Market volatility is expected to increase with approximately $1.79 billion worth of Bitcoin (BTC) and Ethereum (ETH) options scheduled to expire today.

Traders are watching this event closely, especially with the upcoming Ethereum spot exchange-traded fund (ETF).

Traders expect volatility to surge due to option expiration and launch of Ethereum ETF

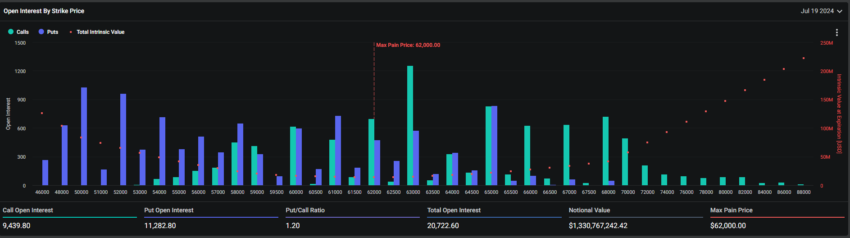

According to Deribit data, 20,679 Bitcoin contracts worth approximately $1.31 billion are scheduled to expire today. This tranche represents a slight decrease from last week's figure of 23,832 contracts . The expiring contract has a put-call ratio of 1.19 and the maximum possible loss is $62,000.

Read more: Introduction to Cryptocurrency Options Trading

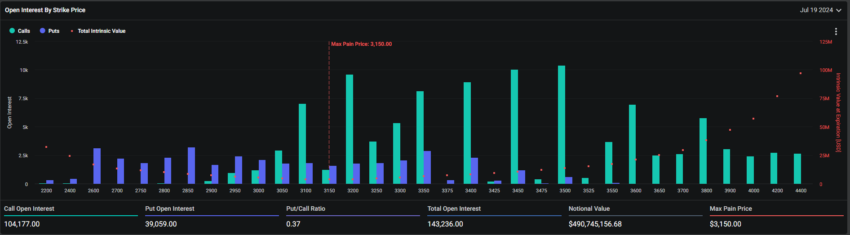

The biggest pain point in the cryptocurrency options market represents the price level that causes the greatest financial discomfort to option holders. Meanwhile, the put-call ratio indicates that buying options (calls) are more dominant than selling options (puts).

In addition to Bitcoin options, 142,583 Ethereum contracts are expiring today, with a notional value of over $483.84 million. The put-call ratio is 0.37, and the maximum divergence is $3,150.

Deribit analysts provided insight into the options market this week. They noted that one fund appeared to be making a gamma play in either direction, converting its December 85,000 call into an August 65,000 straddle due to Kraken's note on Mt. Gox creditor repayment .

In cryptocurrency options trading, gamma refers to the rate of change in option delta proportional to the $1 price change of the underlying asset. This indicates the degree of price exposure risk in an options position.

“After initially selling to 63,000, spot was forced to cover short calls, delta, and [implied volatility] IV. “It may not be a coincidence that $4.5 million was released from an 85,000 call sale in December, and that money was put into a 65,000 straddle in August,” they wrote .

It also pointed out similar transactions, including the purchase of a 70,000 call in August that was funded by a 90,000 call in December.

“These premium inflows are a combination of underperformance FOMO, short covering and new exposure after the German government coin ran out and the market surged above $66,000 beyond many expectations,” Deribit added . .

Deribit also explained that the start of Ethereum ETF spot trading on July 23 stimulated a strong rally in Ethereum . However, the spread between BTC and Ethereum narrowed from 15% to 8%.

Market analysts have noticed this trend since last week. A joint report from BlockScholes and Bybit pointed out that since last week, expectations for these ETFs appear to have influenced the movement of Ethereum derivatives, causing them to move differently from BTC. Investors also have a more positive outlook on Ethereum compared to BTC, according to Blokskole's Centimeter Index, which measures investors' risk appetite based on fund rates, returns, and volatility.

Read more: 9 Best Cryptocurrency Options Trading Platforms

Historically, option expirations tend to produce temporary, sharp price movements. Typically, the market stabilizes soon. However, traders must be careful to analyze technical indicators and market sentiment to effectively navigate potential volatility.