Highlights of this issue :

1. Follow the star funds to enjoy the benefits

2. Coinbase premium finally turns positive

01

X Viewpoint

Bitwu.eth (@BTW0205): The crypto bull market is awakening

Arthur Hayes: The macro situation is changing, interest rate cuts are inevitable, and the cryptocurrency bull market is awakening -

Long#BTC Long#ALTCOIN

BitMEX founder Arthur Hayes publishes latest article "Group of Fools"

Arthur Hayes said:

To counter the weakening of the yen and its potential risks to the global financial system:

The G7 central banks (Fed, European Central Bank "ECB", Bank of Canada "BOC", Bank of England "BOE") with higher policy rates must cut interest rates.

With the US election around the corner, the Fed is not expected to cut interest rates at the upcoming June meeting, and expectations remain as to whether they will start cutting rates closer to the US presidential election in November, while the BOE (Bank of England) may unexpectedly cut interest rates.

The trend is clear, central banks have begun to ease monetary policy. These central bank policy changes will drive the cryptocurrency market out of the summer doldrums.

Cryptocurrencies are awakening and are about to pierce the skin of profligate central bankers: this is the time to long and long ALTCOIN; it’s time to redeploy excess USD liquidity into Altcoin.

2. Rocky (@Rocky_Bitcoin): Follow the star fund to drink soup and eat meat

The market always moves forward amid controversy, progresses amid disagreement, and grows amid iteration. We have always liked to follow the movements of smart money, and most of the time we can catch some early crypto opportunities. For example, #YGG, for example, #FET, but little do we know that among these smart money, there is a common shadow - #DWF (Take Me Flying) @DWFLabs.

Although DWF is controversial, it is cute. The controversy lies in the mixture of market makers and VC investments, with referees and athletes on the field together (within the compliance framework). The cute thing is that their actions are relatively open and transparent, and the wallet address is also very open. If you spend some time thinking about the specific token classification and proportion, you can make statistics by making a Python filter. Basically, it is an open card operation, and most of the ambushes can be eaten. Another name: DWF [Take Me Flying], very interesting.

Here is a brief introduction to DWF. DWF Labs was founded in 2018 by Managing Partner Andrei Grachev - CEO of Huobi Russia and several crypto trading companies. DWF Labs is a leading global "digital asset market maker and Web3 investment firm" with operations in Singapore, Hong Kong, Switzerland, the United Arab Emirates and the British Virgin Islands. It is a subsidiary of Digital Wave Finance, a "one of the world's largest high-frequency cryptocurrency trading entities, trading in spot and derivatives markets on more than 40 top exchanges."

I looked at the experience and LinkedIn of the founder Andrei Grachev, which is quite inspiring. He studied organizational management at Orenburg State University, entered the logistics industry at the age of 18, and worked in logistics for 8 years. Later, he switched to e-commerce and used his spare time to learn about financial markets and other aspects. In 2016, he operated a small Ethereum mine and entered the world of cryptocurrency. In the bull market of 2017, Ethereum rose from $7 to $350. Andrei Grachev sold some ETH and started his crypto journey. He then started a crypto trading company and served as the CEO of Huobi Russia. He also founded DWF LABS in 2018.

This experience is undoubtedly an inspirational story of Web3 youth. In addition to the exponential growth of the industry, this rapid growth is inseparable from the dedication and hard work behind the founders. What many people don’t know is that DWF has never raised funds from the outside and has no investors. Instead, it started from scratch. This growth rate and development potential are awe-inspiring.

So Web3 never lacks opportunities, but lacks the courage and determination to fight and take risks, which is exactly what Andrei Grachev, as a Russian, has in his sturdy bloodline. He doesn't care about life and death, and he will fight if he doesn't obey. This kind of fighting style of the founder has led a strong iron army and created amazing performance: in just 16 months of history, it has invested in 470 projects and established cooperation with about 35% of the projects in the top 1,000 tokens by market value.

Among the publicly known large investments, DWF invested $20 million in Synthetix, $28 million in the blockchain platform Conflux, $40 million in the artificial intelligence platform Fetch.AI, $45 million in the EOS Network Foundation, $50 million in the Algorand Foundation, and strongly supported the Russian project TON, investing tens of millions of dollars in it. The recent outstanding performance of #NOT is obvious to all.

Many times, the icing on the cake of a bull market is not important, but the timely assistance in a bear market is often more valuable. In 2022, the crypto market has experienced the collapse of Three Arrows Capital, Celsius, Voyager, FTX and other events, which have dealt a severe blow to the crypto industry. The Crypto Winter is harsh, the financial market is cold, and the global economy is filled with fear and uncertainty of the coronavirus epidemic; at a time when everyone is afraid to talk about investment and avoid talking about crypto, DWF Labs chooses to go against the current and inject confidence and capital into the market.

For example, it supports Binance Industry Recovery Fund Plan and TON Foundation's "Rescue Fund", provides blood transfusions and guarantees operations to many projects through over-the-counter transactions. In addition to providing financial support, it also helps projects formulate market strategies, conduct market research, media cooperation, etc., as well as talent recruitment and technical service support through DWF Ventures, technical teams, and incubation departments. This kind of timely service has undoubtedly brought warmth to many projects to survive the cold winter of the bear market, and most importantly, it has conveyed confidence and hope to the entire Web3 industry. And this spirit of timely assistance is undoubtedly rare and commendable.

Summary: Web3 is a chaotic market, but it is chaos that gives people the opportunity to achieve success and career. We cannot follow the rules and accept things as they come. Only by breaking the shackles and red tape can we open up a new era. The story of DWF (Take Me Flying) and its founder Andrei Grachev proves this point: not being bound by the secular world and tradition, as long as it is within the compliance framework, anything is allowed. Through market makers, investments, high-frequency trading, OTC and other multi-market strategies, while making profits, do not forget to give back to the Web3 market. The official website of DWF Labs once stated: Regardless of market conditions, DWF Labs invests in 5 projects on average every month.

The active investment strategy brings forward-looking development opportunities to Web3, while also continuously iterating and evolving Web3's technological innovation. A positive feedback flywheel is being perfectly formed, investment-iteration-innovation-verification (failure/success)-investment again-iteration-innovation, and the cycle repeats. Only in this way can an industry grow and develop actively. As an emerging industry, Web3 cannot do without the active investment and development of VC. Blockchain infrastructure, DeFi, NFT, GameFi, DAO, SocialFi, data analysis, privacy, etc. are all key areas of DWF investment, and these areas are the backbone of Web3.

At the beginning of the response, the market always moves forward in controversy, progresses in disagreement, and grows in iteration. Only with more patience, more perspective, and a long-term view can we see the mountains and embrace the mountains and rivers.

3.qinbafrank (@qinbafrank): We may have to wait a little longer to see the overall trend of the cryptocurrency market

This time, the ECB is cutting interest rates in a hawkish and precautionary manner. This can be seen from the following points:

1. The ECB gave up its pre-commitment on a specific interest rate path. Unlike in April when Christine Lagarde said that the ECB would cut interest rates in June, there was no such a clear prospect this time. Of course, it is understandable that the previous clear commitment was reluctantly implemented.

2. Inflation in the EU showed signs of rising in May. Of course, the trend cannot be fully seen from the data of one month. However, the most direct impact of the Houthi armed forces' disturbances in the Red Sea is on imports and exports to Europe, and the container shipping index has skyrocketed for this reason. The rise in EU inflation caused by shipping problems is indeed a risk, which is also the deep-seated reason why the ECB raised the median inflation forecast for 24 years from 2.3% to 2.5%.

3. Another thing that many people may not have noticed is that the ECB has been increasing interest rates while expanding its balance sheet over the past two years. Due to the debt problems of several countries in the eurozone, the ECB has been using two tools to expand its balance sheet during the pandemic: the asset purchase program (APP) and the pandemic emergency purchase program (PEPP). Last night, the ECB also mentioned slowing down the expansion of its balance sheet (equivalent to the Fed's taper): the PEPP portfolio will be reduced by an average of 7.5 billion euros per month. It can also be seen that while lowering interest rates, the central bank has also slightly tightened its balance sheet.

Personally, I think the slight fluctuation in inflation in May and the worsening shipping problems have disrupted the ECB’s previous plans. However, it has been clearly stated before that if the interest rate is not cut in June, it will have a huge impact on the EU market. It’s a bit like having to finish the appointment with tears.

At present, the currency market is still a dollar-priced asset, and it is still closely following the trend of the US market and the direction of the Federal Reserve. The US dollar interest rate is high, and the Federal Reserve has not started to cut interest rates. At the same time, it is still in the context of balance sheet reduction: the slowdown of balance sheet reduction this month and the increase in TGA spending by the Ministry of Finance will only slightly improve liquidity rather than a state of super-abundant liquidity: it is still a strongly structured market, and only a few top and consensus-strong projects can perform well. The overall market may have to wait.

We can also see from the US stock market that the breadth of the recent rise is further narrowing (the rise is more concentrated in a few stocks) rather than expanding.

02

On-chain data

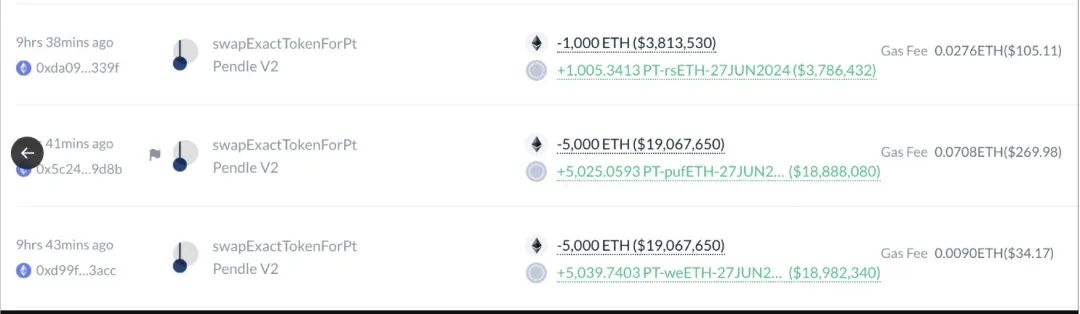

Ember: Sun Ge spent 44,000 ETH in the last four days to buy PT tokens of three LRTs expiring on June 27 on Pendle

Justin Sun spent another 11,000 ETH ($41.94M) last night (9 hours ago) to continue buying PT tokens of three LRTs that expire on June 27: 5,000 ETH to buy 5,039.7 PT-weETH; 5,000 ETH to buy 5,025 PT-pufETH; 1,000 ETH to buy 1,005.3 PT-rsETH. Currently, Justin Sun has spent a total of 44,000 ETH in the past four days to buy PT tokens of three LRTs that expire on June 27 on Pendle, and can obtain about 419 ETH ($1.6M) in currency-based income after expiration.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are: NOT, CHEEKS, TAI, DOG, and GME. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are: Ferrum Network, Trustswap Launchpad, ERC404, Presale Memes, and DN404.

Focus: NOT triggers a boom in "mining flow" projects, TON may become a dark horse in the ecosystem

After NOT "fired the first shot of TON ecosystem tokens listed on Binance", NOT experienced a 60% plunge and then achieved a "7-fold achievement" in just a week or so. According to the official account of Notcoin, the project has now reached the third phase (Phrase 3). As a click game built on the TON blockchain, Notcoin has gained more than 35 million participating users in just a few months with its low threshold and direct revenue rewards, and the average daily active users have exceeded 6 million. The Tap2Earn (click to earn) game mode and the fission of pulling people have also made Notcoin one of the top 5 channels in the number of users on the Telegram platform. If it is regarded as a Meme coin of the TON ecosystem, it may be more in line with NOT's current market positioning and user impression. Not only that, if the role of Meme coin is confirmed, NOT's market value and the price of a single token are expected to maintain an upward momentum, and become a great hope for the TON ecosystem to break the circle of Web2 user groups. After all, the market education benefit of Meme Coin for Web2 users is obvious.

There are some other potential projects in the TON chain: Hamster Kombat is a management simulation game from Tap2Earn. According to reports, it has now reached over 60 million users. In addition, Hamster Kombat’s YouTube channel achieved the amazing achievement of “more than 10 million YouTube channel followers” in just 7 days. Its official Telegram channel has nearly 24 million followers.

CatizenAI is a new mini-game center platform + on-chain metaverse cat-raising game created by Pluto Studio, a Web3 mini-game publishing studio, based on past experience. The Beta test version was launched in March 2024; in April, Catizen had 260,000 on-chain users, making it one of the fastest growing projects in the TON ecosystem; in June, according to official news, its number of users has exceeded 12 million, and the number of on-chain users has exceeded 730,000, winning the first place in the TON ecosystem The Open League twice in a row.

Tapswap is a Tap2Earn-style mining game similar to Notcoin. It is worth mentioning that according to search engine results, the game seems to be popular among many Nigerian players. By tapping the screen, you can get game coins and then exchange them for real legal currency.

Yescoin is another Notcoin imitation, and it just won the second place in the App competition ranking of The Open League. According to its official channel introduction, the project is currently in the first stage, that is, the fair mining stage; the number of channel followers is about 4.43 million.

Ston.fi is an AMM DEX built on the TON chain, offering almost zero fees, low slippage, an extremely simple interface, and direct integration with the TON wallet. It previously announced in May that it had completed a new round of financing, with CoinFund participating in the investment. The specific amount of financing and valuation data were not disclosed.

After NOT completed the "exchange debut" of TON ecology through wash trading and pull trading, TON ecology seems to have found a different development path of "Web2 applet + H5 mini game + Web3 human mining + inviting fission by pulling people". Perhaps in the near future, we will be able to see the TON ecological network with new highs in TVL and the number of active on-chain users, realizing the vision of Mass Adoption that many people have dreamed of. I just hope that users who have "traveled through mountains and rivers" from Web2 can continue to find fun and value after tasting the "sweetness" of Web3 airdrops, and become one of the subsequent builders of TON ecology.

04

Macro Analysis

@BQYoutube: Coinbase premium finally turns positive

After Coinbase’s negative premium lasted for about 10 days, the premium finally turned positive.

In many cases, falling BTC and a positive Coinbase premium often lead to buy the dips opportunities.

@CRYPTOHELL: How Exchange Bitcoin Reserves Affect Market Prices

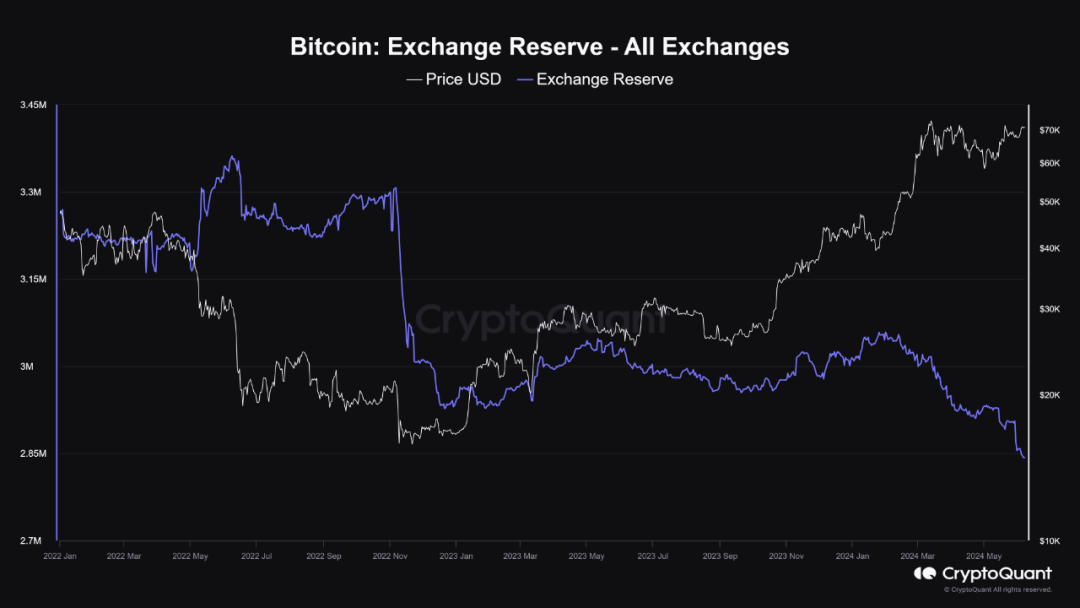

Bitcoin: Reserves - All Exchanges The chart shows two things: the amount of Bitcoin stored on exchanges and the price of Bitcoin in USD.

Foreign exchange reserves (blue line):

From early 2022 to mid-2023, the price of Bitcoin has been trending downward, suggesting that Bitcoin is moving from exchanges to personal storage. The sharp drop in early 2023 could be due to market events or exchange policies. This trend could indicate either long-term confidence in Bitcoin or concerns about exchange security.

Bitcoin price (white line):

Starting in 2023, the price of Bitcoin has risen significantly, from around $40,000 to over $70,000. This growth is happening despite the fact that the amount of Bitcoin on exchanges is decreasing, which indicates either increased demand or limited supply.

Relationship between reserves and prices:

There is a negative correlation between the amount of Bitcoin on exchanges and its price. Fewer Bitcoins on exchanges means less supply on the market, which pushes up the price. This is supported by the law of supply and demand.

in conclusion:

Bitcoin's decline on exchanges has helped boost its price. Other factors, such as global economic conditions and monetary policy, also affect the market. Investors should be aware of these dynamics when planning their strategies. Analyzing these trends can provide important insights into the broader crypto market.

05

Research Reports

@Jack Inabinet: BNB's surge is unlikely to continue

Suddenly, it skyrocketed. Binance founder CZ has just started serving a 4-month prison sentence, but this has not stopped the native token of the exchange BNB Chain, which is closely associated with him, from hitting its highest price ever! Why did BNB perform so well this week?

BNB is up more than 20% from Monday’s low, surpassing $700 for the first time in history. BNB has not recovered since shortly after Binance announced a settlement with the Department of Justice (DOJ) in November for violating the Bank Secrecy Act.

Despite BNB’s current exceptional strength, it’s not the only currency to rise. BNB’s rise comes as many cryptocurrencies, stocks and commodities have risen on investor optimism as major Western central banks begin to cut interest rates.

Many on-chain BNB metrics have risen steadily this week, with daily transaction fees and DEX trading volume being the most impacted by the surge in speculative activity caused by BNB's rise; both metrics have more than doubled from Monday!

While most blockchains (from Solana to Sei, Arbitrum to Optimism) saw a drop in on-chain usage statistics this week, BNB Chain was one of the few blockchains to see an increase in daily active addresses and transactions.

Unfortunately, these recent gains are merely blips in the long term, with every major on-chain BNB metric still well below local highs set in March 2024 following BTC’s all-time high.

Indicating that much of the rally was driven by speculation, open interest in BNB perpetual swap contracts surged 50% during this week’s rally to $1.05 billion, its highest level ever, suggesting that leveraged traders (who will eventually need to close their positions) have contributed significantly to the gains.

If cryptocurrency prices continue to rise in the coming months as global central banks lower their interest rate targets, BNB will likely rise with it and become a top outperformer among major currencies.

BNB’s relative strength against BTC and ETH has increased by 29% and 35% respectively in 2024, and while it’s unlikely that the token will receive a spot ETF like these two alternatives anytime in the future, its holders could see greater upside if recent performance holds up.