Written by: Bai Ze Research Institute

Appchain

SVM Rollup

Sidechain

External link expansion

Bai Ze Research Institute is honored to complete this research with Solana's top AI Agent project HajimeAI⬇️

In 2017, the new “ETH Killer” Solana emerged.

Co-founder Anatoly Yakovenko was responsible for the development of operating systems at Qualcomm and Dropbox, and holds two patents for high-performance operating systems. He created Solana's high-performance underlying framework. When developing Solana, he first proposed the Proof of History consensus mechanism, which greatly improved the speed and efficiency of transaction processing by introducing timestamps on the chain.

Co-founder Raj Gokal is the promoter of the Solana ecosystem, the main supporter of the Saga mobile phone, the investor of DePIN and AI projects such as Helium and Render, the initiator of Solana Summer, and the representative of Solana attending offline events to promote its selling points. Gokal's business acumen and operational capabilities are an indelible part of Solana's success.

Solana is excellent both technically and commercially .

After the mainnet was launched in 2020, the Solana ecosystem expanded rapidly, attracting hundreds of DeFi and NFT projects to create and settle in just one year. By the way, I suddenly remembered that Solana ICO was 0.22U, which is 1180 times higher than the historical high price of 260U. Then, according to the private placement round of 0.04U, it is about 6500 times. VCs made a lot of money.

Due to the bankruptcy of FTX and the network outage, the community has suffered from FUD. The market value and TVL have fallen to the lowest point, and the price has fallen by as much as -96%. However, it is precisely because of the Foundation's persistence in the bear market, optimizing network stability and launching Grants to continue to attract developers that Solana has become so popular today.

Various data indicators on the Solana chain have developed rapidly in the first half of this year, especially in the fields of DeFi, infrastructure, DePin/AI, consumer applications, etc.

Why does Solana need L2? After all, it is still the pinnacle of TPS in Web3. Solana's 1000+ TPS remains the leader among all L1 and ETH L2!

The simplest explanation is that it is the same as Ethereum L2, capacity expansion.

As Solana takes off, the test of network performance is coming one after another. The increase in adoption rate, the prevalence of airdrops and Memecoin, and the batch initiation of transactions by bots have led to a significant increase in transaction volume, and frequent problems such as user transaction failures and high handling fees due to priority fees. If you buy a token on DEX at the right price and then receive feedback that the transaction failed, do you have a headache? When the transaction peaks, the handling fees become higher. Can you accept it?

I think it’s acceptable. This kind of user experience is harmless to Web3 users, as they have already gotten used to it when using the Ethereum main chain.

So why does Solana still need L2? After all, the Foundation is also developing new things to expand Solana vertically, such as Firedancer.

The most important factor is that Solana L2 is a bottom-up movement initiated by application developers.

Everyone should remember a time node, 2024/03/20, which is the time when the Solana L2 narrative really aroused widespread discussion.

DRiP is the top NFT distribution platform on Solana. Even if you haven’t used it, you’ve often seen this name in the Phantom wallet. DRiP distributes millions of NFTs to thousands of wallets every week. However, with the rise in SOL prices and network congestion, DRiP’s weekly on-chain costs are as high as $20,000.

At this point in time, DRiP founder Vibhu opened up a topic that needs to be discussed urgently, "Does Solana need L2?":

Solana will and needs to have L2s or Rollups. I don’t think they will behave exactly like the Ethereum ecosystem, but there will always be large-scale application builders who want higher TPS, less competition for block space, lower fees, and want to own more of the economics generated by their business.

Pay attention to several key words in this paragraph: application builders, higher TPS, more economic benefits

In other words, chain parameters can be customized. Isn’t this the narrative logic of Appchain?

Yes, this is what Solana’s oracle protocol Pyth has already done. Pythnet is the Appchain of the Pyth protocol. Looking through Twitter, it should be the first Appchain to adopt SVM. Using the high throughput and low latency properties of SVM, Pythnet acts as the computing layer of Pyth, which can aggregate pricing data at sub-second speeds and pass it to other chains.

Appchain is like a fork of Solana, with the same SVM environment and the same architecture. The difference is that in order to meet certain application scenarios, developers have the authority to control the infrastructure, customize the consensus mechanism , and specify the validator set . Take Pythnet as an example, it uses the PoA (Proof of Authority) consensus mechanism, selects its own trusted validators, and adjusts the transaction processing and data update frequency according to specific needs.

It is not interoperable with the Solana main chain, which means that even if Solana encounters a transaction peak, it will not affect the performance of Appchain. The disadvantage is that assets are not interoperable and require cross-chain.

Therefore, Solana's Appchain is a product developed by application developers to meet certain application scenarios or needs, and is supported by the Solana Permissioned Environments (SPEs) of the Solana Foundation.

In addition to Pythnet, Cube Exchange and Hyperliquid are also Solana Appchain. The future trend of Solana dApps will have a bit of a <application=application chain> feel. At the very least , dApps that require timeliness, high transaction volume, and a certain base of users will need their own Appchain .

Now Solana L2 has another one, which is a popular one recently, SVM Rollup

Like Ethereum's Rollup, both reduce the burden on the main chain by batch processing a large number of transactions before submitting them to the main chain; both rely on the security of the main chain to ensure the validity of transactions and prevent fraud.

Different from Appchain, SVM Rollup is more like a traditional ETH Layer2, where the state root is stored on Solana and the data is stored on Rollup. It can accommodate a variety of dApps and users.

Projects to watch include: ZetaX, ZetaX (developed by Zeta Markets), Sonic, Grass, and Mantis.

The new Solana L2 form in the past few weeks is Sidechain, which is a bit like a combination of Appchain and Rollup. This type of project puts a lot of computation on the sidechain, but uses Solana as the base layer to verify the Merkel Root. Like Appchain because the sidechain uses a dedicated consensus mechanism, like Rollup because the sidechain also inherits Solana's security.

Projects you can pay attention to include: HajimeAI

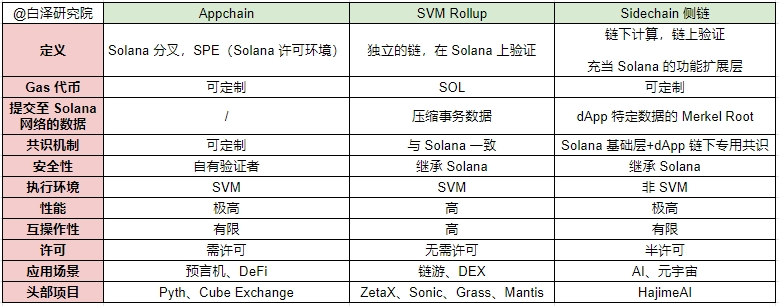

We have made a comprehensive comparison in the table below

It is worth mentioning that there is another L2 based on SVM, which is an external chain extension system. As the name implies, SVM is moved to another chain. But I think it cannot be called Solana L2. In fact, it is a bit like various EVM chains (SVM chains). Representative projects include Eclipse, Nitro, and inSVM. The corresponding names should be Ethereum L2, SEI L2, and Injective L2.

It seems that whether it is Appchain, SVM Rollup, or side chain, they are more targeted at application developers with high-frequency transactions.

Since Appchain is a dedicated chain for specific applications and has low interoperability, it may be easier for it to gain attention than projects like Sonic, ZetaX, Grass, and HajimeAI that claim to be "Solana's first xx track Rollup."

Sonic - Solana’s First Game Rollup Infrastructure

ZetaX - Solana’s First DeFi Rollup

Grass - Solana’s First AI Data Rollup

Mantis - Solana’s First Intent-to-Trade Rollup

HajimeAI - Solana’s First AI Sidechain

First, Sonic attracted attention with its airdrop after financing, and then Web3+AI projects such as HajimeAI began to deploy L2. Regardless of the actual needs, Solana has ushered in the L2 moment and is worthy of long-term attention.

For an analysis of the potential projects in the three categories of Solana L2, namely Appchain, SVM Rollup, and Sidechain, as well as their application scenarios, technical architecture, and potential opportunities, please check the updated "Solana L2" track table in the VIP group.