A. Market View

1. Macro liquidity

1. Macro liquidity

Monetary liquidity improved. The U.S. CPI in May fell to a three-year low year-on-year, but the Fed's dot plot still shows that there will only be one rate cut this year, which is slightly hawkish, and the market's desire for two rate cuts has not been fulfilled. The Fed's approach of trading time for space and preventing the market from betting on rate cuts too early may be the best choice, which can leave room for subsequent policy operations. The S&P and Nasdaq continued to hit new highs, and the crypto market fluctuated widely.

2. Market conditions

2. Market conditions

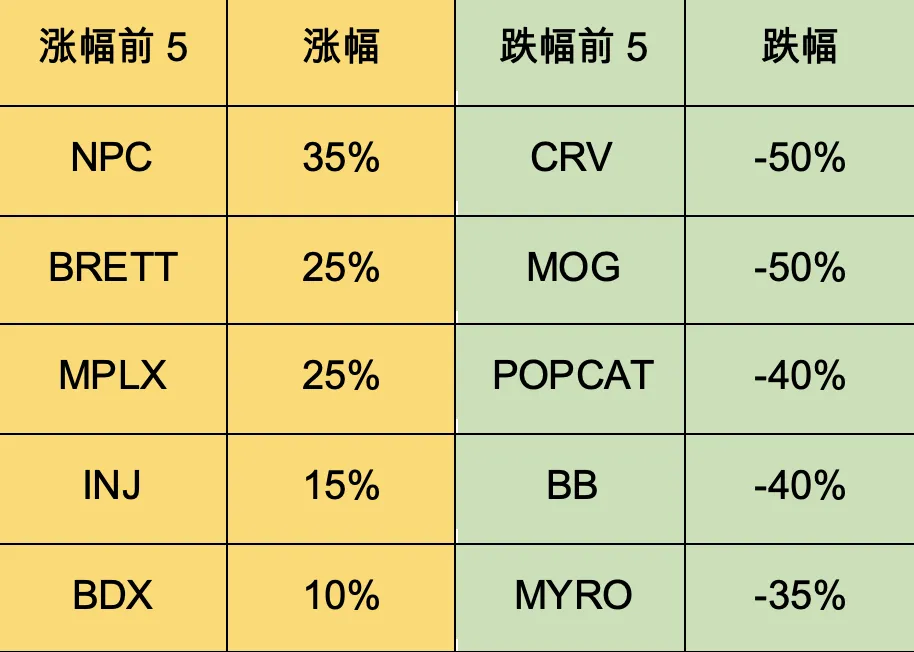

The top 100 companies with the highest market capitalization:

This week, BTC fluctuated widely, and altcoins fell across the board. As BTC is still attracting fiat currency inflows from ETFs, and new funds entering the cryptocurrency market are limited, the market performance of Altcoin has been limited. In fact, the Altcoin seasonal index has returned to the lows of the first half of 2023. In the past 90 days, only more than 20 of the top 100 Altcoin have outperformed BTC. The market hotspots are Base Chain Meme, BTC ecology and Binance new coins.

1. IO: It is decentralized AI computing power, and it may be pledged in the future. RNDR, which is on the same track, has a market value of 4.5 billion US dollars, and AKT has a market value of 1 billion US dollars. After the market rumor that OK was hit, Binance's new coins began to exert their strength, and the competition is always simple and unpretentious. 2. BRETT: It is the head meme of the Base chain. BRETT is a friend of PEPE. Coinbase's new wallet diverts more traffic to the Base chain. 3. PIZZA: The first BTC five-word inscription, it is the first meme of Unisat wallet BTC L2. The BTC ecosystem is relatively unpretentious.

3. BTC market

3. BTC market

1) On-chain data

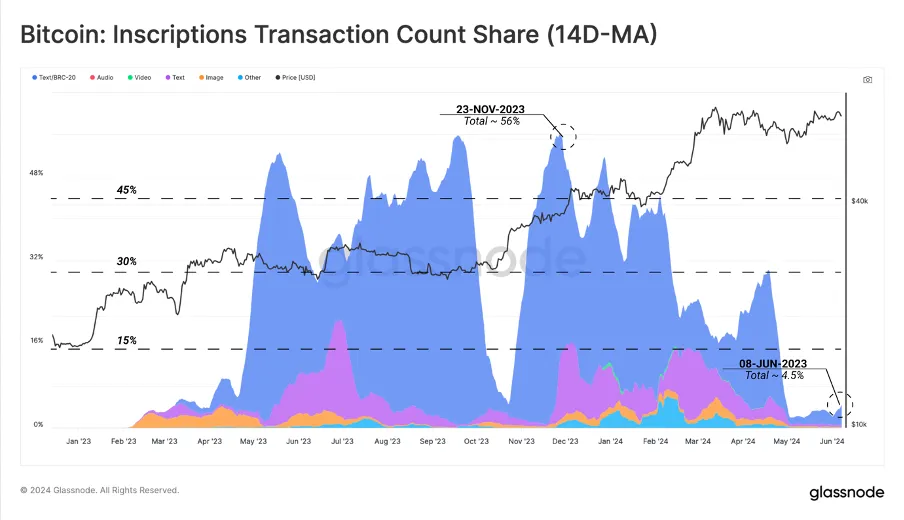

BTC inscription transactions are down. Since the halving in April, the number of BTC inscriptions has dropped sharply. Rune transactions have surged to account for 60% of daily transactions, indicating that speculation has shifted from inscriptions to the rune market.

The market value of stablecoins increased by 1%, and the overall trend of capital inflows was positive.

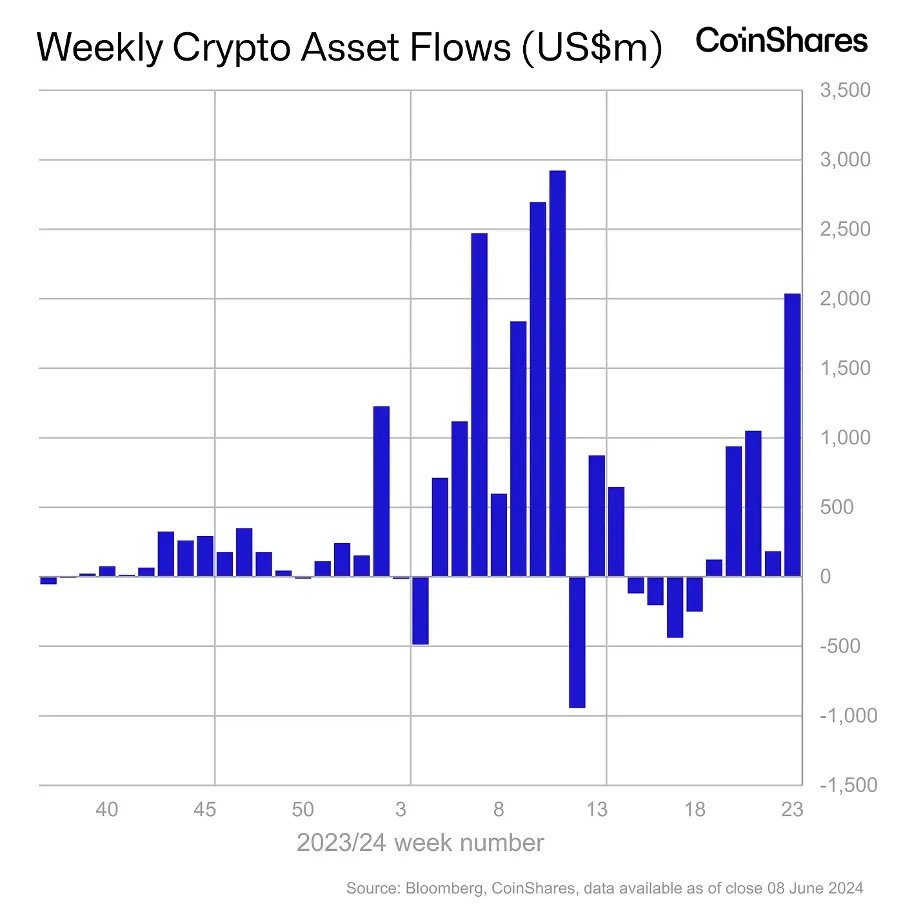

Institutional funds have been net inflows for five consecutive weeks, and the market expects the US monetary policy to cut interest rates.

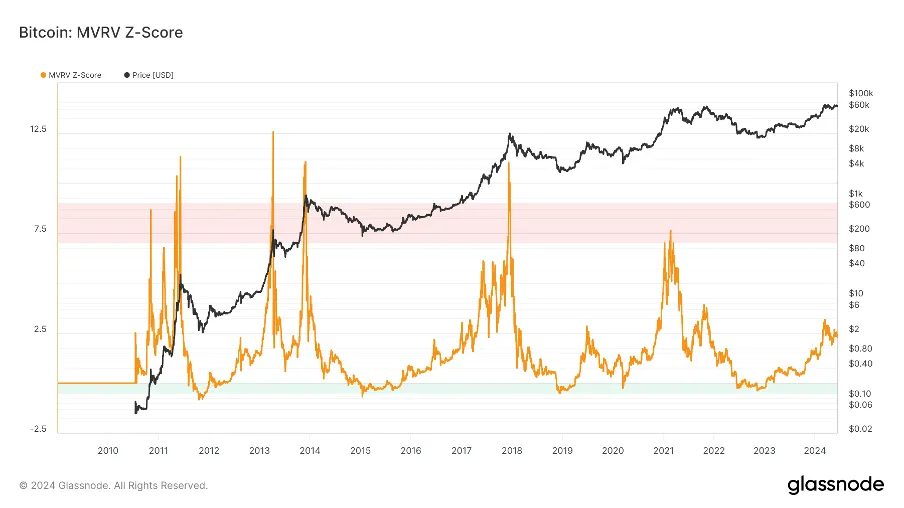

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level, and the holders are generally in a loss state. The current indicator is 2.4, entering the middle stage. The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.3, entering the middle stage.

2) Futures market

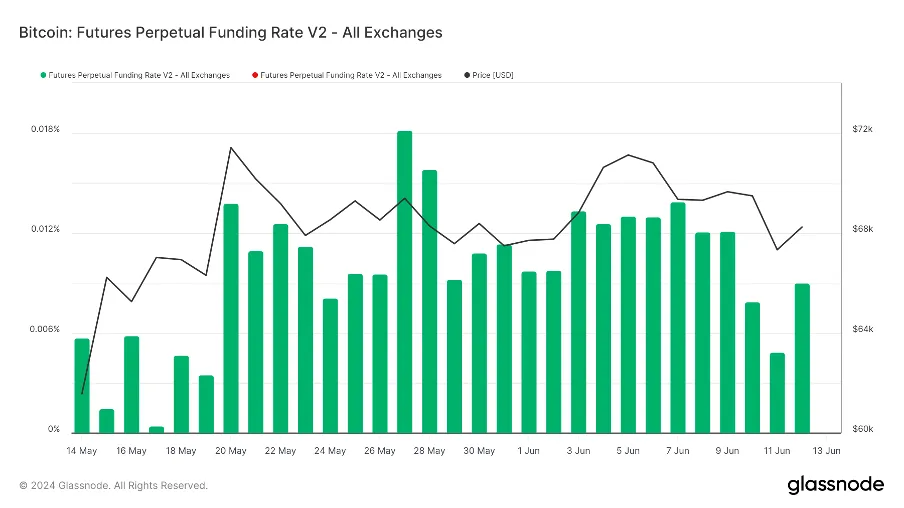

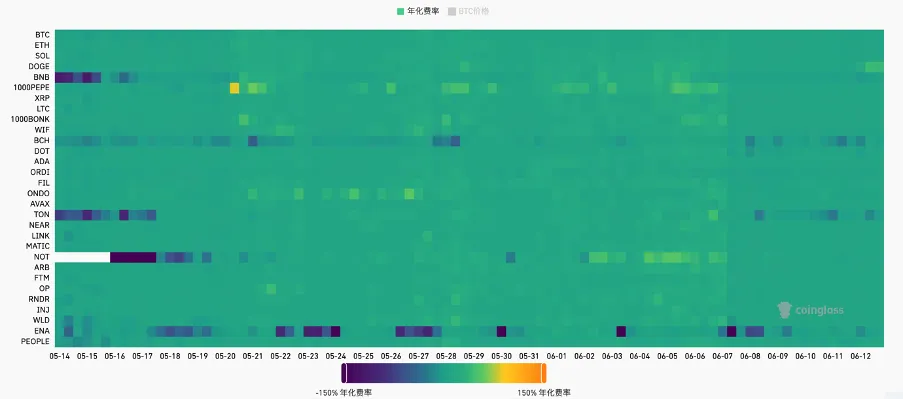

Futures funding rate: The rate dropped slightly this week. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

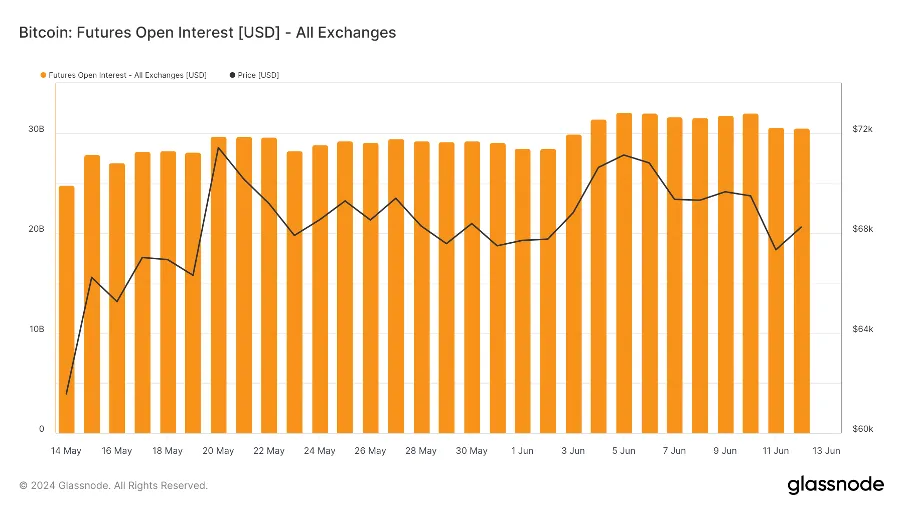

Futures open interest: BTC open interest fell slightly this week.

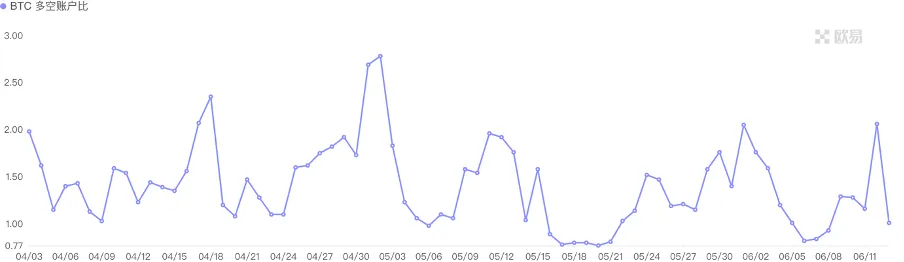

Futures long-short ratio: 1.3, market sentiment is neutral. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. Long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

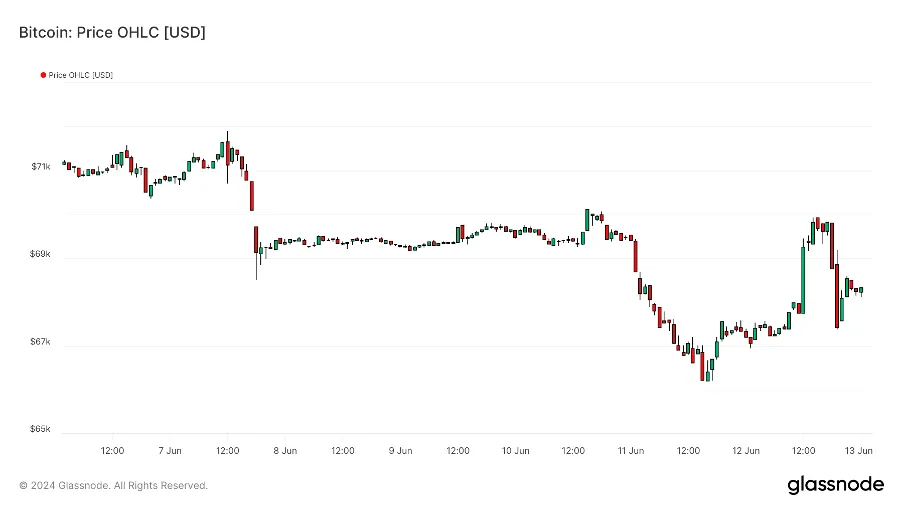

BTC fluctuates widely, and the fluctuation is likely to continue until the end of July. The market liquidity is insufficient, and there are few beta opportunities for sector narratives, mainly alpha opportunities for individual stock manipulation.

B. Market Data

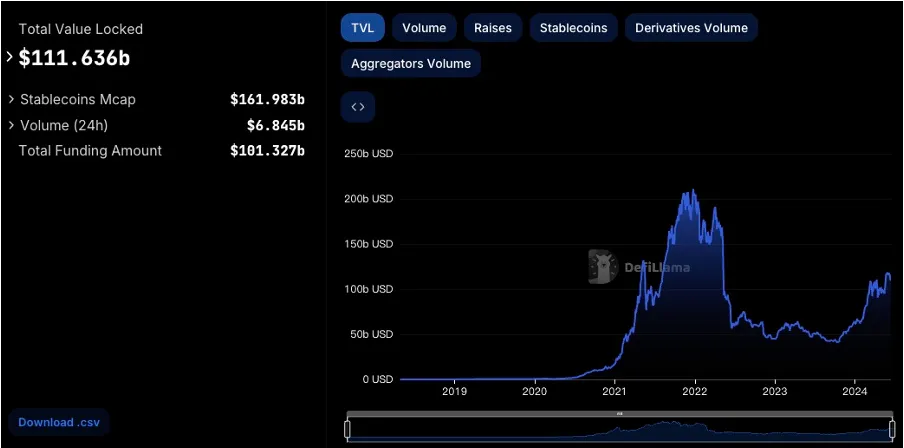

1. Total locked-up amount of public chains

1. Total locked-up amount of public chains

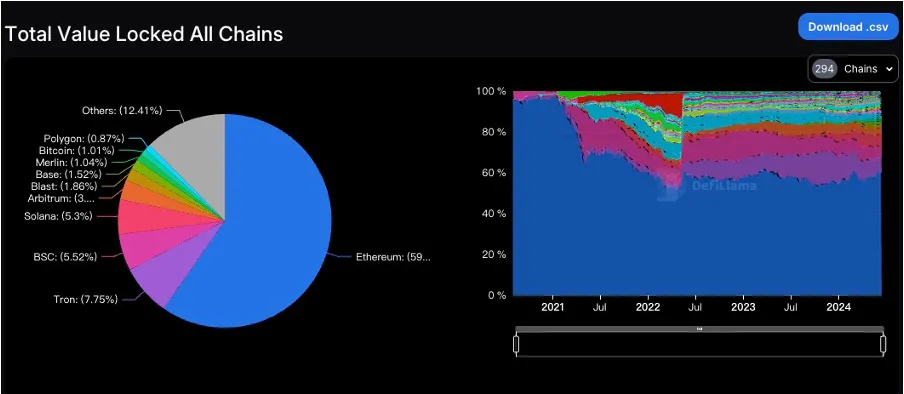

2. TVL Proportion of Each Public Chain

2. TVL Proportion of Each Public Chain

This week's TVL is $111.6 billion, up $1.8 billion, or 1.6%. This week, the TVL of all mainstream public chains except the TRON chain fell. The ETH chain, SOLANA chain, and ARB chain all fell by 7%, the BSC chain and OP chain fell by 11%, the BLAST chain fell by 9%, the BASE chain fell by 6%, the MERLIN chain fell by 4%, and the BTC chain and POLYGON chain fell by 5%. It is worth noting that the total TVL of the SOLANA chain is close to $6 billion. With the recent significant increase in the activity of the SOLANA chain, it seems to be only a matter of time before it surpasses the BSC chain and even the TRON chain in terms of total TVL.

3. Locked Amount of Each Chain Protocol

3. Locked Amount of Each Chain Protocol

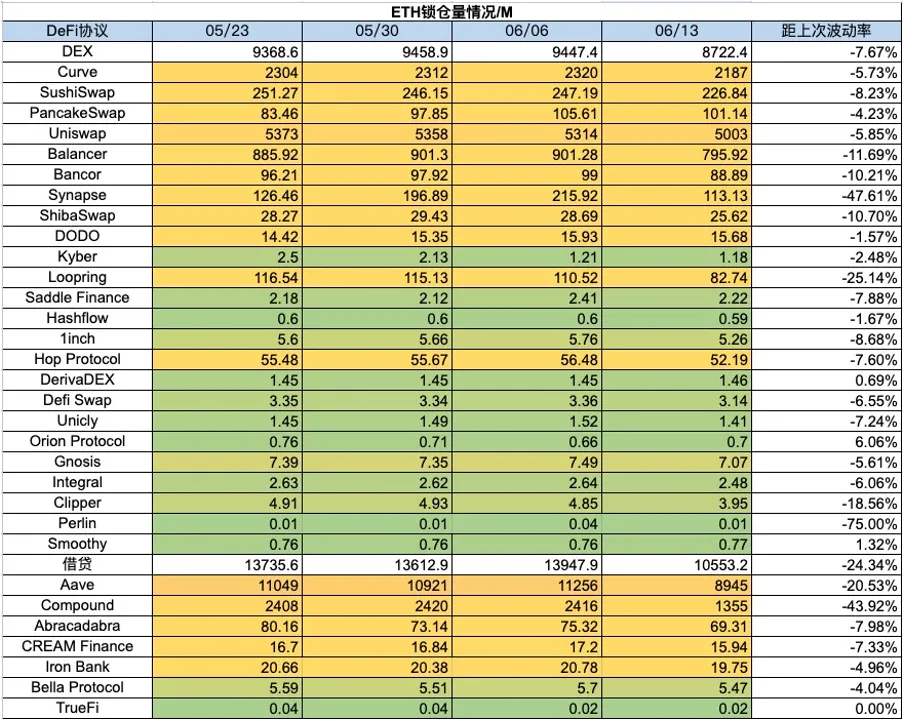

1) ETH locked amount

2) BSC locked amount

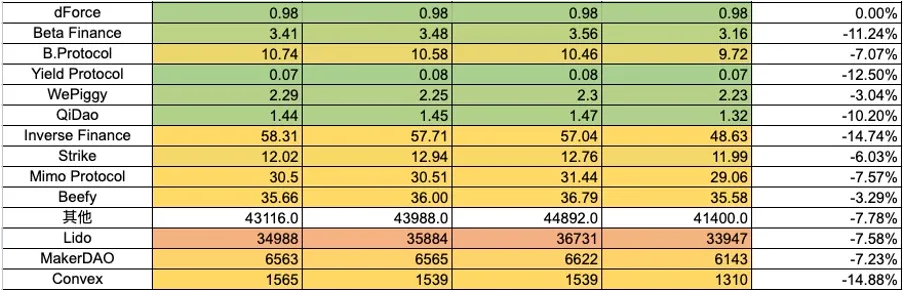

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism locked amount

6) Base locked amount

7) Solana locked amount

4. Changes in NFT Market Data

4. Changes in NFT Market Data

1) NFT-500 Index

2) NFT market situation

3) NFT trading market share

4) NFT Buyer Analysis

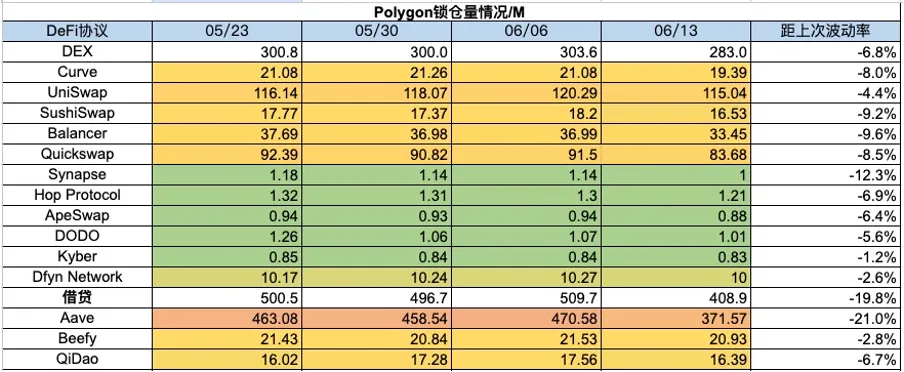

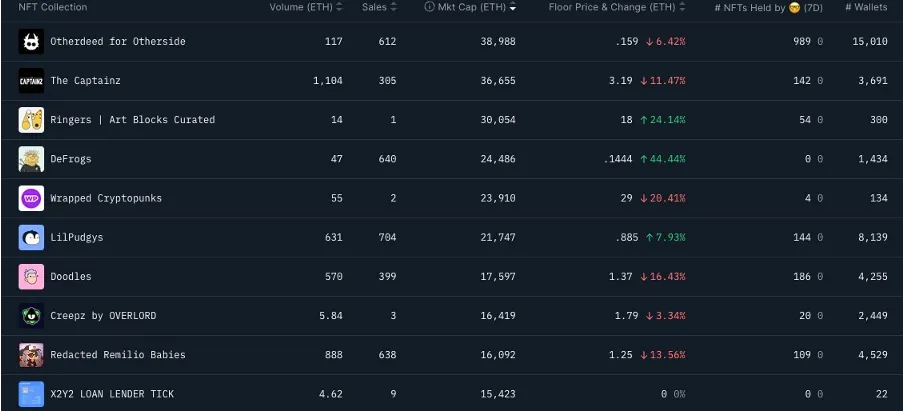

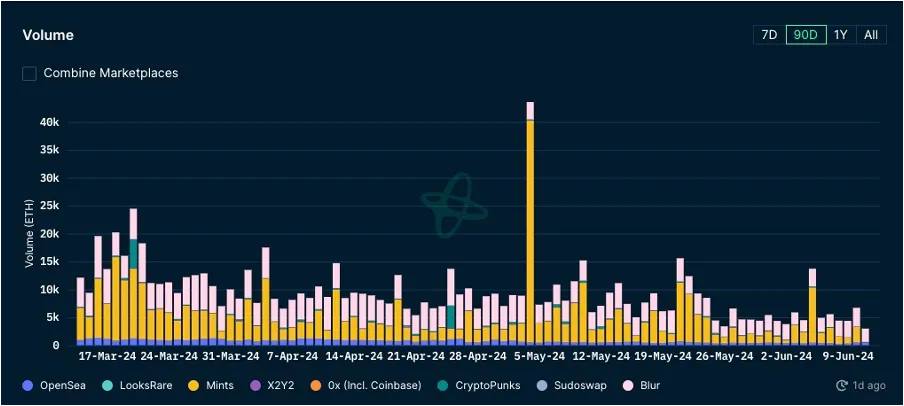

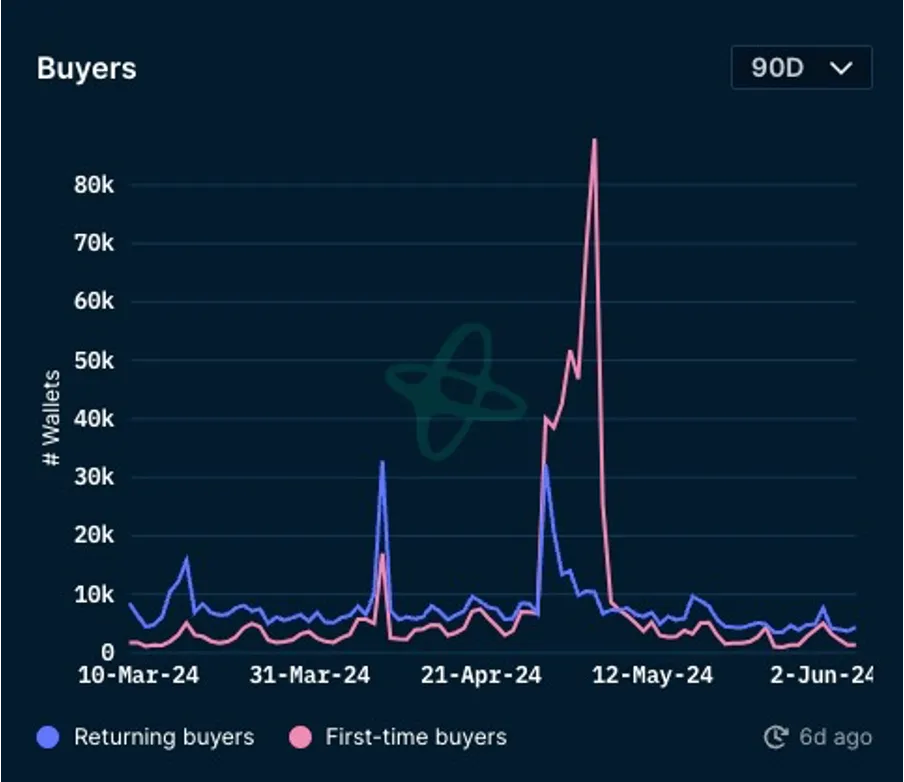

This week, the floor prices of blue-chip projects in the NFT market have risen and fallen, and the overall market continues to fall slightly. This week, CryptoPunks fell 12%, BAYC fell 8%, MAYC fell 10%, Azuki fell 2%, Milady fell 3%, and Doodles fell 16%. In addition, Pandora soared 66%, Pudgy Penguins rose 5%, Ringers rose 24%, DeFrogs rose 44%, and LilPudgys rose 8%. This week, the overall transaction volume of the NFT market has declined significantly, and the number of first-time and repeat buyers has also gradually declined with the transaction volume. Overall, the NFT market has not shown any significant improvement, and we continue to wait.

V. Latest project financing situation

6. Post-investment dynamics

1) ETHStorage — Infra

Modular and decentralized storage Layer2 project EthStorage announced a strategic partnership with Ethereum Layer 2 network Taiko. EthStorage will provide Taiko with a long-term data availability (DA) solution, thereby helping Taiko better derive Ethereum security.

2) Ultiverse — AI Gaming Platform

Ultiverse launched the first season of staking activities. Users can earn points by staking ULTI and obtain tokens of partner projects and ecological projects, including Matr1x, Yuliverse and io.net.

More details: https://rewards.ultiverse.io/stake

3) Space and Time — Data

Space and Time has released a high-performance ZK verifier Proof of SQL for processing data, which is now open to the community, and the data processing has jumped from minutes to milliseconds!

The team is encouraging and inviting the community and other ZKP engineering teams to collaborate with us in this repository to build Web3’s first on-chain database, a performant and expressive foundational database for data-driven smart contracts.