According to The Block , unlike most analysts in the market, Matt Hougan, chief investment officer of crypto asset management company Bitwise, believes that compared with Bitcoin, the launch of the Ethereum spot ETF may have a greater impact on Ethereum. bigger.

In a letter sent to clients on Tuesday, Matt Hougan predicted that inflows into the Ethereum spot ETF will push the price of ether past an all-time high of $5,000.

Matt Hougan noted that once the Ethereum spot ETF starts trading, the first few weeks may be "volatile" for the second-largest cryptocurrency by market capitalization, as funds may flow from the $11 billion Grayscale Ethereum Trust (ETHE) outflow. But by the end of the year, Ethereum will break new highs. Matt Hougan explained that while spot ETFs do not change the fundamentals of underlying assets like Ethereum, they do bring new sources of demand for Ethereum.

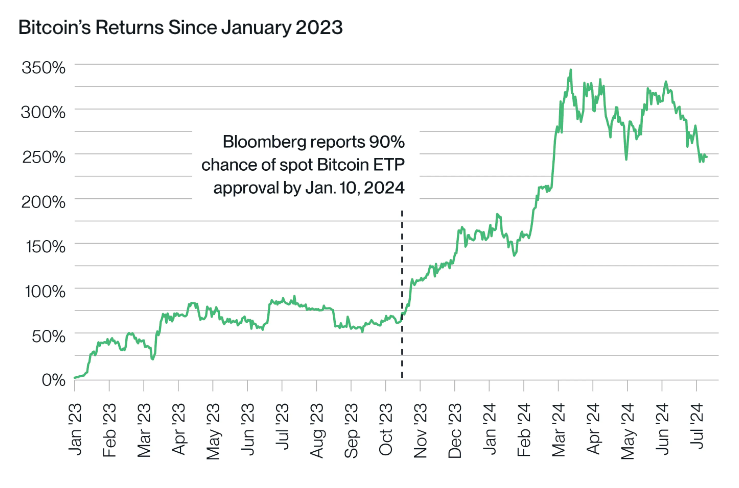

Taking Bitcoin as an example, the price of Bitcoin has increased by about 40% since the launch of Bitcoin spot ETFs, and these ETFs purchased a total of 263,965 BTC. In comparison, Bitcoin miners only produced 129,281 BTC during this period. Purchases are more than twice as much as output. Matt Hougan expects the impact on Ethereum to be greater after the approval of the Ethereum ETF.

Matt Hougan previously predicted that spot Ethereum ETFs would attract $15 billion in net inflows in the first 18 months. That took more time than the Bitcoin ETF to reach the same net flow milestone, which it did just five months after the trade. However, Matt Hougan believes that inflows into Ethereum ETFs will have a greater impact on prices for three related reasons.

First, Matt Hougan pointed out that Ethereum’s short-term inflation rate over the past year was actually 0%, while Bitcoin’s inflation rate was 1.7% when the spot Bitcoin ETF was launched, which means that the market needs $16 billion per year. The amount of Bitcoin purchased can maintain price stability.

Second, Matt Hougan said that Bitcoin miners typically need to sell the new Bitcoins they produce to cover huge operating costs, while validators holding ether do not because the direct costs of maintaining a proof-of-stake protocol are lower. He added:

"Even if Ethereum's inflation rate rises above 0%, I do not expect significant selling pressure from validators. Ethereum's forced sales per day are significantly less than Bitcoin."

Finally, Matt Hougan noted that as Ethereum validators lock up their assets to earn rewards, effectively "withdrawing liquidity from the market," there is currently approximately 27.5% of the total supply of Ethereum, according to The Block Pledged. If you add in the 13% locked in DeFi smart contracts, approximately 40% of the total supply of Ethereum is "unsaleable to some extent or at all."

Matt Hougan believes that if the Ethereum spot ETF is successfully launched and reaches the level of capital inflows he expects, given these dynamics, "it is difficult to imagine that Ethereum cannot challenge its historical record."