First understand what Bitcoin layer 2 is

If you already know what Layer 2 is, you can skip this section.

The so-called Layer 2, the second layer of blockchain, this concept was first used on Ethereum as a way to expand capacity. Because the Ethereum chain was congested, the transaction volume exceeded the carrying capacity of the blockchain, and transaction traffic jams occurred. , the confirmation was slow, and the gas fee was so high, so we established another layer 2 chain, moved the transaction to layer 2 for execution, and then packaged multiple transaction information into one and submitted it back to the main chain for verification. In this way, the burden on the main chain can be reduced. Process more transactions faster and enjoy low gas fees.

Compared to Layer 2, the Ethereum chain is slow, but even slower than the Bitcoin blockchain. The Bitcoin blockchain generates a new block every 10 minutes on average, and processes an average of seven transactions per second (TPS is only 7). The Bitcoin blockchain is relatively young and does not support smart contracts and slightly more complex things (such as DeFi). Neither can be executed.

Bring the concept of Layer 2 to the Bitcoin blockchain. Bitcoin is very slow and does not support smart contracts, but Layer 2 can soon support smart contracts, transfer transactions to Layer 2, and then in some way By packaging the transaction data back into the Bitcoin blockchain for verification, the Bitcoin blockchain can be expanded to handle more transactions while still maintaining the security of the Bitcoin blockchain.

The concept is like this. In fact, each Layer 2 adopts different verification mechanisms, and there are still individual differences in security. It is recommended to choose the more well-known ones with higher TVL to participate in the interaction.

Simply put, Bitcoin Layer 2 is a new blockchain built around the Bitcoin ecosystem. Its purpose is to serve the Bitcoin ecosystem and make the ecosystem more active and rich .

They are faster, support more functions, and can do things that the Bitcoin blockchain cannot do (such as staking and DeFi) at a cheaper cost and faster speed, allowing us to hold more Bitcoins. There are many things to do, you can interact with more protocols, and bring in more elements of smart contracts.

Two picture sources: Bitcoin Layer 2 Stacks official website

Tools required to participate in Bitcoin Layer 2

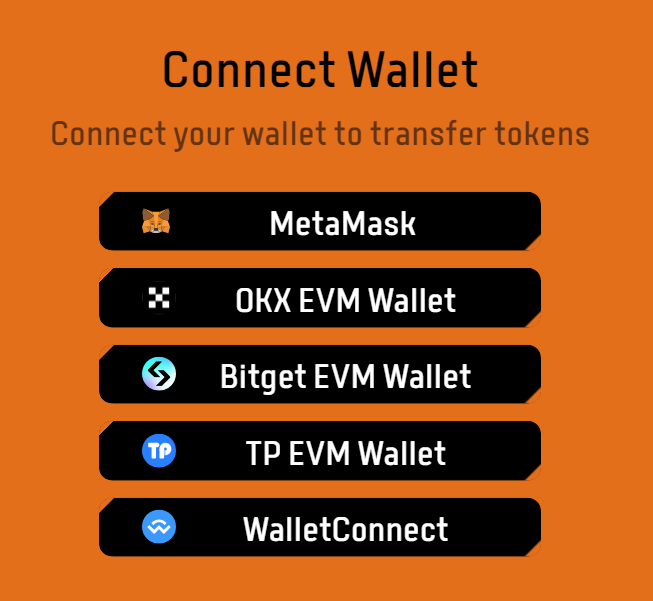

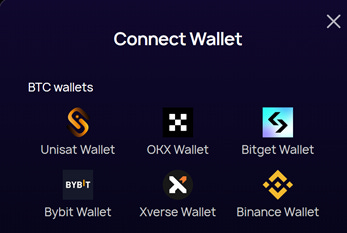

Nowadays, most Bitcoin Layer 2 supports both Bitcoin native and EVM. You can participate if you have a Bitcoin wallet (Unisat, Magic Eden Wallet or OKX wallet) or an EVM wallet (Metamask or OKX wallet) .

Bitcoin wallet tutorial! Introduction to Unisat, taking you through Ordinals and Bitcoin NFT ecology

No need for a private key? What is the MPC wallet of Binance and OKX exchanges? Is it safe?

The operation requires cross-chain transfer of assets to the layer 2 chain. For security reasons, it is recommended to use the cross-chain bridge officially recommended by each layer 2, which can be found on the official website of each chain .

What can I do on Bitcoin layer 2?

Basically, it is similar to what can be done on the general platform public chain. The difference is that Bitcoin has a higher presence in Bitcoin layer 2. There will be more things related to BTC, and it supports native Bitcoin or encapsulated Bitcoin (such as wBTC ), and will further support Bitcoin liquidity staking and re-staking tokens (Bitcoin’s LST/LRT) .

Q: Who is suitable to participate in Bitcoin Layer 2?

A: Two kinds of people

1 Already hold or want to hold Bitcoin-related assets (Bitcoin, Bitcoin derivatives), and want to increase asset activity to earn additional income.

2. I am optimistic about the development of the Bitcoin ecosystem and the possibility of airdrop opportunities or protocol token increases in the future. I want to be the first to participate in the Bitcoin ecosystem and interact more with ecological protocols.

Listed below are the protocols on the Bitcoin layer 2 chain that currently have the top four highest TVLs? What does it do? How to inquire about relevant information and participate? Relevant links will be placed ( it is recommended for first-time users to check the correctness of the links from multiple sources ) .

"Remarks: TVL numbers and protocols come from the well-known on-chain data platform DeFiLlama ."

1. BitLayer

Bitlayer is the first Bitcoin Layer 2 built on BitVM. It aims to provide the same level of security as the Bitcoin network, supports smart contracts, and has the fast and cheap features of Layer 2. The main differences from other Layer 2 It lies in technology, including the introduction of BitVM and DLC mechanisms.

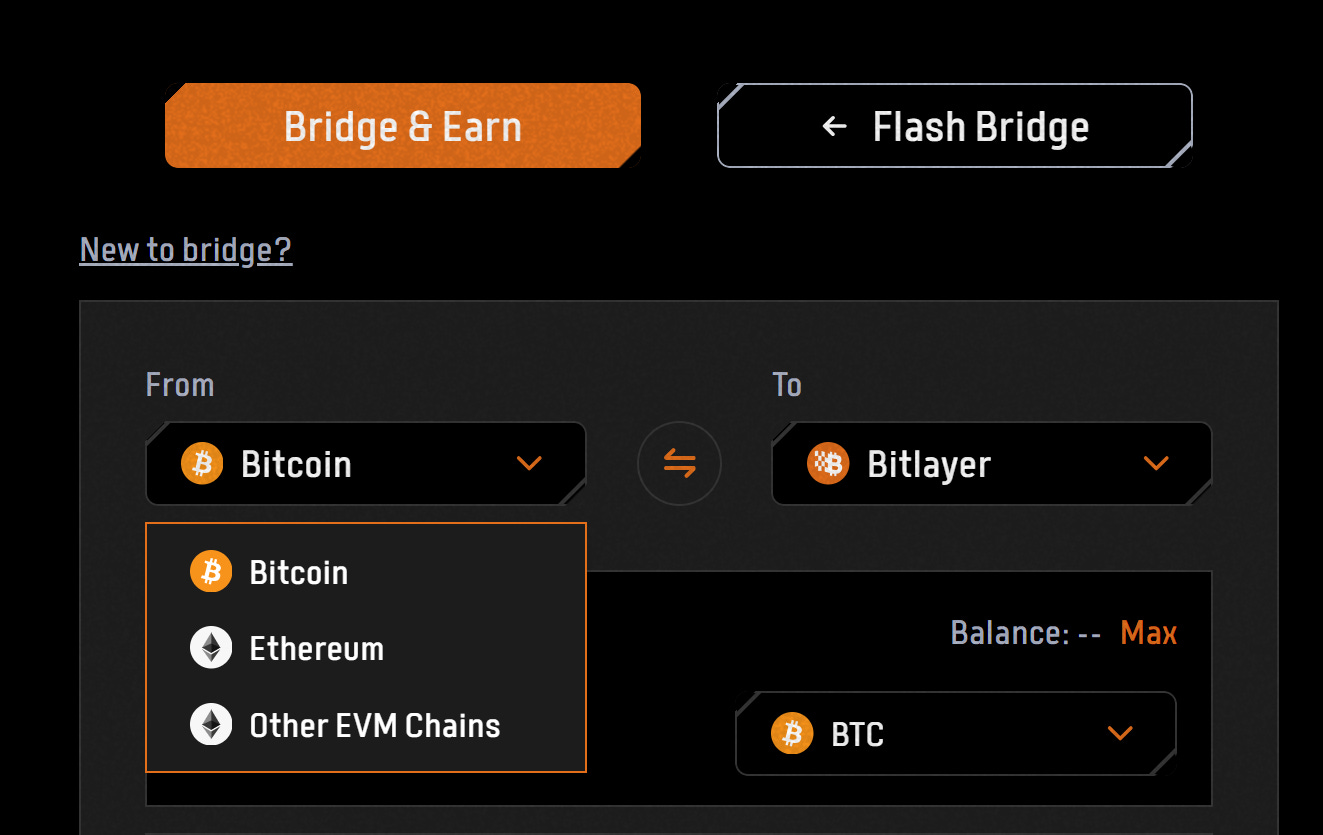

To transfer assets to the BitLayer chain, it is recommended to use the cross-chain bridge provided by the official website, which supports cross-transfer between Bitcoin and other EVM chains.

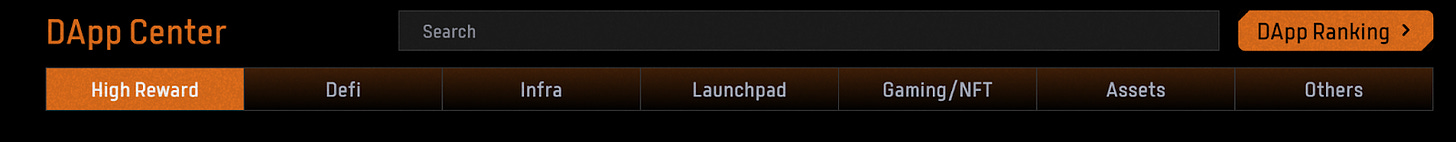

The official website has a list of DApps currently on the chain. It is recommended to compare the correct URL with multiple parties when using it for the first time.

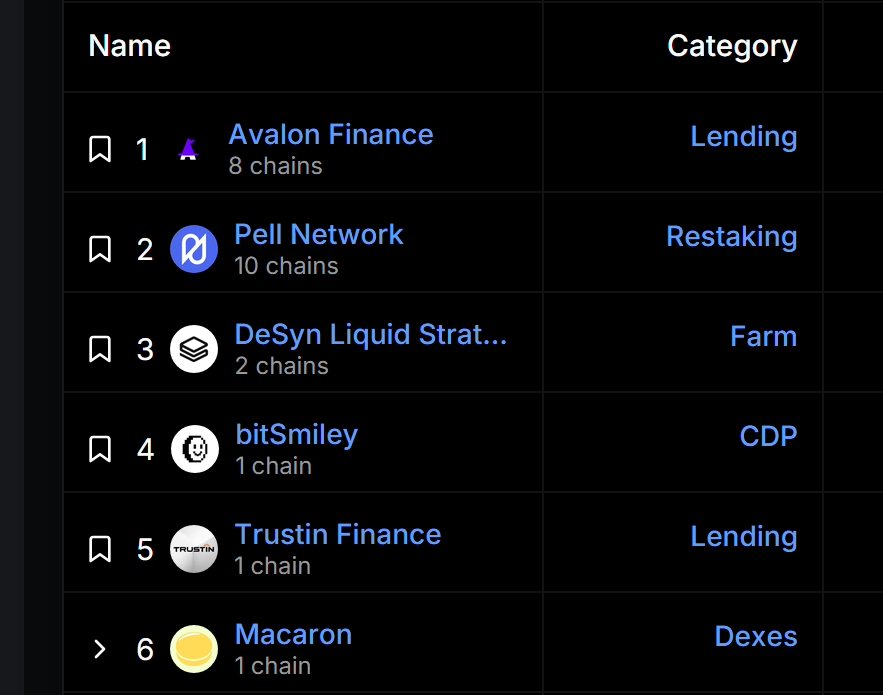

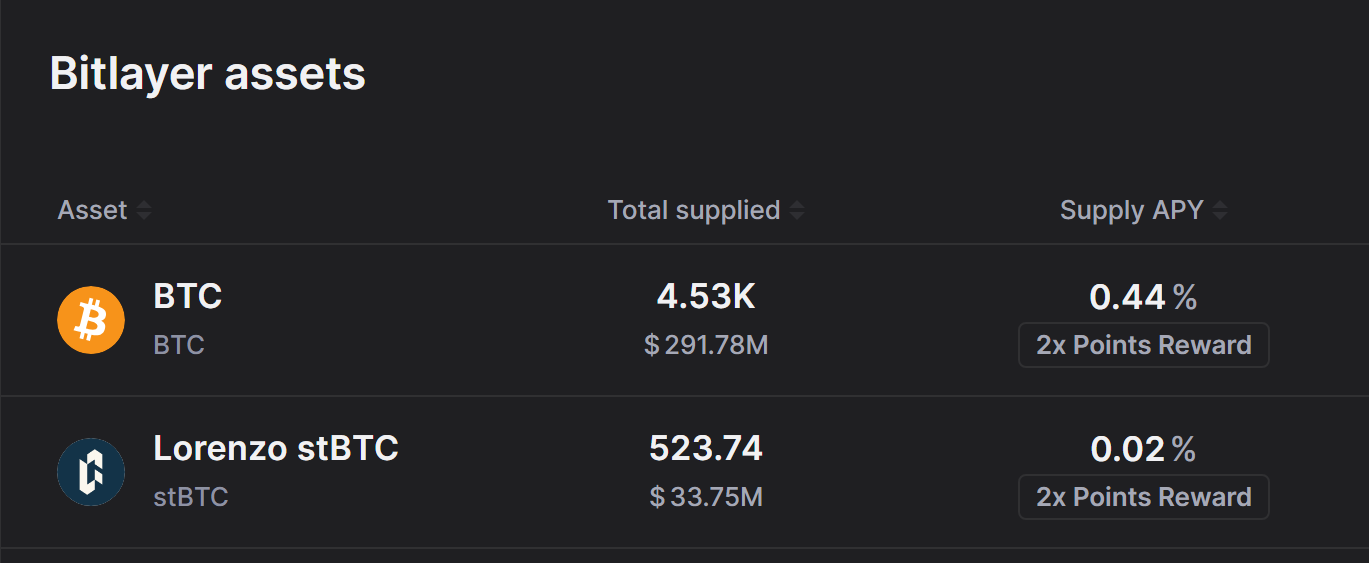

TVL’s top six agreements:

The top six in TVL rankings are basically DeFi protocols. These six include lending, re-pledge, yield farming, stablecoins and decentralized exchanges. The DeFi landscape is quite complete.

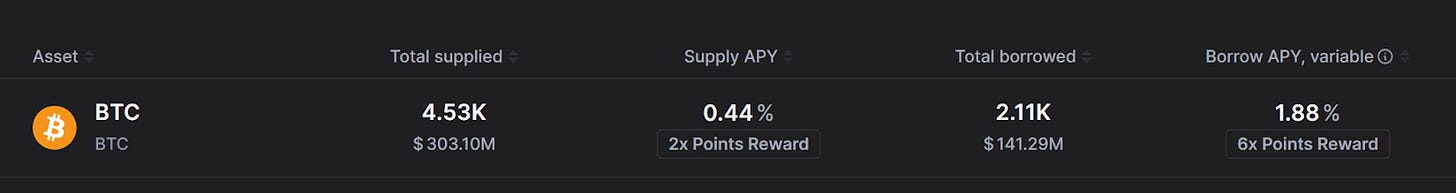

The gameplay is similar to common DeFi, such as BTC lending in the lending agreement Avalon Finance:

You can lend out your Bitcoin holdings in Avalon Finance to earn interest.

Extended reading: Merlin Network lending agreement Avalon Finance, points bonus activity is in progress|Airdrop tutorial

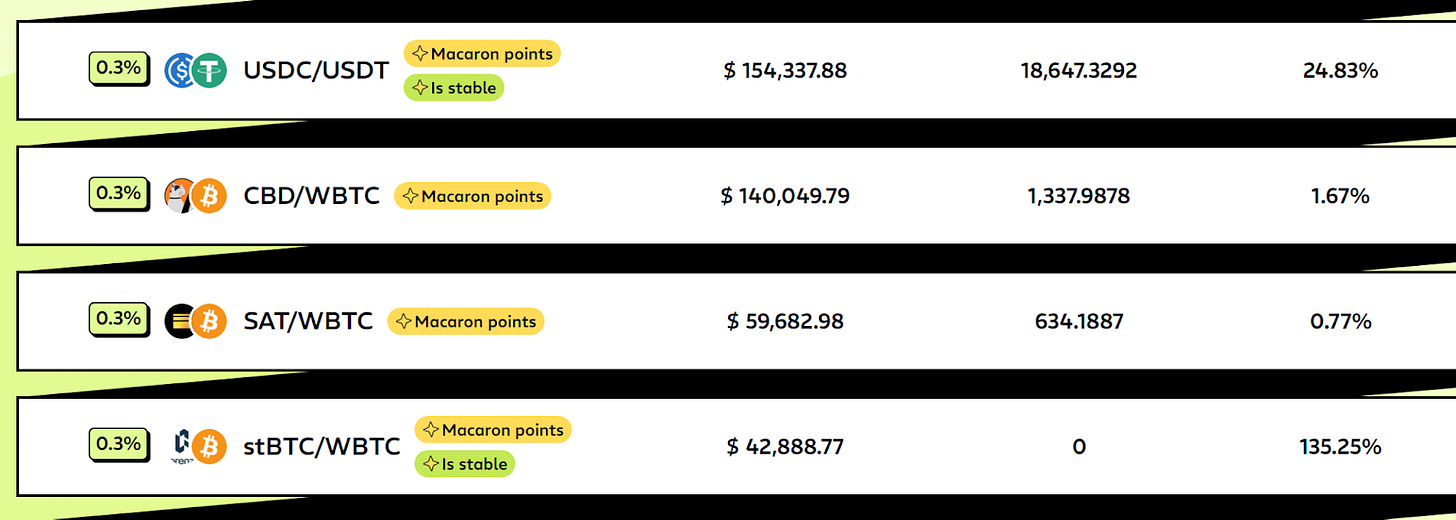

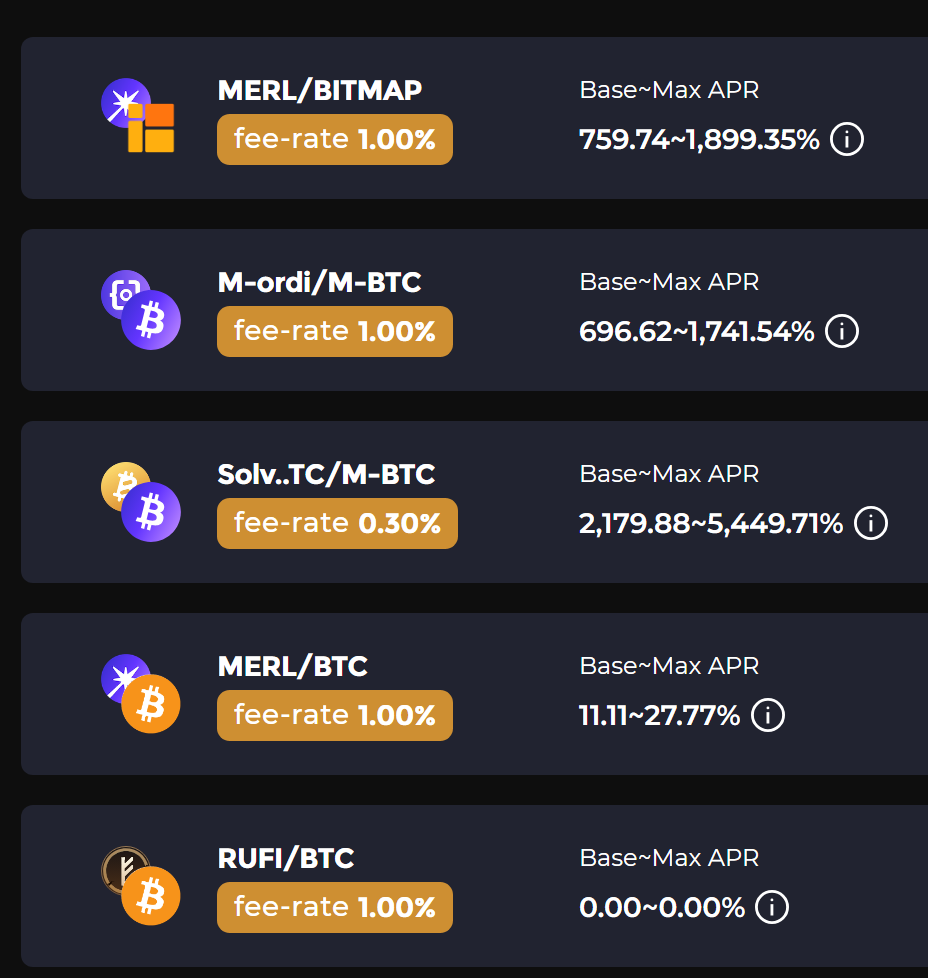

Or participate in liquidity mining on decentralized exchanges to earn income:

Anyone with a sharp eye should have noticed the "points" in these two pictures. Bitcoin Layer 2 is in hot development. Not only Layer 2 itself, but also most of these on-chain protocols are still in their early stages. Many of them have launched point airdrop activities. In the early days, Participating in the interaction can not only earn general DeFi benefits, but also earn additional points, which will lead to airdrop opportunities in the future.

Or there are some Game projects where you can earn points by playing games, or even log in daily to get points. You can find interesting projects in the DApp list to interact with.

Full introduction: Bitlayer - the first Bitcoin Layer 2 built on BitVM

2.Merlin Chain

Merlin Chain has gained a first-mover advantage in this round of BTC Layer 2. In addition to the old Bitcoin layer 2 Stacks, Merlin is the first to issue coins in the new batch of BTC Layer 2, with the largest ecological scale and the most implemented projects .

It mainly supports Bitcoin wallets, and you can use the currently more mainstream Unisat or wallets launched by exchanges (supporting more chains).

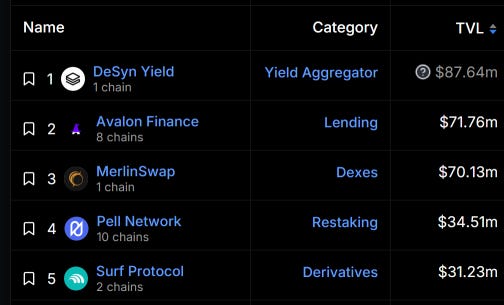

DApps on the chain include AI, DeFi, game, infra, launchpad, NFT, social and other categories. The top five protocols on the TVL ranking chain:

They are income aggregation, lending, decentralized exchanges, re-pledge, and derivatives. The gameplay is general DeFi. For example, the lending agreement Avalon Finance mentioned in the previous paragraph is also deployed in Merlin:

The Bitcoins you hold can be loaned out to earn interest, and the interest rates can be compared between different layer 2s. Earn income by participating in liquidity mining on decentralized exchanges:

There are also opportunities to get airdrop points here.

If you don’t have idle assets to participate in DeFi, you can play some mini-games and interact with AI in game-type protocols. Some can earn coins or points. The simplest ones include daily login points.

Links to each protocol or DApp can be found on the Merlin official website .

Merlin Chain complete introduction:

The much-anticipated Bitcoin Layer 2! Merlin Chain introduction, $MERL airdrop tutorial

3.Rootstock

The first EVM-compatible side chain on the Bitcoin network. The side chain is somewhat different from Layer 2. The main difference lies in the sovereignty and security levels, but it is still a member of the Bitcoin ecosystem.

This is an EVM chain, and a wallet that supports EVM, such as Metamask, must be used.

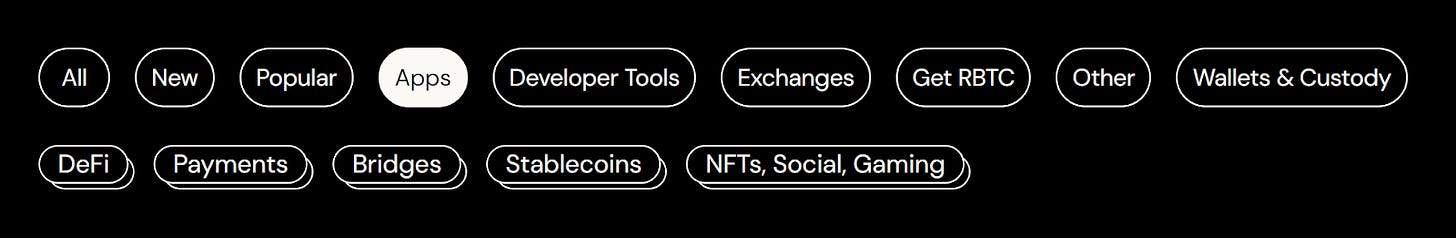

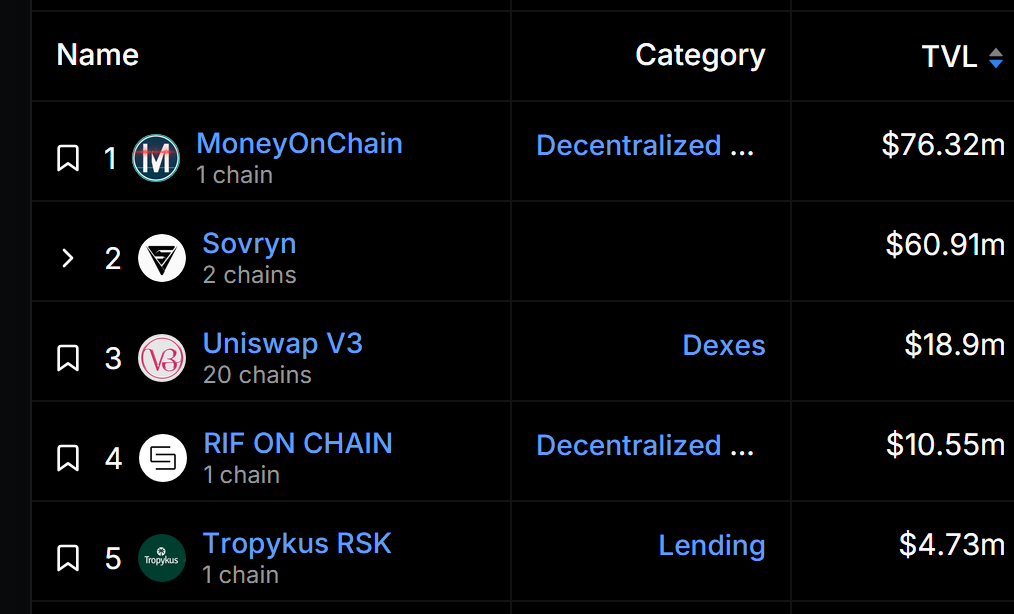

DApps on the chain include DeFi, Payments, Bridges, Stablecoins, NFT and other categories. TVL ranks the top five protocols on the chain:

Sovryn is a composite protocol that also provides multiple products such as DEX / Lending / staking. The top five protocols include stablecoins, DEX, Lending, etc.

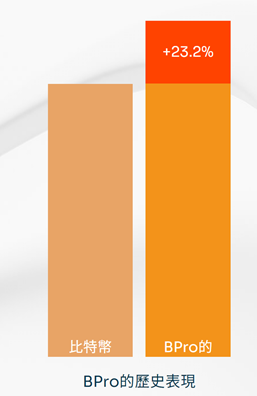

MoneyOnChain is an interesting but complex protocol. Simply put, it is a Bitcoin stablecoin protocol that creates a certain low leverage while maintaining the stablecoin price anchor. Coupled with the partial distribution of the protocol income, the corresponding token BPRO has set a long-term record. Outperforming native Bitcoin by 23%. BPRO is a composite token that is minted by locking Bitcoin. It is composed of Bitcoin itself + the leverage created by stablecoins + protocol income. It is another way to hold BTC for a long time and has the opportunity to obtain better results. performance.

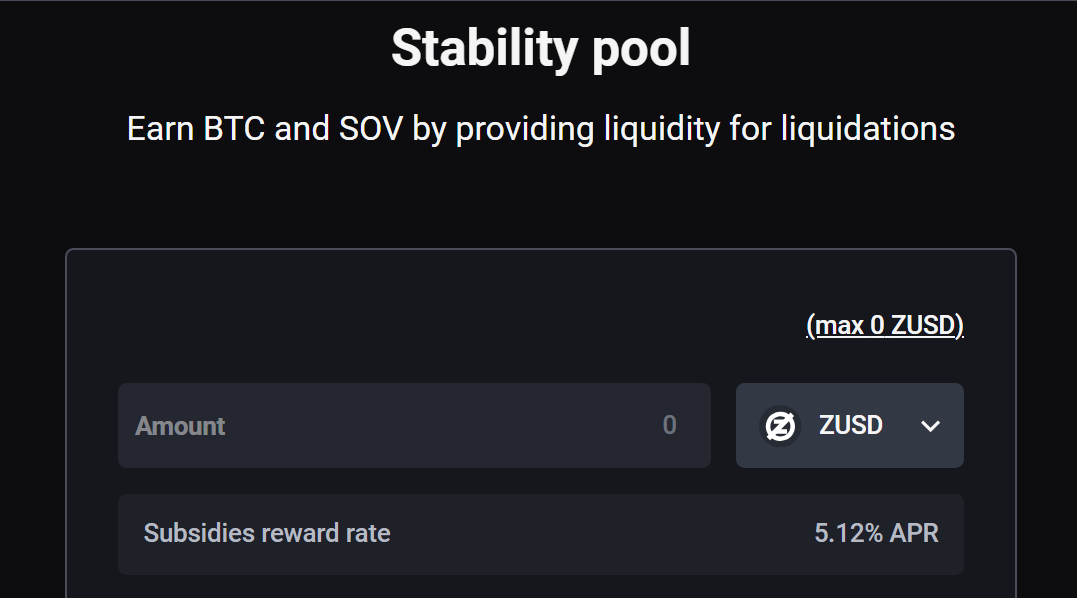

In addition to common liquidity mining and lending, other protocols can also provide stablecoin liquidity to earn BTC.

4.Mezo Network

Mezo is a Bitcoin economic application chain, developed by senior Bitcoin application developers with more than ten years of experience. The Thesis team has launched Fold, Keep Network and tBTC.

App Chain refers to App Chain. Unlike other platform public chains, App Chain only runs its own DApp and usually does not have other protocols on it.

It is still very early, and there are no other applications on Mezo . What you can do is very simple: deposit Bitcoin (BTC, tBTC, wBTC) and earn points. Currently, more than 10,000 people and more than 2,000 Bitcoins have participated.

For operation instruction, please see the complete introduction article:

The above briefly introduces what can be done on the top three Bitcoin layer 2 of TVL. Basically, it is similar to the protocols on other public chains. The main difference is that there will be more Bitcoin-related applications in Bitcoin layer 2, such as Bitcoin Coin lending, mortgage Bitcoin to mint stablecoins, etc.

The operation requires a Bitcoin native wallet or EVM wallet. Please refer to this QA again whether you are suitable to participate:

Q: Who is suitable to participate in Bitcoin Layer 2?

A: Two kinds of people

1 Already hold or want to hold Bitcoin-related assets (Bitcoin, Bitcoin derivatives), and want to increase asset activity to earn additional income.

2. I am optimistic about the development of the Bitcoin ecosystem and the possibility of airdrop opportunities or protocol token increases in the future. I want to be the first to participate in the Bitcoin ecosystem and interact more with ecological protocols.

Bitcoin layer 2 is more than these three. If you want to know more about Bitcoin layer 2, you can refer to this article:

Is the Bitcoin ecosystem more thunderous than rainy? Take you through the 10 existing BTC layer 2 ecosystems and funding amounts

If you want to have a more complete understanding of the entire "Bitcoin Ecosystem", please refer to this article:

Painlessly cross the Bitcoin ecosystem! Cross-chain bridge, infrastructure

Summary - In the past, if you were optimistic about Bitcoin, you could only buy and hold it - now there are interest rates and airdrops, so you can eat three things with one fish.

The Bitcoin ecosystem is still developing rapidly and is in its early stages. Bitcoin is the oldest, most well-known cryptocurrency with the strongest consensus. In the past, because the Bitcoin blockchain had low performance (TPS only 7) and did not support smart contracts, Bitcoin did not have many uses. Then the DeFi Summer broke out , NFT craze seems to have nothing to do with Bitcoin.

However, with the development of blockchain technology, Bitcoin can now be expanded through layer 2, modularization, etc. Basically, all past DeFi and various protocols can be directly moved to the Bitcoin ecosystem, and Bitcoin can also be liquid. Mining, loan interest collection, minting Bitcoin inscriptions, etc., or newer liquidity staking, liquidity re-staking, etc. For these applications that have been popular in other public chain ecosystems, the Bitcoin ecosystem is yet to be developed. Baodi, a market-proven model, can be expected to have strong explosive power in a new and untapped market. This is why since the second half of last year, more and more attention has been directed to the " Bitcoin Ecosystem".

This article is just a simple guide, allowing you who are not familiar with it to have a preliminary understanding of the Bitcoin ecosystem. If you want to further participate or track more Bitcoin ecological news:

▌Research and discuss with the Biyan community. Welcome to join the daily Biyan Chinese exchange group !

▌Subscribe to the daily Coin Research e-newsletter (one article per week to quickly understand market conditions, on-chain data and potential project developments)