The sell-off in Asia-Pacific markets continued on Friday as investors awaited important trade data from China and Taiwan this week, as well as central bank decisions in Australia and India. The Nikkei 225 Index and Topix Index fell sharply, indicating that the market is under tremendous pressure. Japanese micro-strategy Metaplanet fell 18% and has fallen 55% in the past five days.

Table of contents

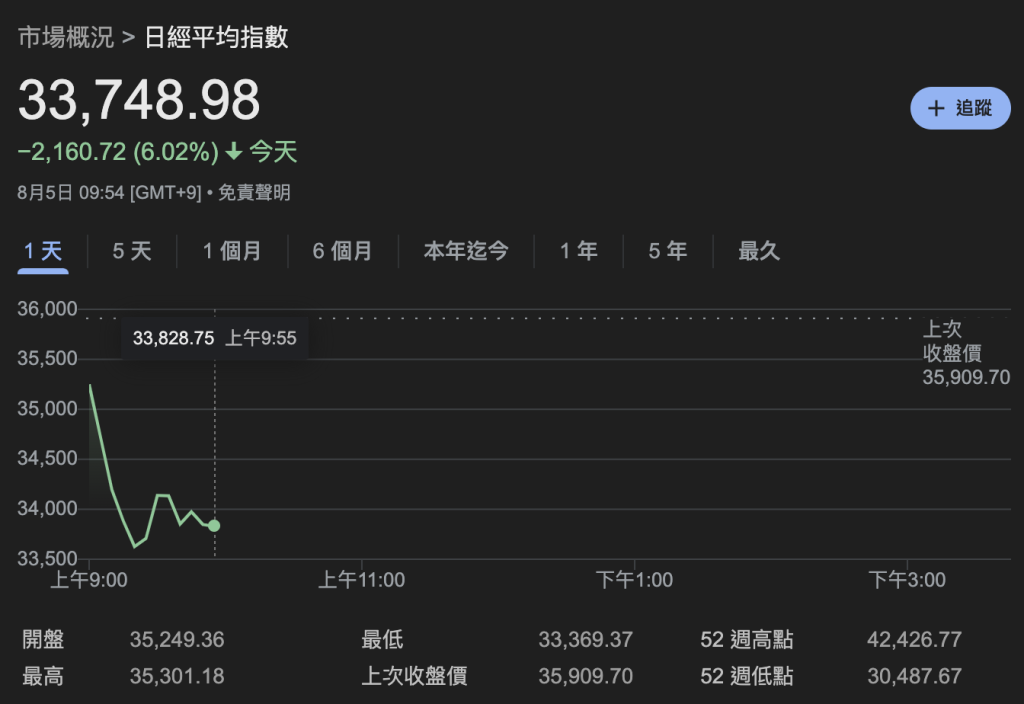

ToggleJapanese stock market leads decline, individual stocks trigger circuit breaker mechanism

The Japanese market led the decline in the Asia-Pacific region. The Nikkei 225 Index and Topix Index fell by up to 7% in volatile trading, and individual stocks once triggered the circuit breaker mechanism to suspend trading. Share prices of heavyweight trading companies such as Mitsubishi, Mitsui, Sumitomo and Marubeni all plunged more than 10%. At these levels, the Nikkei and Topix are close to the edge of a bear market, down nearly 20% from their all-time highs on July 11.

Bear market signs, worst day in eight years

Monday's losses extended a sell-off on Friday, when Japan's Nikkei 225 and Topix dropped more than 5% and 6% respectively. The Topix had its worst day in eight years, while the Nikkei had its worst day since March 2020.

Interest rate hike strategy triggers strong yen

The yen also rose to its highest level against the dollar since January in early trading on Monday, last trading at 145.42. This further exacerbates market instability.

Asia-Pacific economic activity data

On Monday, S&P Global will release data on services sector activity in regional countries including India and China. These data will have an important impact on market sentiment.

Australian market trends

Australia's S&P/ASX 200 index fell 2.3%. The Reserve Bank of Australia begins a two-day monetary policy meeting on Monday. Economists polled by Reuters expect the central bank to keep interest rates unchanged at 4.35%, but the market will focus on the monetary policy statement to see whether the central bank is still considering raising interest rates.

South Korea and Hong Kong markets

South Korea's Kospi fell 3.9% and the Kosdaq fell 3.5%.

US market impact

U.S. stocks fell sharply on Friday as a jobs report for July fell far short of expectations, raising concerns that the economy could slip into recession. The Nasdaq became the first of the three major benchmarks to enter correction territory, falling more than 10% from its all-time high. The S&P 500 and Dow Jones Industrial Average are 5.7% and 3.9% below their all-time highs, respectively.

These volatile market sentiments and changes in economic data have added uncertainty to the future economic outlook. Investors will pay close attention to upcoming data releases and central bank decisions to adjust their investment strategies.