Note: This article comes from @riyuexiaochu ’s Twitter account, and is compiled by Mars Finance as follows:

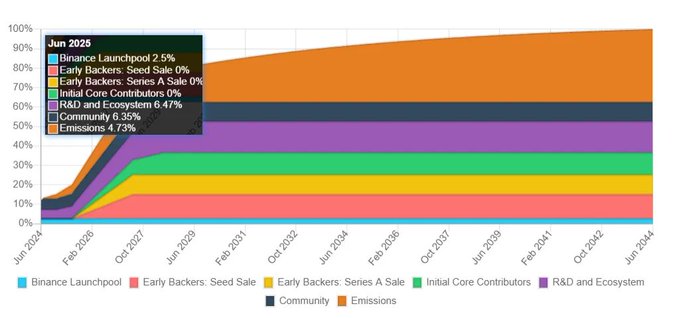

1. Calculate the circulation first. There are three main new circulation items in TGE within one year.

1) Community: 13.28 million, average 1.1 million IO per month

2) Operation and ecology: 14.24 million tokens, an average of 1.18 million tokens per month.

3) Node incentives. At first glance, the annual inflation rate of 8% does not seem high, but it is not. Because there are relatively few tokens in circulation in the first year, the overall circulation inflation is very high. In short, the node incentives in the first year will add 37.84 million tokens to circulation, an average of 3.15 million tokens per month.

Therefore, in the first year of TGE, the monthly new circulation of IO was 5.43 million.

2. Starting from June 2025, the team and investors will begin to unlock. The monthly unlocking is 10.16 million . According to the financing calculation, the cost of investment for seed round investors is 0.1 US dollars, and the cost for A round investors is 0.36 US dollars.

2. Starting from June 2025, the team and investors will begin to unlock. The monthly unlocking is 10.16 million . According to the financing calculation, the cost of investment for seed round investors is 0.1 US dollars, and the cost for A round investors is 0.36 US dollars.

3. IO's token is a little bit special. It has two supply, the initial supply is 500 million and the maximum supply is 800 million. After the initial supply is 500 million, it will be increased every year, starting from 8% in the first year, and then reduced by 1.02% every month. It will be increased to 800 million after 20 years at most. In fact, there are many projects that will increase the supply every year for node rewards, such as ETH, DOT, etc. It's just that other projects will not specifically mention the upper limit of the increase like IO.

4. However, because IO has two supply amounts, it is easy to get it wrong under different data ratios, and some details can easily be misled by the official.

Binance Launchpool: 20 million, 2.5%

Seed round investors: 100 million, 12.5%

Round A investors: 8,120 tokens, 10.15%

Core contributors: 9072, 11.34%

Operation and ecology: 128 million, 16.01%

Community: 80 million, 10%

5. The initial circulation is 95 million, including 20 million for Binance Launchpool, 37.5 million for the community, and 37.5 million for operations and ecology. Generally speaking, the 37.5 million for the community will be used for airdrops. A portion of the 37.5 million for operations and ecology will be used for liquidity provision, and the rest may be reserved or sold by the project party (need to be tracked on the chain to know)