Author: Yohan Yun Source: cointelegraph Translation: Shan Ouba, Jinse Finance

The latest market crash has sent shockwaves through global financial markets, with the price of Bitcoin (BTC) dropping below $50,000 for the first time since your grandma asked you what Dogecoin (DOGE) was. But you’re eerily calm because you’ve been on this crypto roller coaster countless times.

If you feel this way, congratulations, you are already a seasoned cryptocurrency veteran who knows that market volatility is just part of the game .

The plane just shook more, and at times, the in-flight movie was a horror film. So buckle up and check out these 10 signs you’ve been in the crypto space too long:

1. You called the 28% drop a “healthy correction” that “cleared out leverage”

Investing in cryptocurrencies takes a toll on your emotional state. Your soul becomes numb and your computer mouse is covered in sweat stains from countless battles. But this is proof that you are now more mentally stable than ever, even if your portfolio isn’t.

“As long as Tether is stable, I am stable,” you mutter to yourself.

Bitcoin's drop from $62,000 to below $50,000? Just a healthy correction to clear leverage. You believe these big drops are a sign of a bull run, to scare off weak-willed retail investors.

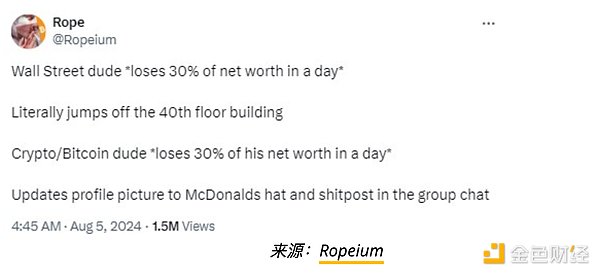

2. You lost 65% of your net worth in one hour, and your first thought is to post a funny picture

Your portfolio is shrinking rapidly and you must act fast before it's too late.

All those friends you pulled into the crypto world are messaging you, blaming you for the market crash. You ignore the chaos and focus on finding the perfect funny picture of a person wearing a McDonald's hat. The world has to know that you're going to flip burgers starting tomorrow to make ends meet. You publish your masterpiece, and just like that, your anxiety is gone. Everything is back to normal again. With priorities in place, you finally take a look at your portfolio - it's all black. But hey, Bitcoin is super cheap today. buy the dips!

3. You like retailers to accept Bitcoin, but you never use it for payment

A new coffee shop opened near your house and it accepts Bitcoin payments. But let’s be honest, you’d rather pay with fiat currency. You work at the Bitcoin cafe all day with your laptop. Of course, the first time you’ll pay with Bitcoin, just to let the new barista know that you’re in the crypto world. But that’s just a one-time thing. In the past, if a merchant accepted Bitcoin, you’d buy their stuff — whatever it was, you’d buy it. But you’re smarter now. If you continue to pay with Bitcoin, you’ll have to give up your precious coins and buy more with fiat currency on a decentralized exchange. Why would you do that? It’s like having your cake and eating it, and then baking another one instead. No, it’s not going to happen.

4. You start seeing celebrities endorse tokens for money, not mass adoption

Once upon a time, a well-known celebrity launched his own cryptocurrency project, which filled you with hope that the industry would soon see millions of social media followers. “That’s what I call mass adoption!” you once said, pumping your fist while sitting at your desk for 18 hours straight.

You go through several cycles and watch these projects collapse, with some of their world-class stars becoming notorious for deceiving fans and getting sued by the SEC.

Fast forward a few years, and a top celebrity launches his own token. Thousands of people innocently buy it, while crypto sleuths point to insider trading.

“These poor people got scammed! This is too bad for mass adoption!” you slap your forehead as you lie in bed, clutching your laptop for the 19th straight hour.

5. You turn off the lights to save money, you're very frugal, you only buy Thursdays, but you're willing to spend $20,000 on new memecoins

Ah, the bear market has struck again. You’re back to turning off the lights like you’re avoiding a vampire, making your own coffee, forbidding takeout, and only eating burritos on Tuesdays. The financial commentators on TV harp on about recession fears and geopolitical tensions, but you’ve been through enough bear markets to know what to do. You’ve mastered the art of surviving until the bull market returns. But wait, what is this? A shiny new meme coin that promises to change your life and let you drive a Ferrari. Every part of your sanity is screaming resistance, but the speculator in you is too strong. Before you know it, you’ve thrown $20,000 into it, shouting “LFG!” and “YOLO!”

6. When Pepe drops to $0.000002, you regret not buying it at $0.000001

We all have a decision we regret that we keep looking back on. Maybe it was ignoring that Bitcoin enthusiast in 2013, losing a hardware wallet, or losing a crucial password.

As the cryptocurrency expert in your circle of friends, you confidently tell your crypto-novice friend to stay away from that new meme coin he found on X. Your scam sensors are off the charts.

Then you sit next to him, watching him awkwardly as Pepe (PEPE) ignores your intelligence and soars from $0.000001 to $0.000002.

7. Your friends are anonymous anime characters and frogs you've never met

You’ve made more friends in crypto than in the rest of your life combined, but you’ve never actually met most of them — you only know their NFT avatars. A friendly wealthy cartoon monkey knows more about you than any of your real-life friends, including how much money you actually have, because you’ve traded crypto together and they can see all your wallet activity. You call your offline friends “real-life friends,” while your crypto friends are just “friends.” Oh, and your real-life friends think you have more Bitcoin than you actually do.

8. Ten years later, you finally give in and sell your crypto two hours before the biggest crypto bull run in history begins

You’ve spent the past decade guarding your wallet through the coldest crypto winter. You’ve finally accepted that crypto isn’t going to let you retire at 35 like your Instagram bros promised.

So, you sell.

Two hours later, Bitcoin exploded and you were left watching the biggest bull run in history from the sidelines. It was just your luck, right?

You laugh to keep from crying and distract yourself by searching for the perfect meme to express your newfound freedom from crypto torture.

“At least I can sleep now”, you think as you open the crypto exchage on your phone.

9. You enter the fourth bull market before you become a millionaire

You initially got into crypto because someone told you that if you bought 1 Bitcoin, you would be one of the richest people in 50 years. But now, the price of Bitcoin has gone through the roof, and you only have 0.3 Bitcoin and 100 million PEPE, and your alarm goes off, it's time to get up and go to work. You thought you had enough time to accumulate more Bitcoin or Ethereum during the bear market, but you've burned all your Ethereum to pay gas fees, and most of the money went into meme coins. Well, try again during the next bear market. Maybe by then, you've mastered the art of holding on and not being tempted by the meme coins that promise to make you rich overnight. In the meantime, go back to work and dream about what it would have been like if you had bought 1 full Bitcoin.

10. You start to think that Satoshi might mean “Central Intelligence Agency” in Japanese

Yes, there are credible theories, and you’ve seen all the YouTube videos. They pepper your brain with all sorts of crazy ideas, like cryptocurrencies are a CIA economic experiment and Satoshi’s untapped Bitcoin reserves are the U.S. government’s emergency fund for future global crises.

Now, you understand why Bitcoin has no leader - Bitcoin is designed to be decentralized. No leader, no problem, right?