Author: fangjun, Developer DAO Source: @fjun99

Ethereum seems to be actively building, and the new upgrade plan includes many innovations (but nothing as exciting as blink), and Ethereum also has many powerful Layer 2s. However, it is true that Ethereum's Gas is at 1 Gwei. What is wrong with Ethereum?

What went wrong with Ethereum?

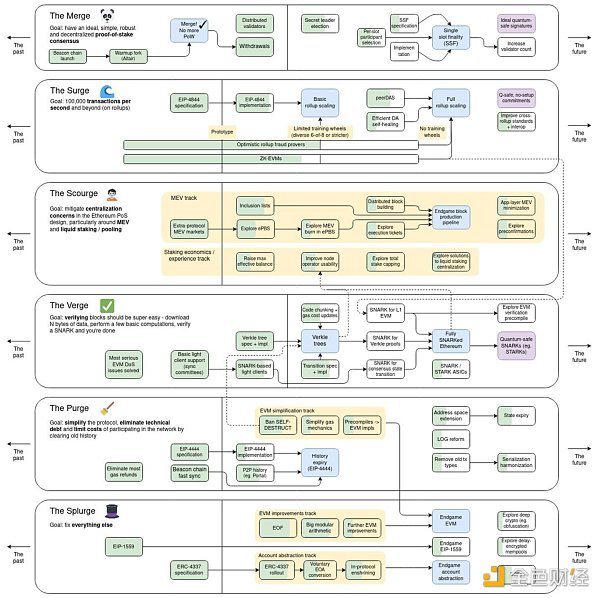

Ethereum is fine as a whole. It is the most powerful smart contract platform, the most decentralized, and has the most prosperous ecosystem, whether it is EVM applications or second-layer chains. There is no problem with the technical route. The roadmap updated by Vitalik on the last day of 2023 is still valid, guiding the development of Ethereum in the next three to five years.

Vitalik also published a lot of articles this year, each of which is very important.

Is Ethereum’s problem a lack of memes?

I don’t think so. Solana’s celebrity meme craze makes it a bit like Las Vegas. Ethereum has always been like Wall Street, and it’s not a reasonable choice to turn Wall Street’s buildings into Las Vegas. At most, we can build an Atlantic City somewhere close.

What is the problem with Ethereum?

First of all, we have been solving technical problems, but what exactly are these technical problems for?

For example, in Vitalik’s discussion today, the final settlement speed is of course important.

Ethereum is now too much like the famous Xerox Research Institute PARC, where Jobs "stole" a lot of things. The vision should have been to create a usable product, like Apple and Microsoft.

The problem with Ethereum is, as Twitter user Emmanuel Awosika has been saying lately, it's a lack of marketing . In my opinion, it's not a lack of marketing, it's a lack of basic vision and positioning. There are no answers to these questions: Vision: What is Ethereum? What product does Ethereum offer? What is the next product of Ethereum? Ethereum is now like Bell Labs. Do you know what it is called now? - Nokia Bell Labs.

Will the rise of ETH and the approval of the ETF solve Ethereum’s problems?

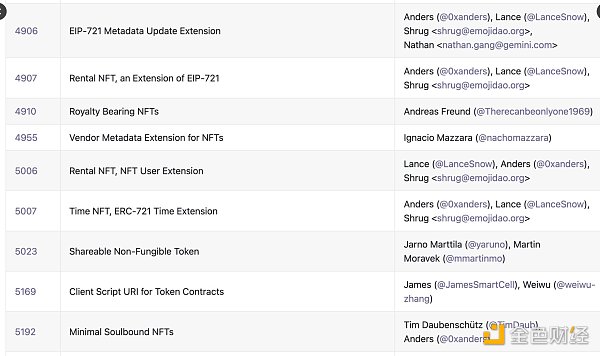

No. Ethereum had a major "speculation" in the last round, which was through a large number of NFTs. Does it seem a bit ridiculous now? Why did so many suddenly appear at that time? Of course, there were also excellent non-NFTs at that time, such as Vault 4626 and AA 4337.

Source: https://github.com/ethereum/EIPs/tree/master/EIPS

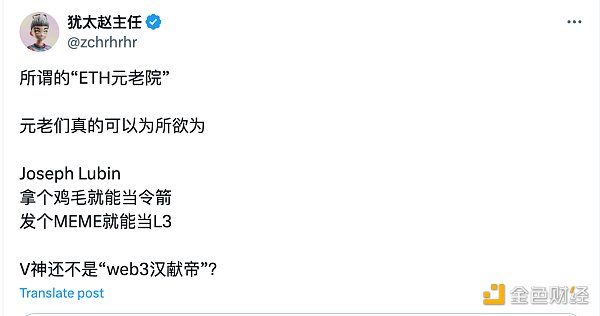

Ethereum L2 is currently in a very unhealthy state. We can certainly say that a hundred flowers bloom, but let’s look at it from another perspective. Twitter user Jewish Zhao (@zchrhrhr) made a particularly good analogy (of course only Chinese people understand it): “V God is Web3 Han Xiandi”, the one who Cao Cao used the emperor to control the princes, and was also known as the “Xiao Min Emperor” in history.”

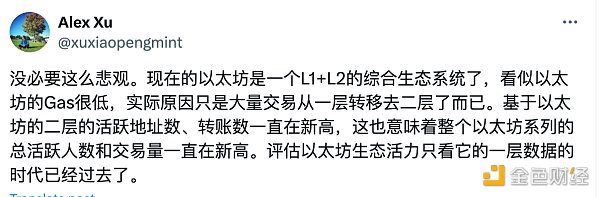

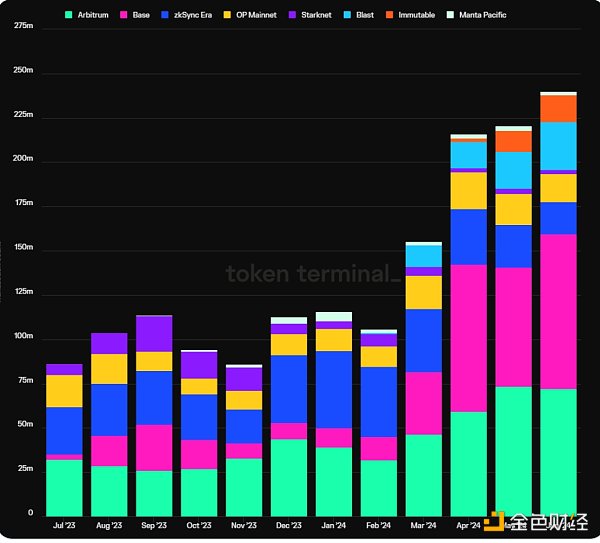

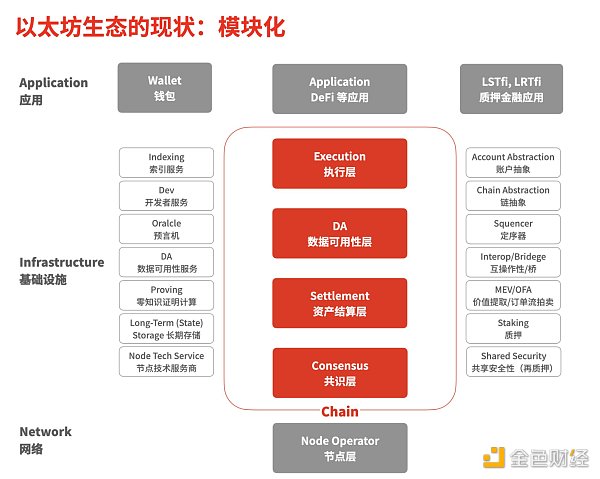

Some people say that Ethereum’s gas is low because all transactions are run on L2, and L2’s transaction volume is huge. This is actually saying that the Eastern Han Dynasty is still here. Okay, no more analogies, even if L2 is right. But at present, as an ecosystem, isn’t Ethereum’s problem “fragmentation”? The high degree of asset fragmentation was already very serious when there were not many L2s in the last round.

Isn’t the high degree of asset fragmentation the core problem of Ethereum as an ecosystem? But can this problem be solved by Polygon AggLayer, OP Superchain, cross-chain bridges/various interoperability services? Obviously not, but this issue seems to have never been considered carefully by the Ethereum Foundation. Of course, Vitalik did discuss it.

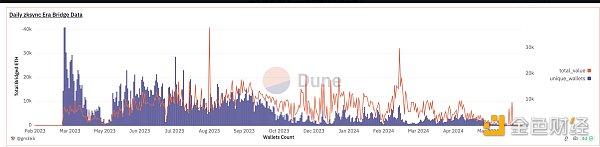

A few days ago, I saw something really funny. The founder of a ZK Rollup said, "Don't be sad, Blast. Come to our place to do tasks and help us increase TVL." The subtext is, I will definitely not call you "electronic beggars" this time. But, isn't this funny? The TVL of Ethereum L2 is all such a bubble. What's the use? Look at the current usage of ZK Sync cross-chain bridge.

Then there is this great post by Twitter user @thecryptoskanda , especially the distinction he made between “mass adoption” and “mass admission”. My view is what was said earlier in this thread, that Ethereum’s dream is Wall Street, New York, and it can build an Atlantic City next to it, but it is unrealistic to directly transform the Wall Street building.

In the narrative of Ethereum, what is still attractive now is what Rubin said: Global Settlement Layer. This is why its Gas was worrying when it was 1 Gwei. If settlement disappears, can it still be the Global Settlement Layer?

If Ethereum is the global settlement layer, then what is Bitcoin Chain? The narrative of BTC is simpler. Before, it was about payment, etc. Now, it is about value storage. In the upcoming report "Modular Blockchain", I will use an analogy to say that the power of Ethereum L2 and BTC L2 is different, one is gasoline and the other is electricity. The power of Ethereum L2 is applications, and the power of BTC L2 is the asset BTC.

We just discussed: "We are not saying that Ethereum is dead, we are saying that Ethereum should work hard :)" From the perspective of infrastructure, no chain currently has the complete architecture of Ethereum.

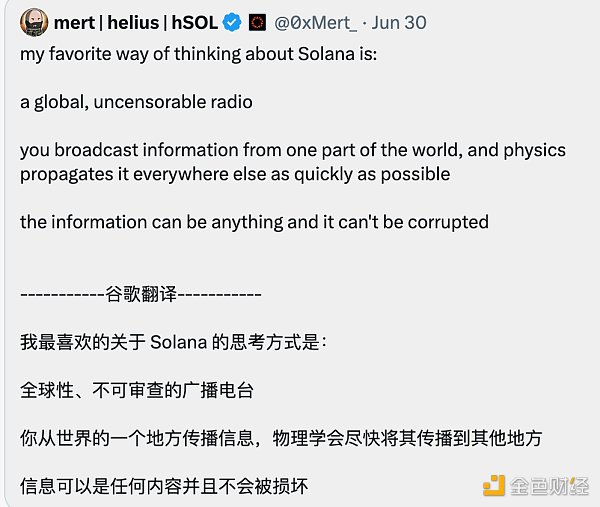

What is the Solana narrative? Mert just made an interesting point: a global, uncensorable broadcast, you broadcast information from one part of the world, and it will be spread to other places as quickly as possible. This seems to be a repetition of Web2.0, but it makes sense. Web3.0's dissemination will be credible. (No permission will be another feature)

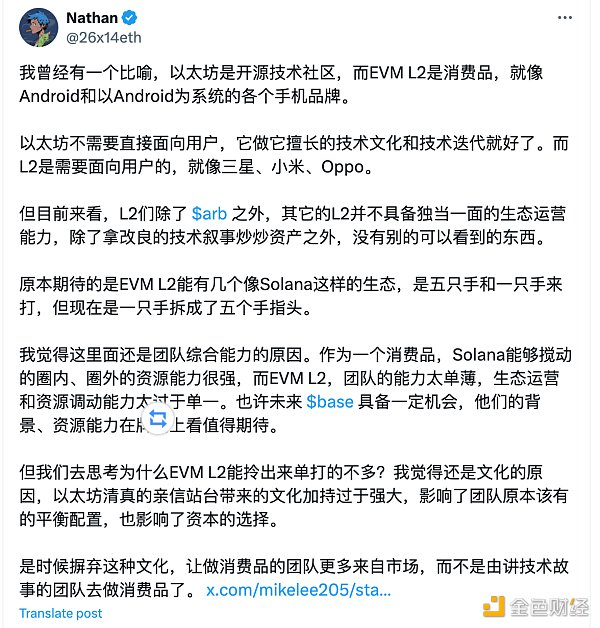

Nathan’s point of view is interesting: “Ethereum is an open source technology community, while EVM L2 is a consumer product, just like Android and various mobile phone brands based on Android.” It is an interesting perspective. But I don’t agree that Ethereum is just a technology community. Ethereum itself is a product, and the second layer is just a distributor. — Distributor of block space.

Is the Ethereum roadmap centered on Rollup still valid? In October 2020, Vatalik published a document confirming this roadmap, and it has been developed according to this roadmap so far. I think this roadmap is still valid, but there are several questions to be answered:

1. The liquidity fragmentation problem discussed above

2. Does Rollup have to be permanent? Altlayer’s temporary Rollup is good

I agree with these two questions:

1) Lack of large-scale applications - there are no new applications in this round

2) Unreasonable capital structure - VCs bet heavily on infrastructure.

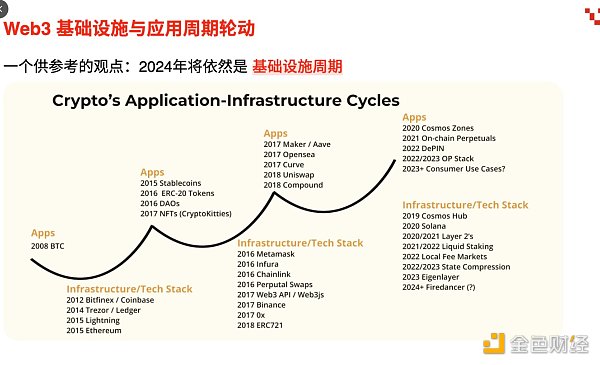

The problem with the Ethereum ecosystem itself is that, although a lot of infrastructure has been built, there is almost no preparation for the application cycle. According to the infrastructure/application rotation cycle, the application cycle will return soon. How should Ethereum respond?

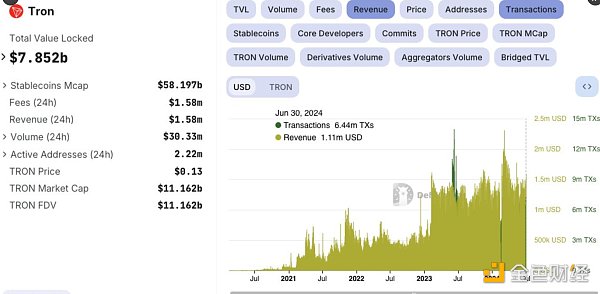

Recently, the USDT transfer rate of Ethereum has been lower than that of Tron. Tron is controversial, but it has done a great job in the transfer scenario. I remember that in the Messari annual report at the end of last year, the CEO of Messari praised Tron's stablecoin transfer. It is not a dream for Tron to earn 1 billion in annual protocol revenue.