Last week, cryptocurrency investments recorded another positive week, with $3.2 billion in inflows for the month. ETFs remain a key driver of capital into the market.

Cryptocurrency markets are generally performing strongly this week, with several catalysts on the horizon. This increases the odds of more capital inflows this week.

Cryptocurrency investment reaches $3.2 billion in 3 weeks

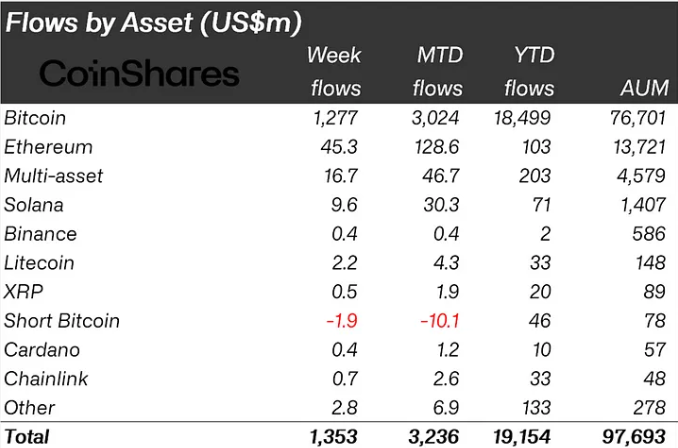

The third week of July saw inflows of up to $1.35 billion, bringing cryptocurrency investments this month to $3.2 billion. This was driven by a surge in Bitcoin (BTC) purchases, reaching $1.27 billion. Conversely, short Bitcoin ETPs (exchange-traded products) recorded outflows of up to $1.9 million, Coinshares reported, citing Bloomberg data.

Ethereum also recorded positive flows reaching $45.3 million, surpassing Solana in the altcoin index and showing the largest inflow of funds this year.

The interest in ether is not surprising. That's because on July 23, five Ethereum spot ETFs will begin trading on the Chicago Board Options Exchange (Cboe) . These include the Fidelity Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and 21Shares Core Ethereum ETF.

“Similar to the launch of the BTC spot ETF, Ethereum spot ETF issuers are competing to offer the lowest possible management fees to attract initial capital inflows. Management fees vary from 0.15% to 0.25%. This fee competition is very important, given the long investment horizons of many ETF investors, as initial inflows can secure high assets under management for one to three years. Overall, market participants are expecting strong interest in the Ether spot ETF and significant inflows in the first three to six months after launch. To gauge the appetite of traditional financial investors for digital assets beyond Bitcoin, it will be important to compare net inflows to BTC, taking into account different market capitalizations,” Mateo Greco, research analyst at Finekia, told BeInCrypto.

Read more: Ethereum ETF explained: What is an Ethereum ETF and how does it work?

This launch will make it easier for hedge funds and pensioners to purchase Ethereum. ETF issuers are lining up to launch index-based ETFs combining spot BTC, ETH, and Solana (SOL) ETFs in the coming months, according to Nate Geraci, CEO of ETF Store.

In addition to strong interest in ETFs, the market is also excited about the Bitcoin 2024 conference, which begins on July 25th. With the news of the Ethereum ETF, there may be more cryptocurrency inflows this week than last week.

Ethereum option open interest trading volume surges following the launch of the Ethereum ETF

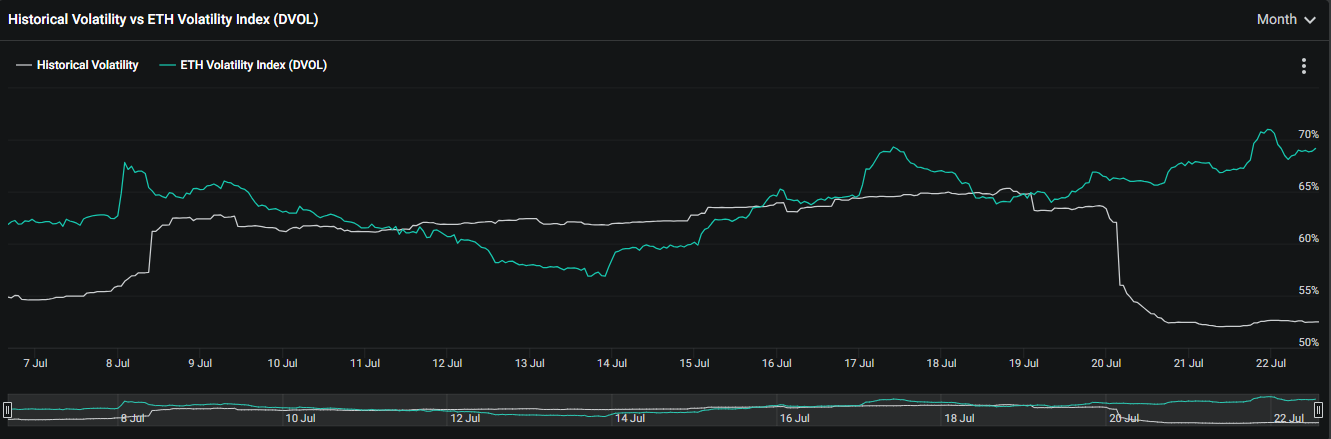

Ahead of the launch of the Ethereum ETF, open interest in Ethereum options has increased sharply on Deribit, a Bitcoin and Ethereum options exchange. Ethereum options implied volatility has risen 26% since last week, according to Deribit data. This suggests increased interest and activity in the market, which is expected to lead to increased Ethereum price fluctuations.

Ethereum price returned to the bottoming range between $3,352 and $3,642 on a daily basis. Volume nodes show tremendous activity between Ethereum bullish (purple) and bearish (orange) with nodes surging within this range.

The Ether market remains strong as the relative strength index (RSI) is still above the average level of 50. When the moving average convergence divergence (MACD) is above the signal line (orange band), it indicates that buying momentum is exceeding selling momentum.

However, for Ethereum to see a continuation of its upward trend, the price must overcome the resistance posed by the supply wall between $3,760 and $3,866.

Read more: How to invest in Ethereum ETF?

Conversely, RSI is sloping south, which is a sign that momentum is falling. This, along with the decline in the MACD histogram, suggests that upward momentum and sentiment are waning, and Ethereum is on the cusp of further declines.

If it breaks below $3,352, the lower limit of the bottoming range, and the closing price falls, it could trigger panic selling. Nevertheless, the bullish logic for Ethereum will only be invalidated if it breaks through the demand zone and closes below $2,924.