Author: Ignas Source: DeFi Research Translation: Shan Ouba, Jinse Finance

The market has shifted from dull to uncertainly bullish. Crypto markets have been lackluster since May.

Prices are stagnant, airdrops are disappointing, infrastructure projects are exhausting, and regular investors are inactive. Crypto Twitter is now more about politics than cryptocurrencies.

The market remains uncertain, but this uncertainty is more bullish than bearish. Let me explain.

External uncertainty

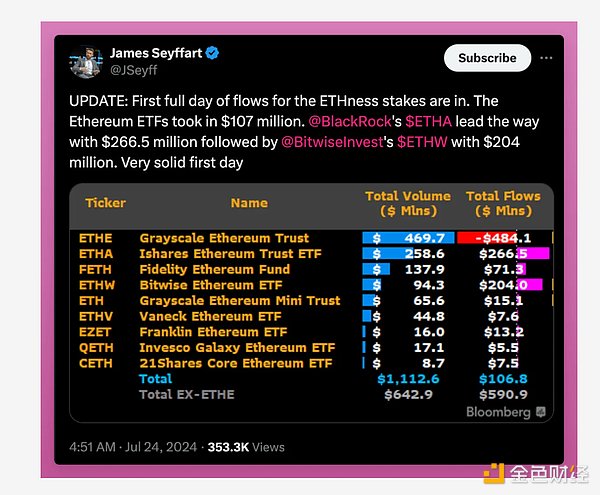

First, the Ethereum ETF is finally online and the data is beginning to be released.

On the first day, the ETH ETF’s trading volume reached $1 billion, accounting for 25% of the BTC ETF’s trading volume. It is expected that the ETH ETF’s trading volume will be between 10% and 20%, which indicates that this is a bullish signal.

But will this trend continue? Will inflows exceed Grayscale’s outflows?

This is the main uncertainty for ETH right now, causing the price of ETH to fall. But over time, this uncertainty will gradually diminish, and Grayscale will hold less ETH.

If every day we hold this price level it will be a bullish sign.

Next up is the US election. Will Trump win? Will he declare Bitcoin a reserve asset at the Nashville conference? Is Kamala really willing to change the Democratic Party’s stance on cryptocurrencies?

Too many uncertainties.

The market doesn't like uncertainty; it wants answers. However, I believe that the United States will eventually change its negative stance on cryptocurrencies, which is a natural process in the development of technology.

Third, Mt Gox creditors. Will they sell their BTC, or will they hold on? Or will they sell BTC and buy other crypto assets?

We don’t know yet. This uncertainty has a negative impact on cryptocurrency prices, but one day we will realize that it doesn’t matter. Just like the German sale of BTC, the Mt. Gox incident will pass, leaving behind the selling pressure we have been worried about for years.

So, what is my point?

It is often said that the markets are driven by two forces: fear and greed. However, I believe that fear is more powerful than greed.

Loss aversion is a powerful force in investing, making fear a more dominant driver than greed. The pain of losing money is stronger than the excitement of making money, making us overly cautious. This fear leads to early selling or makes people unwilling to invest even when there is a good opportunity in front of them.

In markets, this means that fear often drives decisions more than the appeal of potential gains, leading to conservative and overly bearish reactions.

Over time, our fear will decrease and FOMO will set in. The current external uncertainty is temporary. Grayscale will eventually run out of ETH, Mt. Gox creditors will sell what they want, and even if Trump loses and the Democrats remain against crypto, we will be able to continue to prosper as we have for years under this anti-crypto government.

However, external uncertainty is only part of the bullish sentiment. There are also things going on within cryptocurrencies.

Internal uncertainty

Internal uncertainty refers to decisions made by the local crypto community, such as developers, traders, and airdrop farmers. This bull run is somewhat boring because it is mainly driven by external factors, such as:

BTC/ETH ETF

The government's erratic policies

Potential interest rate cuts, etc.

We really lack strong internal innovations to attract regular investors and keep them interested. So far, there are only two internal factors that have triggered FOMO in this bull run:

Memecoins

airdrop

Airdrops have re-energized old and new DeFi dApps, generating seemingly positive engagement metrics, but these are mostly fake and driven primarily by speculators who use dApps solely for the airdrops.

The enthusiasm around the airdrop has waned, evident in the drop in sentiment on X and falling interest rates on lending platforms as farmers borrow assets to maximize their yields.

You can see that the Stablecoin IPOR Index has dropped from 20% to 7% since March, but is still higher than it was a year ago.

This is nothing new to anybody. What is uncertain is how we can continue to issue tokens to the market and convince people to buy them.

This is my biggest problem. Every cycle, we find new ways to release tokens to the market. Points for airdrops is just the latest trend, but it will definitely not be the last. Those who realize how it works first will get the highest return on investment (ROI).

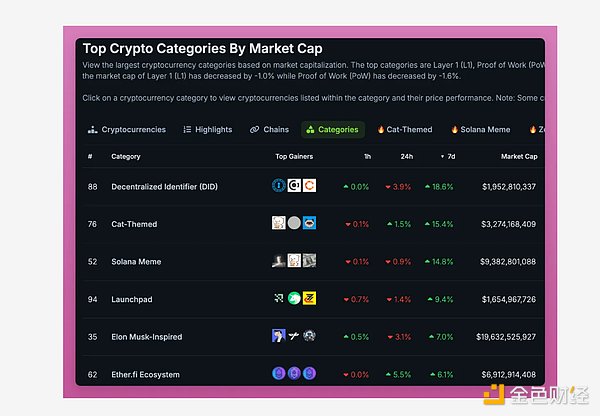

Currently it seems that only memecoins are still performing relatively well.

As the market turned bullish this week, memecoins emerged as the best performing sector. This means that speculators are bullish but waiting for the right time to enter the market.

Nothing else is going up except memecoins.

Making money on memecoins is equally challenging because thousands of memecoins enter the market and most go directly to zero.

I believe this uncertainty about the future of token issuance is why DeFi tokens may perform well later in the cycle.

DeFi OG tokens like UNI, MKR, LDO, AAVE, and SNX have large circulating supplies, reducing the risk of a massive sell-off.

With potential regulatory clarity, these tokens, backed by solid business models and revenue generation, could attract more capital inflows. In particular, DeFi OG tokens offer an interesting hedging option as the market tires of memecoins and new tokens pour in.

Currently, memecoins are doing well because tokens with utility are considered “securities” by regulators, but memecoins lack utility and are less risky from a regulatory perspective. Positive signals from the government could significantly change the mentality around cryptocurrencies.

But it's all still full of uncertainty.

Summarize

There has always been a lot of uncertainty in the cryptocurrency market. Despite this, we have seen success in global cryptocurrency adoption, such as ETFs, risk asset allocation, and cryptocurrency becoming a political issue. I believe this adoption trend will continue.

This uncertainty is actually good because it allows us to overcome obstacles and make progress. Like religion, cryptocurrency influences more and more people. However, once it becomes a dominant force, the uncertainty disappears and the growth potential decreases.

Uncertainty is the engine of growth.

Internal uncertainty is of a different kind. What worked before no longer works. We have hit roadblocks and need new innovative approaches to move forward. While some innovations are emerging, it is not clear what will truly revolutionize the new coin printing press.

I was optimistic because I believed I could be one of the first to find it.