Author: Stacy Muur, Crypto KOL; Translation: 0xxz@ Jinse Finance

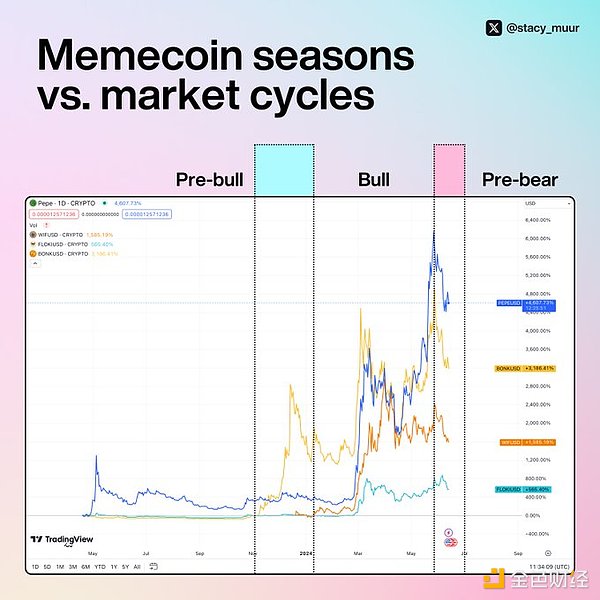

Historically, memecoin seasons have marked the end of bull cycles.

According to a recent research report on Memecoin investment published by Messari, now is the time to take profits.

The key insights of the research report are as follows:

The chart below is the most noteworthy.

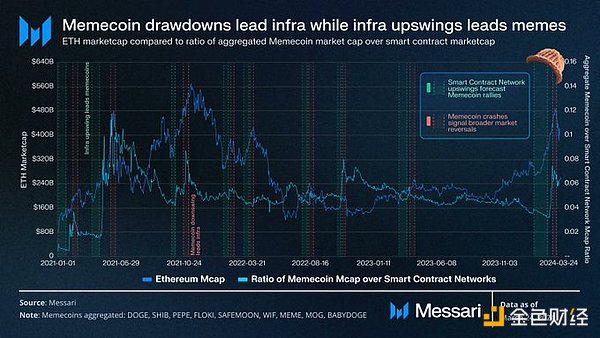

It compared the correlation between Ethereum and Memecoin market caps and found an interesting pattern:

Infrastructure skyrocketed → Memes skyrocketed → Memes plummeted → Broader downtrend.

This is quite logical: crypto bull runs usually start with BTC or smart contract platforms due to factors such as liquidity, risk-reward profile, and technological breakthroughs.

These assets signal that crypto is not dead yet, attracting speculation and development.

Speculation then shifts to riskier assets like memecoins, which could see explosive gains.

However, memecoins are often the first to crash, signaling the end of a wave of speculation in crypto assets.

So what kind of market are we in now?

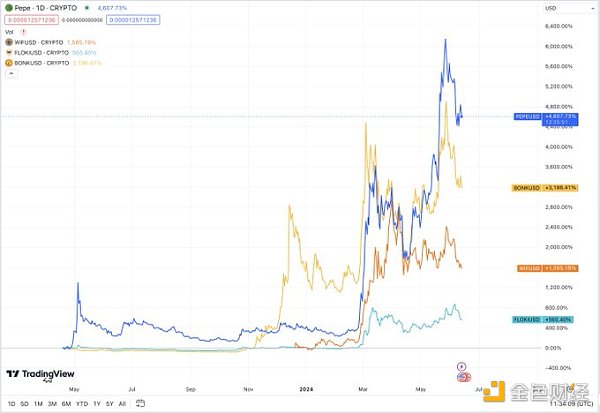

The pump season for the leading memecoin may be (almost) over.

New memecoins like $BORPA, $LUMI or moonthat may be printing money, but overall, investors are starting to take profits, indicating that the speculative cycle is about to end.

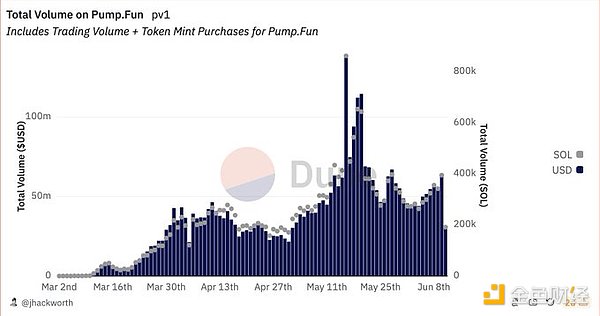

pump.fun is another confirmation.

In their research, Messari recommends the following investment framework based on this model:

1. Buy the meme when classic DeFi/crypto games start to rise;

2. When memecoin drops beyond the threshold, move the entire portfolio to cash and stop trading.

Memecoin has traditionally been viewed as a non-serious late-stage speculative asset characterized by explosive returns and dramatic declines.

However, markets continue to adapt and future profitability of this strategy is not guaranteed.

Importantly, according to this framework, we are now likely in the post-bull market rather than the pre-bear market.

Will the bull market be short-lived? In fact, no one guarantees that the bull and bear markets will last for a long time.