Bitcoin continued to fluctuate wildly in a turbulent August, opening the week below $60,000. After a dramatic recovery from a six-month low, Bitcoin (BTC) price action is struggling to resume its bullish trend. Who will be in control in the coming days? While the showdown between bulls and bears has already begun, there are still many volatility factors that could bring surprises.

The main source of volatility comes from macroeconomic data outside the crypto community, especially the U.S. Consumer Price Index (CPI). July's CPI data is closely watched by analysts because of the controversy over how the Federal Reserve will respond to instability in global markets. CPI data will be released on August 14, followed by the Producer Price Index (PPI), while unemployment claims data will be released over the weekend.

For traders, the double "death cross" on BTC/USD is a warning that adverse conditions can occur even in a bull market. Bitcoin network infrastructure has also responded to recent market turmoil, with mining difficulty expected to drop for the first time in six weeks. Cointelegraph will take a closer look at the key factors currently affecting the market.

Bitcoin price action ‘volatile’

BTC/USD 1-week chart. Source: TradingView

After a quiet weekend, Bitcoin’s volatility rose at the close of the week, with a last-minute drop attributed to manipulation by large traders. According to data from Cointelegraph Markets Pro and TradingView, the closing price was just over $58,700, a slight rebound from the $10,000 loss two weeks ago.

The Asian trading session on August 12 continued the theme of volatility, with a local low of $57,700 on the Bitstamp platform. “It’s all chaos on the short timeframes, but the weekly chart tells a different story,” famous trader Jelle responded on X.

165 days of mid-term consolidation, this cycle is not over yet

Another trader, Roman, said: “We are slightly above expectations but the 55k support test is the next focus. I will be looking for a long setup in this area.”

Credible Crypto noted that “ buy liquidity on exchange order books is currently slightly above the ‘untouched lows’ around the $55,000 region.

“Many are eyeing the green bullish zone between 54.5-56.5k as there is local demand there, as well as the same unexplored lows,” he wrote in part of X’s post, along with an explanatory chart.

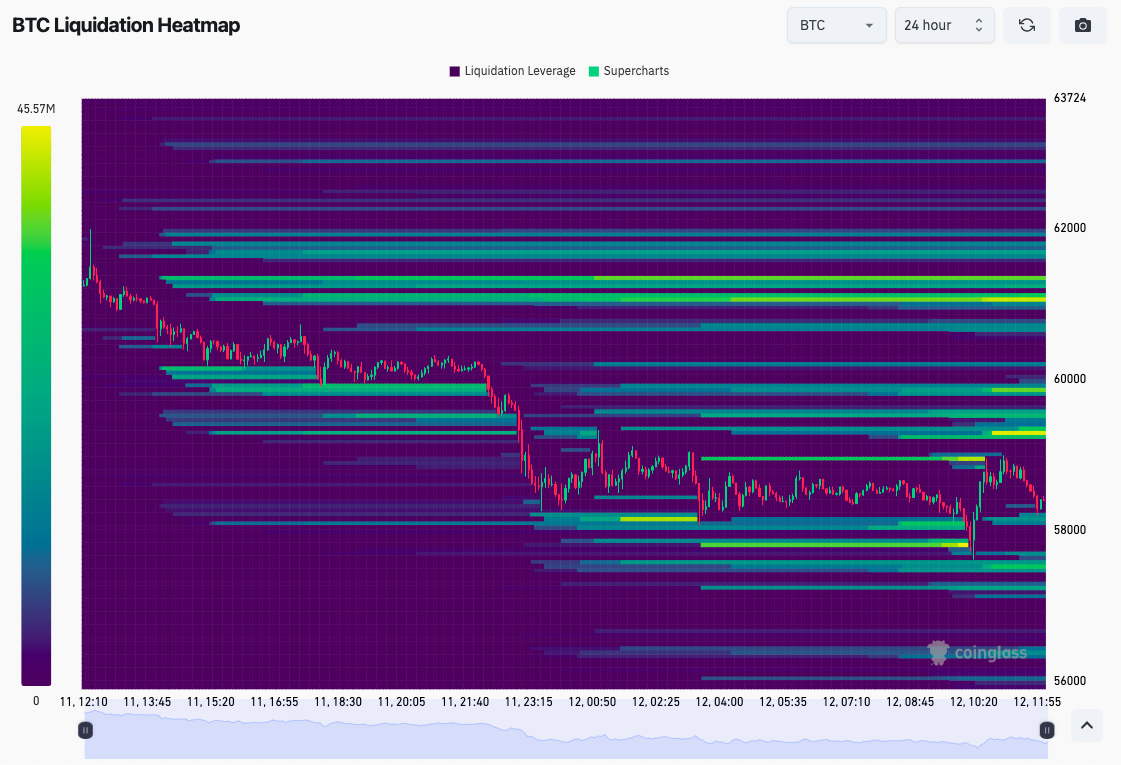

Having said that, the heatmap shows that there is a lot of bids above this area, ahead of the ‘ideal’ long zone.

BTC/USDT chart showing Binance liquidity. Source: Credible Crypto

Credible Crypto acknowledged that open interest has been reset to the weekly close.

He concluded: “I wouldn’t be surprised if we lead the 54.5-56.5k area and reverse before then.”

BTC liquidation heat map. Source: CoinGlass

Bitcoin Bulls Face Double Death Cross

Bitcoin has formed two separate “death crosses” over the past week, an issue that has captured the attention of the trading community.

Cointelegraph reported that these crossovers involved the 21-day, 50-day, 100-day, and 200-day simple moving averages (SMAs).

Recently, the 21-day SMA crossed below the 100-day SMA, and the 50-day and 200-day SMAs also repeated this action.

Keith Alan, co-founder of Material Indicators, confirmed that “the Bitcoin bull market failed to avoid the second death cross.” However, he believes that these death crosses are not the final conclusion of the market, and the volatility of the market may still offset its impact.

“Again, they’re lagging indicators, so you have to wait and see,” he said.

Previously, renowned trader Benjamin Cowen believed that a daily close above $62,000 was necessary to avoid further death cross issues in the future.

BTC/USD 1-day chart, 50,200 SMA. Source: TradingView

CPI week is coming, VIX volatility remains unstable

This week's CPI and PPI data will undoubtedly be a challenge for risk asset traders.

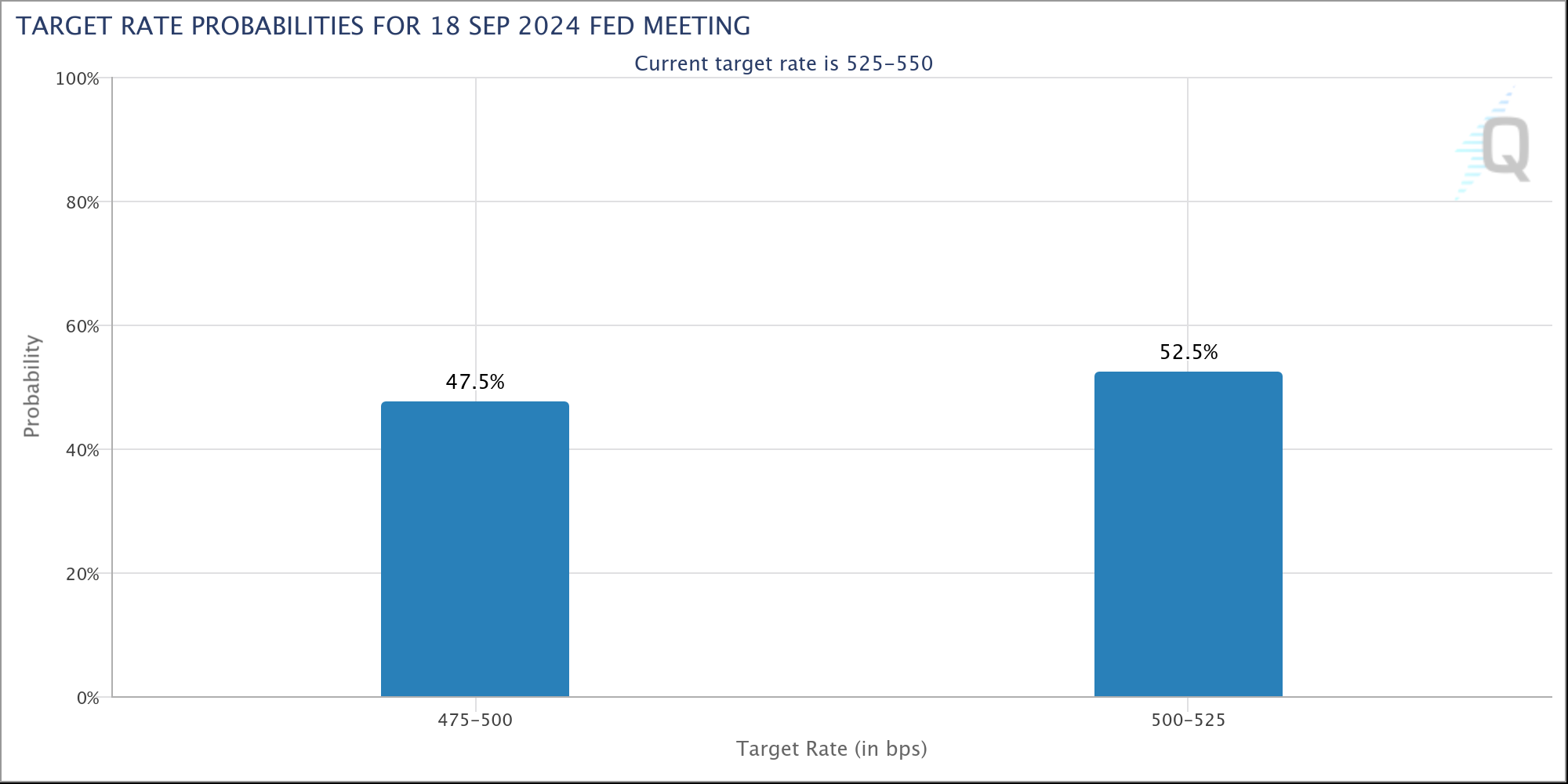

Any surprise would add to the complexity of U.S. inflation, with the Federal Reserve already under pressure to cut interest rates at its next meeting in September.

The turmoil surrounding Japan last week added further pressure on the Fed to respond, but as of now, the status quo remains unchanged - interest rates are at their highest level in more than two decades.

“We face a busy week,” The Kobeissi Letter concluded, noting that the VIX volatility index remained elevated after reaching its third-highest level on record last week.

Kobeissi noted that the VIX volatility index remains elevated after hitting its third-highest level on record last week.

However, the CPI itself is expected to continue to decline, which should prompt the Federal Reserve to consider a crucial rate cut.

Charlie Billelo, chief market strategist at wealth management firm Creative Planning, sees fuel prices as a potential factor leading to a dovish Fed.

“U.S. gasoline prices have fallen from $3.82 a gallon a year ago (a 10% drop) to $3.45 a gallon (the national average),” he noted last week.

“If this continues, it could be a factor in depressing headline CPI in August (the Cleveland Fed currently forecasts 2.7%), thus solidifying the Fed’s rate cuts.”

The probability of the Fed's target interest rate. Source: CME Group

The latest data from CME Group's FedWatch tool showed that as of August 12, markets were pricing in an almost equal chance of a 0.25% and 0.5% rate cut in September. The latter probability rose significantly during the height of the Japanese market volatility.

Mining difficulty will see a moderate correction

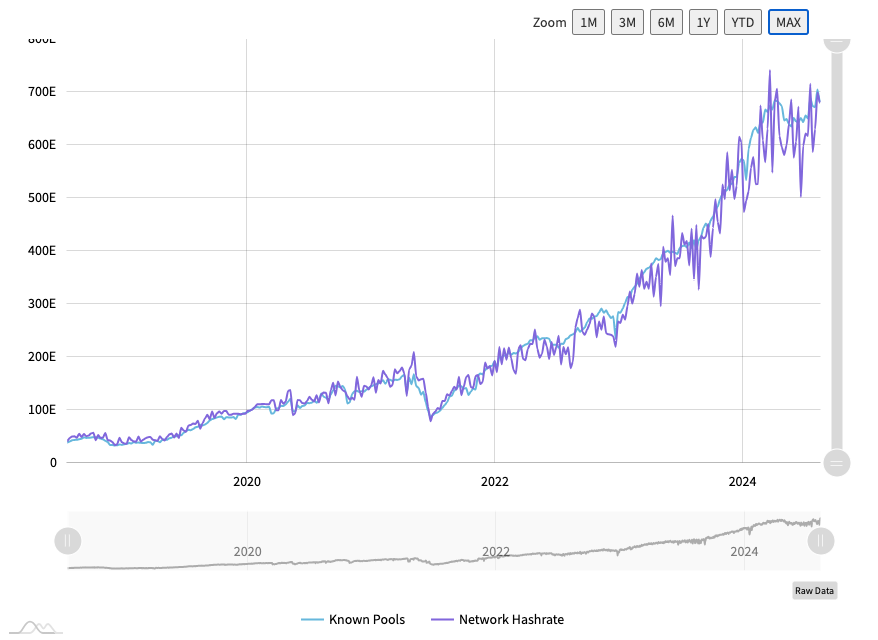

The Bitcoin network infrastructure is now beginning to react to the market turmoil of the past two weeks.

During this period, BTC/USD’s six-month low has turned into a retest of $63,000.

The mining difficulty is currently expected to drop modestly in the automatic adjustment on August 14. BTC.com expects the drop to be approximately 3.5%.

This would be the first difficulty drop in six weeks, but would be fairly normal for a year that has already seen several drops of more than 5%.

Overview of Bitcoin network basics (screenshot). Source: BTC.co

Meanwhile, raw data from MiningPoolStats confirms that hash rate continues to hit new all-time highs. This highlights the growing resilience of the mining industry, which has begun to adapt to the post-halving situation.

Bitcoin hash rate raw data (screenshot). Source: MiningPoolStats

By analyzing data from U.S. mining companies, Ki Young Ju, CEO of crypto analytics platform CryptoQuant, stressed that the average cost of mining 1 BTC is still around $15,000 lower than the current spot price.

“The average mining cost per Bitcoin for U.S. miners is about $43,000. Marathon Digital’s second quarter 2024 report puts the average mining cost per BTC at $42,969,” he noted last week.

“This can be calculated using their operating hash rate, their cost per petabyte of hash per day, and the average number of bitcoins mined per day.”

Crypto market sentiment hits multi-year lows

As the crypto market fluctuates, trader sentiment also changes.

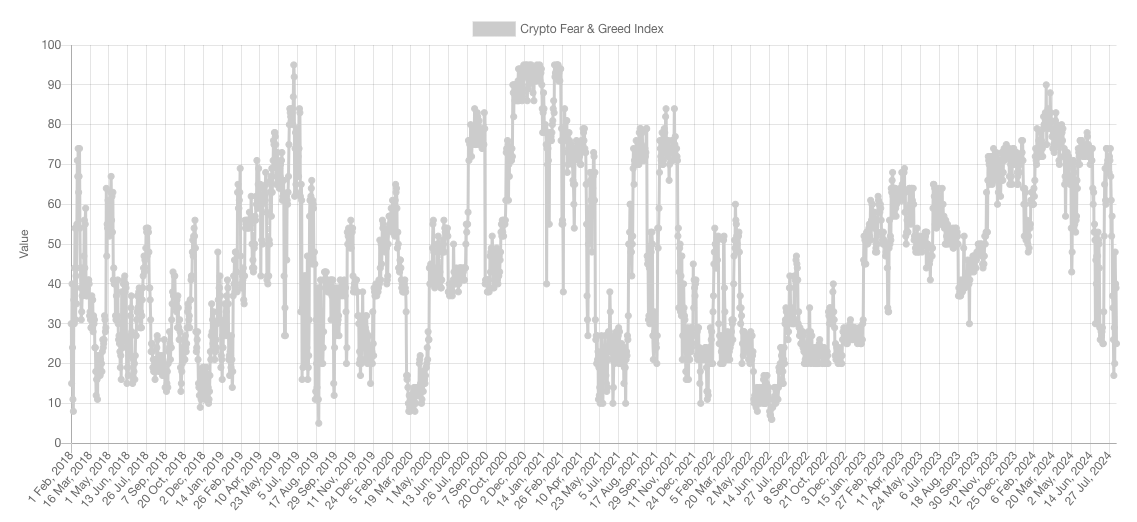

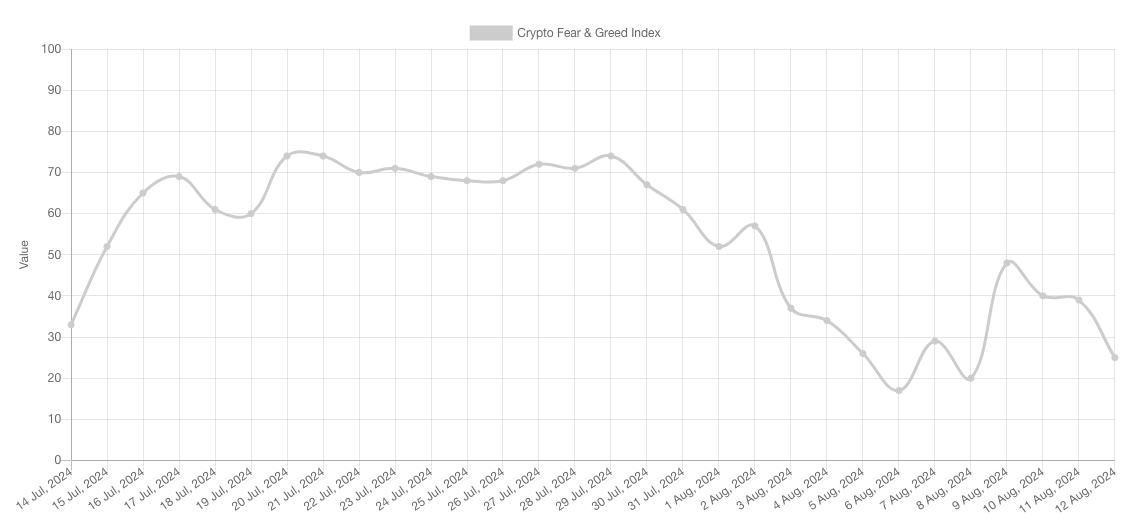

The latest reading from the Crypto Fear & Greed Index was surprising, with wild swings reflecting the fickle nature of market sentiment.

On August 6, the Fear & Greed Index fell to a low of 17/100, its highest level since July 2022, even exceeding the FTX crash at the end of that year.

Crypto Fear and Greed Index. Source: Alternative.me

Crypto Fear and Greed Index. Source: Alternative.me

BTC price then rebounded, shifting sentiment from “extreme fear” to neutral within a few days, hitting 48/100 before falling back again.

As a result, as of August 12, cryptocurrencies are back in “extreme fear” territory, albeit without a corresponding price drop.

Crypto Fear and Greed Index. Source: Alternative.me

Crypto Fear and Greed Index. Source: Alternative.me