Author: TheiaResearch Article translation: Block unicorn

I am optimistic about the future of our industry, but I am not expecting another bubble like the one I saw four years ago. I expect excellent assets—and there are many excellent assets—to perform well over the next few years, and I am betting all my capital on that expectation. However, there is a strange idea built into the structure of the industry that even worthless assets should trade at astronomical valuations every four years. This has already happened twice—once in 2017 and again in 2021—so logic dictates that it should happen again in 2025. I believe this idea is wrong and is holding our industry back.

Divide the world into two paradigms - the fundamentals paradigm and the cyclical mania paradigm. The fundamentals paradigm means that you believe in the long-term vision of the industry, but do not expect the token to trade above its intrinsic value. Under the fundamentals paradigm, investors are incentivized to work with great teams to build profitable businesses in large markets, and builders are incentivized to focus on the basic economics of products, customers, and the business. On the other hand, the cyclical mania paradigm means that investors believe that bubbles will occur every four years and none of this matters. The natural incentive is to time the market and try to invest in tokens with narrative value when the mania begins. There is no need to consider fundamentals or whether the team is building for the long term - none of these issues matter when the price of each asset is far above its intrinsic value.

I think it is surprising that many investors operate under a cyclical mania paradigm and will be disappointed in the next few years as fundamental strategies perform well and narrative tokens do not. There are too many sellers and too few buyers to repeat the situation of 2020-2021.

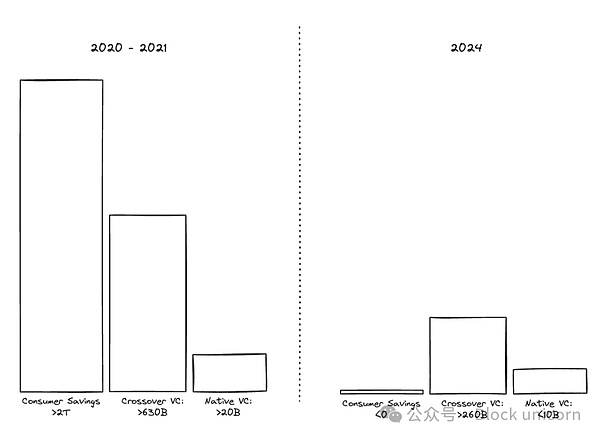

We are experiencing a bubble in 2021 as multiple inelastic buyer groups meet in a market with little supply. We are seeing local venture capital funds raise over $20 billion in 2021 and aggressively deploy that capital into the market as quickly as possible. Crossover funds raised $630 billion between 2020 and 2021, building on over 10 years of good performance during the 2010-2020 technical bull run, and aggressively deploying into the crypto market. Retail investors have ~$815 billion in stimulus checks in their hands and are confident in the industry. Super-cap investors also have $1.5 trillion in new capital thanks to the rapid price increases of BTC, ETH, and SOL (and a number of other tier-one tokens that are trying to replicate those gains). People in these groups believe that the industry will deliver on its promise in the short term; they believe that on-chain finance will disrupt Goldman Sachs in the next few years and that everything will be built on the blockchain ecosystem by the middle of this century.

With no sellers to meet this demand, the only people entering this period holding large amounts of tokens are the founders and a few early venture investors. They can’t sell — partly because of the lockup period, and partly because they believe in the story and have new capital to invest. Remember the logic of market cap: if 90% of tokens are locked up and only 10% of tokens are trading at double the price, the total market cap will double as well. Therefore, the growth in market cap during the last bubble was mainly due to too many buyers buying up too few tokens from too few sellers.

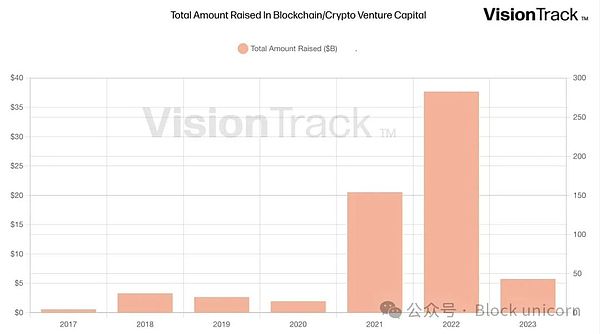

The structure of the market is completely different today, and it has become much more difficult for local funds to raise new capital. Fundraising in 2023 is down 85%, with little recovery in 2024 (e.g. Paradigm raising $800M in 2024 vs. $2.5B in 2021). Crossover funds will be slow to return, and retail investors have largely disappeared as consumer savings fell from over $2 trillion in 2021 to negative numbers in 2024. The remaining retail participants would rather invest in meme coins (or shit) than in the complex infrastructure narratives that are embedded in venture capital unlocking. The big players are showing a shift in preference for the yield of core assets (like BTC, ETH, and SOL) rather than narrative tokens. While there is a group of directional liquidity funds willing to buy tokens, they are small compared to the overall market, and we don’t want to buy low-quality assets at high valuations.

There is a slight forced selling dynamic in the market. There are two core return metrics in venture capital (VC) - total value to paid capital ("TVPI") and paid distributions to paid capital ("DPI"). TVPI includes realized gains on assets you have sold and unrealized gains on assets you have not sold but have marked, DPI only includes cash returned, reflecting how much money has been returned for each dollar invested. VC funds raised before 2019 have performed quite well in both TVPI and DPI, but most of their returns are still on the books. These large funds are reaching the statutory end of their life cycle, which means they need to sell their remaining positions to return capital to fund investors. VC funds raised after 2019 still have plenty of fund life left, but with DPI returns being modest (<0.10x) in most cases, and fund investors demanding to see DPI returns before allocating to the next fund, the largest holders in this industry are likely to be net sellers in the coming years.

In late 2023 and early 2024, many investors tried to get in ahead of another mania, causing narrative token prices to rise. The problem was that most people were buying assets they didn’t really believe in, hoping someone would buy them from them at a higher price. This wave of foolish money did not show up, and the market rejected a true bull run attempt for narrative tokens. These buyers will not show up, and narrative tokens will continue to underperform for years to come.

We are on the eve of a fundamental shift, and those who believe in the vision of an internet-based financial system understand that we are still in the early stages of one of the greatest cash flow opportunities in the history of capitalism. To benefit from it, you just have to work hard and focus on the fundamentals.

I wish our industry could develop like Silicon Valley did after 2001. The entire industry thrived over the next few decades, but only through hard work, product-market fit, and proper risk assessment. Voodoo valuation techniques like "click-through valuation" and "eyeball valuation" faded away as the market shifted to valuation based on first principles and basic economics. During this time, companies like Amazon, Apple, and Google built the most profitable businesses in the world, and almost everyone who worked hard and focused on the fundamentals succeeded.