Written by: Huo Huo

2024 is a super election year, with dozens of countries and regions around the world holding key elections, involving a total population of more than 4 billion. The US election is undoubtedly the biggest focus. However, unlike in the past, among all the super PACs participating in the 2024 US election, the topic of cryptocurrency ranks third in popularity.

I still remember that four years ago, it was rare for presidential candidates to discuss Bitcoin during campaign events. Three years ago, when El Salvador first adopted Bitcoin as legal tender, everyone was still watching. However, in last year's primary election, the situation began to change, and the era when encryption was marginalized in politics seemed to be gone forever.

On the one hand, former President Trump and current President Biden are making various efforts to win the support of crypto voters; on the other hand, many crypto companies plan to inject large amounts of cash into the 2024 US presidential election, and there are already signs that these funds are helping the crypto industry win more support in Washington.

In addition, among the 12 primary candidates participating in the 2024 US presidential election in 2023, 5 presidential candidates have clearly publicly expressed their support for Bitcoin and the encryption industry. At the end of December 2023, Argentine President Javier Milley was elected. It is reported that Milley's policy proposals include dollarization, ending currency controls, closing the central bank, drastically reducing national spending, and actively supporting Bitcoin...

Argentine President Javier Milley

So which presidents and regions around the world have clearly expressed their support for Bitcoin?

El Salvador: Nayib Bukele

El Salvador became the first country in the world to officially recognize Bitcoin as legal tender in 2021. In 2021, El Salvador made Bitcoin legal tender and simultaneously launched Chivo Wallet, a government-designed digital wallet app that allows users to pay with either U.S. dollars or Bitcoin. At the time, Bitcoin was trading at around $36,000.

The decision was made by Salvadoran President Nayib Bukele. On the one hand, El Salvador is an agricultural-driven economy that is overly dependent on remittances from abroad as a major component of its GDP; on the other hand, Bukele came to power eager to lead El Salvador to prosperity, and his party holds 64 seats out of 84, giving it absolute decision-making power.

When the price of Bitcoin fell to a low of around $16,000 in November 2022, Bukele announced that El Salvador would begin purchasing one Bitcoin per day.

In March 2024, according to foreign media reports, Bukele said that the country's Bitcoin holdings may exceed public estimates, and posted on Twitter that El Salvador is earning Bitcoin-related income through its passport program, exchanging Bitcoin for US dollars for local businesses, mining and government services. He said that the Bitcoin investment portfolio is worth nearly US$205 million and has made a profit of US$83 million from the Bitcoin investment strategy.

Then on March 14, Booker posted again that the country was preparing to deposit "a large portion" of its Bitcoin assets into "cold wallets" and other related offline devices.

However, a study published in the journal Science in December 2023 showed that since El Salvador adopted Bitcoin as its legal tender, Bitcoin has not been widely used in the country, and "digital payments (application scenarios) are scarce and concentrated."

President of the United States (former president, candidate)

The next US presidential election will take place in late 2024, and although polls will not open until November 5, 2024, dozens of US politicians have already expressed their intention to run against the current Democratic President Joe Biden.

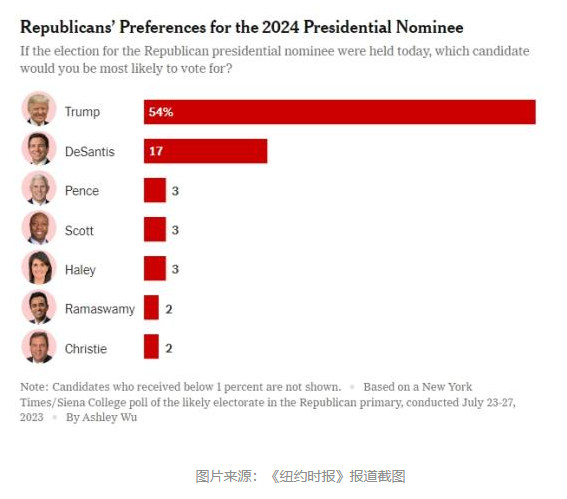

Among the 12 candidates participating in the 2024 US presidential election, five presidential candidates who have explicitly and publicly expressed support for Bitcoin and crypto assets include four Republican candidates: Donald Trump, Ron DeSantis, Francis Suarez, Vivek Ramaswamy, and Robert Kennedy Jr. of the Democratic Party. According to FiveThirtyEight data at the time, among the Republicans who had announced their candidacy, Donald Trump had the highest support rate of 54%; Ron DeSantis ranked second at 17%.

As expected, Trump and Biden started the battle of "crypto election".

As we all know, the current Biden administration (Democratic Party) seems to have been taking an anti-crypto stance, so once a pro-crypto candidate is elected, this may have a huge impact on the next crypto bull market. Judging from the current party attitudes towards crypto, the majority of Democrats, led by Biden, tend to be cautious about crypto, especially after the collapse of FTX, the Democratic Party has further strengthened its strict regulatory direction. Most Republicans, led by Trump, may have shown a rare tolerance for crypto in order to show their different political views and attract votes.

As Trump continued to call for "crypto-friendliness" and support for technological innovation, and even opened a crypto donation website in May, Biden and other Democrats could no longer sit still and began to loosen up, announcing the recruitment of Meme managers.

Perhaps encryption only accounts for a very small part of the entire US election, but this does not mean that encryption voters are not important. It may be that a small policy will have a greater impact on voter support.

1) Donald John Trump

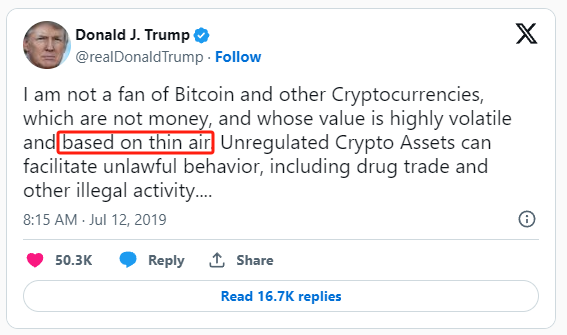

Although Trump has publicly expressed his negative attitude towards cryptocurrencies during his previous presidency (January 2017-January 2021), believing that crypto assets are "thin air", he has been very "honest" in his actions in the past two years and has become one of the presidential candidates who is most proficient in cryptocurrency.

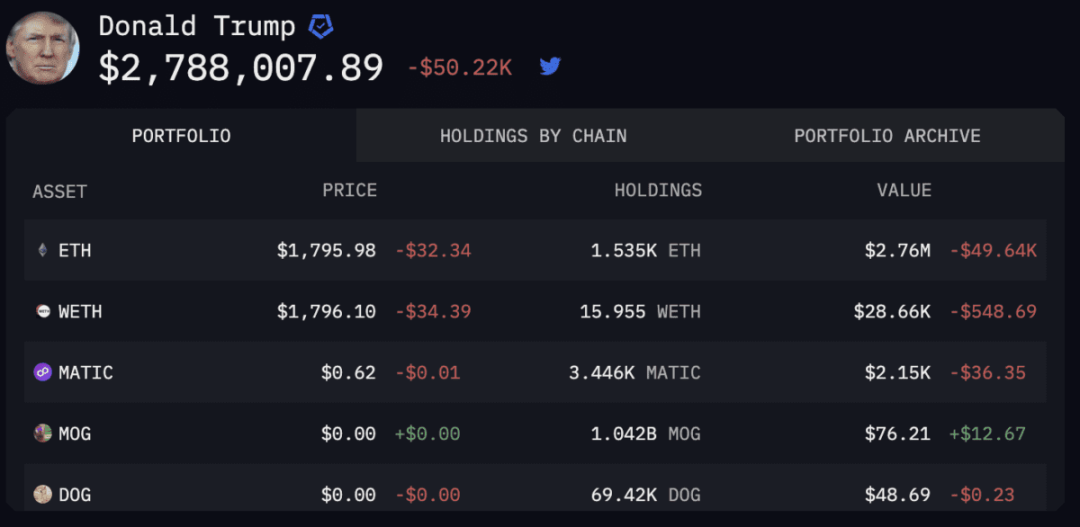

He launched the NFT project Trump Digital Collectible Cards on December 16, 2022, and earned a total of $4.87 million after all were sold out. In the crypto wallet suspected to be his own, according to the disclosure of the Washington nonprofit Citizens for Responsibility and Ethics (CREW) on August 14, 2013, he also held nearly $2.8 million in crypto assets (ETH).

Currently, Trump leads other Republicans in the polls with a considerable advantage. However, as more and more Republicans announce their candidacy and Trump is involved in cases, it is still full of unknowns who will ultimately represent the Republican Party in the 2024 US presidential election.

2) Ron DeSantis

On July 31, 2023, at a campaign event in New Hampshire, U.S. presidential candidate and Florida Governor Ron DeSantis said in response to the Biden administration’s continued crackdown on crypto assets and crypto institutions since 2023:

“When I’m elected president, I will end Biden’s war on Bitcoin and crypto.”

“We will allow Americans to invest in Bitcoin and crypto assets. No one forces you, but if you want to buy (crypto assets), you can buy them.”

DeSantis is also adamantly against CBDC (central bank digital currency), arguing that unlike cryptocurrencies, central bank digital currencies would massively transfer power from individual consumers to the central government, giving the federal government the ability to control where money goes.

DeSantis also said, “If I were president, we would abolish central bank digital currencies from day one.”

3) Robert F. Kennedy Jr.

Another person who invested in crypto assets is Robert Kennedy, the Democratic candidate for the US presidency in 2024. He is a member of the famous political family, the Kennedy family, and the nephew of former US President John F. Kennedy.

On July 24, 2023, Kennedy Jr. attended a Bitcoin conference in Miami and announced that his campaign would be "the first presidential campaign in history to accept Bitcoin donations via the Lightning Network."

Robert Kennedy to speak at Miami Bitcoin Conference in 2023

On July 27, he confirmed on Twitter that he does hold Bitcoin and has bought 2 Bitcoins for each of his 7 children. He emphasized that Bitcoin is an inflation-resistant currency, which gives retail investors freedom instead of holding legal tender that is dominated by the system. He hopes to exempt Bitcoin from capital gains tax.

Like DeSantis, Kennedy Jr. is more firmly optimistic about the future of Bitcoin and encryption, and promised the public that if he is elected president , he will gradually use Bitcoin to support the US dollar. He explained that this is a gradual process, and the plan will start from a very small scale, perhaps only 1% of the national debt will be backed by hard currency, gold, silver, platinum or Bitcoin.

4) More

The other two presidential candidates, Vivek Ramaswamy and Francis Suarez, currently have a lower chance of becoming the US president in 2024 according to polls, but it is not impossible, and they are both supporters of Bitcoin.

But unlike DeSantis, Vivek Ramaswamy said he is a fan of Bitcoin, but will not use Bitcoin as a commodity to help stabilize the dollar : "I think that Bitcoin does not meet the criteria of a commodity basket for a number of reasons. Bitcoin may become part of the commodity basket at some point in time, but for some technical reasons, I will not include it today."

Presidential candidate and Miami Mayor Luis Suarez will accept Bitcoin donations for his presidential campaign. During his tenure as mayor, Suarez was known for his advocacy of cryptocurrencies. He vowed to make Miami a Bitcoin hub, and he practiced what he preached, accepting Bitcoin wages as mayor. Suarez is also deeply involved in the development of the crypto industry and believes that the United States needs a president who understands crypto assets and artificial intelligence technology.

President of Argentina: Javier Milei

Javier Millet is an Argentine economist, former member of the Argentine National Chamber of Deputies and leader of the liberal movement, who successfully ran for the November 2023 presidential election.

Tucker Carlson, a famous American journalist, once interviewed Milley, which has been viewed more than 421 million times on Twitter. One of the key contents of this interview is the dollarization of the Argentine economy. In this proposal, Milley has always emphasized the importance of abolishing the Argentine Central Bank and talked about the opportunities that Bitcoin can provide for this process.

In his vision, Bitcoin will become the main remedy for Argentina's inflation after the closure of the country's central bank. Before the presidential campaign, Milley shuttled between multiple talk shows, often promoting the benefits of Bitcoin and crypto assets, believing that "Bitcoin can eliminate the central bank."

On November 20, 2023, perhaps due to Milley's election, Bitcoin, which was hovering around $30,000, rose above $37,000, with a 24-hour increase of 2.3%.

After his election, and especially in recent weeks, contrary to some previous reports, the Millet government has not promoted the Bitcoin standard in Argentina . Many sources have clarified that Javier Millet has no actual pro-crypto policies, and stated that while Millet is positive about Bitcoin and critical of the central bank, his main economic proposal is the dollarization of the Argentine economy, not the adoption of Bitcoin as legal tender. Millet's comments about Bitcoin being "the return of money to its original creators, the private sector" were taken out of context to imply a broader policy approach to adopting Bitcoin, which was not proposed by him.

Is this a lesson for the US election and the development of encryption?

Mexican presidential candidate: Indira Kempis

Kempis is currently a Senator of the Republic in the 65th Legislature of the Federal Congress of the Civic Movement Party. In late August 2023, amid internal disputes over the future of the party, she announced her intention to become the first female presidential candidate in Mexico.

Kempis is well known among Bitcoin and crypto asset advocates as she has been outspoken about the opportunities that Bitcoin’s early adoption could bring to Mexico. The senator has encouraged the crypto economy over the past few years since taking office in 2018. She has also pushed for Mexico to enact Bitcoin regulations similar to El Salvador’s, according to Bitcoin Magazine.

Kempis introduced a bill to create a CBDC in 2022, when she made headlines by suggesting that the Banco de Mexico be the sole issuer of the digital peso, although she did not mention crypto in the bill.

However, after criticism from the cryptocurrency community over the introduction of a CBDC, Kempis supplemented the bill to include Bitcoin, with the intention of making the first crypto asset the legal tender in Mexico.

The Bank of Mexico has yet to provide an analysis of the CBDC bill, and responses from lawmakers have been mixed. For example, one senator expressed strong opposition, arguing that while Bitcoin is legalized in El Salvador, Mexico "will not accept" Bitcoin as legal tender.

She has also actively participated in some crypto-related activities, such as in August 2023, in the province of Nuevo León, where she was born, she participated in promoting the certification of the "My First Bitcoin" course.

However, the Mexican presidential election began on June 2, 2024. On June 3, Claudia Sheinbaum, the presidential candidate of the campaign alliance of the ruling National Regeneration Movement Party of Mexico, announced her victory in the presidential election in the capital Mexico City, becoming the first female president in Mexican history. She will take office on October 1, but not much has been revealed about her crypto stance.

Although this result is of great significance for the advancement of gender equality in Mexico, the current Mexican government is likely to continue its policies and strategies for crypto regulation in the future, so it is worth keeping an eye on it.

Current UK Prime Minister: Rishi Sunak

Rishi Sunak, the new leader of the ruling Conservative Party of the United Kingdom, officially took office as Prime Minister of the United Kingdom on October 25, 2022.

Sunak actively promoted economic policies and financial legislation during his tenure as Chancellor of the Exchequer. Although there is no clear crypto event directly related to him, his policies and decisions have had an impact on the UK economy and financial sector.

While serving as Chancellor of the Exchequer in April 2021, Sunak proposed that the UK Treasury and the Bank of England explore the creation of a central bank digital currency (CBDC).

In April 2022, Sunak called for recognition of stablecoins as a valid method of payment.

When Sunak was asked by reporters a few months before his election, he said that he preferred BAYC to Crypto Punks. He preferred a portfolio of multiple cryptocurrencies to one or two cryptocurrencies. It can be seen that he has been paying attention to cryptocurrencies for a long time.

After taking office, Sunak began to promote the British pound stablecoin and said, "My ideal is to make the UK the center of global crypto asset technology." He then included stablecoins in the scope of supervision and made cryptocurrencies one of the recognized payment methods.

And in April 2023, he also proposed to make the UK a crypto-friendly technology center and planned to launch the official UK NFT.

However, the UK general election will be held on July 4, 2024, a day that could cause the ruling Conservative Party to lose power. According to voting intention surveys, the Labour Party is currently expected to win the upcoming election, and the Labour Party has not yet clarified its position on the crypto industry and is currently silent on crypto legislation, but they have expressed their desire for the UK to become a tokenization center and expressed support for the Bank of England's digital pound plan.

President of the Central African Republic: Faustin Archange Touadera

(Faustin-Archange Touadéra)

The President of the Central African Republic is a loyal "believer" in Bitcoin and has always supported and been committed to the promotion and application of Bitcoin. In April 2022, it was announced that Bitcoin would be adopted as legal tender, and tax payments would be accepted for encrypted payments. In addition, a legal framework was established to regulate the use of cryptocurrencies. This made the Central African Republic the second country after El Salvador to officially adopt Bitcoin as legal tender, and also the first country in Africa to adopt Bitcoin as a payment currency.

In April of the same year, he pushed the National Assembly of the Central African Republic to pass a bill announcing the adoption of Bitcoin as legal tender to help the country's economic recovery and construction.

In May of the same year, the "Crypto Center" Project Sango was launched to attract global crypto enthusiasts, and plans to build a crypto island and a digital wallet. At the same time, it stated that the Central African legislature had passed the "Tokenization Act" to approve the tokenization of land and natural resources. However, as the crypto bear market deepened, the plan did not develop smoothly.

But the President of the Central African Republic said, "If everyone is not optimistic about Bitcoin, then we will issue our own country's cryptocurrency."

In July of the same year, Central Africa launched the public sale of the national cryptocurrency Sango Coin, positioning Central Africa as a "crypto-economic country". Sango Coin is deployed on the Bitcoin sidechain and interacts with the Bitcoin mainchain, allowing users to trade between Sango Coin and Bitcoin. The initial public sale price was $0.1, the total supply was 21 billion, and the token sale was divided into 12 cycles, with the price gradually rising to the final $0.45. Central Africa also provides various empowerments, such as purchasing and staking Sango Coin in exchange for citizenship, obtaining electronic residency, or obtaining land property by staking Sango Coin.

However, two months after the Sango Coin public sale, the Constitutional Court of the Central African Republic ruled that the use of tokens to purchase land and citizenship was unconstitutional. In addition, the country’s National Parliament announced in March this year that Bitcoin would be changed from legal tender to a benchmark cryptocurrency.

It can be said that despite the ups and downs, China and Africa are still exploring this path.

Prime Minister of Japan: Fumio Kishida

The Japanese government has a relatively open attitude towards cryptocurrencies and is considered one of the leading markets for crypto assets in the world. It has adopted a series of regulations and measures to regulate and promote the development of cryptocurrencies.

In April 2017, Japan officially recognized crypto assets as a legal means of payment and promulgated the Payment Services Act to regulate crypto CEX/DEX and service providers.

In addition, the Japanese government has set up a special agency, the Financial Services Agency (FSA), to regulate crypto CEX/DEX and related businesses. The FSA reviews exchanges and takes measures to ensure the safety of users’ funds.

In November 2021, Fumio Kishida, who was from the Liberal Democratic Party, was elected Prime Minister of Japan. After taking office, Fumio Kishida said in a speech: "With the shrinking labor force, there is an urgent need to utilize digital technology. Japan will actively promote the digital transformation of the public and private sectors."

In June 2022, the Japanese parliament passed a bill clarifying the legal status of stablecoins, defining them essentially as digital currencies, making Japan one of the first major economies to introduce a legal framework for stablecoins.

Subsequently, Fumio Kishida proposed to use Web3.0 as the pillar of economic reform, and released a white paper in April 2023 to address issues such as digital currency tax reform and NFT. The white paper formulated regulatory proposals for all Web3.0-related matters from NFT to DAO.

In July 2023, at the WebX Summit hosted by the media CoinPost, Fumio Kishida said in his speech that Web3 technology has the potential to subvert the traditional framework of the Internet and lead social change, and the Japanese government is working hard to improve the development environment of Web3.

On February 16, 2024, the Fumio Kishida government also approved a bill to enhance Japan's industrial competitiveness - the Industrial Competitiveness Enhancement Act. The bill will take measures to add crypto assets to the list of assets that investment limited partnerships can acquire and hold. This is a major policy change that will directly allow venture capital companies to invest in projects that specifically issue crypto assets.

It can be said that after Fumio Kishida was elected prime minister in 2021, he immediately developed crypto-related industries such as Web3. The passage of these bills this year means that Japan is further open to the development of digital assets.

Former Brazilian President: Jair Bolsonaro

Former Brazilian President Jair Bolsonaro also took an open and positive stance on crypto policy. He once said he would support the legalization of Bitcoin as legal tender and hoped that Brazil could become the first country to adopt Bitcoin. During his term, no VAT or income tax was imposed on crypto transactions. He also supported the Brazilian Central Bank's research on issuing digital currency.

In addition, in April 2022, Bolsonaro approved a bill in the Brazilian Senate after a long deliberation. This is the first bill in Brazil to regulate encryption, which will lay the foundation for creating a regulatory framework for the country's encryption industry.

The bill was first proposed by a federal congressman in 2015 and was eventually signed into law by former Brazilian President Jair Bolsonaro, legalizing cryptocurrency as a means of payment in Brazil.

Overall, Bolsonaro has promoted the openness of Brazil's crypto policy, but also hopes to use digital assets to strengthen national sovereignty and control. His policies have played a certain role in promoting Brazil to become the crypto hub of South America.

summary

It can be seen that crypto assets, led by Bitcoin, are infiltrating into the development process of various countries in the form of economy or politics. The emergence of crypto-asset-friendly countries has accelerated the journey of crypto from marginal finance to mainstream finance.

As more countries recognize the potential of blockchain technology and digital currencies, we may see a more integrated and robust global crypto market.