This week, the three major macroeconomic data of the United States were released, which were generally favorable to the expectation of interest rate cuts. However, after the release of CPI data, Bitcoin only benefited for a short time, breaking through 70,000 at one point, and then went down all the way.

Compared with other markets, Bitcoin's performance is not surprising. In the U.S. stock market, except for the three AI giants Nvidia, Microsoft and Apple, which continued to rise strongly, other heavyweight stocks performed mediocrely. Data shows that although the S&P index hit four consecutive record highs last week, the equal-weighted S&P has not changed in the past four months.

There are currently three major factors that are still unfavorable to Bitcoin: the strong US dollar in terms of currency attributes, the net outflow of Bitcoin spot ETFs for as many as four days last week, and the continued weakness of on-chain data.

01

Industry and Macro

On June 12, the United States announced that CPI in May increased by 3.3% year-on-year, a slight decrease from the previous value and expected value of 3.4%; CPI in May increased by 0% month-on-month, 0.1% lower than expected, and also slowed significantly from the previous value, reaching the lowest level since July 2022.

On the 13th, the US PPI in May was -0.2% month-on-month, the largest month-on-month drop since October 2023, lower than the expected 0.1% and significantly lower than 0.5% in April.

On the 14th, the preliminary value of the University of Michigan Consumer Confidence Index in June was 65.6, significantly lower than the expected 72. The previous value in May was 69.1.

Based on these latest data, major Wall Street analysis agencies believe that the Federal Reserve is likely to cut interest rates for the first time in September. Although the Federal Reserve's press conference on the 12th was still tough, Powell admitted that he had not yet taken into account the latest data.

However, these macro benefits are only reflected in the three AI giants. Financial blog Zerohedge commented: "It seems that the only important ones now are the top three technology companies - Apple, Microsoft and Nvidia - whose market capitalizations are almost the same, all around $3.2 trillion... In fact, nothing is more important than these three companies now."

As far as industry news is concerned, the most important thing last week was that the chairman of the US SEC confirmed that the approval of the ETH spot ETF will be completed before the end of summer. When this major positive news will be realized in the market, we still have to wait for the achievement of macro consensus and the influx of funds.

02

On-chain data

According to coinglass data, Bitcoin ETF funds continue to experience net outflows. From the trend point of view, the scale of fund outflows is still relatively strong, and short positions are expected to remain relatively strong.

According to glassnode data, transaction fees on the Bitcoin chain continue to decline, which indicates that activity on the Bitcoin chain has weakened and there are signs of capital outflow.

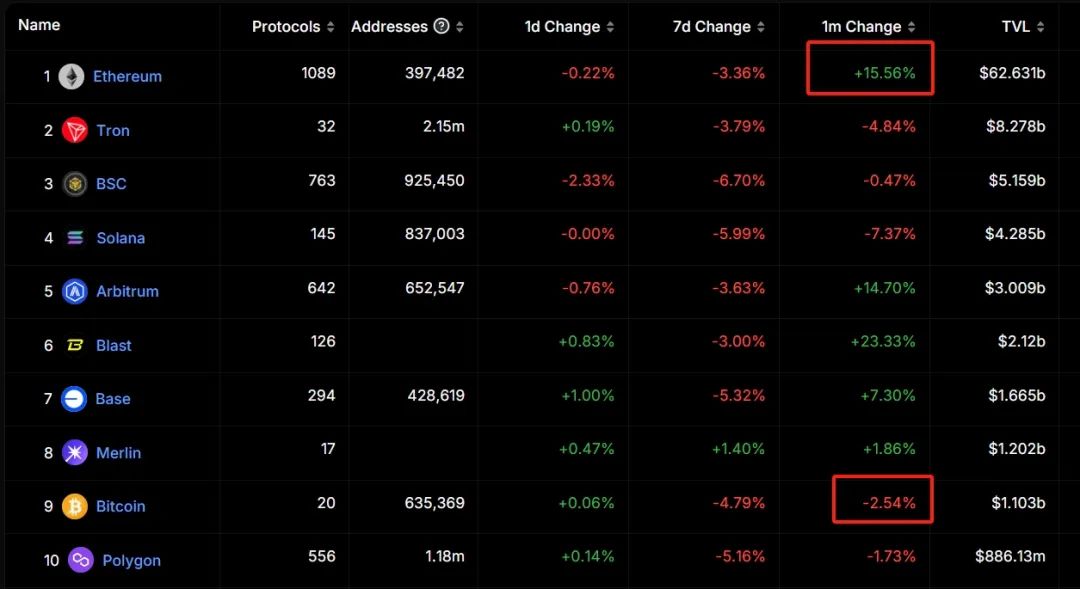

According to Deflama data, the net capital inflow into the Bitcoin ecosystem in the past month was -2.54%. In comparison, the capital inflow into the Ethereum ecosystem was 15.56%. Overall, the Bitcoin ecosystem still maintained a net outflow of funds.

Overall, Bitcoin ETF funds continue to have a net outflow, and institutional investors have sold off to a certain extent; judging from the on-chain data, Bitcoin on-chain transactions are weak, and there are signs of certain capital outflows at present. BTC is expected to remain weak in the future.

03

technical analysis

The past two weeks have been two weeks of intensive disclosure of macro data, and the fluctuations in the market also reflect changes in market expectations. There will be no more important data before July, so the market may maintain its current state of volatile downward movement in the short term. From the perspective of performance, BTC continues to test the price support area (red box area) after the release of the previous May CPI data. A rebound to the blue line area may trigger another decline. However, from the spot perspective, since the optimistic expectations for BTC in the long term have not changed, and the current mining shutdown price is generally around 60,000, the decline has also become an opportunity to accumulate chips at the bottom.