Table of contents

ToggleEthereum spot ETF opens for trading tonight

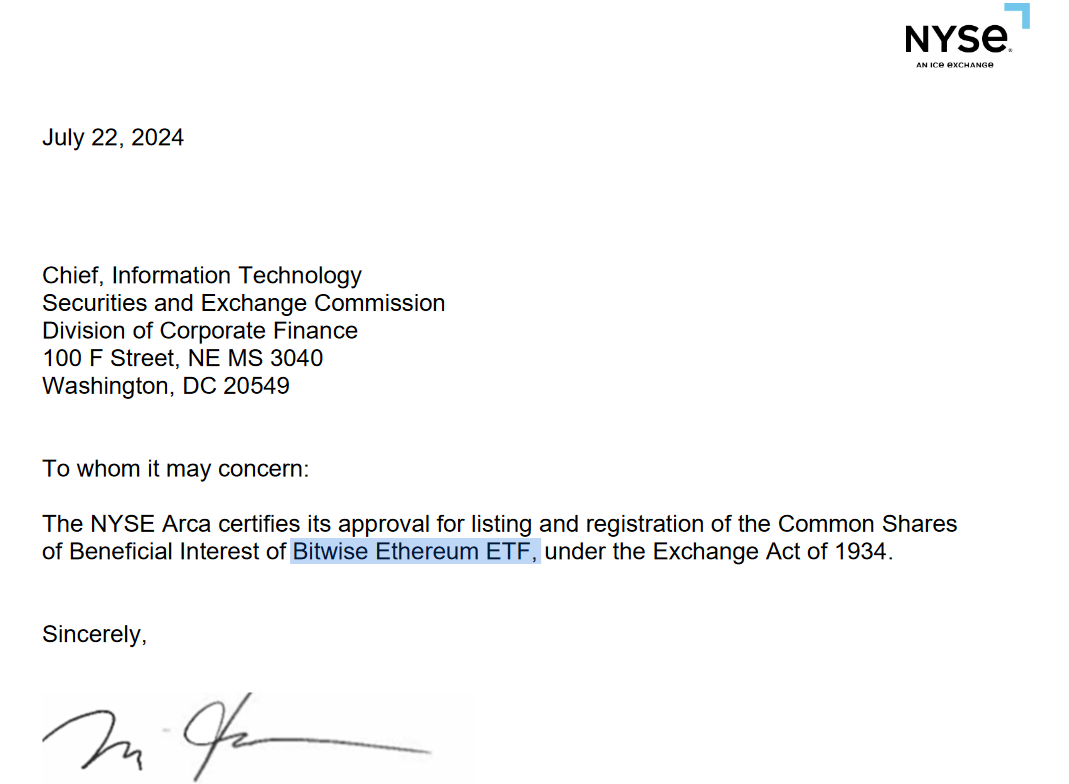

The U.S. Securities and Exchange Commission (SEC) has today approved the final S-1 registration statement required to list an Ethereum spot ETF on their respective stock exchanges, including Nasdaq, the New York Stock Exchange and the Chicago Board Options Exchange. This means that Ethereum ETFs issued by BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck and Invesco Galaxy will be listed and traded on their respective exchanges tonight.

Matt Hougan, chief investment officer of Bitwise, said:

"We have now fully entered the era of cryptocurrency ETFs. Investors can now access more than 70% of the liquid cryptocurrency market through low-cost ETPs."

Impact on Ethereum

The launch of the Bitcoin spot ETF gained massive market adoption, pushing the price of Bitcoin to all-time highs. In addition, this product has become one of the most successful products in the history of the US ETF market. However, some analysts predict that while Ethereum spot ETFs could push Ethereum prices as high as $6,500, inflows into these funds will not be as high as their Bitcoin-focused counterparts.

Cryptocurrency market maker Wintermute pointed out that the Ethereum ETF will receive up to $4 billion in capital inflows from investors in the next year, lower than the $4.5 billion to $6.5 billion expected by most analysts. In comparison, Bitcoin Spot ETF inflows reached US$17 billion in just half a month. However, Wintermute also said that driven by these capital inflows, the price of Ethereum will rise by approximately 24% in the next 12 months.

The reason why Wintermute believes that the Ethereum spot ETF cannot attract large amounts of funds is that the SEC rejected the issuer’s request to provide a staking function for the Ethereum ETF. Wintermute said in the report:

“This loss reduces the competitiveness of the ETH ETF compared to direct holdings, while investors who hold directly can still benefit from staking.”

On the other hand, Will Cai, index director at research firm Kaiko, also said in a report that when the futures-based Ethereum ETF was launched in the United States late last year, demand was not ideal. All eyes are now focused on the launch of spot ETFs, with high hopes for rapid capital inflows into the ETFs.

Will Cai warned that regardless of the long-term trend, Ethereum prices may be quite "sensitive" to inflows on the first day of trading. In other words, the poor performance of capital inflows on the first day of trading may trigger a continued decline in Ethereum. According to data tracked by Kaiko, Ethereum’s implied volatility rose sharply over the weekend, jumping from 59% to 67% for contracts approaching expiration (July 26), the report stated:

"This shows that confidence in ETH has weakened since its launch, as traders are willing to pay a higher premium to hedge their bets."