Last weekend was a week of relatively high volatility in the price of Bitcoin (BTC). On July 21, Bitcoin reached $68,6410 due to a series of macroeconomic issues.

BTC has settled back at $67,218, but this on-chain analysis explains why the price could retest the authoritative threshold it has avoided for nearly two months.

Bitcoin is not ready to hesitate

Bitcoin's performance over the past seven days has been much better than last month. During this period, Bitcoin price rose 6.89%.

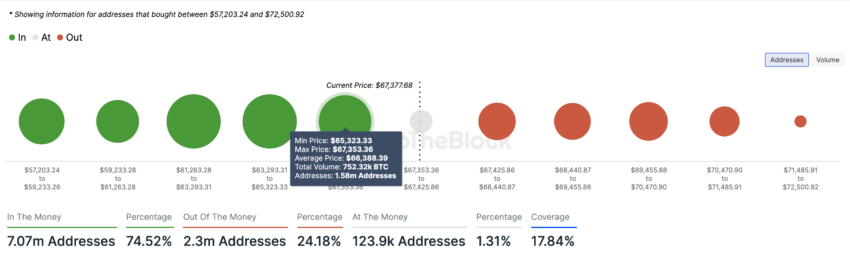

However , as the last ten days of July approach, Bitcoin is showing even stronger strength. BeInCrypto made this discovery after analyzing the Inflow/Outflow of Money Around Price (IOMAP) indicator.

IOMAP classifies which addresses are making money at the current price and which are not. Simply put, this means people who bought BTC at a price lower than its press time value. We also look at who bought at a higher price and who accumulated at the current price.

If the currency has a greater number of addresses, Bitcoin may receive support and its price may trade higher. However, if the opposite occurs, resistance will occur and BTC may experience a price decline.

Read more: Bitcoin Halving History : Everything you need to know

According to IntotheBlock above, 1.58 million addresses purchased BTC between $65,323 and $67,353. That's significantly more than addresses that accumulated anywhere between $69,425 and $72,500.

Therefore, Bitcoin’s support level is around $66,388. If this price holds, it could break above the overhead resistance and reach $69,455.

Outside of the on-chain realm, the Bitcoin conference scheduled for July 25-27 is one factor that could drive Bitcoin prices higher.

That's because U.S. presidential candidate and frontrunner Donald Trump is expected to speak at the event. Additionally, the direction of the cryptocurrency market is expected to be determined by the results of the November presidential election.

Biden's announcement increases interest in Bitcoin

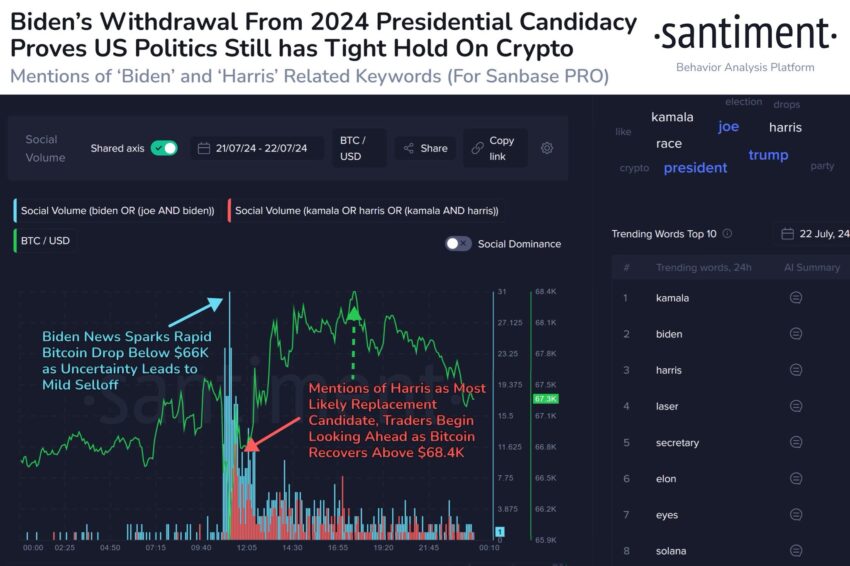

In addition, the election took an interesting turn yesterday , July 21, as current President Joe Biden withdrew from his candidacy. Minutes after the announcement, the price of Bitcoin plummeted below $67,000.

However, after Biden nominated Vice President Kamala Harris, it rebounded and tested $68,400 again. This is similar to Coyne's reaction following Trump's assassination attempt .

Trump has told the cryptocurrency community on several occasions that Biden will ease his “war” on the industry. As a result, several big names in the cryptocurrency industry decided to support him.

So the former president may step up his intentions again. This could increase the chances of Bitcoin accelerating towards $70,000.

BTC Price Prediction: New Monthly High Looks Near

Despite the slight decline, BTC is trading above key support levels, indicating that upside potential still exists. However, some indicators on the daily chart give mixed signals.

One of the indicators examined is the Funds Flow Index (MFI). MFIs use price and volume to measure buying and selling pressure. It also indicates whether an asset is overbought or oversold.

Anything above 80 indicates overbought, and anything below 20 indicates oversold. At press time, MFI is at 79.52, indicating that Bitcoin may soon become overbought.

If this happens, $68,030 may be difficult to achieve. However, the Awesome Oscillator (AO), which measures momentum, is positive. A positive number means upward momentum is increasing, while a negative number means it is not.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Therefore, AO figures at press time indicate that Bitcoin could move close to or above $70,000. If this situation holds, Bitcoin could surpass $68,030, and the next target could be around $71,982.

However, Bitcoin is at risk of falling, especially since defunct exchange Mt. Gox appears ready to repay its creditors, according to Spot on Chain.

Once this begins, it may be difficult for BTC to rise above $70,000. In this case, BTC's next move could be down to $64,928.