According to DL News, this is a turbulent time for miners as Bitcoin mining costs become increasingly unstable. According to Canadian-listed mining company Hut 8, they hope to remain profitable by cutting expenses and using special software.

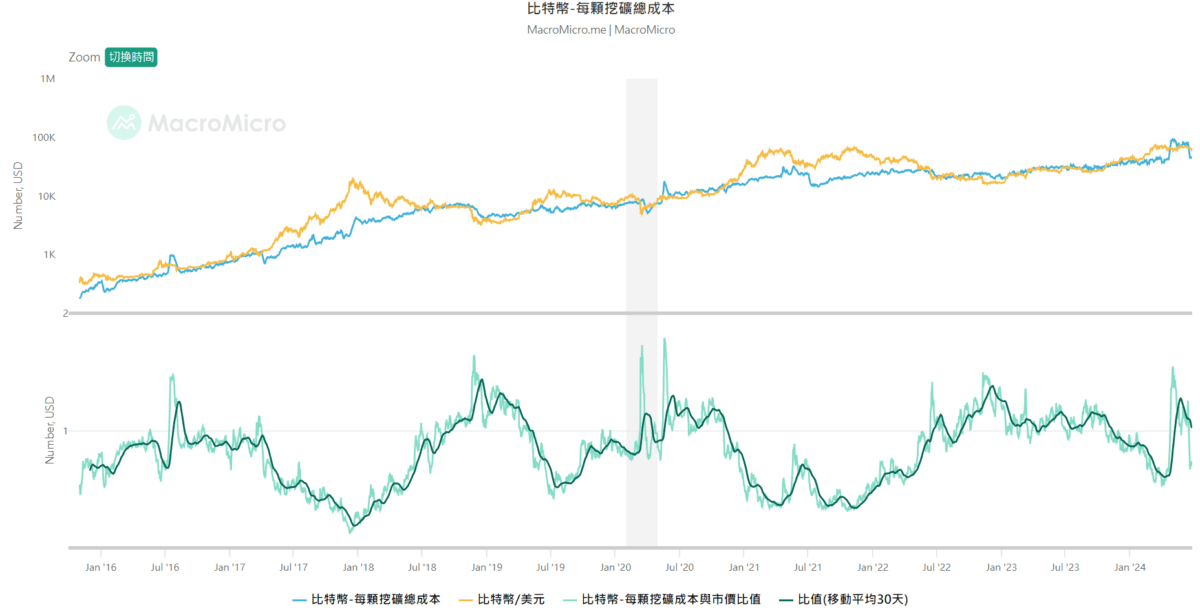

According to data from "Financial M Square", the average cost for miners to produce each Bitcoin soared to US$83,668 in early June, which is approximately 37% higher than the current Bitcoin price of approximately US$61,000. Although the cost of mining has plummeted to $45,719 this week, it is likely to rise again.

Hut 8 CEO Asher Genoot said in an interview with DL News that "those miners that have not reached sufficient scale" are likely to no longer be profitable in this environment, and if they have not stopped mining, they will be forced to terminate operation.

As more miners join the Bitcoin network, it becomes increasingly difficult to solve the complex equations that lead to rewards. This mechanism may help explain wild fluctuations in mining costs, as unprofitable miners shut down their mining rigs. In addition, the Bitcoin network completed its fourth block reward halving in April this year, which may affect the recent financial situation of miners.

cut the expenses

The largest operating cost for Bitcoin miners is energy, and many miners are locked into multi-year contracts to protect against fluctuations in energy markets.

Hut 8 said the company reduced operating expenses in the first quarter by discontinuing unprofitable products and initiated a budget review process to address recurring expenses. According to Hut 8’s first-quarter financial report, the company’s average cost of producing each Bitcoin was $24,594.

Debt financing is also a big issue. To remain competitive, mining companies must regularly update their equipment with newer, more efficient models. To do this, they often take on debt to fund these purchases.

The key is hash price

According to Hut 8’s Genoot, the key to determining a miner’s profitability is a metric called hash price , which is calculated based on the Bitcoin network’s mining difficulty, Bitcoin price, and network rewards.

To assess profitability, miners look at hash prices relative to energy costs and the efficiency of their mining machines. According to Genoot's calculations, the current hash price is approximately $0.053. He said this means energy costs for miners need to be below $0.065 per kilowatt-hour to be profitable.

Keeping an eye on hash prices is one of the ways Hut 8 remains profitable. Genoot said his company runs software on mining machines that automatically shut down power when electricity prices exceed expected revenue. This allows Hut 8 to mine when it is profitable and further control costs, something smaller operators are unable to do.

Miners are not only concerned about whether current operations are profitable, they also need to plan for what may happen in the future. The cost of Bitcoin mining is directly related to the network hash rate - that is, the total computing power of all Bitcoin mining machines. The number of Bitcoins produced by a miner is usually consistent with the miner's contribution to the hash rate.

related articles:

" JPMorgan Chase: The market value of U.S.-listed Bitcoin mining companies reached a record $22.8 billion in June "

" Miners cash out on Bitcoin rally, with number of coins transferred to exchanges hitting two-month high "

" ViaBTC: Innovative Bitcoin applications are the key to solving the mining subsidy problem "