Just around 8 pm yesterday (16th), the Legislative Yuan passed the "Draft Amendment to the Money Laundering Prevention Law" on the third reading, which involves amending the penalties for general money laundering crimes, virtual asset services, and third-party payment services .

Regulate registration required for domestic and overseas transactions

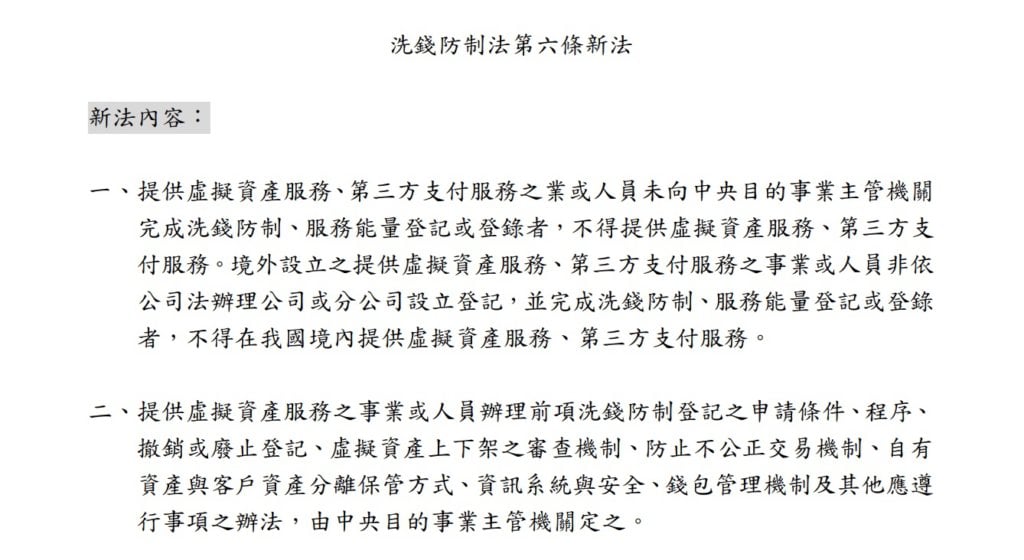

What has attracted much attention is that Article 6 of the new Money Laundering Prevention Act reads:

Businesses or personnel that provide virtual asset services or third-party payment services may not provide virtual asset services or third-party payment services if they have not completed money laundering prevention, service capacity registration or registration with the central industry competent authority.

Enterprises or persons established overseas that provide virtual asset services and third-party payment services are not allowed to provide virtual asset services or services in China unless they have registered the establishment of a company or branch in accordance with the Company Law and completed money laundering prevention and service capacity registration or registration. Third-party payment services.

More open? Guoke Lawyer: In line with the trend, Taiwan opens the door to compliance supervision to the world

This has caused many community partners to worry that the new law may affect the services currently provided by overseas exchanges. After all, they are still the largest channel for most Taiwanese investors to enter the crypto.

However, regarding this point of view, "Guoke Lawyer" Lin Hongyu provided a different angle when interviewed by Dongzhong. He believed that this amendment will not destroy Taiwan's cryptocurrency environment, but will clearly open a new door:

In the future, Taiwan will provide a clearer regulatory mechanism - a registration system, and provide a guidance and compliance channel for global virtual asset service providers to come to Taiwan.

In addition, Guoke lawyer added that currently Taiwan’s local exchanges are required to pass a money laundering prevention statement, but this is actually an exception that is not expressly stipulated in the mother law. After the future transition to the "registration system", in principle, whether it is a local or overseas exchange, as long as it can complete the registration, it will be able to operate legally in Taiwan, allowing operators to start from the same starting point.

At the same time, this is also expected to resolve the unclear scope of the current money laundering prevention statement and strengthen the execution of combating illegal fraud.

When will the details of Taiwan’s VASP registration system appear?

As for how fast the progress will be? Guoke lawyer speculates that details of the registration system may be released as soon as the end of the year.

The Money Laundering Prevention Law (new law) is expected to be promulgated by the President before July 31, 2024, and the competent authorities have begun to revise and adjust the measures to prevent money laundering. It is expected that the supporting measures may be officially announced and implemented before the end of 2024.

On the other hand, does not registering immediately make it illegal? It is reasonable to speculate that after the regulatory details are released, there will usually be a transition period, just like the situation after Hong Kong announced its licensing system.

Other provisions

In addition, it is different from previous administrative penalties. The revised Money Laundering Prevention and Control Law also lists criminal liability, which means that in the future, after the prosecutorial agency receives a report and investigates that illegal situations have indeed occurred, the person in charge will be punished with a fixed-term imprisonment of not more than 2 years, criminal detention, or a combination thereof. A fine of less than 5 million yuan.

Providing virtual asset services or third-party payment services without completing money laundering prevention, service energy registration or login in violation of the above provisions, or still providing virtual asset services after the money laundering prevention registration has been revoked or abolished, or the service energy login has been revoked or invalidated, Third-party payment service providers shall be sentenced to fixed-term imprisonment of not more than 2 years, short-term detention, or in addition or in combination with a fine of not more than 5 million yuan.

The Financial Supervisory Commission has previously stated that "individual currency dealers" have been placed under the supervision of the Financial Supervisory Commission. As long as natural persons engaged in virtual currency must abide by the "Business Registration Law" and "Tax Registration Rules", they must also abide by the "Money Laundering Prevention Law". After the criminal liability is released, currency merchants who cannot meet the demand must pay special attention.

Three possible directions for the development of traditional financial industry and overseas exchanges in the future

In the future, it is reasonable to speculate that these traditional banks and overseas exchanges may advance in three directions:

- Arriving in Taiwan: Complete the registration system and comply with anti-money laundering regulations

- Two-point operation: It is still uncertain whether Taiwan will open up derivative products in the future, so it may become a local website and an overseas website.

- Cooperation with local exchanges in Taiwan, or mergers and acquisitions

Note on the move: Regarding the future of cryptocurrency laws, Yang Yueping, associate professor at the National Taiwan University School of Law, previously pointed out that the Financial Supervisory Commission decided to formulate virtual asset laws and should simultaneously allow traditional financial institutions to invest in virtual asset business . He said that this is not only beneficial to the development of the industry, but also helps to improve the legal compliance level of the entire industry.

But in general, although subsequent registration details and open businesses... still need to be formulated by government agencies. But in general terms, Taiwan has officially taken a big step in regulating cryptocurrency service providers, and is willing to open up all relevant businesses to Taiwan through a registration system.