Written byBiraajmaan Tamuly

Compiled by: Mars Finance, MK

Despite the launch of the Ethereum ETF, the ETH price failed to break through the $3,400 resistance level. The main reason was the massive outflow of funds from Grayscale’s spot Ethereum ETF.

Ethereum fell to $3,278, and despite the launch of a spot Ethereum ETF in the United States, the market will still end July with a loss of about 1%.

Since the US spot Ethereum ETF was listed on July 23, the market's immediate response has caused its price to fall by 9%. Since its listing, the price of ETH has fallen by 4.05%. In addition, there are other factors that may have hindered its price performance.

ETHE's capital outflow rate exceeds GBTC

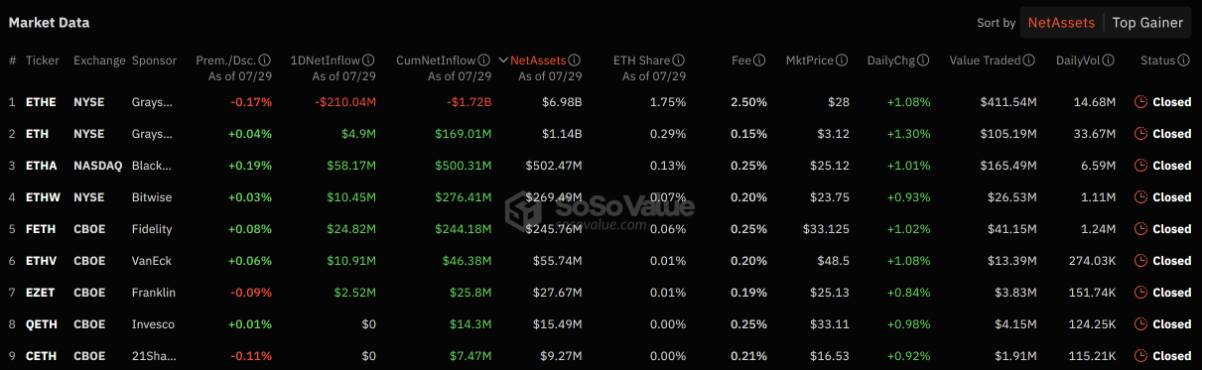

According to Sosovalue, the overall performance of ETFs has been poor, with cumulative net outflows currently reaching $439.64 million.

As shown in the chart below, the vast majority of the selling pressure came mainly from Grayscale. As of July 29, other major spot ETH ETFs including BlackRock, Bitwise, and Fidelity all recorded positive daily inflows.

Source: Sosovalue

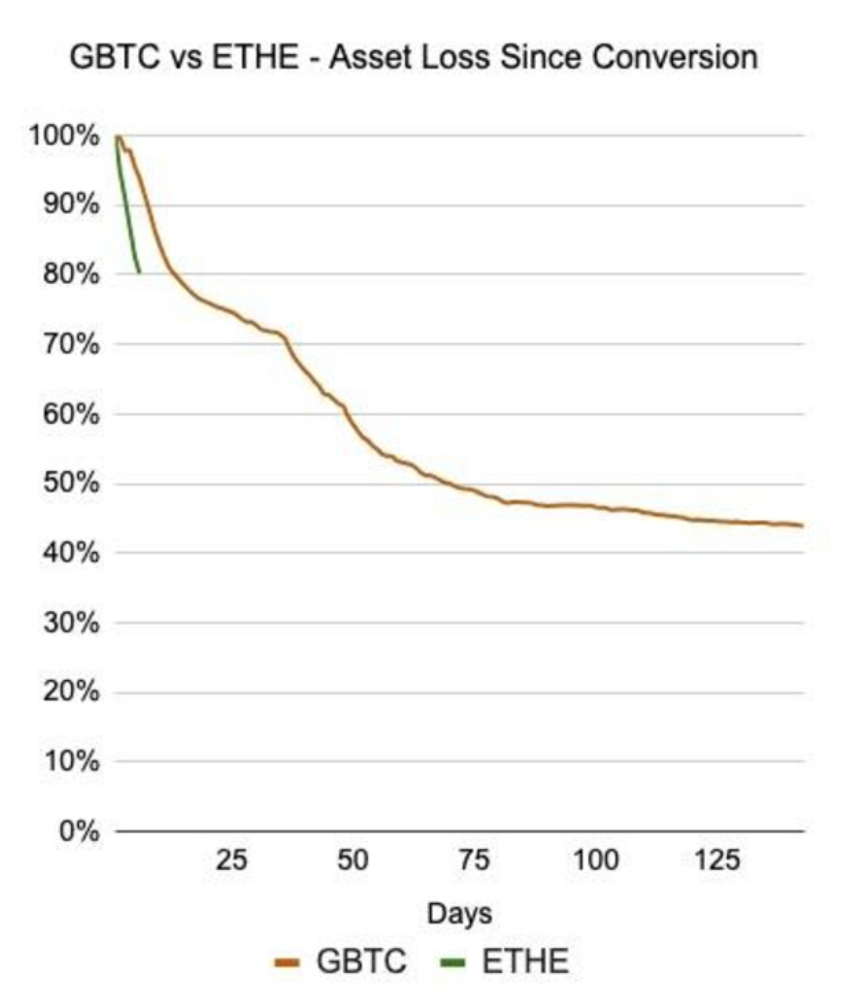

We also noticed that Grayscale’s ETHE saw faster outflows than GBTC following the sharp drop in the Bitcoin spot market. Bitcoin price fell to $66,317, and the ETF has been in existence since its launch in January. The chart below highlights the asset losses of both investment vehicles since the conversion. GBTC vs. ETHE asset losses since the conversion

Image source: Glassnode

According to Cointelegraph, analysts expect Grayscale’s massive outflows from ETHE “may” decrease this week.

Exchanges have “almost no demand” for ETH

In addition, Ethereum exchange withdrawal volume has decreased significantly since March. Independent analyst Crypto Lion pointed out that this metric is closely related to price and indicates "almost no demand."

Source: Cryptoquant

Crypto Lion also believes that the estimated leverage ratio (ELR) has driven ETH’s price action during this turbulent period. This metric reflects the ratio of open interest in futures contracts to exchange balances. A higher ELR indicates that futures/perps are dominating price action, which is usually short-lived or volatile. He noted:

After the ETH ETF was approved, the price of ETH fluctuated in a range. However, it is recommended not to buy it without withdrawals and the ELR issue is not resolved.

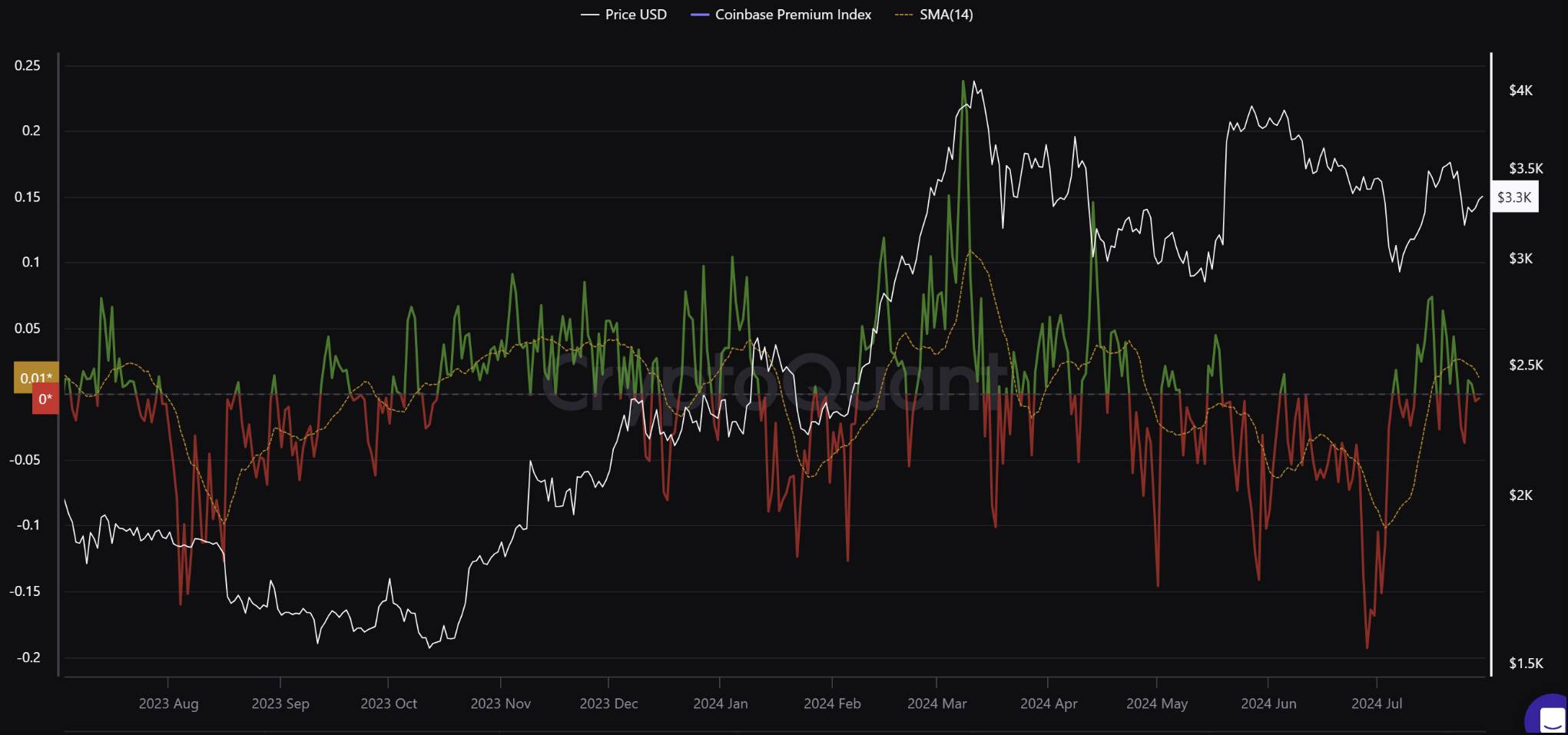

Coinbase Premium Index turns negative

Coinbase’s data also shows a similar lack of demand. In the second quarter of 2024, Coinbase’s ETH premium index continued to decline. The index reached its high point for the year in March, which coincided with ETH’s peak, but has now turned negative. Negative premium values indicate that U.S. investors lack buying power and spot demand has dried up.

Source: Cryptoquant

In May 2024, the potential approval of an Ethereum ETF increased Coinbase’s spot buying volume, which had a bullish impact on its price. The Coinbase Premium Index also surged above 0.15, indicating the presence of demand from ETH spot buyers. As mentioned above, the current downward trend of the index has had an opposite effect on ETH prices.