In front of thousands of conference attendees in Nashville, Bitcoin bulls turned the volume up to 10. Michael Saylor predicted that by 2045, the price of the world's largest cryptocurrency will rise to $13 million, and Bitcoin's market capitalization will reach $280 trillion, requiring an average annual return of 29% to reach that level.

No bitcoin conference would be complete without some optimism from Michael Saylor, and the executive chairman of MicroStrategy delivered on that promise in Nashville on Friday.

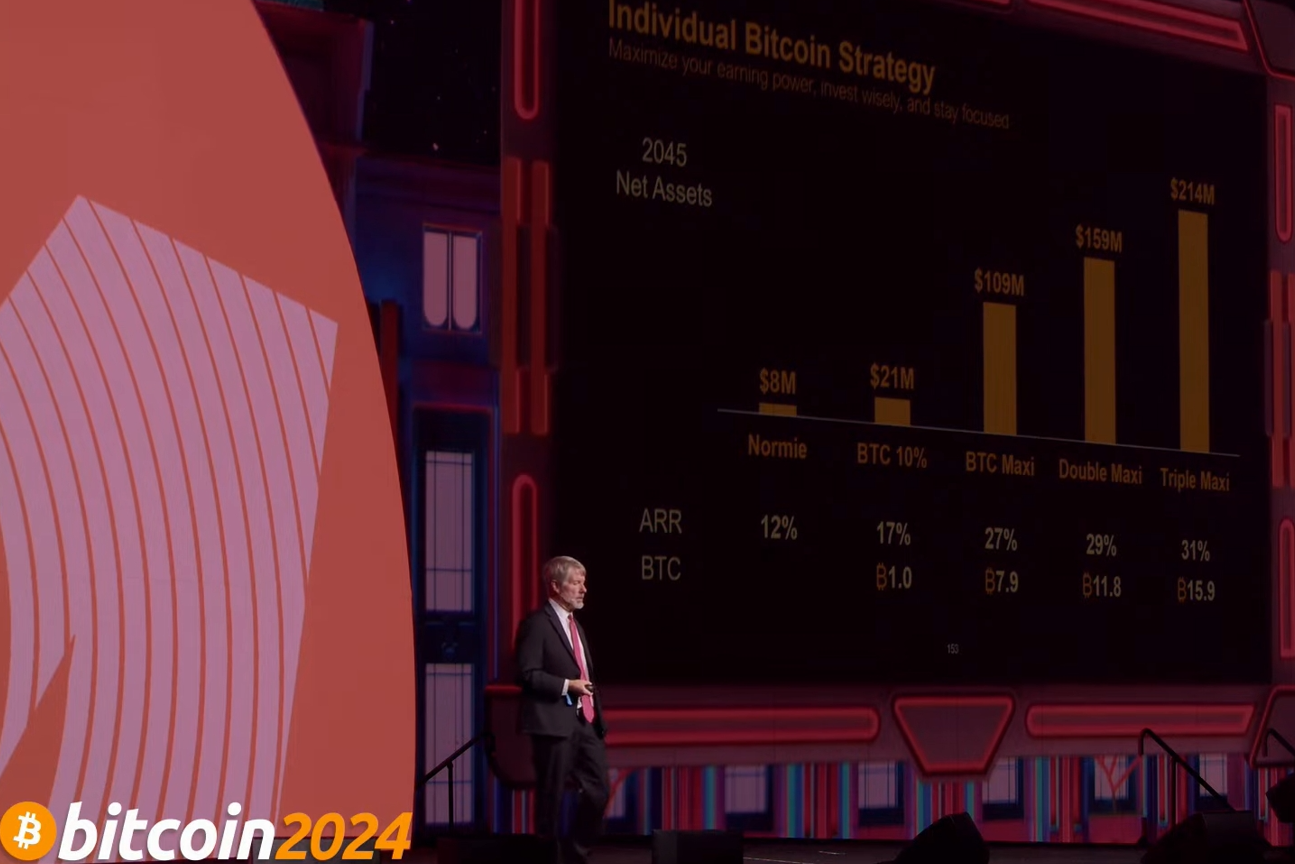

Saylor said that for Bitcoin to reach his predicted base of $13 million by 2045, it would require an annual return of 29%. At that level, he continued, Bitcoin would have a market cap of $280 trillion, or 7% of global wealth. In a bull market scenario, Saylor said Bitcoin could be worth as much as $49 million, or 22% of global wealth, while in a bear market scenario, Saylor believes Bitcoin would be worth $3 million, or 2% of global wealth.

Saylor himself is believed to hold more than $1 billion worth of Bitcoin , while MicroStrategy has earned a reputation as the largest corporate holder of Bitcoin, holding more of the asset than any other public company. As of Friday, the company had about 226,000 Bitcoins in its vaults, worth about $15.3 billion.

Saylor delivered the keynote address to hundreds of attendees at this year’s annual conference, which attracted about 8,000 attendees, some of whom waited in line for more than an hour to see the popular bitcoin thinker speak in person and hear him talk about his growing advocacy for bitcoin.

“The global economy is in trouble because we rely on imperfect assets and imperfect systems to store capital,” said Saylor, who called Bitcoin a “little orange asset of possibility.”

Saylor spoke about the "lifespan" of different assets, from government-backed debt to Ferraris, none of which have very long lifespans. The popular Bitcoin advocate contrasted those assets with digital capital, which he said is an innovation that will likely have a lifespan far longer than those assets.

“Entropy is diluting the value of their physical assets,” Thaler said, citing “war, famine and disasters” as other factors that undermine the value of normal assets in the long run.

However, Saylor said that bitcoin held by a custodian has a lifespan of about 1,000 years. He added that bitcoin held in self-custody could last up to 10,000 years. Bitcoin held by artificial intelligence could last up to 100,000 years, he said. This view helps explain Saylor's sudden pivot to bitcoin four years ago.

MicroStrategy began acquiring Bitcoin for company funding following the pandemic-induced market crash in 2020. The company's pace of acquisitions has not slowed down since then. According to data from Bitcoin Treasury , the company added about 12,000 Bitcoin to its balance sheet in June, when the price of Bitcoin was hovering around $65,000. The acquisition is MicroStrategy's 39th purchase of Bitcoin since it first bought it in August 2020 at a price of about $12,000 .

Saylor often cites MicroStrategy's stock price as evidence of its success. So far this year, the company's stock price has risen 155% to around $1,750, reaching a high of $1,919 in March. Under Saylor's leadership, business software company MicroStrategy has accumulated 226,331 bitcoins over the past four years, which are currently worth about $15 billion and are about 80% higher than the cumulative purchase price.

“ As of August 10 of this year, we’ve been on this road for 48 months,” Saylor said, noting that many companies are currently trying to copy chip maker Nvidia. “The irony is that it’s easy to copy MicroStrategy. I just gave you the playbook.”

OneMedNet, a publicly traded company that provides clinical imaging solutions, did follow Saylor’s lead before Saylor took office, announcing that it had invested $1.8 million in Bitcoin through a private placement.