Submission of S-1s securities report for the first time in the United States... Staking function excluded

If approved, it will become the third digital asset ETF after BTC and ETH.

Experts say, “It’s impossible to launch within the year… Approval will come after the U.S. presidential election.”

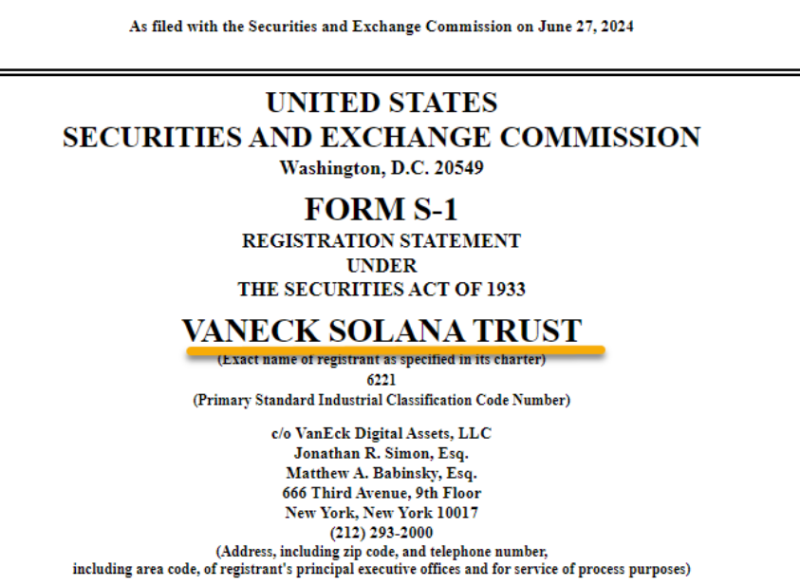

Van Eck's application classified Solana as a product rather than a security and designed an ETF that tracks Solana's spot price without Solana's staking function. If this product is approved by the SEC, it will become the third digital asset ETF to be approved for listing by the U.S. financial authorities, following Bitcoin and Ethereum.

Matthew Siegel, head of digital assets at Van Eck, explained the significance of the launch of Solana spot ETF, saying, “We decided that Solana was an attractive investment product by focusing on Solana’s high scalability, speed, and low transaction fees.”

The news of VanEck's spot ETF application was announced at a time when the market launch of the Ethereum spot ETF had not yet been announced, leading to Solana's rebound. Solana soared about 10% on the 27th.

Currently, the Ethereum spot ETF is likely to be launched on the market in early July. Two days ago, VanEck submitted '8-A', an ETF-related securities report, to the SEC. 8-A is a required document that companies issuing specific securities must submit to the SEC, and is classified as the last document submitted when applying for an ETF.

Regarding Van Eck's application for approval of the Solana spot ETF, many experts predict that it is close to impossible for the Solana spot ETF to be approved within the year.

Eric Balchunas, a Bloomberg ETF researcher, predicted, “Approval of the Solana spot ETF will be determined by the results of the November presidential election,” and added, “If former President Donald Trump is elected, the speed of approval could accelerate.” In addition, James Seifert, a researcher at Bloomberg ETF, said, “At the earliest, the approval results will not be available until March of next year.”

Reporter Seungwon Kwon ksw@