.

5. Others

Fantom Sonic

At present, Fantom's launch of Sonic mainnet is a sell news for FTM speculators. Keep an eye on AC's subsequent actions. Now that the link is out, there must be something to do on it (my expectation)

Uniswap "Start Fee Mechanism" Voting

It has been postponed. The reason may be that a certain VC is putting pressure on Uniswap. I will keep a certain attention on this matter (as a bystander), but UNI will most likely not participate in the hype.

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background