Author: Matías Andrade Source: Coin Metrics Translation: Shan Ouba, Jinse Finance

Key Takeaways:

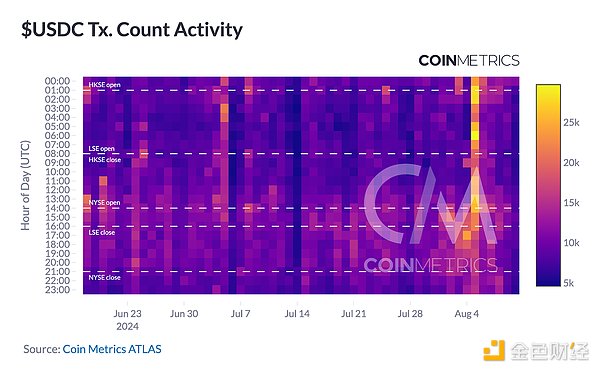

The Ethereum blockchain maintained consistent transaction activity during the crash, with USDC transaction activity increasing to nearly 30K txs/hour during this period.

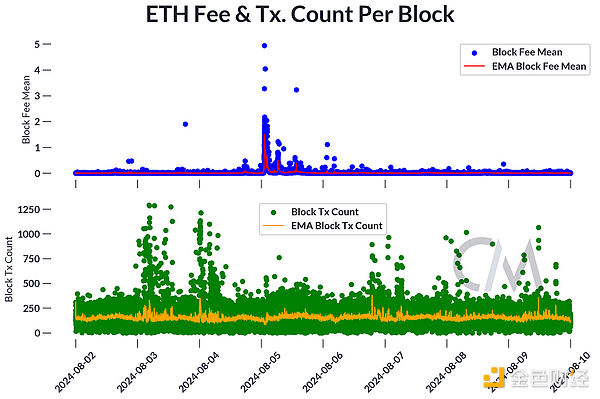

However, due to all this activity, gas fees spiked to over 5 ETH per block, but the network continued to function normally, allowing transactions to proceed at a higher cost.

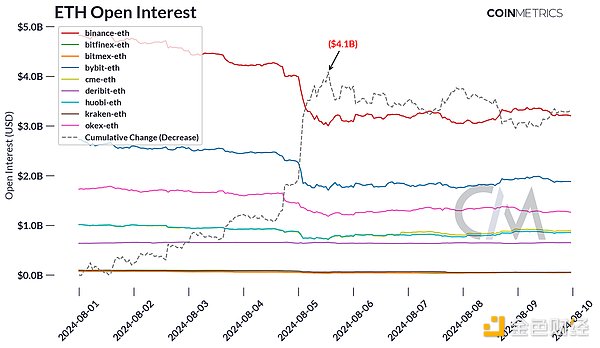

Ethereum futures open interest fell by $4.1 billion, providing insight into market sentiment and future price action, especially for traders who rely on the profitability of ETH carry trades or assets like USDe.

introduce

The recent crash in the cryptocurrency market has once again drawn attention to the stability and resilience of the crypto ecosystem. In this article we evaluate the performance of various elements within the crypto space during and after the crash and compare it to traditional financial markets. We will focus on two key areas: the robustness of decentralized systems and the stability of synthetic financial products within the crypto ecosystem.

Risks of License Financing

In the recent market crash, permissionless systems in cryptocurrencies, exemplified by Ethereum, stood in stark contrast to traditional financial markets. The Ethereum blockchain runs 24/7, enabling uninterrupted trading, while traditional markets have limited trading hours. However, while sufficiently motivated traders are able to interact freely, the cost is paying gas fees; similarly, or slippage similar to traditional markets.

Source: Coin Metrics Stablecoin Dashboard

As shown in the above chart, USDC trading activity shows that the Ethereum network maintained consistent activity throughout the crash without any errors. Users can continue to trade, although fees will be higher due to increased network congestion. This accessibility is in stark contrast to many traditional financial brokers, who reported downtime and maintenance issues during the same period.

Source: Coin Metrics Network Data Pro

As shown in the above figure, during the crash, Ethereum's gas fees rose sharply, with the gas fee for a single block rising by more than 5 ETH. Although transaction costs have increased significantly, it is important to note that the fee increase is temporary, and most importantly, the network is still functioning normally, and if users are willing to pay higher fees, they can execute transactions.

On-chain yield primitives

As various crypto-financial products mature, market participants have developed new and innovative ways to generate returns for on-chain investors. Unlike traditional stablecoins that may rely on off-chain collateral or centralized mechanisms to maintain their pegs, Ethena's USDe is primarily backed by on-chain assets and protocols (although it still interacts with CEXs).

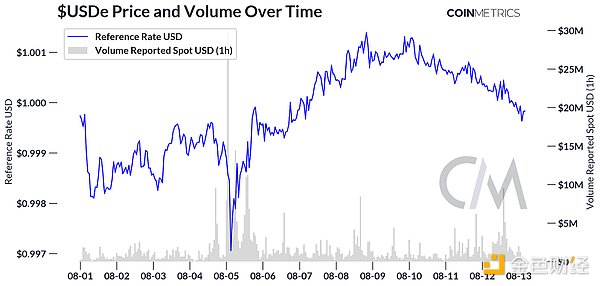

USDe is a synthetic stablecoin product created by Ethena on the Ethereum blockchain. Unlike traditional stablecoins that are backed by fiat currency reserves, USDe relies on a different approach to maintain its peg to the US dollar. USDe relies on staking ETH and short perpetual futures to generate returns on a dollar-neutral portfolio, creating a "synthetic dollar bond" that tracks the dollar while providing returns that are at least partially native to the Ethereum blockchain. We can see USDe's price activity in the last few days of August in the chart below, noting that the market has kept the peg within 0.3% of $1 par.

Source: Coin Metrics Market Data

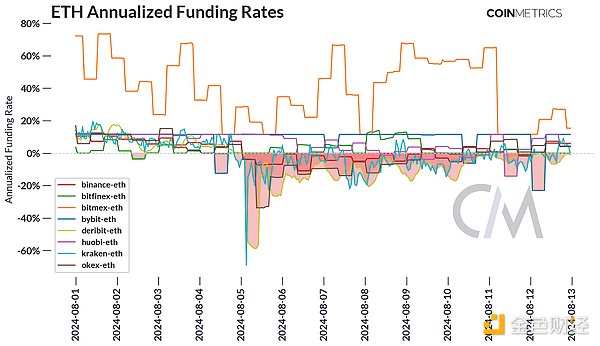

One of the main concerns about USDe is its reliance on centralized control and the potential fragility that this brings, especially the requirement for a consistently positive funding rate, which is critical to the sustainability of its peg to the dollar. However, during the weekend market correction, most ETH futures markets saw negative annualized funding rates, although by August 13, most markets had negative funding rates with a few exceptions.

Source: Coin Metrics Market Data

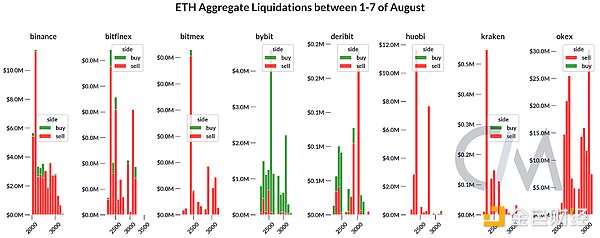

As shown in the figure below, market participants reduced their long exposure to ETH during the crash or were liquidated. The forced liquidation of these leveraged long positions caused open interest to fall further as open futures contracts were liquidated in large quantities. This self-reinforcing cycle of price declines, margin calls, and liquidations could exacerbate the market sell-off. Astute investors can use close monitoring of market liquidations to understand market characteristics, understand the underlying dynamics driving digital asset price movements, and adjust trading strategies accordingly.

Source: Coin Metrics Market Data

A decrease in open interest is often accompanied or preceded by a large price move or sell-off in the underlying asset as traders become more risk-averse and close out leveraged positions. A decrease in open interest can provide insight into overall market sentiment and the likelihood of future price action. In the chart below, we can see that open interest, measured by the grey dashed line, has decreased by approximately $4.1 billion.

Source: Coin Metrics Market Data

By analyzing changes in open interest and ETH’s price action, one can better understand the dynamics and sentiment of the Ethereum futures market, thereby informing trading strategies and risk management decisions.

in conclusion

The recent crypto market crash provides valuable lessons for understanding the strengths and weaknesses of the crypto ecosystem. While permissionless systems have demonstrated remarkable resilience in terms of accessibility and functionality, they also face challenges such as high transaction costs under stress. Synthetic products like USDE have demonstrated impressive stability, highlighting the potential of well-designed DeFi tools while also highlighting the importance of tracking the performance of the underlying portfolio when considering future stability. By leveraging the returns inherent in the blockchain ecosystem, these innovative financial products offer a compelling alternative to traditional yield-generating tools.