The much-anticipated macro double headline day finally arrived, and the results lived up to expectations. First, the CPI data was far below expectations, with the core CPI up 0.16% month-on-month (the lowest level since August 2021), far below the market's expectation of 0.3%, with the "super core CPI" being particularly weak and negative; service spending fell, commodity prices were flat, and housing inflation rose but remained within controllable limits. After the CPI was released, Wall Street economists quickly lowered their PCE forecast from 2.8% to 2.6%, moving in the right direction of the Fed's long-term goals.

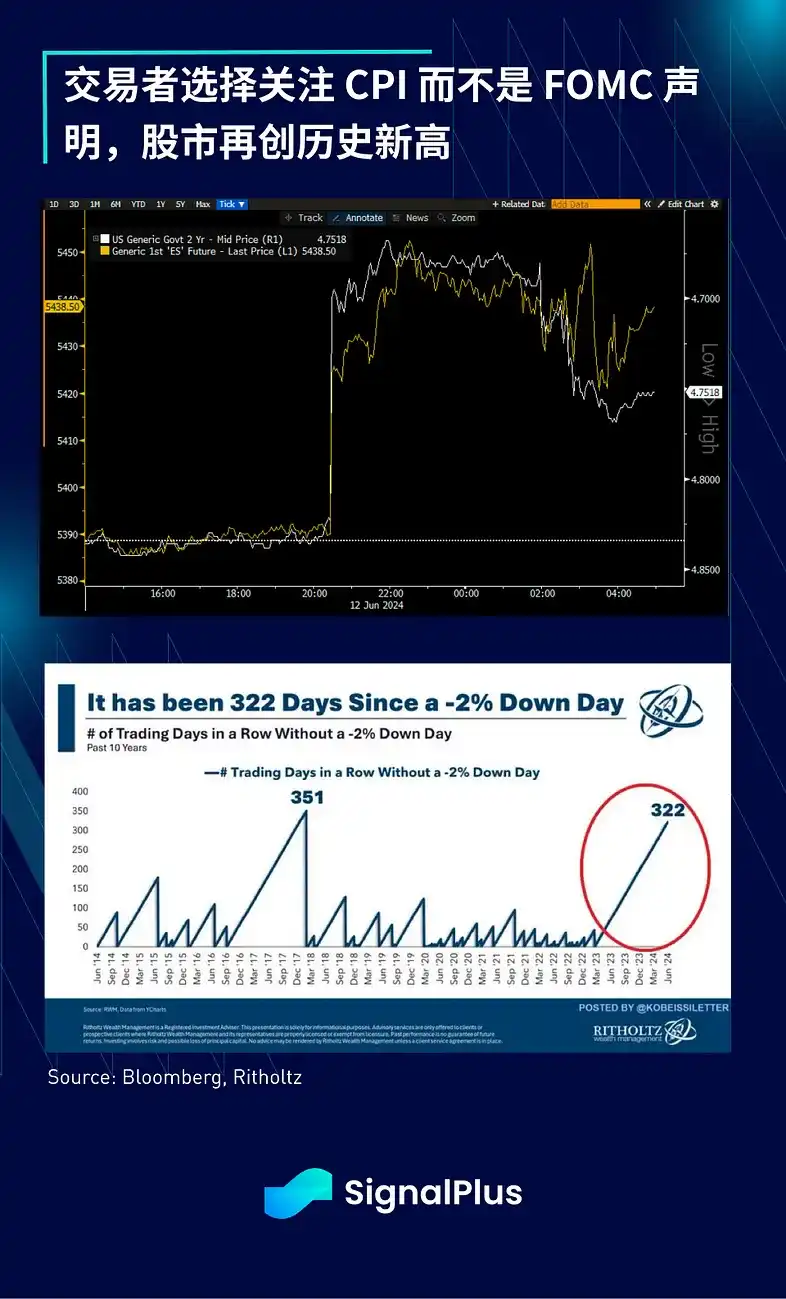

The macro market reacted sharply to the data, the US Treasury bond bull steep trend intensified, the 2-year yield fell sharply by 17 basis points, and the pricing reflected the expectation of a rate cut at the December FOMC meeting, which was as high as 51 basis points. The stock market also fluctuated by multiple standard deviations. As the market expected the FOMC meeting at 2 pm to be dovish, the SPX and Nasdaq indexes both rose by 1.5%, setting new highs.

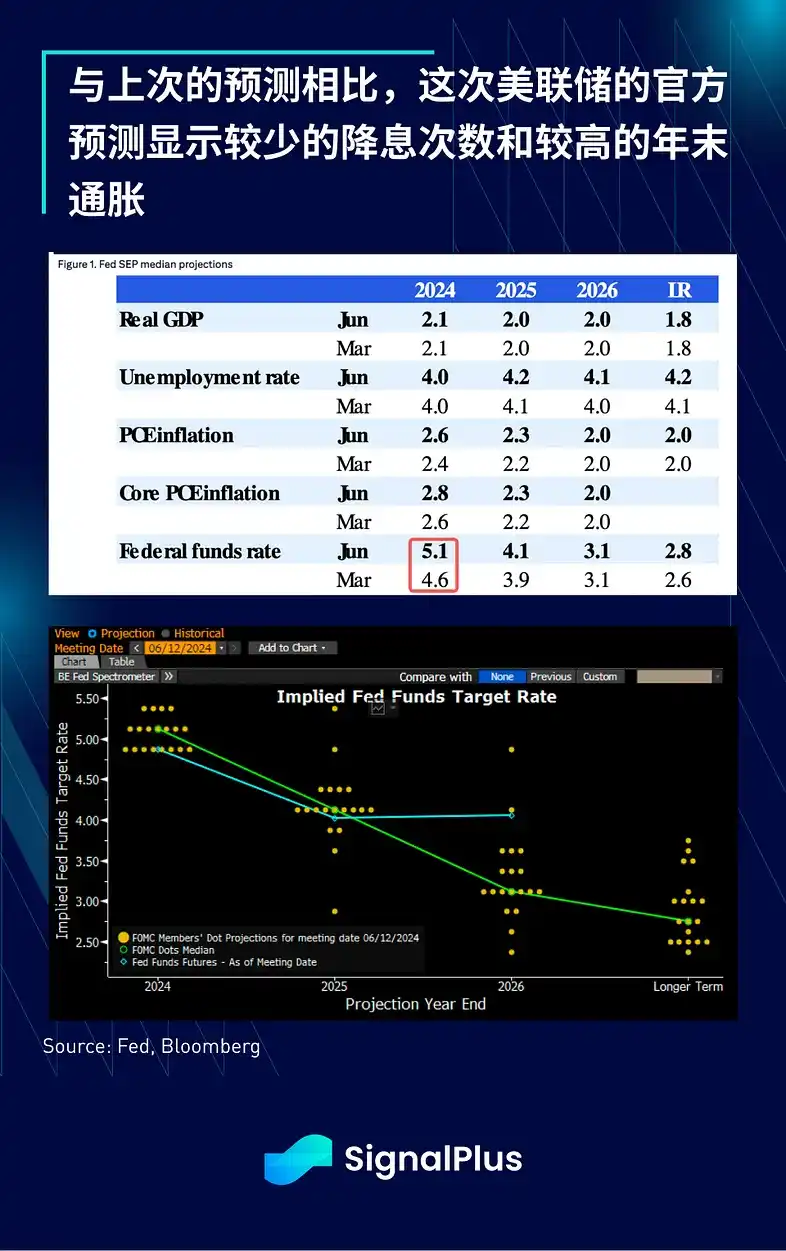

Interestingly, the FOMC's initial statement and dot plot brought some hawkish shocks, with the latest Fed forecasts showing only 1 rate cut in 2024, fewer than the previous forecast of 3. In addition, core PCE inflation is forecast to be 2.8% by the end of the year, higher than the previous forecast of 2.6%.

Naturally, Chairman Powell spent much of the press conference trying to pull the narrative back to a dovish tone, clearly attempting to downplay the importance of official forecasts. Chairman Powell even went so far as to say that “most” officials had not factored the lower-than-expected CPI data into their forecasts, and therefore those forecasts were somehow out of date, which was quite a clever move.

In addition, Powell pointed out that the job market has returned to a state equivalent to that before the epidemic, and the number of job vacancies, the quit rate, and the recovery of the labor supply all show signs of normalization. On the economic front, the Fed believes that growth will continue at a solid pace, and officials "see what we want to see to some extent, that is, demand is gradually cooling down." Finally, he also emphasized that the Fed is paying attention to downside risks and hopes to make a soft landing of the economy a top priority.

In summary, Bloomberg pointed out that Powell mentioned inflation 91 times, while the job market was only mentioned 37 times, indicating that price pressures are still the main focus. The stock market followed the trend and decided to refocus on the earlier CPI data. The SPX index closed at 5,438 points, close to a record high, while the 2-year and 10-year US Treasury yields closed at 4.70% and 4.3%, respectively, both of which were one-week lows. The SPX index is currently in the second longest streak of no more than 2% declines in history, and it only takes another month to set a new record!

Crypto prices have struggled all week despite an overall stronger macro environment. The combination of long-biased market positioning and BTC ETF holders raises questions about how much of the year-to-date inflows has been for accumulation rather than relative value or basis trading, causing BTC to struggle to break through $70,000. ETH also fell 8% this week, mainly due to the fact that the stimulus from the ETF approval has faded, while the decline in fees and competition from L2 continue. The technical situation looks a bit challenging at the moment, and cryptocurrencies may be vulnerable if stock market sentiment turns around belatedly.