The cryptocurrency market is undergoing a phased adjustment, and the best strategy in the short term is to wait patiently.

Crypto Market Summary

1. Since BTC price broke through ATH in March, it has not been able to maintain a clear upward momentum. With the market's pessimism about the US dollar interest rate cut and the lack of mainstream narrative in the market, the cryptocurrency market is undergoing a phased adjustment. The best strategy in the short term is to wait patiently. In the long run, we believe that the overall bull market will arrive in late 2024 to 2025.

2. It is expected that the Ethereum spot ETF will be approved for listing as early as July 4, which is good for market sentiment and the Ethereum ecosystem. The S-1 document required for the Ethereum spot ETF review has received feedback from the SEC and is required to complete the modification and submit it before June 21 (this Friday).

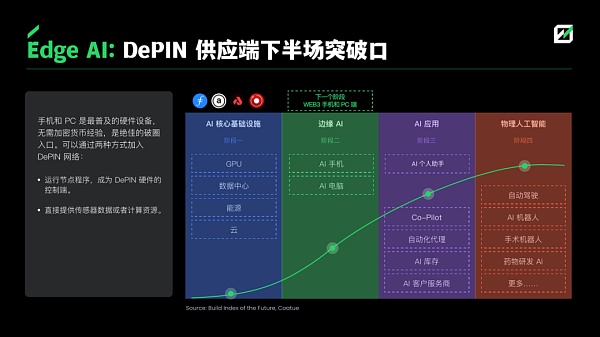

3. FMG released an in-depth research report on DePIN, proposing three major trends in the DePIN track: the combination of the DePIN model and consumer goods; the edge device economy and sharing economy based on Web3 mobile phones; and releasing DePIN liquidity through the RWA model.

4. The meme craze represents the "narrative-free stage" of the market. Due to the lack of narrative in the current market and the large number of Altcoin with high FDV that are constantly unlocked, investors have begun to turn to meme speculation. This round of meme narrative has a more solid foundation than the previous cycle, including the entry of investment institutions, liquidity provided by trading platforms, and increased community participation.

5. The two recent large airdrops (ZKSync, Eigenlayer) have both seen the buzzwords "ZKscam" and "EIGENscam" within a few days of the airdrops. Any flaw in the project's airdrop mechanism will cause great dissatisfaction in the community. The airdropped tokens are distributed to users with extremely low retention rates at almost zero cost, and more than half of the tokens will be sold immediately. It is expected that the project will gradually become less enthusiastic about airdrop operations, and the project still needs to have excellent product capabilities and market promotion capabilities.

1. Market Overview

1.1 Crypto Market Data

On June 19, the total market value of cryptocurrencies was 2.38 trillion US dollars, down 5.92% from the beginning of the month. BTC's market value accounted for 53.92%, a slight increase from 52.66% at the beginning of the month. The Crypto Fear and Greed Index showed a downward trend and is currently at a neutral level.

As of June 19, the combined market capitalization of Bitcoin and Ethereum was down 3.5% from the beginning of the month, while Altcoins were down 15%.

According to the rules of the previous two Bitcoin halvings, there is a 12-18 month interval between the halving time and the peak of the bull market. The rise is not achieved overnight, but is accompanied by fluctuations and periodic declines. This halving will occur on April 20, 2024, and it is expected that the market will begin to improve by the end of 2024.

Although this year's net inflows are stronger than last year, they are still significantly lower than the level during the 2021/2022 bull market, and the inflows are not enough to support the bull market. According to JPMorgan Chase estimates, the net inflows into the crypto market so far this year have reached $12 billion. Among them, Bitcoin spot ETFs have a net inflow of $16 billion. Since January, the exchange's Bitcoin reserves have decreased by about 220,000 (US$13 billion), indicating that most of the funds flowing into spot ETFs are actually transferred from existing digital wallets, rather than new funds.

1.2 Macro-monetary environment

After the announcement of lower-than-expected CPI at 20:30 on the evening of June 12, the crypto market generally rose for a few hours. At 2:00 a.m. on June 13, at the FOMC meeting, the Fed unexpectedly used a dot plot to indicate that it would only cut interest rates once this year, lower than the three times in March. The crypto market then began to weaken.

According to Coinshare statistics, the largest outflow of funds since March 22 was $600 million (week number, by 6/15), of which Bitcoin outflow amounted to $621 million, and ETH, LIDO and XRP funds showed a small inflow. According to sosovalue data, BTC spot ETF has been outflowing every day since June 13.

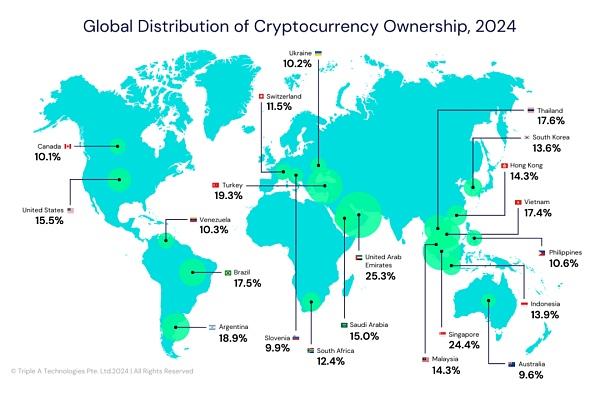

1.3 Crypto Population Forecast

Triple-A released the 2024 Global Cryptocurrency Ownership Status Report, which showed that the global digital currency user base reached 562 million in 2024 (equivalent to 6.8% of the world's population), up from 420 million in 2023.

34% of cryptocurrency holders are between the ages of 24 and 35, the largest proportion among all age groups. Young people are the absolute main force of the crypto community.

2. Crypto Market Hotspots and Narratives

2.1 Combination of AI and Crypto

Nvidia estimates that there are more than 40K companies worldwide using GPUs for AI and accelerated computing, with a developer community of more than 4 million people. Looking ahead, the global AI market is expected to grow from $515 billion in 2023 to $2.74 trillion in 2032, with an average annual growth rate of 20.4%. Meanwhile, the GPU market is expected to reach $400 billion by 2032, with an average annual growth rate of 25%.

Bitwise analysts predict that AI + Crypto will unlock a huge market of 20 trillion US dollars. As a track that is strongly tied to the concept of AI, the decentralized computing network is one of the vertical fields in the crypto field that is most likely to gain real demand.

2.2 Meme Narrative

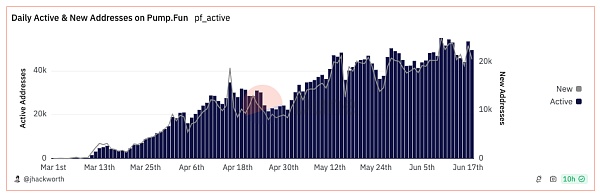

Meme has gradually been accepted by the mainstream crypto market, and more and more people agree that consensus is value and existence is reasonable.

At the institutional level, Bybit reports that institutional investors’ investment allocations in meme coins have increased by more than 300% this year, reaching a peak of nearly $300 million in April. Currently popular choices are DOGE, SHIB, and BONK.

At the exchange level, Binance launched several Meme coins, including PEPE, WIF, and BOME, further providing sufficient liquidity for Meme and triggering investors' enthusiasm for Meme coins.

At the community level, symbols have great cohesion. Meme, as a universal language, enables the community to quickly reach a consensus and form a simple and effective communication path. In addition, many celebrities have begun to get involved in Memecoin, which has enhanced the spread of Meme, similar to the purchase and holding of NFT collections by celebrities in the previous cycle.

At the issuing platform level, Pump.fun has issued more than 1 million memes, and the transaction volume of Pump.fun has reached 3.6 billion US dollars, and the number of new users is growing continuously. With the support of the issuing platform, Meme has become a minimalist fundraising mechanism and listing strategy.

III. Regulatory Environment

Bloomberg ETF analysts Eric Balchunas and James Seyffart said that the launch date of the Ethereum spot ETF may be brought forward to July 4. The reason is that SEC staff sent comments on S-1 to issuers last week, and the comments were brief and there were no major issues. They required the revisions to be completed and submitted before this Friday (June 21).

In the previous issue of FMG's Crypto Market Watch, it was mentioned that the 19b-4 form was approved in May, and trading can only begin after the S-1 form takes effect. The sudden approval of the ETF reflects the Biden administration's soft stance on cryptocurrency policy, which is due to election needs. The analysis of ARK Invest CEO and Chief Investment Officer Cathie Wood also supports this judgment. She said at the Consensus conference that the Ethereum spot ETF application was approved because cryptocurrency is an election issue.

Trump’s pro-crypto stance against the multi-million crypto industry in the United States has prompted Biden voters to make strategic adjustments in cryptocurrency policy. The Biden re-election campaign has begun reaching out to key figures in the cryptocurrency industry, seeking guidance on “the crypto community and crypto policy moving forward.”

4. Research Topic: FHE Fully Homomorphic Encryption

Fully homomorphic encryption (FHE) is an advanced solution for secure computing that allows an unlimited number of arbitrary operations on ciphertext (including any number of addition and multiplication operations), thereby ensuring the privacy and security of data during processing and computing. The lightweight work on FHE has achieved remarkable results at home and abroad, but its high computing, storage and communication overhead still cannot meet the objective performance requirements of resource-constrained local devices in edge computing systems.

Opportunities brought by FHE:

1. Solve privacy issues in AI and edge computing

In the training process of large language models, all links involving data processing and transmission, such as data distribution, model training, parameter and gradient aggregation, may affect data security and privacy. If the problem of data privacy cannot be solved, it will not be possible to truly scale on the demand side. In addition, the premise of using edge computing power is to ensure data privacy, and FHE is a privacy computing technology born for this scenario.

2. DePIN Hardware Acceleration

The computing power required for FHE is about 1000-10000 times that of ZK, and some hardware companies are working on producing FHE chips.

Recently, projects with FHE concepts have received large amounts of VC investment, making it a hot topic in the crypto community. However, the application of FHE technology is still in its early stages, and we will continue to pay attention.

The data comes from: Coinmarketcap, Coinshare, Sosovalue, Bloomberg, Tripe-A, Bybit