Without a big increase in liquidity, only some markets benefit. This is very obvious in the risk market, where only a few technology stocks in the U.S. stock market continue to grow. Other risk assets such as Bitcoin generally stagnate.

Under such external environment, the internal supply of Bitcoin has reached a tight balance with insufficient demand due to high profits. In other words, there is no large inflow of external funds, but the internal supply of the market is relatively sufficient. In this case, it is difficult to break through the market. This is also a common phenomenon after breaking through the previous high in the bull market.

Investors have two choices, either to remain patient or to prefer range trading for short-term profit. Short-term trading suggestions focus on the pressure within the 65,000-67,000 box.

01

Industry and Macro

On June 18, the U.S. Department of Commerce released retail sales data for May. The data showed that U.S. retail sales in May increased by 0.1% month-on-month, lower than the market expectation of 0.3%, and the previous value was revised down from 0% to -0.2%. Although the data is not important enough, it is also conducive to the promotion of interest rate cut expectations. The latest statement from Fed officials is to cut interest rates at the end of the year. Neel Kashkari, president of the Minneapolis Fed, said, "Bank of America predicts that the Fed will cut interest rates once this year, but it will not cut interest rates until December."

Within the industry, Glassnode's latest report reflects that the supply in the Bitcoin market is relatively sufficient, because 87% of the liquid supply is in a profitable state. Fortunately, long-term holders are not inclined to sell off, but are hesitant about prices and future expectations, and are trading in reduced volumes. Glassnode's on-chain data shows that long-term investors have only transferred less than 0.006% of their total holdings to exchanges.

In this tight balance, it is difficult to fall or rise. The market expects enough stimulus to break through the existing range of fluctuations.

02

On-chain data

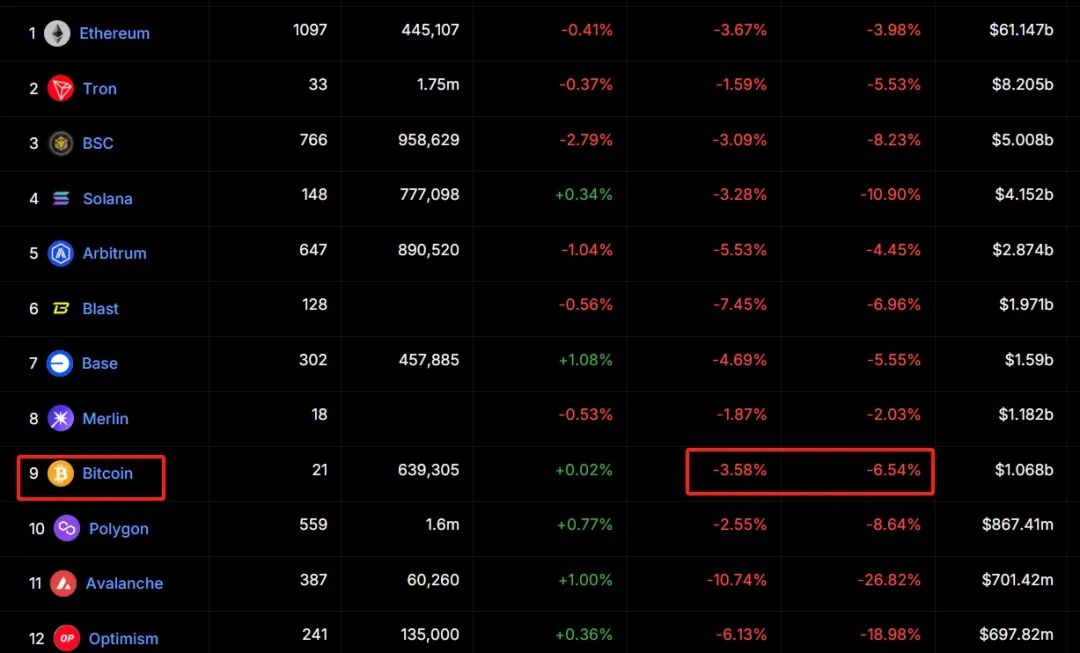

According to Deflama data, the capital inflow of Bitcoin in the past month was -6.54%, and the net capital inflow in the past week was -3.58%, which means that the funds on the Bitcoin chain as a whole maintained a net outflow state.

According to Coinglass data, Bitcoin ETF funds continue to show a net outflow state. However, judging from the outflow trend, there are signs of a certain slowdown in the outflow of Bitcoin funds.

Overall, funds on the Bitcoin chain are showing a net outflow, and institutions are also continuing to reduce their holdings; however, the trend of institutional outflows has slowed down, and it is expected that the selling pressure from above will remain heavy in the future, and the short positions will be relatively strong.

03

technical analysis

In the past week, BTC continued its volatile downward trend. Unless there is a sudden positive news in the industry or fundamentals, the price is unlikely to reverse in a big direction, but will only maintain a weak volatile pattern. From the perspective of support, the left box is the area that needs to be focused on. If it falls below, it will further prove the weakness of the price and deepen the short trend; and the upper 65,000-67,000 box is the pressure range in the short term. It is necessary to pay attention to the performance of the price rebounding to this range. If there is a weak breakthrough, it may continue to rebound at the H1 level.