Bitcoin is now in an awkward situation again. Is it a correction or an exhaustion of upward momentum? How will Bitcoin's market develop in the future? This round of bull market is very different from the previous ones. This article analyzes the main factors driving the development of Bitcoin's market and looks forward to the future of Bitcoin.

Analysis of Bitcoin Price Driving Factors - Bitcoin ETF

There are many different observations on the current bull market. From the current market changes, the increase or decrease of Bitcoin ETF holdings by institutions is a very important factor. In addition, information and data related to the Federal Reserve's interest rate policy also significantly affect the changes in Bitcoin's market. This article first focuses on analyzing these two driving factors.

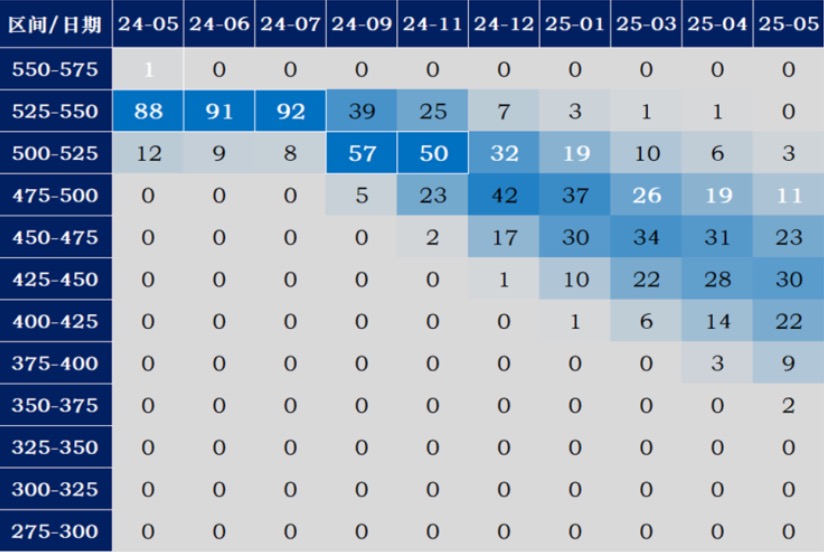

After the Bitcoin ETF was approved, the changes in institutional demand for Bitcoin ETFs can be roughly divided into three stages. As can be seen from the figure below (data as of June 15), in the first stage, institutions increased their holdings of Bitcoin ETFs in large quantities, and the demand was very strong; in the second stage, the institutional demand for increasing holdings of Bitcoin ETFs declined significantly, and the selling volume even exceeded the increase in holdings at one point; in the third stage, the institutional demand for Bitcoin ETFs rebounded somewhat compared to the second stage, but fell significantly compared to the first stage.

What is the reason for the huge demand for Bitcoin ETFs in the first phase? This article believes that this is the release of the long-accumulated demand of institutions, which in a sense also has the meaning of scrambling for shares. However, after Bitcoin reached around $70,000, the market's upward momentum dropped sharply and the selling increased, which showed that institutional demand began to slow down. From a deeper level, this means that institutional strategies have begun to change from scrambling for shares to strategic position building (selling high and buying low), and they tend to sell once they think the price is too high. In this process of transformation, a very iconic event is that BlackRock's Bitcoin holdings surpassed Grayscale, which has been working in many crypto markets. This is like in a relay race, the original crypto giant officially handed over the right to speak to the traditional Wall Street giant.

What does the recovery of demand for Bitcoin ETFs in the third phase indicate? On May 1, a large amount of Bitcoin ETF funds were sold off, and the price of Bitcoin fell sharply to $58,307. Then Bitcoin ETFs began to increase their holdings again. This may mean that $58,000 is a more appropriate purchase price for Bitcoin. This may also be determined by the mining cost of Bitcoin.

Analysis of Bitcoin Price Driving Factors - Bitcoin Miners

On April 20, Bitcoin completed its fourth halving. With the block reward halved, its income was directly reduced by half, which will also significantly increase the mining costs of miners. The Block Pro data shows that BTC miners' income in May (due to the fourth halving event in April) decreased by 46% month-on-month to US$963 million. Due to the changes in Bitcoin miners' income and expenditure, this will also affect their investment decisions. Their selling behavior and mining costs can provide a reference price for Bitcoin investment.

On June 13, CryptoQuant published a post on the X platform stating that Bitcoin miners are under pressure and have begun to sell off. Recently, mining pool transfers, OTC trading volume surged, and large listed mining companies reduced their holdings significantly. When the price of Bitcoin fluctuated between $69,000 and $71,000, miners increased their selling efforts. Data showed that on June 10, miners sold 1,200 Bitcoins through OTC transactions, setting a record high daily trading volume in two months. In addition, major US Bitcoin companies have also increased their selling efforts.

According to the data from the official website of Biyin, as of June 15, mining machines such as Ant S19 have reached the shutdown price. In addition, the shutdown price of a considerable number of mining machines is around US$60,000. This is also the main reason why the market can be supported here.

Overall, the miners' selling behavior suggests that the price of Bitcoin at $69,000-71,000 may be a more suitable selling price in the short term, and a large number of miners' mining machine shutdown prices are in the range of $58,900-63,300, which may be a more suitable buying price in the short term. This can be confirmed to a certain extent with the trend changes of Bitcoin ETF mentioned above, and they have a strong correlation with each other.

Analysis of Bitcoin Price Driving Factors - Macro Finance

The impact of the United States' macroeconomic policies and data on Bitcoin is very direct. Once data and meeting statements that are favorable to the Federal Reserve's interest rate cuts appear, the probability of Bitcoin rising will increase significantly; vice versa.

On June 7, the seasonally adjusted non-farm payrolls in the United States in May increased by 272,000, the largest increase since March this year, higher than market expectations and significantly higher than the 175,000 in the previous month. The non-farm data exceeded market expectations, indicating that the US economy is still strong, and the market's expectations for the Fed's interest rate cut have therefore declined. Bitcoin also fell sharply, breaking the previous upward trend.

Subsequently, on June 12, the U.S. Bureau of Labor Statistics data showed that the overall U.S. CPI was flat month-on-month in May, and the index rose 0.3% in April. Since the release of solid data in February and March, the CPI has been on a downward trend. Analyst Chris Anstey pointed out that this is actually the first month with a good inflation report, and several more such good reports are needed to really make the Fed cut interest rates in September. Affected by the cooling of the U.S. CPI in May, the market increased expectations of the Fed's September rate cut, and Bitcoin also rebounded sharply.

Then on June 14-15, the Federal Reserve issued a regular meeting statement: Information obtained by the Federal Open Market Committee (FOMC) since the April meeting shows that the pace of improvement in the job market has slowed, although economic activity growth appears to have accelerated. Although the unemployment rate has fallen, the increase in jobs has decreased. Household spending growth has strengthened. Since the beginning of the year, the housing market has continued to improve, and the drag on the economy from net exports appears to have eased, but corporate fixed investment is weak. Market-based inflation compensation indicators have declined, and most survey-based indicators show that longer-term inflation expectations have basically not changed much in recent months. Influenced by this report, Bitcoin has stabilized after falling, and in a sense, the macro impact is actually weakening.

Overall, the impact of macroeconomic policies is long-term; at the same time, at the key points when certain important data are released, their impact on Bitcoin is extremely significant. As the release of key data ends, Bitcoin returns to a balance, and the market's long-short game begins again.

Analysis of Bitcoin Price Driving Factors - Bitcoin Technology Development

I have mentioned in many previous articles that the real reason or the essential reason for supporting the development of Bitcoin is its own technological development. Although Bitcoin's technological development is slow, every technological development can drive a financial boom. The main reason for the popular inscriptions in 2023, as well as the runes that followed, is the Taproot upgrade.

In 2024, Bitcoin will also usher in a series of important upgrades, such as support for BitVM, the expression of smart contracts on Bitcoin, the launch of Taproot Assets mainnet, OP_CAT proposal, OP_TXHASH proposal draft, Lightning Timeout Trees, updated Musig 2 proposal, BIP-324 – V2 transmission, etc. After a series of upgrades, many new use cases can be continuously unlocked. We have seen the birth of many Bitcoin Layer2 projects, opening up new territory for Bitcoin's financial landscape. On June 7, Ethereum Layer2 leader Starknet also announced its entry into Bitcoin, and the key lies in whether the OP_CAT proposal can be passed. This article believes that as more and more Bitcoin technologies are upgraded, more and more application scenarios and use cases will be generated, which will promote the development of Bitcoin and its ecology.

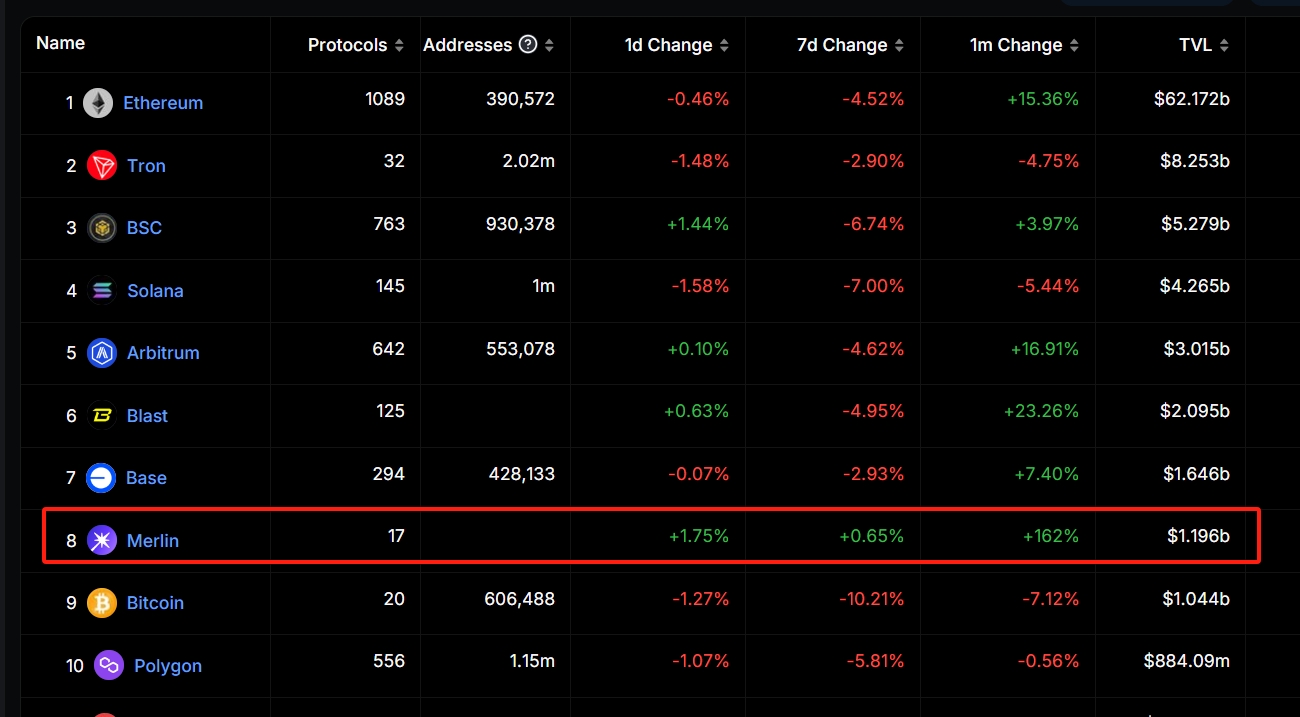

Judging from the current data, the development of Bitcoin ecology is still in its early stages, and the previously popular runes, inscriptions, and Bitcoin Layer 2 are beginning to enter the ecological construction period. Taking Merlin, the leader of Bitcoin Layer 2, as an example, Deflama data shows that as of June 15, Merlin's monthly capital inflow increased by 162%, the fastest growth among the top ten public chains and Layer 2; its current TVL funds reached US$1.196 billion, ranking eighth, surpassing many old public chains in just a few months.

Bitcoin short-term outlook

From a technical point of view, the new Bitcoin proposal OP_CAT may become the main driving factor and core factor of the next round of Bitcoin's rise. Once it is officially merged into the Bitcoin Core code, it will undoubtedly greatly promote the development of the Bitcoin ecosystem and drive up the price of BTC. From a macro perspective, with the overall upward movement of the interest rate dot chart, the median interest rate in 2024 will be raised from 4.6% to 5.1%, which means that there may be only one interest rate cut this year, and the probability of a rate cut in September has increased. From a medium-term perspective, Bitcoin may usher in a golden September and silver October. From a short-term perspective, the behavior of Bitcoin miners and the shutdown price of mining machines provide a reference price for buying and selling: the bottom range is between $58,900 and $63,300; the short-term top range is between $69,000 and $71,000.