Highlights of this issue :

1. The inevitability of copycat stocks in a bull market

2. Is buying crypto stock HOOD a good choice?

01

X Viewpoint

1. Rocky (@Rocky_Bitcoin): Depin modularization introduction

Today I read a #DEPIN report from @iotex_io, which talked about the modularization of DEPIN in the future. It was very interesting. I think the modularization of DEPIN is much more interesting than the modularization of blockchain. Hardware manufacturers, infrastructure builders, application builders, users. 4 stakeholders.

It is divided into 9 modules: hardware + connection solution (Bluetooth or MQTT, etc.) + sorting controller + data availability + storage + off-chain computing + blockchain + identity DID + governance, which constitute all the components of DEPIN.

At present, there are a large number of entrepreneurs innovating in each module. I believe that in the future, it will be easy and fast to use. As shown in the figure, I found that there is only one P2P data transmission module, #DATA, which I have mentioned many times in previous articles.

In a list of investment institutions, we found that Multicoin basically occupies half of the market, and the projects invested by Multicoin + A16Z together have greater potential. What is amazing this time is that #Near and #Eigen are both assigned to the DEPIN track, which should be closely related to their DA plan.

The report also highlights the following projects for reference:

Aethir @AethirCloud builds distributed GPU-based computing infrastructure for enterprise use cases. Aethir makes it easier for GPU infrastructure providers to scale and for buyers to access GPUs around the world.

ATOR @atorprotocol is building the largest global anonymous routing ecosystem, leveraging decentralized privacy protocols, on-chain incentives, and signature hardware to rapidly scale the network.

DATS @DATSProject conducts cybersecurity audits using hacker-inspired strategies and distributed high-performance computing (D-HPC) to improve Web3 security and defend against sophisticated cyber threats.

DIMO @DIMO_Network is an open and user-controllable IoT protocol and network. It connects drivers, developers and manufacturers on a shared network, sharing status, development tools, payment channels, etc.

dTelecom @dTel_org is a decentralized real-time communication (RTC) that allows anyone to contribute idle bandwidth through $DTEL tokens and earn rewards. It provides cost-effective RTC resources for customers' applications to add audio/video/chat solutions without the additional overhead of traditional on-premises and cloud solutions.

HNT @helium is a decentralized, blockchain-based wireless infrastructure project that allows individuals and organizations to deploy and operate wireless networks through token incentives. It uses the Solana blockchain as its foundation. The main token driving the network is HNT, while IOT and MOBILE tokens are used to promote LoRaWAN and 5G networks respectively.

Ketchup Republic @KetchupRepublic uses the Proof of Engagement (PoE) mechanism to tokenize real-world spaces and actions. It provides basic support for various applications, including local life services, SocialFi and GameFi, by converting real-world participation into tokenized rewards and incentives.

Network3 @network3_ai is building a dedicated AI L2 for developers around the world that will provide model optimization, compression, federated learning, and confidential computing to enable efficient and scalable AI deployment.

Onocoy @onocoyRTK is building a network of RTK (Real Time Kinematic) stations to provide high-precision positioning for everyone. The Onocoy system is community-owned, borderless, and aims to become an indispensable public utility with global coverage.

Starpower @starpowerworld is pioneering the energy internet, similar to Uber, connecting millions of energy devices around the world to virtual power plants (VPPs), etc., with a market value of more than $100 billion.

Textile @textileio is building Tableland, an open source, permissionless cloud database built on SQLite, and Basin, a scalable subnet for fast and secure data storage, powered by the Filecoin network.

WiHi @WiHiWeather is decentralizing weather monitoring and forecasting, democratizing data access and improving forecast accuracy. Transitioning to a Web3 framework promises to break down barriers and make data collection more efficient, participatory, and conducted on a wider geographic scale.

2.Rocky (@Rocky_Bitcoin): Why there is a copycat market in every bull market!

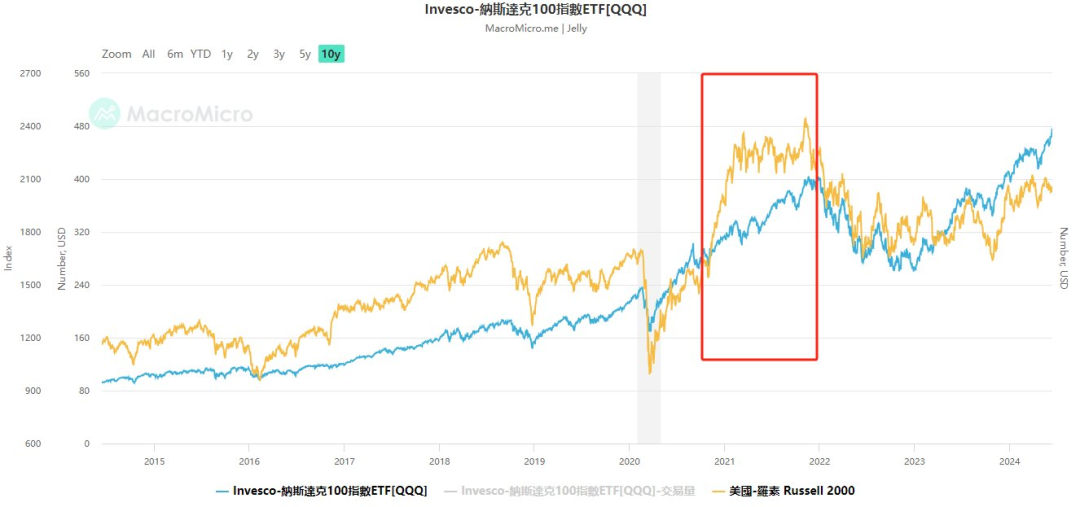

Now the Web3 market is becoming more and more like the US stock market. Historically, the US stock market has not always been led by the seven golden flowers. From the comparison between the S&P 500 Index and the Russell 2000 Index, and the Nasdaq 100 Index and the Russell 2000 Index, we can find that the small and medium-cap stocks (Altcoin) have surpassed the blue chip market in most of the market, and in the second half of the market, the trend will be stronger and sharper, far surpassing the blue chips.

Let's look at the third picture, which shows the market share of BTC over the years. There have been two times when BTC's market share exceeded 70%. The first time was on August 19, 2019 (a small peak in the rebound in 2019). The second time was in December 2020 (the scene in 2020 when BTC took the lead in charging to 40,000). Then the market share of BTC turned down, providing nutrients for more cottages. The magnificent cottage market started. The root of all this is that the peak of BTC's market share is unsustainable, mainly because it is difficult for BTC to attract off-site funds to enter the market, resulting in the depletion of funds in the market. Only the money-making effect can stimulate fresh blood outside the market and push up the market again. The cottages that spend little money to do big things often play the role of aerial refueling engines in the middle of the market.

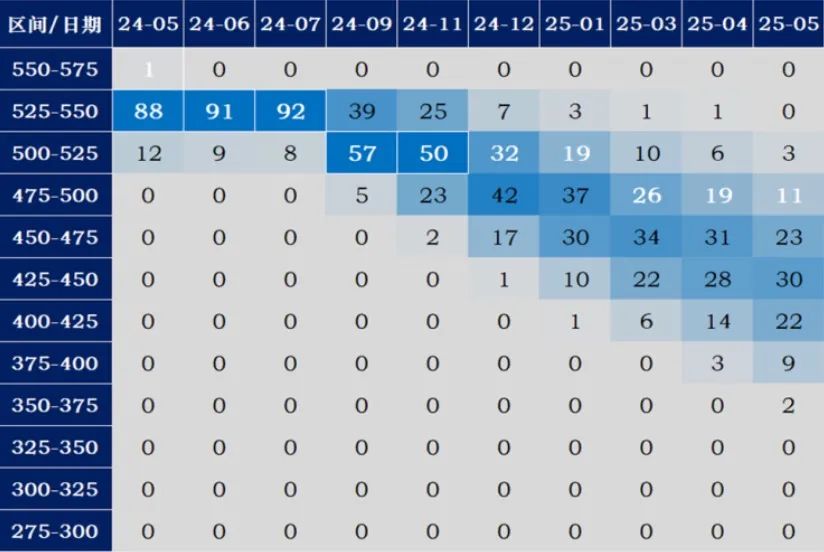

3. The market value is huge and difficult to push up. The total market value of cryptocurrencies is currently 2.55 trillion US dollars, and the market value of BTC is 1.31 trillion US dollars. We expect this value to double to 5 trillion in the mid-term of the bull market, corresponding to a BTC market value of 2.6 trillion US dollars. We reasonably predict that the market value of BTC in this bull market will be between 3.55 trillion and 4.48 trillion. The corresponding BTC price is between 178,000 US dollars and 222,400 US dollars. (Detailed analysis below)

With such a huge market value, it is difficult to provide momentum again after the BTC market value reaches 2.6 trillion in the medium term by relying on ETFs or market forces. The willingness of real retail investors to buy BTC is extremely low. They would rather choose PVP MEME coins than buy BTC worth hundreds of thousands of dollars. In this case, the role of copycats is born.

First, it provides a good return on investment compared to the BTC, bringing market popularity and funds.

Second, for institutions, they contribute to the Web3 industry and also need corresponding returns. Both ignition and harvesting require efforts. As the saying goes, you can't catch a wolf without sacrificing your son. Only by better profit recovery can they make better contributions to the next round of industry development.

Third, historical experience tells us that the bull market will end in chaos. Copycats create emotions to cover up the escape of blue chips. This is an unchanging script.

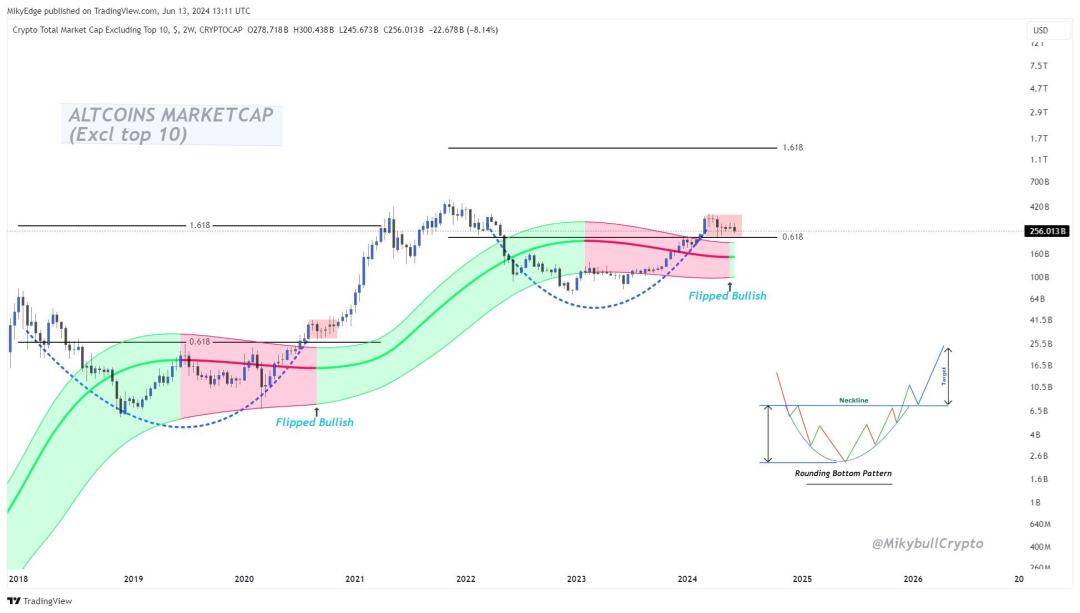

At this moment, we have seen many Altcoin with historically low volumes. As the saying goes, low volumes mean low prices. The reluctance to sell has reached its peak, so there is no need to panic. As shown in Figure 4, the example discussed with the foreign community last night, the altcoins are already ready to move, and there is a high probability that they are on the eve of an explosion.

3. Dayu (@BTCdayu): Problems with the ETH ecosystem

On the surface:

L1 is too slow, so L2 was created;

L2 divides liquidity, thus cross-chain bridge;

There are more cross-chain bridges, so there are intention transactions;

The intention was to trade and start chain abstraction.

In essence: there are no users and no innovation on L2. Rushing to build more distant infrastructure is not long-termism, but just telling a story and creating a bunch of selling pressure of tens of billions of dollars every month.

02

On-chain data

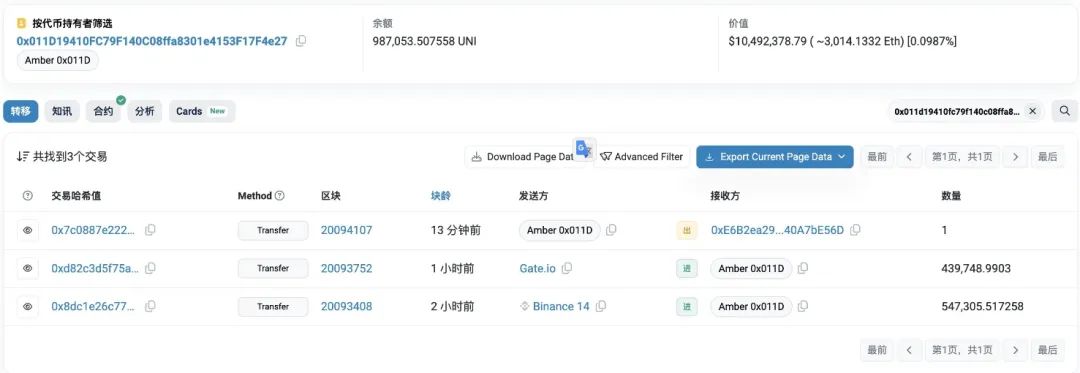

Embers: Amber Group withdraws 987,000 UNI from the exchange

In the past 2 hours, Amber Group withdrew 987,000 UNI ($10.36M) from Binance and Gate.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are ENA, IO, BASEHEROES, BBEER, and NOT. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are FTX bankruptcy assets, Base ecosystem, Algorithmic stablecoin, Jobs, and Nomad Capital.

Hot Spot Focus——Layer2 King Bomb is coming, the four kings begin to compete on the same stage

After the Dencun upgrade, the transaction cost on Ethereum's second-layer blockchain has been reduced by up to 99%, and Arbitrum may become the biggest winner of the Dencun upgrade. In the week before the upgrade, the number of transactions on Arbitrum was only 747,000, and in the week after the upgrade, this number jumped to 1.5 million. On June 3, according to Token Terminal data, the number of monthly active users of Arbitrum exceeded that of Ethereum for the first time, with Arbitrum's monthly active users exceeding 8 million, while Ethereum's monthly active users were about 7 million. At the same time, it also attracted many companies to participate in the ecological construction, including heavyweight company Franklin Templeton and Securitize, a company that helps BlackRock tokenize assets. Arbitrum fully utilizes the advantages of L3 and goes all out in the field of Web3 games. The Web3 ecosystem has already taken shape.

Optimism develops horizontally, and Op Stack expands its territory. In Op Stack, Base develops rapidly and has an extremely close relationship with Optimism. In February 2023, the crypto trading platform Coinbase announced the launch of Base, an Ethereum layer 2 network built on OP Stack, and reached a cooperation with Optimism. Coinbase joined OP Labs as a core developer to contribute to the mission of Optimism Collective and expand OP Stack's leading position as the most powerful public product. Base will also return a portion of transaction fee income to the Optimism Collective treasury to further realize the sustainable future vision of "influence = profitability". From the data on Deflama, Base's monthly capital inflow increased by 162%, and its TVL has risen to 7th place, surpassing many well-known public chains. Relying on Coinbase's strong support and users, the Base ecosystem has blossomed in many aspects and still has great potential in the future.

StarkNet adopts the STARK-based Rollup route. Although this solution has obvious advantages over other solutions in terms of decentralization, trustlessness, and anti-censorship, it is difficult to develop. StarkNet is still continuously improving its performance. Recently, StarkNet has been rumored to enter the Bitcoin extension layer, which has become its main strategy different from other Layer2, but from the current news, this is still uncertain. Whether StarkNet can expand on Bitcoin depends on whether the OP_CAT proposal can be passed.

According to Dune data, as of June 11, the total value of zkSync bridge storage (TVB) was about 3,286,428 ETH, and the total number of bridge user addresses was 2,926,969. Compared with other L2s, the total value of Optimism bridge storage was 770,890 ETH, Arbitrum was 3,794,152 ETH, and Starknet was 904,659 ETH. In addition to airdrops, the most important thing for zkSync is to promote the decentralization of the Prover network.

Compared to ZKsync, StarkNet issued its tokens relatively early, and there are also some well-known projects in the ecosystem. Recently, it has begun to plan to enter the Bitcoin ecosystem, which is also a new path, but this road may also have twists and turns. From the data, Arbitrum may become the biggest beneficiary after the Decun upgrade. At the same time, its ecosystem has also developed rapidly, but it may be due to the large number of tokens unlocked, and the performance of ARB tokens is not good. Optimism has great development potential through cooperation with Coinbase, and the Base built on Op Stack, but Optimism's own development is slightly behind Arbitrum.

As the last project to issue tokens among the four major Layer2 projects, many people have high hopes for zkSync. However, judging from the community's reaction, many of the people who are trying to get the tokens may not be satisfied. Some participants said, "The overall witch rate is very high. After all, there are less than 700,000 addresses left among millions of addresses. The hit rate of individual addresses is about 15%, all of which are low-income addresses. In addition, the price of ZK is so low, it's not interesting." In addition, from the data, although zkSync has many bridged assets, its TVL is still relatively small. Compared with other Layer2 projects, the construction of zkSync ecosystem is obviously slow. At the same time, GemSwap, a decentralized trading platform on ZKsync, ran away with the money before issuing the token, which also added some clouds to the ZKsync ecosystem. How the Zk system will develop in the future remains to be further observed.

04

Macro Analysis

Guojin Macro: The probability of the Fed cutting interest rates in September increases, and trading appears before the rate cut

The June FOMC statement said that economic activity continued to expand at a steady pace. Job growth remained strong and the unemployment rate remained low... The recent process of deflation "has made some progress" - described as "stagnant" in May.

The meeting maintained the policy interest rate unchanged and slowed down the balance sheet reduction plan. The FFR target range remains at [5.25%-5.5%]. The upper limit of balance sheet reduction is US$60 billion/month, of which the upper limit for government bonds is US$25 billion/month, and the upper limit for institutional bonds and MBS is US$35 billion/month.

The June economic forecast summary kept the GDP growth forecast unchanged, fine-tuned the unemployment rate forecast, and raised the PCE and core PCE forecasts for 2024 and 2025 by 0.2 and 0.1 percentage points.

The interest rate dot plot has moved up overall. The median interest rate in 2024 has been raised from 4.6% to 5.1%, which means that there may be only one interest rate cut this year. The long-term neutral interest rate expectation has risen from 2.6% to 2.8%, which means that the actual neutral interest rate has risen from 0.5% to 0.8%.

Comparing the consensus market expectations with the Fed’s rate cut guidance, we can see that the short-term “expectation gap” has been bridged, but the long-term gap has not yet been bridged. The former believes that the long-term neutral interest rate level may have risen to around 3.6%, and the corresponding actual neutral interest rate is 1.6%, which is 0.8 percentage points higher than the Fed’s expectations.

The probability of a rate cut in September has increased. The OIS implied federal funds rate has fallen by about 5BP on average compared to last week. The probability of a rate cut in September has risen by 10 points to 57% compared to last week. The market currently expects the Fed to cut interest rates twice this year, one more than in the May meeting.

The Nasdaq rose, the US Treasury yield fell, gold rose, and crude oil fell. Inflation in May boosted the market more than the meeting itself. As of the close, the Nasdaq rose 1.5%, the S&P 500 rose 0.9%, the Dow fell 0.1%, the US dollar index fell 0.5% to 104.7, and the 10Y US Treasury yield fell 9BP to 4.3%. Gold rose 0.3% to $2,322, mainly after the release of inflation data, and the decline widened after the interest rate meeting. WTI crude oil futures fell 0.3% to $78.3 due to the unexpected increase in inventories.

Viewpoint reiterated: Since the beginning of the year, the market has been worried about the risk of the US inflation stickiness exceeding expectations and the Fed's second rate hike. At present, the market is no longer discussing this possibility. In our report "The Inverted Logical Relationship" on January 7, we pointed out that the Fed may have reversed the cause and effect relationship because of the fear of re-inflation and believed that the Fed does not have the conditions to cut interest rates... The specific timeline is: disinflation-Fed rate cut-economic recovery-re-inflation-Fed's second rate hike... The risk of re-inflation affects the space for rate cuts, not whether there will be a rate cut.

Our baseline assumption is that the first rate cut will be before September, and there will be 1-2 rate cuts throughout the year, but they are likely to be "hawkish rate cuts." Therefore, "rate cut trades" mainly appear before rate cuts, not after them.

05

Research Reports

@Jack Inabinet: Is buying crypto stock HOOD a good choice?

Robinhood doubles down on crypto as it announces $200 million acquisition of Bitstamp. Should you buy COIN or HOOD stock?

1. COIN Case

Coinbase is often considered the most reputable cryptocurrency exchange, a distinction that has enabled it to develop deep connections with U.S. retail and institutional cryptocurrency enthusiasts over its 12-year history.

Centralized cryptocurrency exchanges typically provide limited financial information; however, as a listed company on a U.S. stock exchange, Coinbase must undergo rigorous audits and submit corresponding reports to the SEC, thereby reducing the possibility of customer funds being misappropriated.

While the most familiar function of any exchange is the trading feature, Coinbase is more than just a simple marketplace; the company was a pioneer in building CEXs on-chain and played a major role in infrastructure development, launching its own wallet and Ethereum L2 Base!

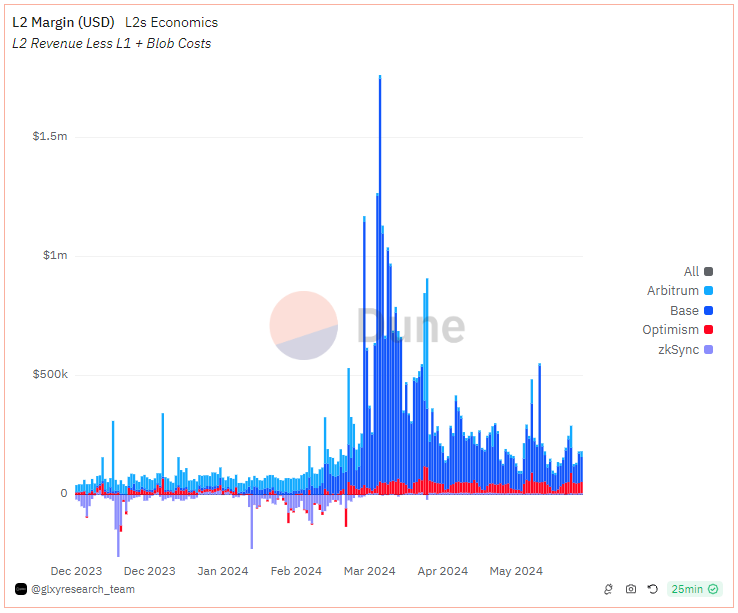

Thanks to the implementation of EIP-4844 in Ethereum’s March Dencun upgrade, the L2 cost of publishing data has been drastically cut, increasing Base’s on-chain operating margin to almost 100%, allowing almost every penny of transaction fees paid on Base to be directly remitted to Coinbase’s coffers.

While base revenue has dropped significantly from the peak of congestion in late March, the network is the second-largest L2 by TVL and generates more profit than any other major L2, according to L2BEAT calculations, with net profits regularly exceeding $100,000 per day.

In addition to on-chain infrastructure, Coinbase also provides users with comprehensive custody tools, providing white glove staking services in addition to institutional-grade custody solutions – as well as ETH liquid staking tokens.

Coinbase Custody is widely recognized as the preeminent digital asset custody provider and serves eight of the 11 U.S. spot BTC ETFs, including Grayscale’s GBTC and BlackRock’s IBIT (the two largest such products in terms of assets under management). This arrangement enables Coinbase to earn custody fees on the assets it manages, as well as trading fees on creation and redemption, which will provide a strong revenue driver for the company if spot crypto ETFs continue to gain traction among traditional market participants.

Crypto payments have yet to achieve mainstream adoption, but the Coinbase team has developed the infrastructure needed to make this happen through its Merchant Platform, which enables merchants to accept hundreds of crypto assets as payment for goods and services directly into their self-insured crypto wallets.

Further public willingness to hold crypto assets and recognition of the benefits of self-custody technology will benefit Coinbase in generating revenue from the platform.

Coinbase also caters to international users who are not bound by U.S. financial regulation, and they can access futures on various crypto assets through the exchange; if the crypto industry gains positive regulatory clarity, these services could easily expand to the U.S. platform – which currently only offers BTC and ETH futures.

As an added side benefit, holders of COIN shares can receive a small upside from the success of the Coinbase Ventures portfolio, which contains many lucrative private market opportunities that are unavailable to retail and outside investors.

2. HOOD Case

Although Coinbase is ahead of Robinhood in terms of the volume of crypto transactions it processes, Robinhood remains the undisputed champion for U.S. retail traders.

Despite hosting fewer assets on Robinhood’s platform than Coinbase (even when the former’s stock, options, cash, and cryptocurrency balances are added together), it had 70% more monthly active users than Coinbase in the first quarter of 2024, highlighting the exchange’s popularity among retail traders.

Admittedly, Robinhood’s biggest advantage is regulatory compliance; the exchange is regulated by the U.S. Securities and Exchange Commission (SEC) as a broker-dealer, and if a new classification of digital asset securities falls within the agency’s purview and their trading is restricted to registered brokers, then Robinhood is well positioned to become the dominant cryptocurrency exchange.

While Coinbase is clearly the more crypto-native company and has attracted a well-connected talent pool in the industry, there’s nothing stopping Robinhood (other than regulatory uncertainty) from creating its own crypto app.

Robinhood has developed its own proprietary non-custodial wallet solution and recently launched an integration that allows users to purchase crypto directly from the Uniswap mobile app using funds from their Robinhood Connect account!

With its proposed acquisition of Bitstamp (which may still be rejected by regulators), Robinhood acknowledged the growth potential of its crypto business despite its ongoing legal dispute with the U.S. Securities and Exchange Commission (SEC) over crypto, and confirmed that it will do its best to participate in blockchain technology.

Bitstamp’s 4 million active users are primarily based in Europe — a highly desirable demographic for a U.S.-centric buyer — and the acquisition includes moving Bitstamp’s core products for staking and lending, allowing Robinhood to better compete with crypto CEXs’ service offerings and highlighting that it can simply buy crypto technology developed by others to catch up to crypto-native competitors.