The previous dehydration point of view pointed out that the decline expectations are converging and the rebound may continue. Last week's market played out according to this script. The core logic is that the German government's selling pressure has basically ended, and the Mt. Gox selling pressure has not actually appeared, but the Bitcoin ETF funds have maintained a net inflow. The evolution logic of this week's market remains unchanged. If the Mt. Gox selling pressure is slow and limited, the rebound trend is still expected to continue.

From a macro perspective, the recent rise in Bitcoin is also related to the Trump deal, because the economic agenda announced by the Republican Party is quite favorable to Bitcoin, including Trump's confirmation to attend the Bitcoin conference, which are new external stimulus factors.

01

Industry and Macro

Last week, after the assassination, Trump still promised to give a speech in person at the Bitcoin 2024 conference. Conference organizers said that since the announcement that Trump would attend the conference, ticket sales have accelerated, and the final audience number is expected to be between 20,000 and 45,000.

Recently, the capital market has been developing along two lines: rate cut trading and Trump trading. As Trump's approval rating rises, risk assets such as Bitcoin are favored. This is what traders call the "Trump trade." That is, any risk asset that meets the guidance of Trump's campaign economic platform is expected to perform well.

As for the prediction of MtGox's selling pressure, we can refer to the vote in the Reddit MtGox forum last week. The vote showed that among the 467 members who participated in the vote, 260 people chose not to sell the bitcoins after receiving the compensation, accounting for 55%, the highest; 88 people chose to sell all, accounting for 18%, ranking second among the voting options; 68 people chose to sell 1% to 25%; 26 people chose to sell 25% to 50%.

If the voting results are in line with the facts, it can be expected that the selling pressure on MtGox will not be very large. Moreover, the possibility of retail creditors selling in a concentrated manner in time is smaller than that of the German government.

02

On-chain data

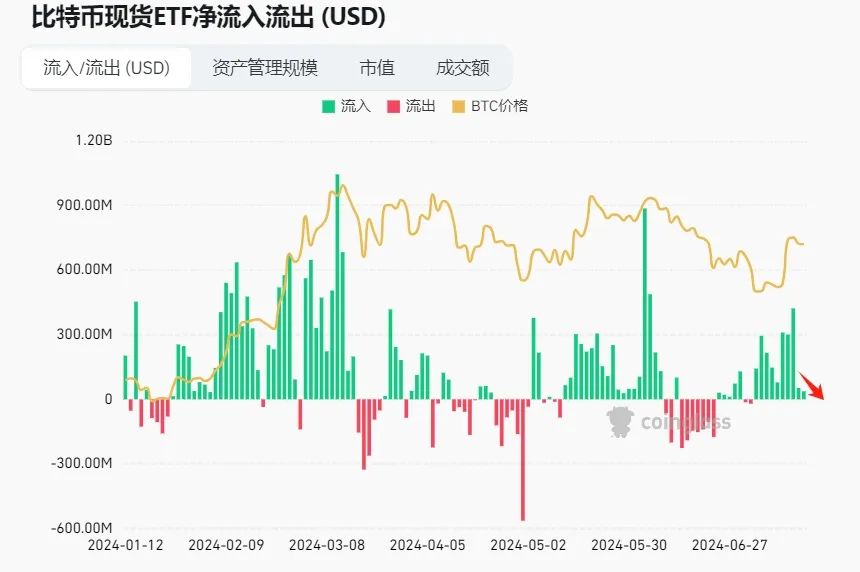

According to Coinglass data, the inflow of funds into Bitcoin ETFs decreased significantly on July 17 and July 18. However, on July 19, Bitcoin ETFs saw a net inflow of US$384 million (approximately 5,997.49 BTC). Overall, funds continued to show clear signs of inflow.

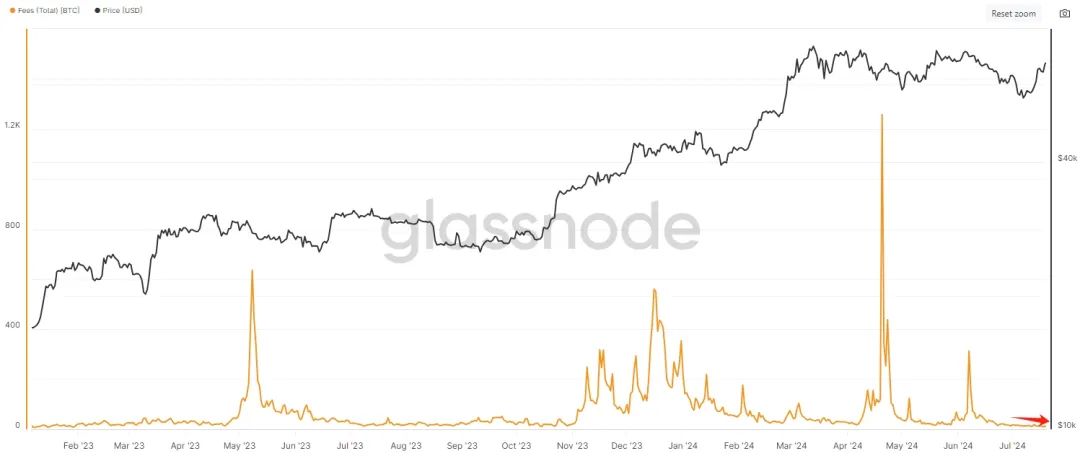

According to glassnode data, Bitcoin on-chain transaction fees continue to decline, which indicates that Bitcoin on-chain activity is still relatively weak and market activity is relatively low.

According to Deflama data, the net capital inflow into the Bitcoin ecosystem in the past month was -26.73%, and the net capital inflow in the past week was 11.65%. Overall, the capital showed signs of net inflow in the past week, and the market is still relatively heavy in short-term shorts.

Overall, the activity on the Bitcoin chain is relatively low, but the inflow of funds into Bitcoin ETFs has increased. The dominant factor affecting Bitcoin in the near future is still at the macro level. In particular, Trump may attend the Bitcoin conference next week, and Bitcoin is expected to strengthen further. In addition, TON, which had a large rise in the previous period, has shown signs of slowing capital inflows, and is expected to perform relatively weakly in the short term.

03

technical analysis

BTC continued its rebound trend in the past week. As we said last week, the real resistance will be above 68,000, so BTC still has some room to move upward, but after reaching the red box above, we should pay attention to the counterattack of the short force. There will still not be much macro data next week, so the market will fluctuate more around the resistance and support of the price. Although the short area is obvious, the downward range is unlikely to be too large, and the long and short sides may still play around 65,000. The final direction may be clear after the US interest rate on August 1.