By Peter Horton

Compiled by: TechFlow

Key Insights

Pump.fun, a gamified token issuance platform, collected a total of $48 million in fees in Q2. Raydium was the main beneficiary of pump.fun - its average daily trading volume increased by 77% month-on-month to $867 million, and its TVL (total value locked) increased by 46% month-on-month to $991 million.

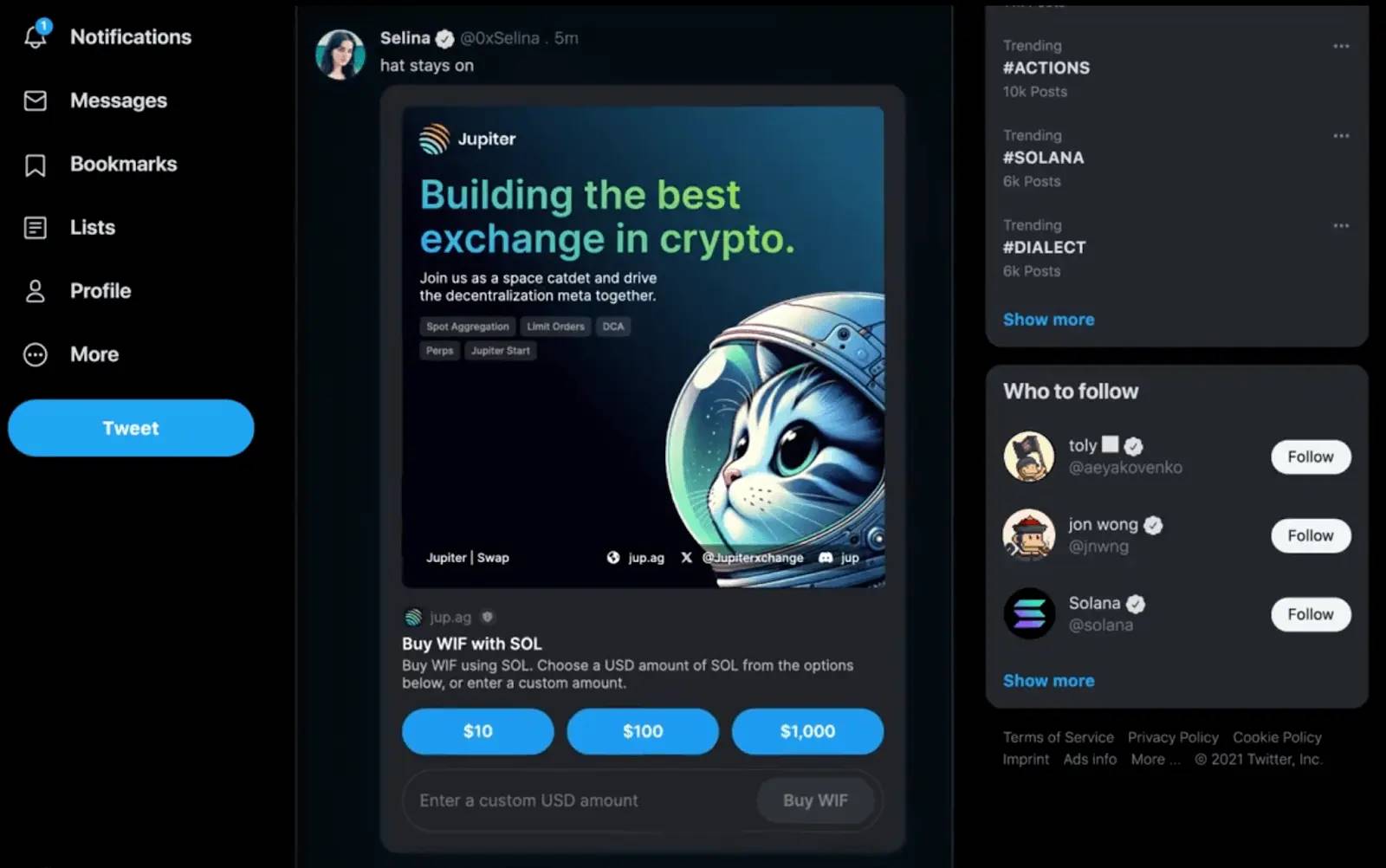

Dialect and the Solana Foundation have launched Solana Actions and Blockchain Links (Blinks), enabling users to preview and execute transactions directly in a variety of digital environments, starting with X (formerly Twitter).

Institutional builders continue to choose Solana for payment use cases. PayPal expanded PYUSD to Solana, leveraging the token to extend features like confidential transfers, and Stripe announced it will support payments on Solana.

Several Solana ecosystem teams launched scaling solutions that enable users to stay on L1, including Light Protocol and Helius’ ZK compression and MagicBlock’s MagicBlock Engine.

Spam caused by memecoin activity and Ore mining led to network congestion in early Q2. This was mitigated by the Agave update which leverages stake-weighted Quality of Service (QoS) and introduced new structural requirements for SOL.

Primer

Solana ( SOL ) is an integrated open source blockchain with the goal of synchronizing global information at the speed of light. Solana optimizes latency and throughput, sacrificing some verifiability. It achieves this goal through its novel timestamping mechanism (called Proof-of-History (PoH)), block propagation protocol Turbine , and parallel transaction processing. Since the mainnet launch in March 2020, several network upgrades have further improved network performance and resilience, including QUIC , stake-weighted quality of service (QoS), and local fee markets .

The development and growth of the network and ecosystem is supported by the non-profit Solana Foundation , Solana Labs , and many third-party organizations including Anza , Colosseum , Helius , and Superteam . Solana Labs has raised over $335 million through private and public token sales. The Solana ecosystem has growing projects in many areas including DeFi, consumption, DePIN, and payments.

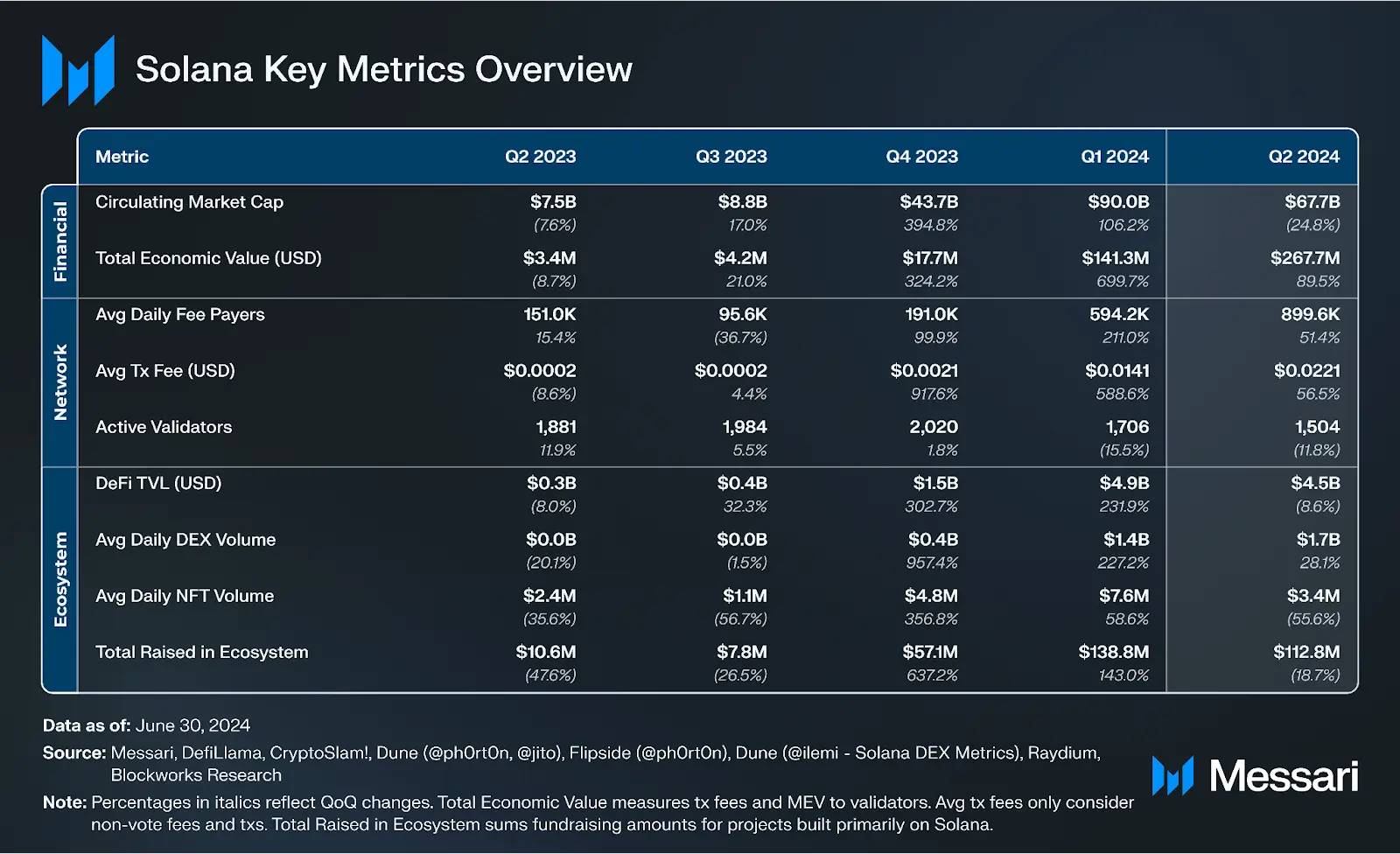

Key indicators

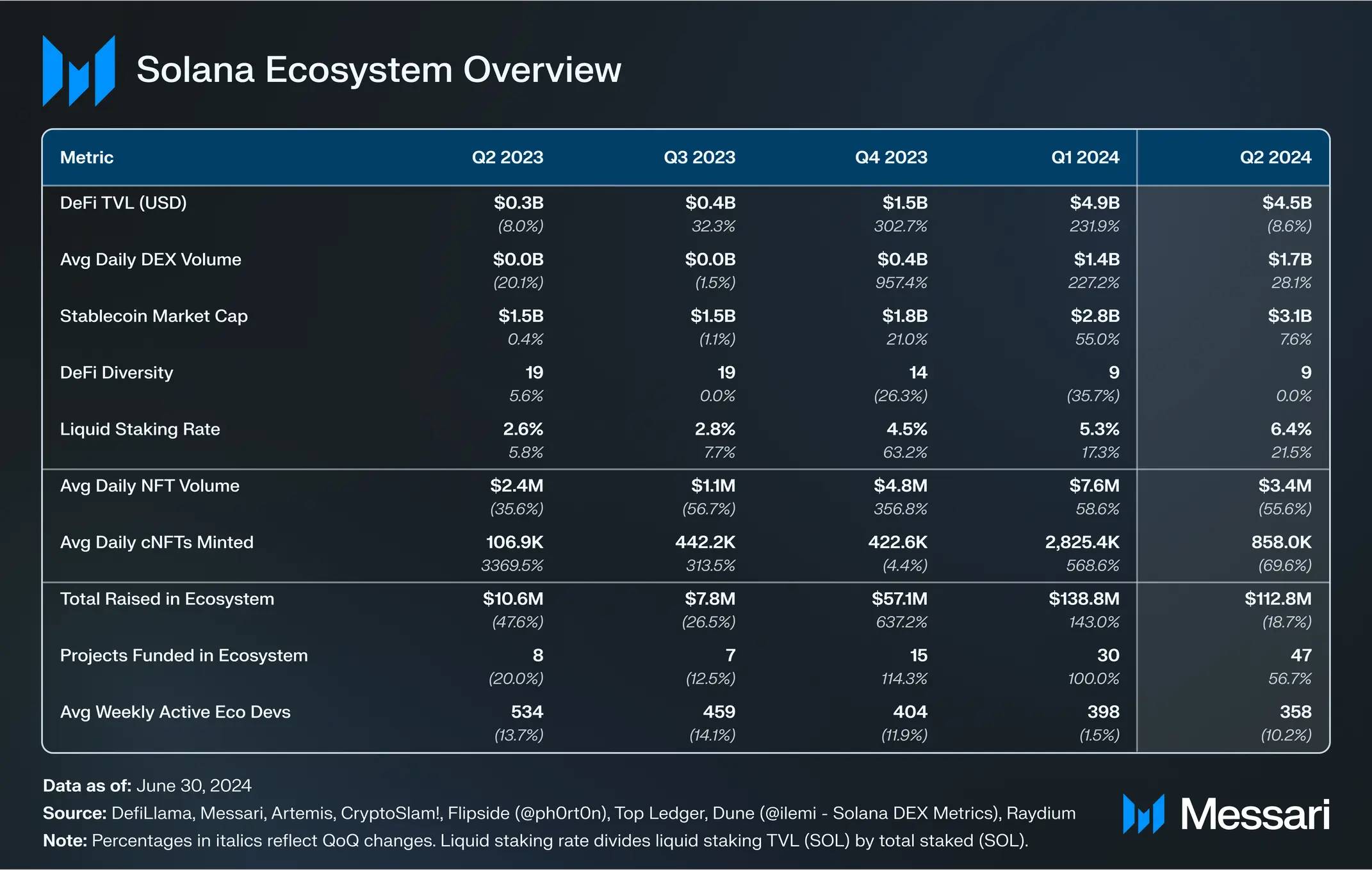

Ecosystem Analysis

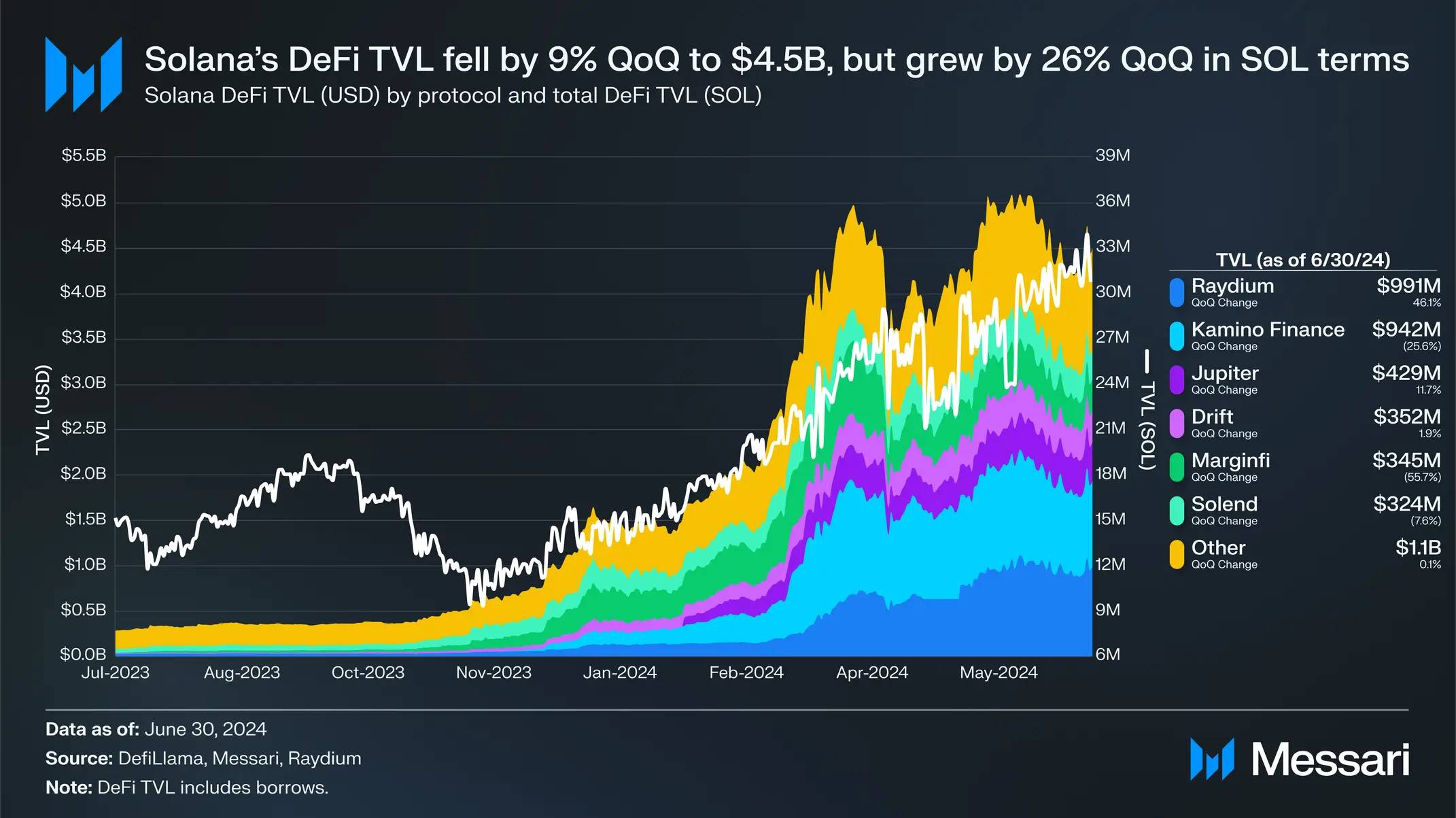

DeFi

Solana’s DeFi TVL fell 9% month-over-month to $4.5 billion, ranking fourth among the networks. However, DeFi TVL denominated in SOL grew 26% month-over-month, suggesting that the decline in USD terms may be driven more by token price depreciation than capital outflows.

Borrowing

Kamino Lend’s TVL fell 26% month-over-month to $942 million. The drop came after strong growth in March, when a future points snapshot was announced. Kamino launched its token on April 30, airdropping 7.5% of the total supply. KMNO had a market cap of $33 million at quarter end with a circulating supply of 10%. In Q2, Kamino also added support for token scaling , enabling borrowers to repay debt with collateral assets , and launched a notification feature powered by Dialect.

After significant growth in the second half of 2023, MarginFi’s lending protocol lost TVL market share in the first half of 2024. Its TVL fell 56% month-on-month to $341 million, mainly due to more than $200 million in withdrawals in 24 hours in April. The outflow was in response to the Twitter storm and the resignation of MarginFi leader Edgar Pavlovsky, who cited internal disputes. MarginFi’s points program has been running for more than a year, and some users were unhappy with the lack of token issuance. Despite this, MarginFi successfully processed all withdrawals during the turmoil and saw some deposits return later. In Q2, MarginFi also introduced its liquidity layer and improved its onboarding experience .

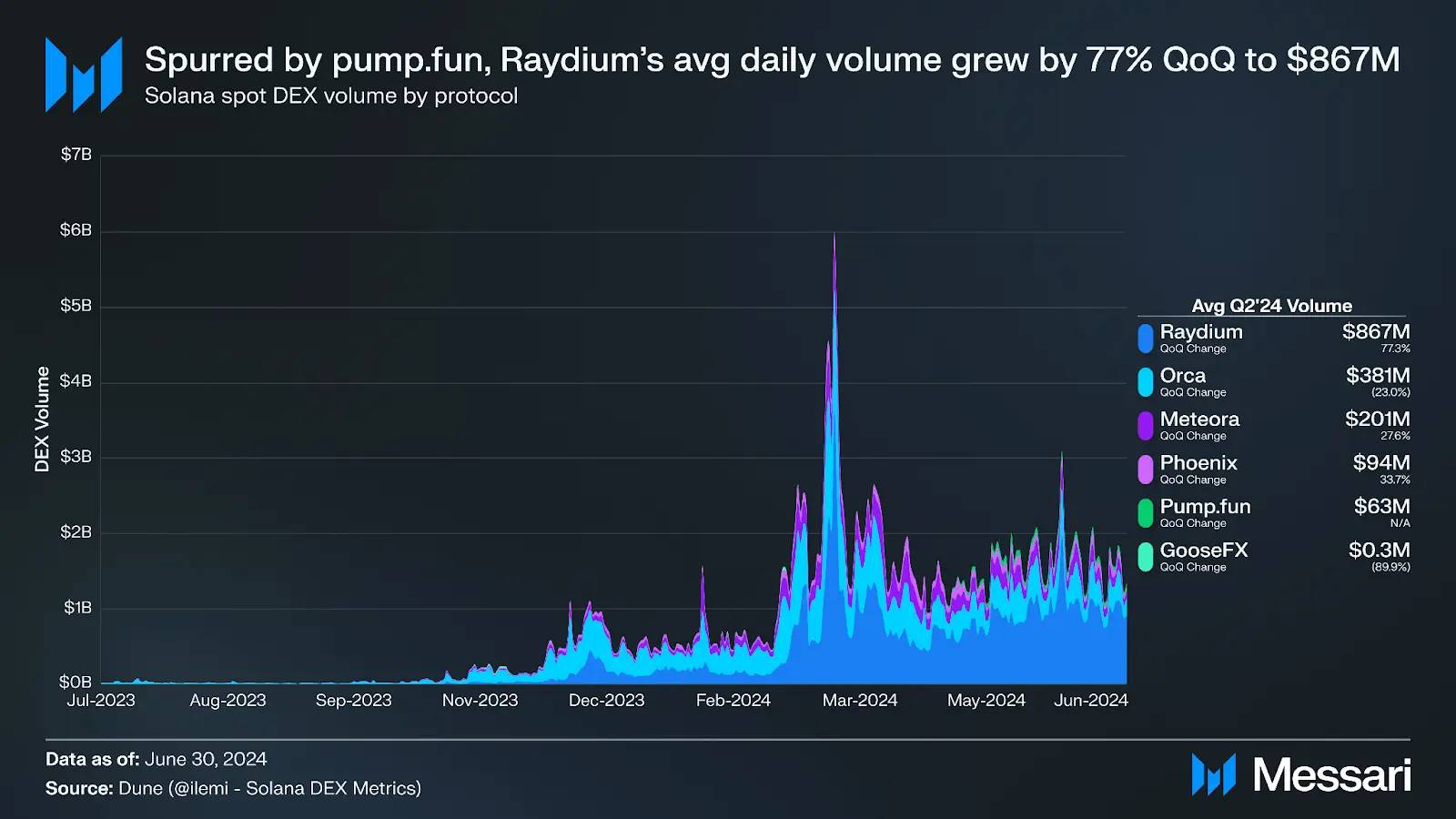

DEXs

DEX volumes declined slightly from peak activity in March but remain at elevated levels. Average daily spot DEX volume increased 32% month-over-month to $1.6 billion. DEX activity continues to be driven by memecoin trading, with WIF, MEW, POPCAT, and GME among the top ten tokens by token pair volume in Q2.

In Q2, memecoin meta-transactions shifted to pump.fun, a gamified token issuance platform that became one of the most widely discussed applications in crypto. It collected an average of $525,000 in fees per day in Q2. In late May, several celebrities began launching their own tokens on pump.fun, sparking a celebrity memecoin frenzy and some controversy . The popularity of Pump.fun spawned forked projects such as Dexscreener’s Moonshot , Whales Market’s whales.meme , and Meme Royale .

Raydium is the main beneficiary of pump.fun, as all liquidity obtained from pump.fun's bonding curve will be transferred to Raydium after the token reaches the market value threshold. Raydium's average daily trading volume increased by 77% month-on-month to US$867 million, and its market share increased from 40% in the first quarter to 54%. Its DeFi TVL also increased by 46% month-on-month to US$991 million, becoming the DeFi protocol with the highest TVL on Solana. In the second quarter, Raydium also released its V3 user interface and launched a new constant product AMM program.

Jupiter remains Solana’s primary source of trading , accounting for 51% of spot DEX volume in Q2. However, its market share declined throughout the quarter, falling to 37% in the final week, surpassed by Raydium’s 38% market share. Notable updates to Jupiter this quarter include:

Metropolis: At the end of June, Jupiter announced Metropolis, its V3 exchange protocol upgrade. New features include instant routing support for new tokens on Raydium, Meteora, and Orca; dynamic slippage settings; improved token search capabilities; new token list tabs; and simplified user experience warnings.

Token Economics Update Proposal: Jupiter founder meow shared a proposal to reduce the total supply of JUP by 30%, with the team supply and future airdrops each reduced by 30%.

GUM: At the end of May, Jupiter announced its Giant Unified Market (GUM) initiative to work with RWA token issuers, market makers, and investors to bring more types of assets to the chain.

Ultimate Acquisition: In late April, Jupiter acquired mobile wallet Ultimate and its team to support its planned Jupiter Mobile app.

The average daily trading volume of Jupiter perpetual contracts was $370 million, a 13% increase from the previous month. Other major perpetual contract exchanges include:

Drift: Drift’s daily perpetual contract volume fell 11% month-over-month to $127 million. In mid-May, the Drift Foundation released the DRIFT token, airdropping 12% of its total supply. The token governs the Drift DAO , which consists of an elected security committee and the Realms DAO that manages general protocol development, and a Futarchy DAO that distributes grants. DRIFT had a market cap of $76 million at the end of the quarter, with about 17% of tokens in circulation.

Zeta: Zeta’s daily average perpetual contract volume increased 212% month-over-month to $82 million. In mid-May, it announced a $5 million funding round led by Electric Capital and plans to build a dedicated rollup on Solana. At the end of the quarter, Zeta launched its token and airdropped 10% of its total supply. ZEX had a market cap of $18 million at the end of the quarter, with about 16% of tokens in circulation.

FlashTrade: After launching fully last quarter, FlashTrade gained traction at the end of the second quarter, with average daily trading volumes of $104 million in March.

Stablecoins

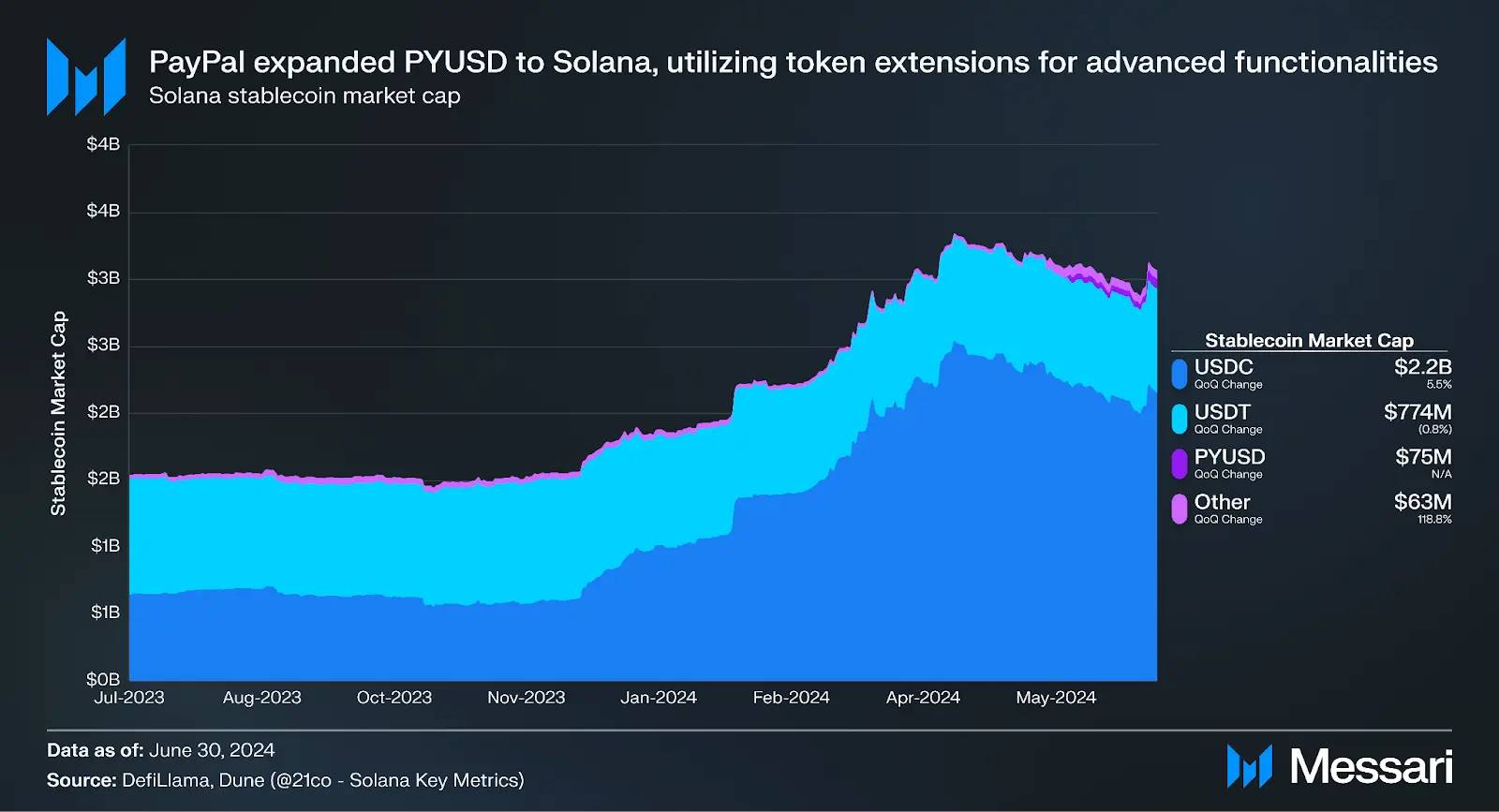

Solana’s stablecoin market capitalization grew 8% quarter-over-quarter in Q2 to $3.1 billion, ranking sixth among all blockchain networks.

At the end of May, PayPal expanded its stablecoin PayPal USD (PYUSD) to Solana, making it the second supported network after Ethereum. The stablecoin is issued by Paxos and approved by the New York State Department of Financial Services. In addition to low transaction costs and high throughput, PayPal also pointed out that the token expansion function is a key reason for its choice to deploy on Solana.

PYUSD has several extended features, especially confidential transfers. This feature keeps the transfer amount hidden from everyone except the transfer source, destination, and optional third-party auditors. Confidential transfers are not yet enabled on Solana because they require further system calls to activate . PayPal also highlighted memo fields and transfer hooks, which allow developers to add programmable logic to transfers.

At the end of the quarter, PYUSD had a circulating market value of $75 million on Solana, but the distribution was relatively concentrated. Although the token has been officially launched, it is still waiting for more integrations to promote wider adoption. There are already centralized exchanges working to integrate token extension functions to support PYUSD. Shortly after the end of the quarter, several Solana dApps including Jupiter and Kamino (and an incentive campaign ) have access to PYUSD.

Despite these developments, USDC remains the dominant stablecoin on Solana, with its Solana market cap up 5.5% month-over-month to $2.2 billion. Circle expanded its Web3 services to Solana in June, bringing its programmable wallet and Gas Station capabilities. These APIs enable developers to embed secure multi-chain wallets into their applications and pay transaction fees on behalf of users. The rollout will be phased in, with future releases supporting NFT transfers and programmatic interactions.

Other notable DeFi-related events include:

RWA: Parcl’s token launch , BAXUS’ $5 million round , AgriDex’s $5 million round , etherfuse’s MXNe launch , MetaWealth’s Solana migration , elmnt’s tokenized commodity introduction , Drift and Ondo’s partnership , Bridgesplit’s closed beta launch , VNX and Sygnum Bank’s partnership , and Velo and Solana Foundation’s partnership .

Bitcoin related: Zeus Network’s $8 million financing and token issuance , Wormhole’s WBTC issuance , 21BTC issuance , and Zeus Network’s APOLLO alpha testnet launch .

Restaking: Picasso’s restaking announcement , Composable’s Mantis introduction , and Solayer’s restaking introduction .

Others: Ellipsis Labs’ $20 million funding round , DFlow’s beta release , C3’s launch , Adrena’s perpetual contract introduction , Ranger Finance’s perpetual contract aggregator introduction , Photon’s limit order launch and incentives , Lifinity Sandglass launch , Bullpen’s Telegram bot launch , RugCheck Token Verification launch , Prism V4 launch , and Coinhall’s Solana integration .

Liquidity Staking

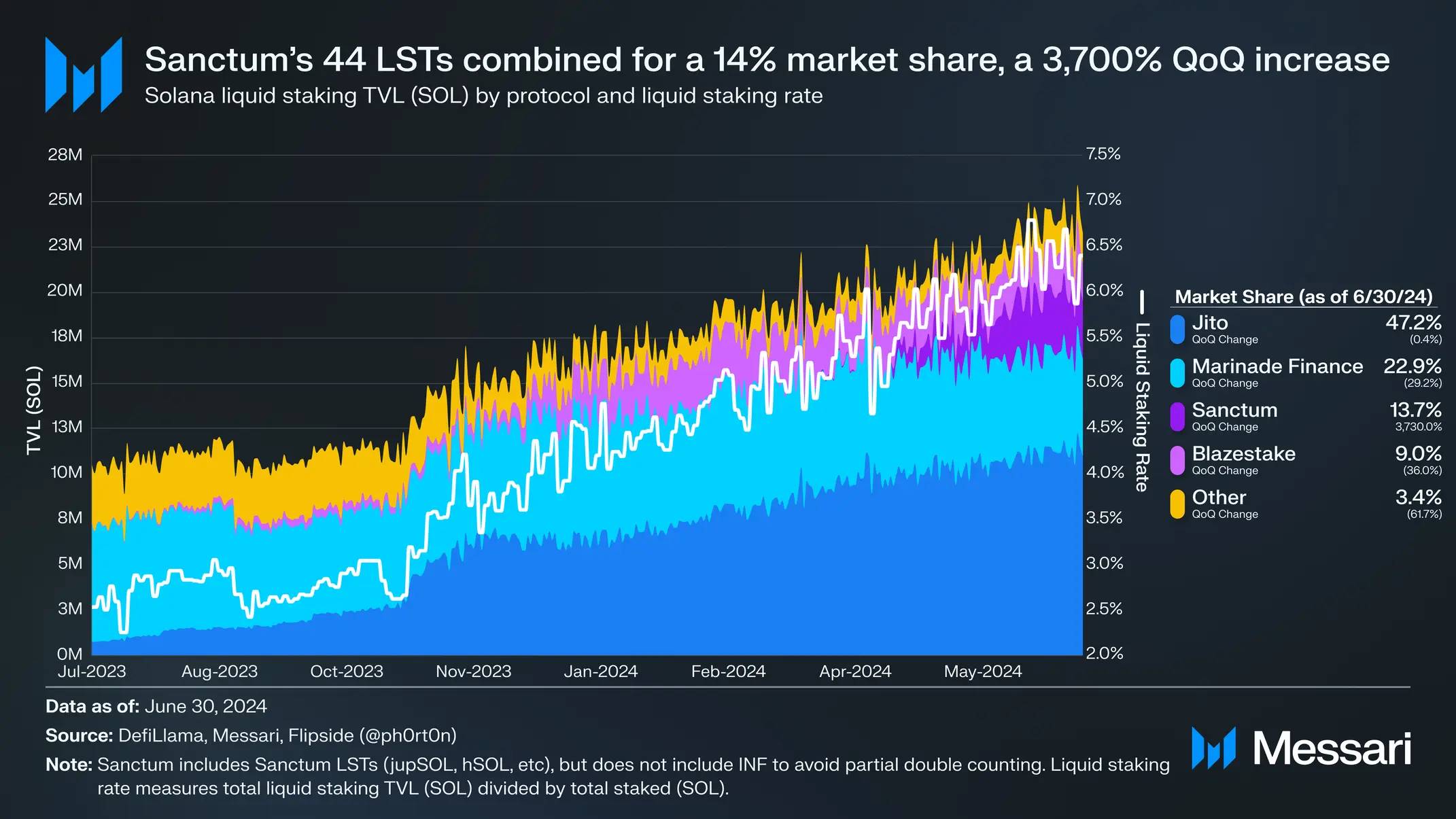

Solana’s Liquid Staking Rate (the percentage of liquid staked SOL as a percentage of total staked) increased 22% quarter-over-quarter to 6.4% in Q2. With 65% of eligible SOL supply staked, the Liquid Staking Rate needs to continue to grow to support a yield-based SOL ecosystem.

Since its launch last quarter, Sanctum has rapidly gained market adoption, with Sanctum LSTs accounting for nearly 14% of Solana LST market share, up 3,700% month-over-month. Its adoption has been accelerated by multiple market structural changes, particularly Stake-Weighted Quality of Service (SWQoS). To alleviate network congestion issues in April, the Solana network upgrade further leveraged SWQoS. SWQoS incentivizes applications and infrastructure providers to run validators and accumulate stake to provide a better user experience for their users.

As a result, several projects launched their own validators, including Jupiter, Drift, DRiP, and Helius. Like the others, these four projects also launched single validator LSTs to improve distribution and provide unique benefits. For example, DRiP distributes free Droplets to hausSOL holders, and dSOL can be used as collateral on Drift.

Solana does not currently support validators returning block rewards (base and priority transaction fees) to delegators. This native functionality only applies to inflation rewards. Historically, this has not been a big deal as fees typically only accounted for 1% of total validator rewards (excluding MEV). But since late March, this has risen to 5-10%, prompting validators to reallocate fees to compete on Annual Percentage Yield (APY). To this end, many validators have chosen to use the single-validator LST because its fee reallocation mechanism is simpler.

LSTs are also trying different ways to distribute staking rewards. For example, Cubik’s iceSOL distributes all staking rewards to public goods funding, while wifSOL DCA all staking rewards to WIF and distributes WIF back to delegators.

In total, Sanctum has 44 LSTs , with over 20 new LSTs added in Q2. The richness of LSTs is thanks to Sanctum Infinity , a multi-LST liquidity pool that enables supported LSTs to leverage each other’s liquidity. The top Sanctum LSTs by stake include Jupiter’s jupSOL (2.3 million SOL), Helius’ hSOL (403,000 SOL), and Solana Compass’ compassSOL (340,000 SOL).

In early April, Sanctum announced a $6.1 million funding round led by Dragonfly. It then launched Sanctum Wonderland, a points program where participants can collect pets representing LST and upgrade them through community quests. In early June, it launched CLOUD, announcing future airdrops and token sales through Jupiter’s LFG and Meteora Alpha Vault .

Jito’s jitoSOL remains Solana’s LST leader. Its supply grew 22% month-over-month to nearly 1.1 million SOL, with a 47% market share. The community is currently discussing a governance proposal to begin transitioning management of the Jito staking pool to StakeNet . StakeNet is an open source protocol for decentralizing Solana staking pool operations. The proposed transition will bring greater transparency, enhanced security, greater efficiency, and community governance to Jito.

Marinade’s mSOL supply fell 13% month-on-month to 5.3 million SOL, with a 23% market share. Its native staking product, Marinade Native, has an additional 2.7 million SOL. In mid-June, Marinade launched its Stake Auction Marketplace, where validators can bid for staked SOL. The feature will be rolled out in phases and is expected to go live in the third quarter of 2024.

consumer

NFT

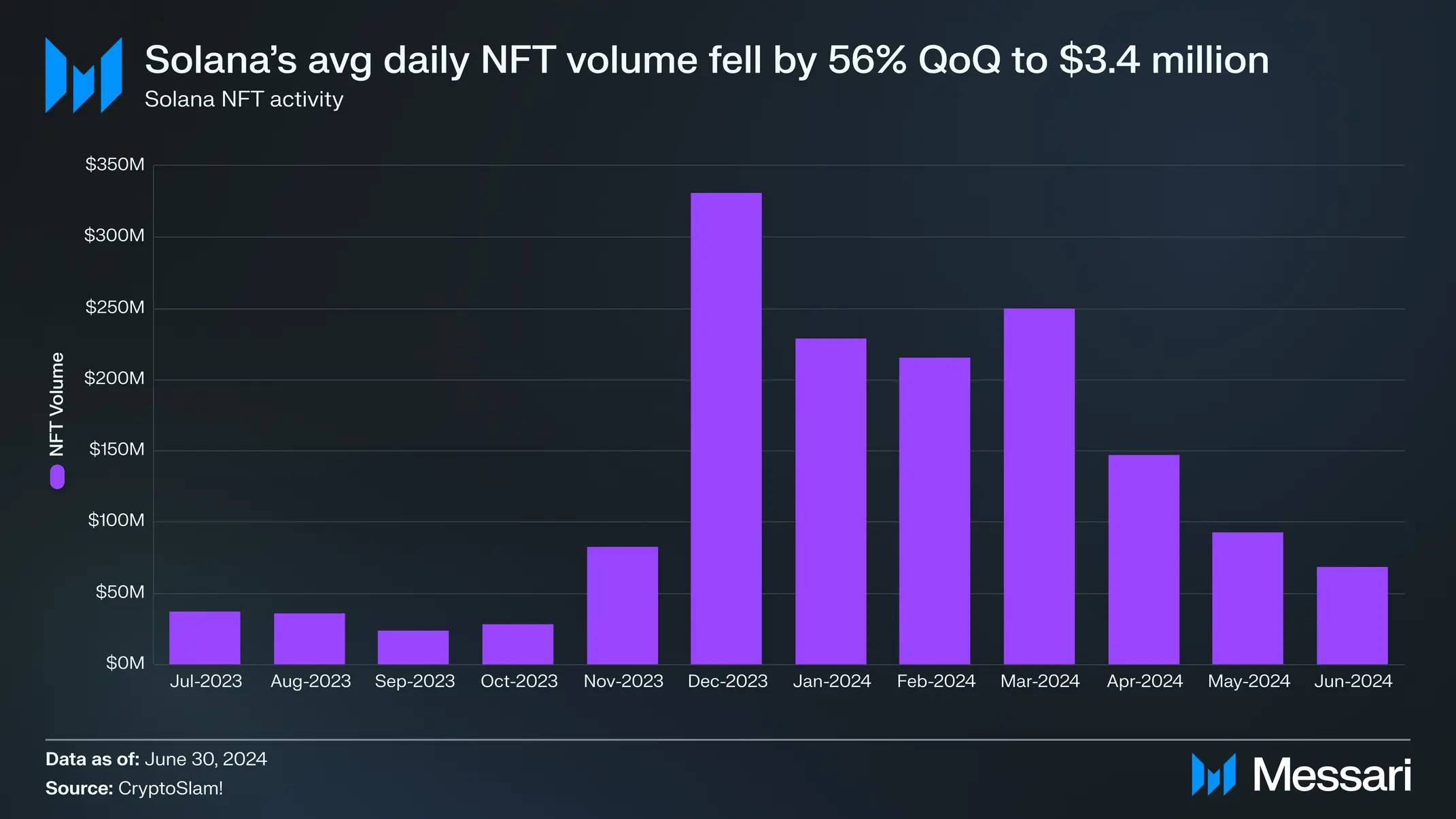

After an active period in late 2023 and early 2024, NFT trading volume declined in the second quarter. Average daily trading volume fell 56% month-on-month to $3.4 million. This quarter, the NFT market landscape changed, with Magic Eden regaining most of the organic trading volume share, increasing from 25% to 59%. In contrast, Tensor's market share fell from 71% to 35%.

In early April, the Tensor Foundation released the TNSR token and airdropped 14.8% of the total supply. Since the token was released, its market share is 31%. At the end of the quarter, TNSR had a market cap of $73 million and about 13% of the total supply was in circulation. Magic Eden continues to run its rewards program and is expected to launch its own token .

Mads Lads was the most traded series, with a total trading volume of 230,000 SOL. Just at the end of the quarter, a single address purchased 59 Mad Lads, spending a total of about 5,600 SOL (about $800,000). Other top series ranked by Q2 trading volume include Solana Monkey Business (104,000 SOL), Tensorians (91,000 SOL), Froganas (74,000 SOL), and Famous Fox Federation (51,000 SOL).

Most Solana NFTs are minted through Metaplex’s NFT standard. In early April, Metaplex launched a new NFT standard called Core . Core uses a single account design for cost and performance optimizations and has a flexible plugin system for further customization . The first external plugin is the Oracle plugin , which enables digital assets to react to real-world data.

At the end of May, Metaplex launched MPL-404, a hybrid token standard protocol developed in partnership with Mutant Labs, which pioneered the SPL-404 standard. Dubbed “Hybrid DeFi,” the token standard aims to bring more liquidity to NFTs while retaining their unique characteristics.

Other NFT-related events included SharkyFi’s SHARK launch , Exchange Art’s token announcement , Artrade’s introduction and Picasso sale , Garden Labs’ release of its owner-editable metadata program, 3.land’s open source cNFT minter , and Claynosaurz’ selection as a finalist for the Collision Choice Awards.

Social and creator platforms

Blinks are shareable links that convert Solana Actions into URLs rich with metadata. These links allow supported clients (such as browser extension wallets or bots) to display enhancements, making transaction previews or extension interaction buttons immediately visible in the wallet. Currently, only blinks from registered partners will expand directly on Twitter. Users also need to enable blinks in the browser extension wallet's settings for them to expand.

Many top Solana projects have already created blinks, including Jupiter, Tensor, Sphere, and TipLink. Blinks builders can apply for small grants (up to $1,000 each) through the Superteam Earn track or apply for larger grants directly from the Solana Foundation (up to $400,000 distributed in total).

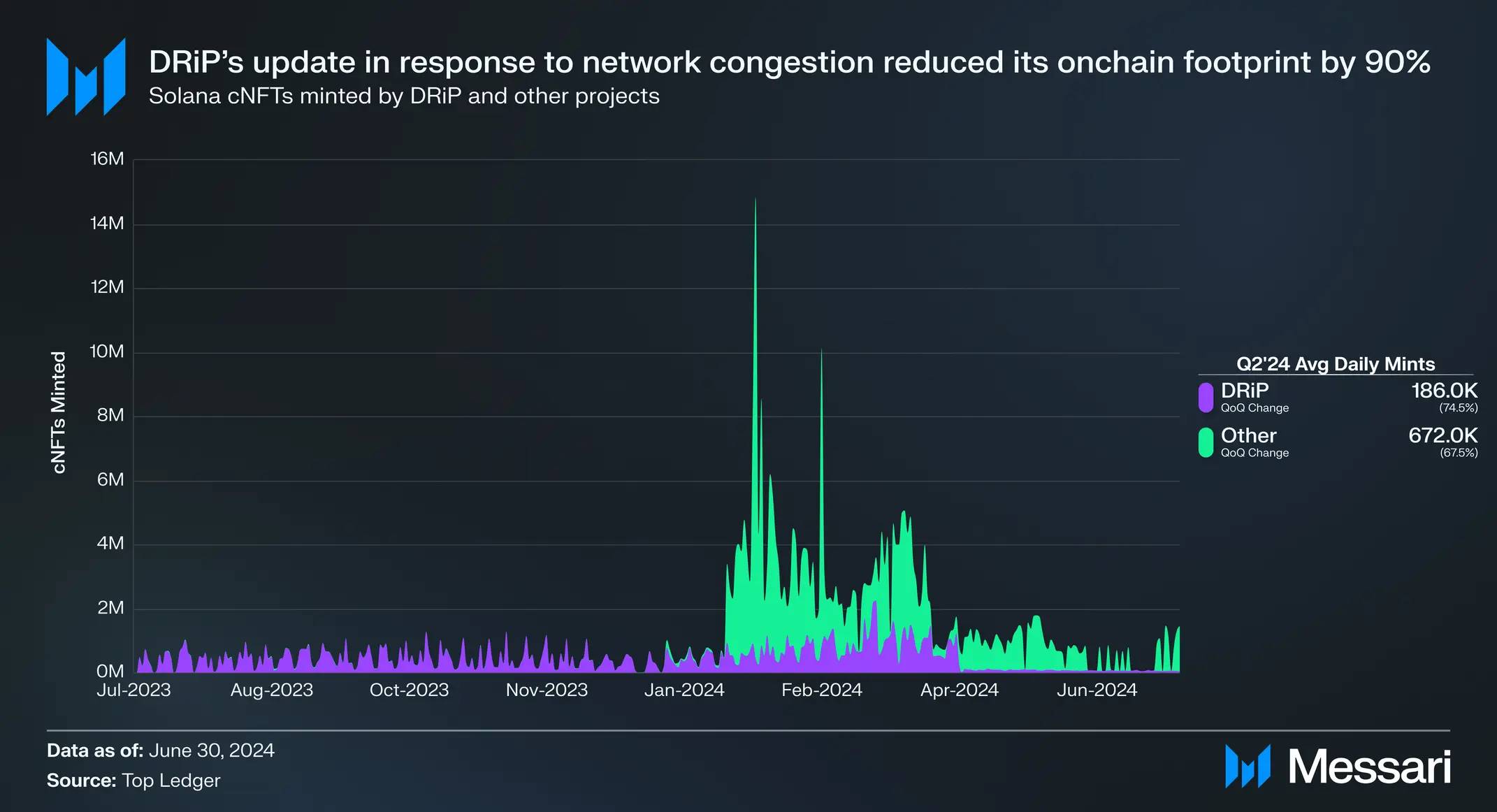

Like other applications, DRiP's user experience was affected by network congestion in early April. In mid-April, it released an update to address this issue. Now, DRiP will only mint collectibles on the chain when users claim them, so its average daily minting of cNFTs has been reduced by 90%.

In mid-April, DRiP introduced comic book artist Todd McFarlane, creator of The Amazing Spider-Man and Spawn. In an auction on DRiP, a 1:1 digital scan of the original artwork Spawn #1 sold for over 110 SOL ($16,000). Other creators joining DRiP in the second quarter include Rockstar Games artist Stephen Bliss , wallstreetbets , and singer Jason Derulo .

Other consumer-related events include:

Solana Labs' Bond: In mid-June, Solana Labs launched Bond, a customer loyalty platform and API. By enabling brands to easily launch NFTs and integrate blockchain-based payment rails, it aims to open up new revenue streams, provide product traceability and authenticity, enhance customer insights, and protect data privacy.

Audius Update: Audius is a music streaming platform that aims to redistribute power to artists. At the end of June, it launched paid live streaming, enabling artists to instantly receive payments for tracks and albums to Coinbase or other Solana wallets. Subsequently, it announced that it had signed licensing agreements with all major US performing rights organizations (PROs).

Others: Cupcake’s beta launch , Only1’s $1.3 million round led by Newman Group, Solarplex’s acquisition by Forward Research from the Arweave ecosystem, dReader’s Cubik grant round distributes $40K to comics creators, Access Protocol’s transferable subscription feature launch , Crowny’s app launch , GigHub’s launch , Nina’s iOS app launch , and Popset’s introduction .

game

While some on-chain games are built entirely on the Solana mainnet, others have opted for scaling solutions for customizability and higher performance. In Q2, several projects announced Solana-based scaling frameworks designed for gaming:

MagicBlock: In mid-June, MagicBlock launched MagicBlock Engine, a framework that enhances performance and virtual machine (VM) customizability without sacrificing composability. The engine deploys " ephemeral rollups, " temporary runtimes that settle state to Solana when shut down. All programs and accounts still exist on the Solana mainnet, but are actually mirrored to ephemeral rollups. The temporary runtime can take advantage of custom SVM validators optimized for speed and other configurable items such as gas-free transactions. The entire life cycle of the ephemeral rollup is abstracted from the user, who still trades and holds assets on the Solana mainnet. Although MagicBlock Engine is built for full-chain games, the team noted that it has attracted interest from non-gaming projects.

Sonic: In mid-June, Sonic announced a $12 million funding round led by Bitkraft and launched its testnet. Sonic is a Layer-2 stack that supports game-specific rollups that share a network of sorters and settle on Solana. Sonic leverages the SVM while supporting EVM code through its HyperGrid interpreter.

In early May, Solana Labs partnered with Google Cloud to bring its Web3 game development API GameShift to game developers on Google Cloud. After exiting beta last quarter, GameShift added several new features this quarter, including asset crafting , in-game token support , and developer wallets .

Other gaming-related developments in Q2 included Star Atlas’ Surge launch , STEPN’s partnership with Adidas, Blockasset’s partnership with UFC, Aurory’s Seekers of Tokane early access launch , Nyan Heroes token launch and esports partnership , Solana Speedrun 3 game idea contest , Photo Finish LIVE’s Virtual Kentucky Derby and Pace Advantage partnership , Blessed Burgers’ burger game , Chomp’s public beta launch , BetDEX updates , Portals’ airdrop , Bladerite developer Seeds Labs’ $12 million funding round , MON Protocol’s Solana integration , The Backwoods launch , SolForge Fusion launch , Solana Games Ambassador Program creators , Lowlife Forms trailer , Valannia’s gameplay trailer , and Love Monster’s Solana expansion plans .

DePIN

Solana is becoming the hub for DePIN applications, hosting projects such as Helium , Hivemapper , Render , and Teleport .

Notable events in the second quarter include:

Helium Licensing Program: In mid-June, Helium Mobile announced a licensing program for its technology stack, allowing third-party manufacturers to produce and sell hotspot devices. The program is designed to generate licensing fees and expand the Helium Mobile hotspot network, reducing dependence on T-Mobile. After the quarter ended, the Helium Foundation announced plans to expand the Helium network beyond wireless.

Shaga Fundraising: Shaga, a P2P network for gaming computers, announced a $1 million funding round led by Arca near the end of June. Shaga was previously the winning project at the Solana Foundation’s Q3’23 Hyperdrive Hackathon and is currently in closed beta.

Io.net’s Token Launch and Criticism: In mid-June, decentralized GPU aggregator io.net launched its token, IO, with an accompanying Binance Launchpool and community airdrop. IO ended the quarter with a market cap of $325 million, with a little over 10% of the total supply in circulation. Earlier this quarter, the project was criticized for the number of GPUs displayed on its UI. Just two days before the token launch, its CEO resigned and the former COO took over.

Ambient Funding: In May, Ambient announced a $2 million seed round led by Borderless Capital. Ambient also announced the acquisition of PlanetWatch, a decentralized environmental monitoring network. In the third quarter, Ambient plans to migrate the PlanetWatch token and network from Algorand to Solana, and launch a new mobile app and upgraded backend.

Teleport in Austin: After launching in its first city (College Station, Texas) last quarter, decentralized ridesharing protocol Teleport went live in Austin, Texas in late May.

Roam Migration: In early April, the decentralized WiFi network Roam announced its migration to Solana. The Roam app was later launched on the Solana Mobile dApp store.

Payment

With low transaction costs, sub-second finality, and a network of thousands of nodes, Solana promises to help drive mainstream payment flows — Visa said it will expand its USDC settlement pilot to Solana in the third quarter of 2023.

Notable events from Solana-native payment infrastructure companies and applications this quarter include:

Stripe Crypto Payments: In its 2024 keynote, Stripe announced that it will re-support crypto payments in the summer. It will first support USDC payments on Solana, Ethereum, and Polygon.

TipLink Update: During its 2024 keynote , TipLink unveiled two new products. The TipLink Wallet Adapter creates an in-browser wallet linked to a user’s Google account, eliminating the need for traditional wallet browser extensions and seed phrases. The Wallet Adapter has been integrated with multiple Solana applications, including Jupiter, DRiP, Tensor, Drift, Sphere, and Helio. TipLink also launched TipLink Pro, a suite of tools that allow developers to distribute tokens through campaigns.

Sphere Updates: In May, Sphere launched Offload Wallet, which enables users to make offline payments instantly by sending USDC to a wallet address tied to a connected bank account. It also launched SphereBot, which allows payments to be made directly through Telegram. Finally, its on/offramp product exited private beta and was opened to all users in June.

Helio Shopify Pay plugin update: In April, Solana Labs closed credit card payments for Solana Mobile Episode 2, and now only accepts payments through the Solana Pay Shopify plugin. Since Episode 2 pre-orders opened in January, the plugin has helped Solana Labs save more than $1 million in fees compared to traditional payment methods. Payment platform Helio launched a set of new features for the plugin, which has been managed since December. The new features include:

Multi-token payments, allowing buyers to use hundreds of tokens that are automatically exchanged to the merchant’s preferred currency via Jupiter

Supports other stablecoins besides USDC, including PYUSD, EURC, and USDY

Improved UI with faster transaction confirmations and automatic offline payments

Loyalty program with cNFT airdrops, Discord memberships, and discounts for NFT holders

Coinflow Labs Funding: At the end of May, payment infrastructure provider Coinflow Labs announced a $2.25 million funding round led by CMT Digital. Coinflow Labs helps companies integrate blockchain-based payments, and its clients include Solana Labs and Audius.

Other developments: Decaf’s on/offramp release , Code released on Google Play, Phantom integrated Meso for onramping, Brazilian digital bank Nubank supports Solana, and XPOS’ Solana integration .

infrastructure

Infrastructure-related events worth noting in the second quarter include:

ZK Compression: At the end of June, Light Protocol and Helius launched the extension primitive ZK Compression. ZK Compression functions like a compressed NFT: it stores account data in a Merkle tree off-chain and publishes its root on-chain. However, it works for any token or account, not just NFTs. In addition, it uses SNARKs technology to compress Merkle proofs, making the verification process more efficient. Helius co-founder Mert said that the state cost of an airdrop of 1 million addresses using ZK Compression was only $50, while it was as high as $260,000 without it. In addition to supporting new application scenarios, ZK Compression may also provide an alternative solution to Solana state for certain applications that require large amounts of state storage. One trade-off in the short term is the reliance on indexers to ensure access to compressed accounts and related data. During periods of high traffic, this reliance may result in the inability to update the Merkle tree . However, as economic incentives and open source indexer implementations bring more indexer options, this may not be a problem in the long run. ZK Compression is currently running on the testnet.

Squads Funding and Fuse Launch: In mid-June, Squads Labs announced a $10 million funding round led by Electric Capital and launched Fuse in public beta. Fuse is a mobile-first smart wallet that replaces traditional mnemonics and single key pairs with multi-factor authentication. Each wallet is a 2/3 smart wallet controlled by a local device key (protected by Apple Face ID), a 2FA key (encrypted and stored in iCloud or a cold wallet), and a recovery key (another wallet or email). It also features spending limits, key rotation, and gas abstraction to improve security and user experience. Fuse is powered by the same multisig protocol as Squads, which protects over $10 billion in assets.

Modular SVM: SVM is increasingly being used as an alternative to the EVM for L2, application chains, and other environments . At the end of June, Anza released a new SVM crate that makes it easier to use SVM outside of the Solana mainnet. The crate modularizes the SVM, decoupling low-level SVM components from the rest of Agave's validator runtime. Other SVM-related initiatives and projects announced in Q2 include ABK Labs, an SVM-focused development shop formed by former Solana Foundation employees, the testnet launch of the SVM Bitcoin L2 Yona Network, the introduction of Solana scaling solutions from MagicBlock and Sonic , and the release of a whitepaper for the Solana SVM aggregation framework Lollipop from Popsicle Network and MultiAdaptive.

Bonsol introduction: At the end of April, Anagram launched the open source verifiable computing system Bonsol. Using the risc0 toolchain , Bonsol enables developers to perform verifiable computations on private and public data and integrate the results into Solana programs.

Arcium introduction and funding: In May, Arcium (formerly Elusiv) announced a $5.5 million funding round led by Greenfield Capital and launched its private incentivized testnet . Arcium is a parallelized confidential computing network that enables developers to run encrypted computations.

Other developments include:

Wallets and Fintech Applications: Phantom acquires embedded wallet provider Bitski, Coinbase Wallet integrates Solana DEX (powered by Jupiter), Kraken launches Kraken Wallet with Solana support, Portal integrates Solana, Backpack Wallet updates , Moongate adds Apple ID login , Infinex integrates Solana, Squads Labs partially acquires Fibonacci Finance’s codebase, Safeheron integrates Solana, SwissBorg integrates Solana, xPortal integrates Solana, and Orbit is released .

Interoperability and modularity: Wormhole’s token launch , LayerZero integrates Solana, Mayan closes $3M seed round , deBridge launches points program and tokens , Neon EVM upgrade , Entangle integrates Solana, Jupiter integrates deBridge into its bridge widget, and Eclipse integrates Neon EVM’s Neon Stack.

Developer tools: Anchor 0.30.0 released , Trident released , RugCheck released API, NovaNet testnet , Spiderswap released public API, LiteSVM released program tester, Lighthouse Protocol released documentation and integrated Blowfish, Flare released , Mollusk released program testing tools, and Triton released Vixen.

Explorers and Data: SolanaFM 2.0 update , Rated integrates with Solana, Bubblemaps integrates with Solana, Top Ledger receives grant from The Graph Foundation, Solscan adds transfer tags , Reclaim Protocol integrates with Solana, SonarWatch releases validator, and SlamNet is introduced .

AI: DainTrader launches , Wayfinder launches PRIME cache , and Gather AI incentivized beta .

Governance and Identity: MetaDAO launches futarchy-as-a-service platform adopted by Drift, Deans List, and FutureDAO, Wormhole receives grant to bring Worldcoin’s World ID to Solana, Bonfida and Civic launch quadratic voting capabilities , and Civic Pass integrates token expansion.

Oracles: Switchboard completed $7.5 million in financing and Pyth released Solana to pull the oracle.

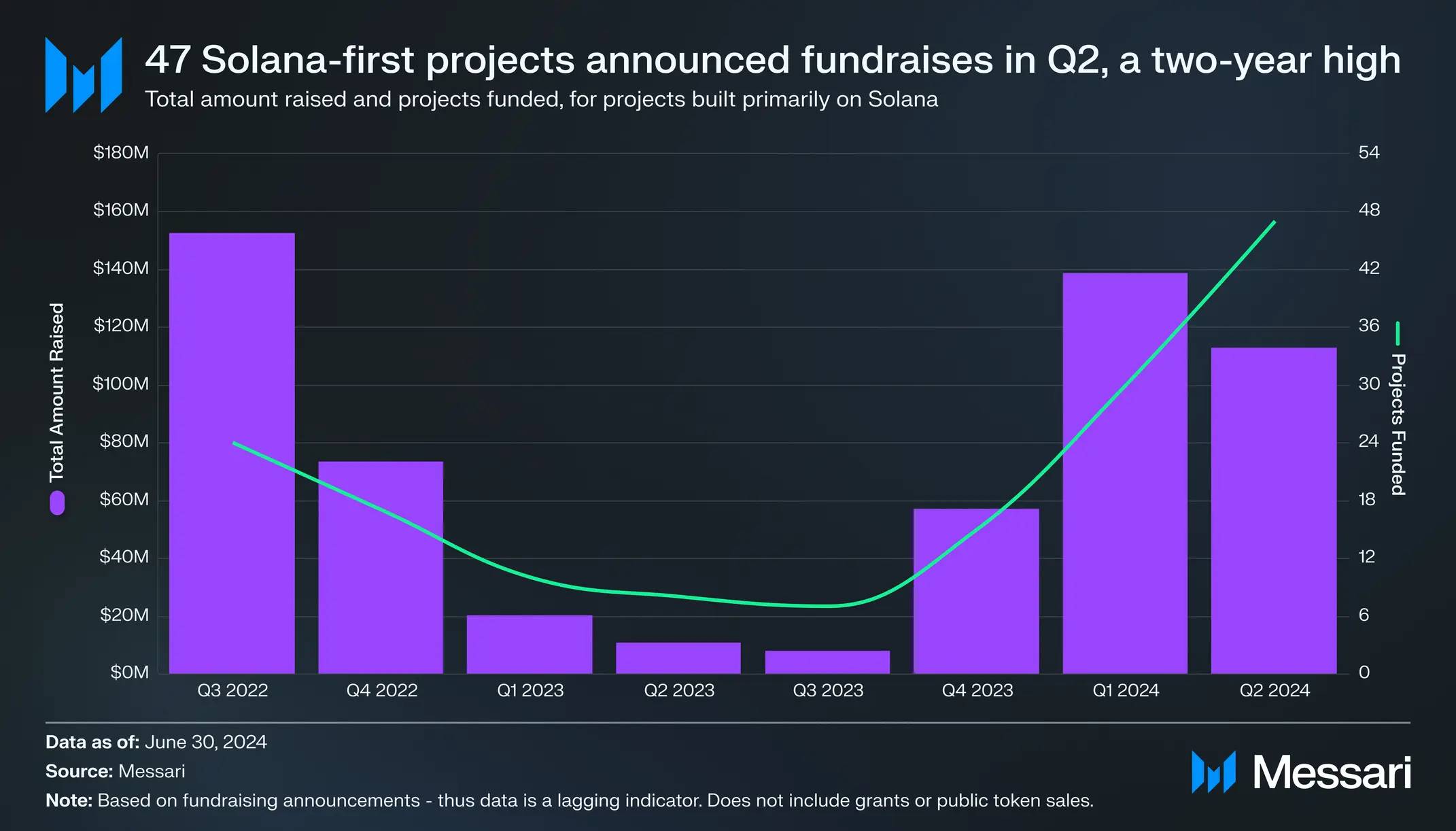

increase

After a long bear market, funding in the Solana ecosystem is picking up. In Q2, 47 projects built primarily on Solana announced funding rounds, the highest level in two years. These projects raised a total of $113 million, although this was down 19% quarter-over-quarter. From Q4 2023 to Q2 2024, Solana projects raised a total of $309 million, compared to just $39 million in the first three quarters.

Hackathons and Accelerators

After the first quarter kicked off , Colosseum held its first hackathon Renaissance from March 4 to April 8. The hackathon attracted more than 8,300 participants from more than 95 countries and 1,071 submissions. The grand prize winners of each track are as follows:

Overall winner ($50,000): Ore , a digital currency mined by a novel Proof-of-Work (PoW) mechanism. Ore launched in early April and became the most traded program on Solana. As miners competed to get their mined transactions on-chain, their efforts exacerbated Solana’s network congestion issues, as detailed in the Network Usage section below. Ore has been suspended since mid-April to focus on the development of V2, which aims to implement a new, more difficult to manipulate PoW algorithm and introduce ORE staking to better align miners’ incentives with the project.

First Prize in the Consumer Apps Track ($30,000): Banger , a marketplace for buying and selling screenshots of tweets.

First Prize in the Crypto Infrastructure Track ($30,000): High TPS Client , a modified Solana client with scheduling and pipeline optimizations built by the Rakurai team.

First Prize, Gaming Track ($30,000): Meshmap , a crowdsourced 3D map built for augmented a