In our mid-year review, we present 10 charts covering some of the key crypto market fundamentals and technical trends.

Key Takeaways

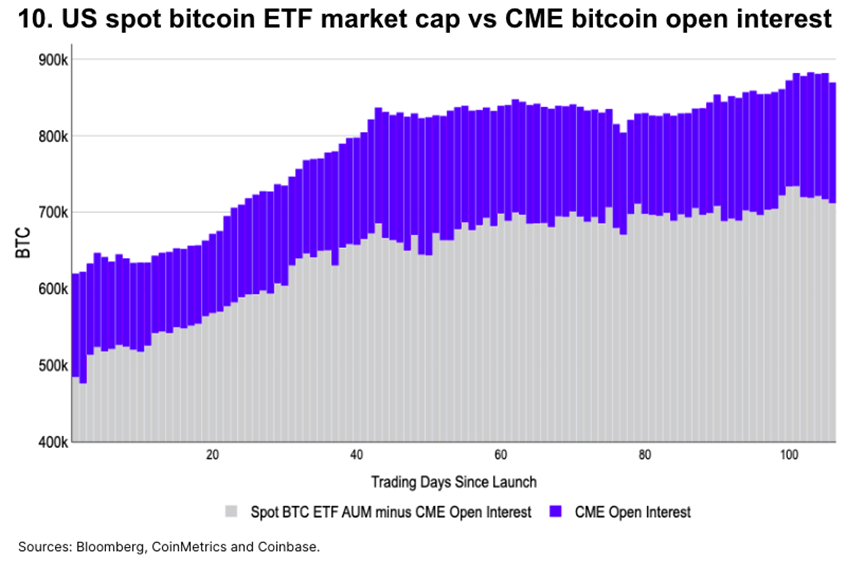

•We normalize the growth of total value locked (TVL) by the price appreciation of the native gas token on the top Layer 1 (L1) and Layer 2 (L2) networks.

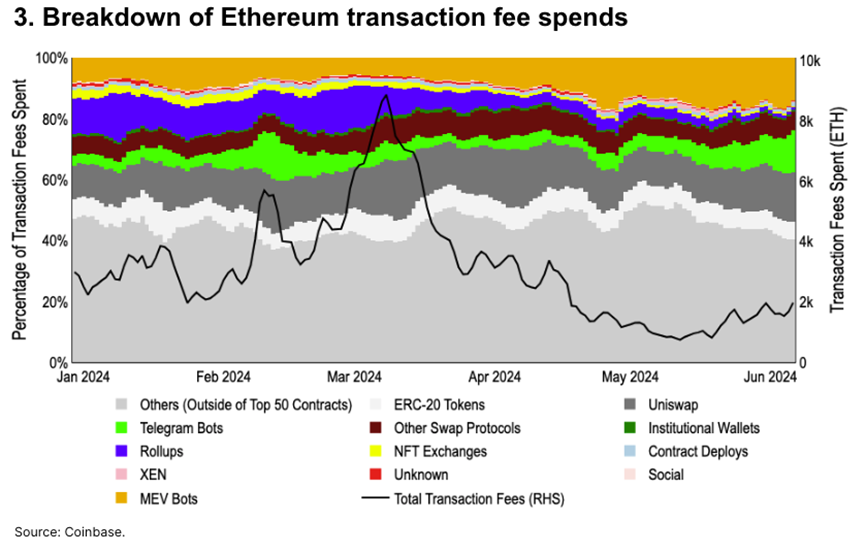

•We isolate the impact of CME futures underlying trading on ETF flows, showing that the growth of unhedged exposure to BTC ETFs has slowed significantly since early April.

Summary

In our mid-year review, we provide 10 charts covering some of the key crypto market fundamentals and technical trends. We normalize the growth of total value locked (TVL) by the price appreciation of the native gas tokens on the top layer 1 (L1) and layer 2 (L2) networks. We also take a relative approach, measuring the impulse of on-chain activity in these networks through total transaction fees and active addresses, and then specifically break down the biggest drivers of Ethereum transaction fees. After that, we look at on-chain supply dynamics, correlations, and the current state of liquidity in crypto spot and futures markets.

Separately, a more closely tracked indicator in the cryptocurrency space is the inflows and outflows of U.S. Bitcoin spot ETFs, which are often viewed as an indicator of changes in demand for cryptocurrencies. However, the growth in CME Bitcoin futures open interest (OI) to date suggests that some of the ETF inflows since launch have been driven by basis trading. We isolate the impact of CME futures basis trading, showing that the growth of unhedged exposure to BTC ETFs has slowed significantly since early April.

Fundamentals

Growth in TVL

Rather than comparing the raw TVL of different chains, we track TVL growth through the price appreciation of their native gas tokens. Typically, native tokens make up a large portion of TVL in an ecosystem due to collateral or liquidity usage. Adjusting TVL growth by price growth helps distinguish how much of TVL growth comes from net new value creation, as opposed to pure price appreciation.

Overall, TVL is growing faster than the total crypto market capitalization, up 24% year-over-year. The fastest-growing chains — TON, Aptos, Sui, and Base — can all be considered relatively new and benefit from a rapid growth phase.

Activity drivers: costs and users

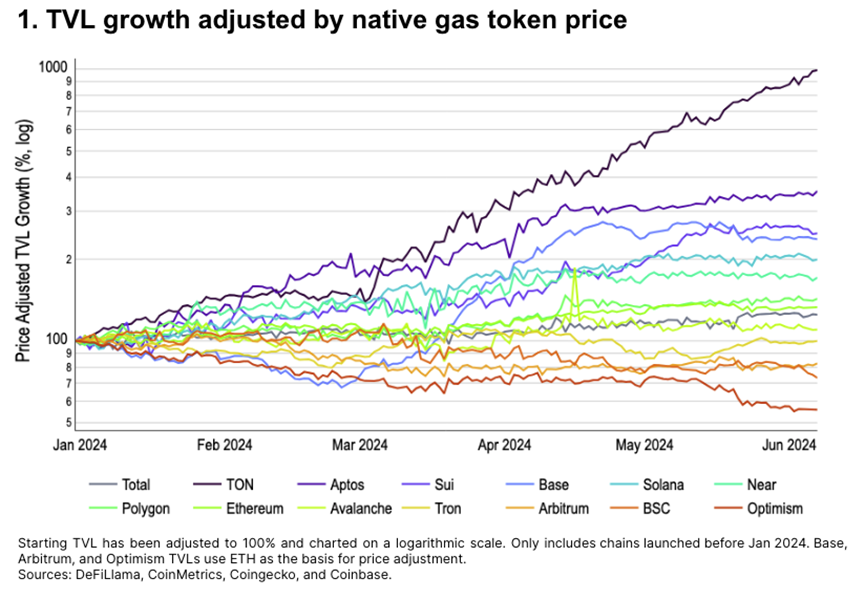

We compared each network’s (1) average daily active addresses in May with its (2) average daily fees or revenue for the same period, both measured as standard deviations compared to the previous four months (Jan-Apr). It shows:

• Token fees generally declined in May, with the exception of Solana and Tron

• Significant growth in active addresses on Ethereum L2 (especially Arbitrum) due to fee reduction after EIP-4844

• Cardano and Binance Smart Chain fees fall short of decline in wallet activity

Transaction cost drivers

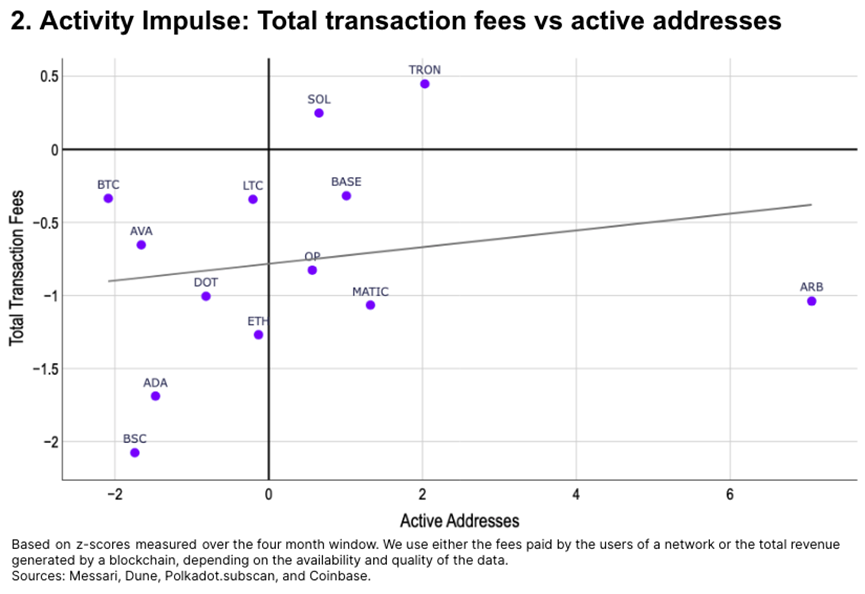

A breakdown of the fees for the top 50 Ethereum contracts. Together, these contracts account for over 55% of total gas consumption year-to-date.

After the Dencun upgrade in March, rollup expenses gradually decreased from 12% of mainnet fees to less than 1%. MEV (maximum extractable value) driven transaction fees increased from 8% to 14%, and direct transaction fees increased from 20% to 36%. Although ETH has been experiencing inflation since mid-April, we believe that the return of market volatility (and high-value transaction demand) may offset this trend.

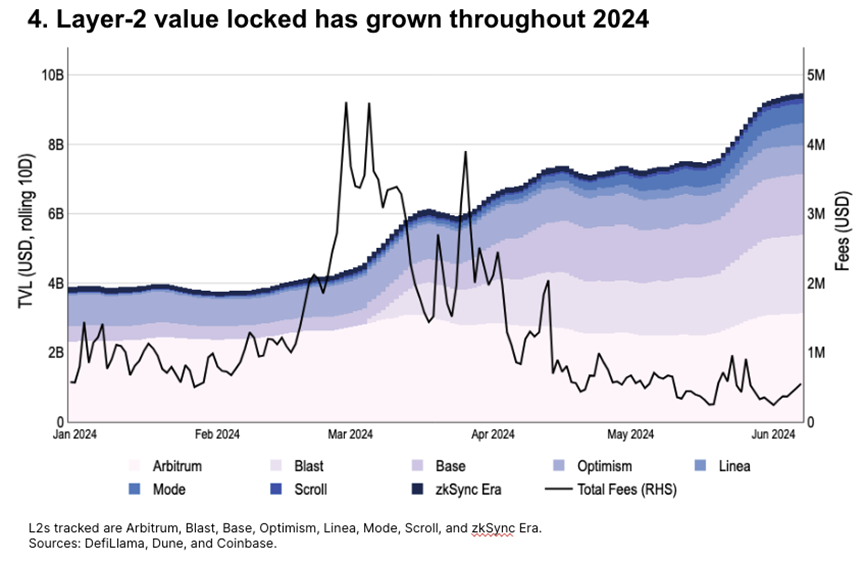

Ethereum L2 Growth

Ethereum L2’s TVL has increased 2.4x year-over-year, with total L2 TVL at $9.4 billion as of the end of May. As of early June, Base currently accounts for around 19% of total L2 TVL, behind only Arbitrum (33%) and Blast (24%).

Meanwhile, following the launch of blob storage in the March 13 Dencun upgrade, total transaction fees have dropped significantly, even though TVL (and transaction counts on many chains) are at all-time highs.

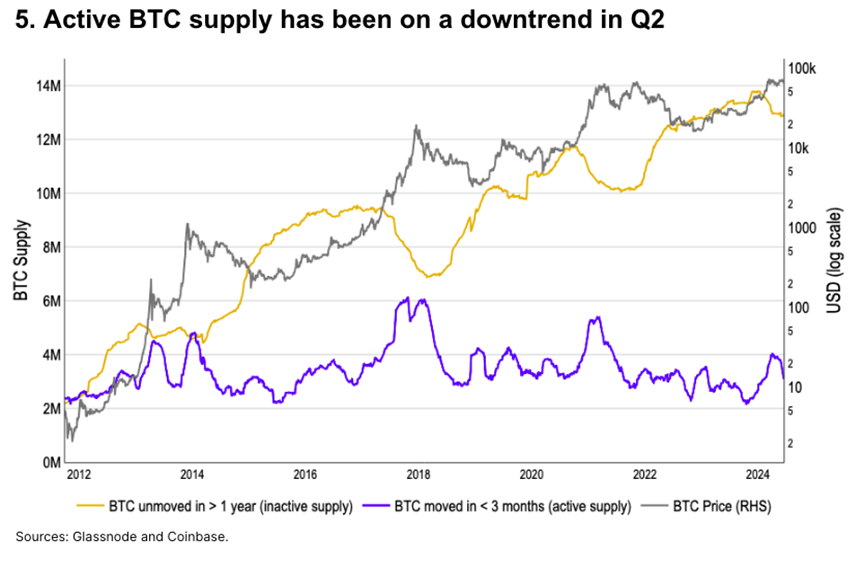

Bitcoin active supply changes

The decline in active Bitcoin supply, which we define as Bitcoin moved in the past 3 months, has historically lagged behind local price peaks, indicating a slowdown in market volume. Active Bitcoin supply reached a local peak of 4 million Bitcoin in early April, the highest level since 1H21, before falling to 3.1 million Bitcoin in early June.

However, at the same time, BTC’s inactive supply, i.e. BTC that has not moved in over 1 year, has remained flat year-to-date. We believe this suggests that near-term market optimism has waned, although long-term cyclical investors are still paying attention.

Technical aspects

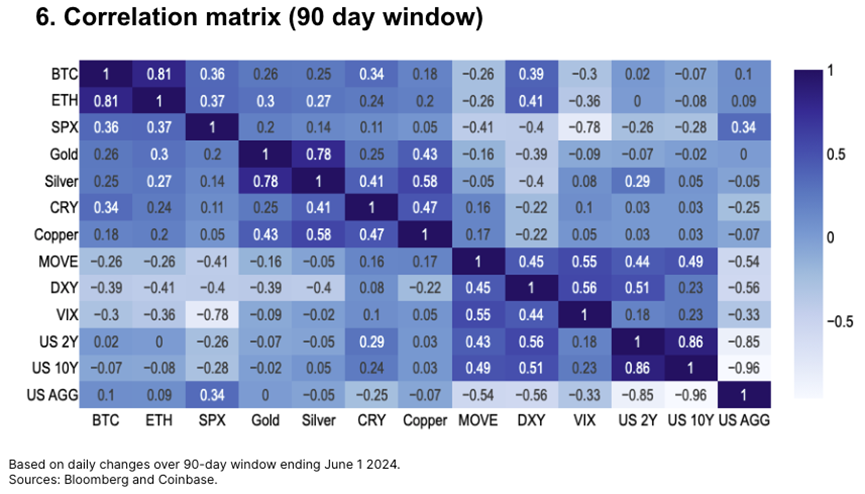

Correlation

Based on a 90-day window, Bitcoin’s returns appear to be moderately correlated with daily changes in a number of key macroeconomic factors. This includes U.S. stocks, commodities, and the multilateral dollar index, although the positive correlation with gold remains relatively weak.

Meanwhile, the correlation between Ethereum and the S&P 500 (0.37) is nearly identical to the correlation between Bitcoin and the S&P 500 (0.36). Crypto pairs continue to trade with high correlations compared to the cross-sector, although the BTC/ETH correlation has slightly decreased to 0.81 from a peak of 0.85 in March-April.

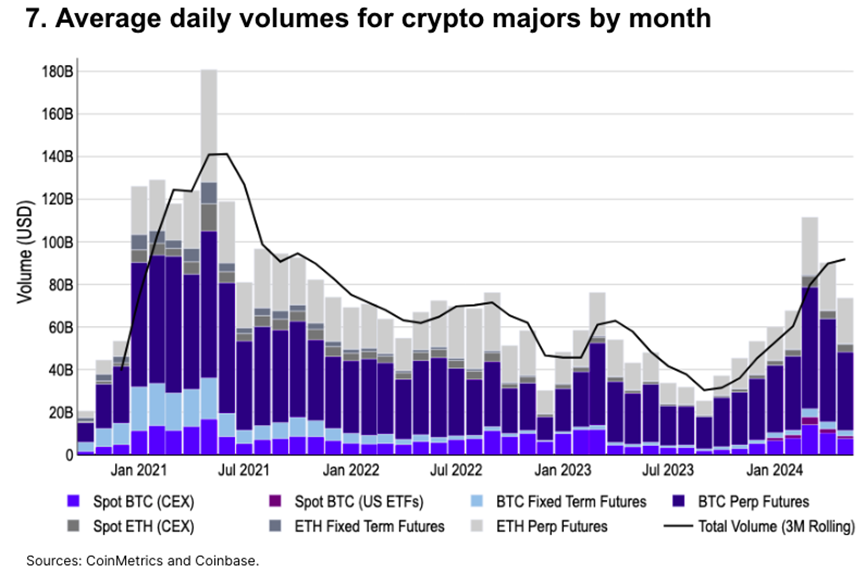

Increase market liquidity

Average daily spot and futures volume for Bitcoin and Ethereum combined is down 34% from its peak of $111.5 billion in March 2024. Still, May’s sales ($74.6 billion) were higher than any month since September 2022, except for March 2023.

After the approval of the US spot Bitcoin ETF in January, spot Bitcoin trading volume also increased significantly, with spot centralized exchange (CEX) Bitcoin trading volume in May increasing by 50% compared to December ($7.6 billion vs. $5.1 billion). In May, spot Bitcoin ETF trading volume was $1.2 billion, accounting for 14% of global spot trading volume.

CME Bitcoin Futures

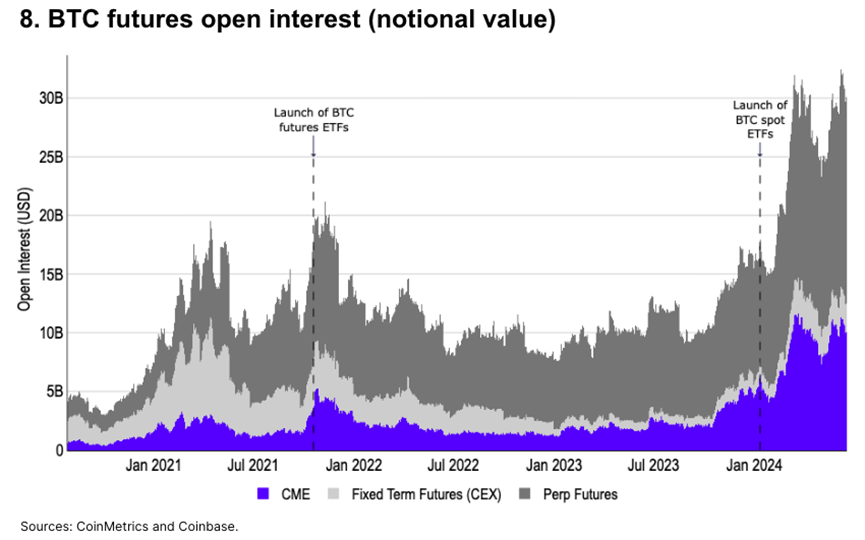

CME open interest has grown 2.2x since the beginning of 2024 (from $4.5 billion to $9.7 billion) and 8.1x since the beginning of 2023 (to $1.2 billion). We believe that the majority of new flows YTD can be attributed to basis trades following the approval of spot ETFs. Following their launch, Bitcoin basis trades can now be completed entirely through traditional securities brokers in the US.

Perpetual open interest also increased from $9.8 billion to $16.6 billion, with the percentage of CME open interest remaining around 30% (29-32%) throughout the year. That being said, CME futures have seen a significant increase in market share from 16% at the beginning of 2023, indicating an increase in interest from onshore US institutions.

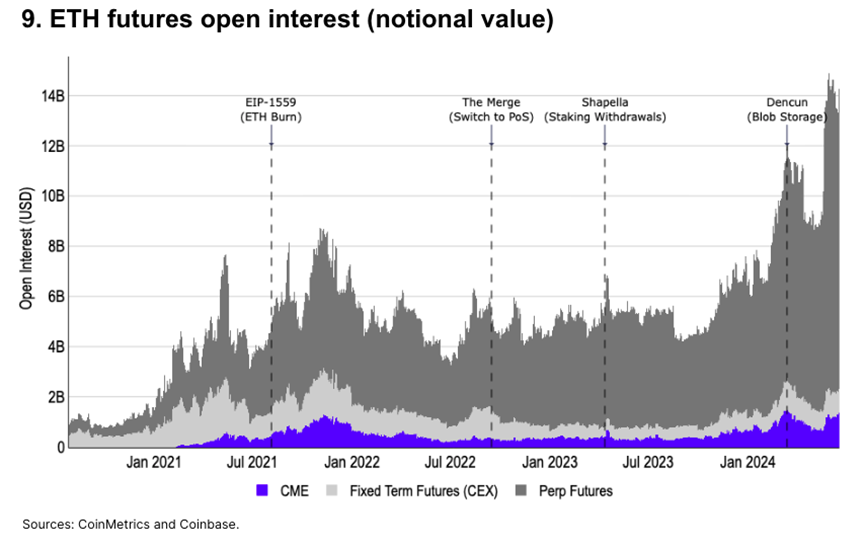

CME Ethereum Futures

CME ETH futures open interest is close to all-time highs. However, ETH open interest is still dominated by perpetual futures contracts, which are only available in certain non-US jurisdictions. As of June 1, 85% ($12.1 billion) of total open interest was in futures trading, while CME futures trading accounted for only 8% ($1.1 billion).

The impact of endogenous ETH catalysts on open interest is usually visible, with the last major spike in open interest following the approval of a spot ETH ETF in the U.S. (19b-4 filing). Prior to that, the Dencun upgrade on March 13th saw open interest peak.

In addition, traditional fixed-term futures on centralized exchanges remain popular, with open interest comparable to that of CME futures.

Isolate CME Bitcoin Basis Trade

Normalizing the total spot ETF market capitalization against CME Bitcoin open interest shows that the majority of spot ETF flows since early April (day 55) can be attributed to basis trading.

After the spot ETF was approved, the amount of Bitcoin in ETF custody increased by about 200k BTC as of March 13 (day 43). This indicates that Bitcoin was bought in a targeted manner during this period, which partly explains the price increase during that period. Since then, the amount of Bitcoin in ETF custody has remained between 825-850k until the end of May when it strongly broke out of this range.