Author: Lao Bai, ABCDE partner Source: @Wuhuoqiu

Since Ordi ignited the BTC ecosystem, BTC C has actually quickly followed the path that ETH once took - first popularizing on-chain assets (similar to ERC20), then expansion solutions (Rollup), and then Staking/Restaking. However, since BTC does not have leaders like ETH Foundation and Vitalik to guide the direction, the BTC ecosystem presents a situation of "letting a hundred flowers bloom", or "let a hundred flowers bloom (zao)".

The explosion and rapid cooling of on-chain assets

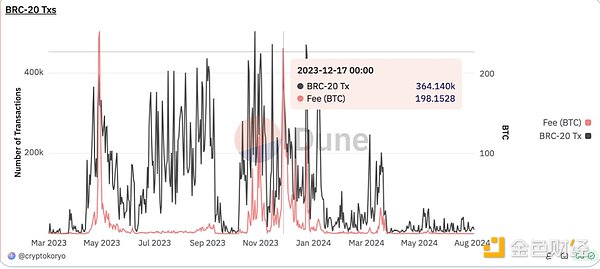

On the asset side, Ordinal was the first to cause a craze, followed by various XX20 tokens such as Brc20, Arc20, Src20, and Orc20. Last year, many people were optimistic that the problem of BTC's security model would be solved, especially when the block reward after the halving was reduced to a negligible level, and on-chain transactions required sufficient fees to pay miners. However, although the inscription new activity at the end of last year caused the fee to exceed the block reward for a time, and even reached 300BTC in a day, by August, the daily fee income dropped sharply to only 0.x BTC. Rune was also briefly popular in April and May, and then quickly died out.

It can be said that BTC has gone through the ICO boom of ETH in 2017 and is now entering the expansion solution stage represented by Merlin. Similar to the practice of Polygon (originally called Matic), some projects in the BTC ecosystem first use ETH's EVM technology stack + a multi-signature side chain to run.

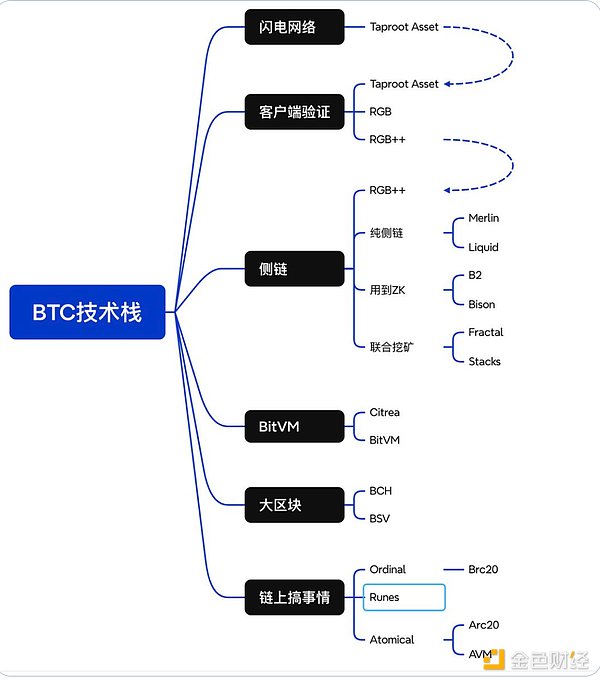

Unlike the Rollup solution officially promoted by ETH, BTC has a wide variety of expansion solutions and more diverse technical routes. It is difficult to predict who will win in the future. For ease of understanding, a simple diagram is drawn, which also includes on-chain assets as part of the expansion technology.

Currently, Taproot Asset only supports the transfer function. The most "BTC-native" expansion solution is undoubtedly RGB (expected to be launched on the mainnet in September). RGB++ and UTXO Stack, as well as Unisat's Fractal, have also received widespread attention recently. In addition, a route is missing from the diagram, which is a contract virtual machine expansion similar to layer 1.5. The representative project is undoubtedly Arch Network, and the recently mentioned OP_NET is also included, but Arch uses ZKVM, while OP_NET uses WASM.

Since the technical stack of the expansion plan is extremely messy and even more complicated than the situation of on-chain assets, it is hard to say who will win in the end. There is also a pessimistic view that these directions may all be falsified in the end. After all, the current main narrative of "electronic gold" does not require expansion, and expansion is more for the service of "on-chain assets". If the on-chain asset route cannot rise, expansion will naturally lose its meaning.

Phase 3: The Rise of Staking/Restaking

Compared with the first two directions, the Staking/Restaking route appears to be more solid, because it does not conflict with the narrative of "electronic gold" at all, and is even a perfect complement - releasing the liquidity of gold and turning gold into an interest-bearing asset!

At this stage, the most important project is undoubtedly Babylon. Unlike ETH, which naturally has POS income, BTC does not have a similar mechanism. With the existence of Lido, EigenLayer's Restaking narrative is more like a booster or icing on the cake for ETH. Babylon is a timely help for BTC. It re-stakes through trust minimization to generate income, making BTC no longer an interest-free "gold".

In addition, there are two projects worth mentioning: Solv and DLC.Link. The former provides interest and liquidity for BTC in the form of Cefi+Defi, while the latter uses DLC technology to cast dlcBTC. In the context of WBTC suffering from a trust crisis, it provides a decentralized and secure version, allowing BTC to participate in the Defi ecosystem on chains such as ETH and Solana.

Back to Babylon with Lorenzo

Babylon is undoubtedly targeting the ecological niche of EigenLayer, and the ecological niche of asset entrance is also crucial. On the EigenLayer side, there are projects such as Etherfi, Renzo, and Puffer, while on the Babylon side, there are Solv, Lombard, and Lorenzo competing for the entrance.

The differentiation of each company is more significant than EigenLayer's LRT project. For example, Solv not only has income on Babylon, but also has various cooperative incomes in Cefi and Defi. Lombard has an advantage in capital and resources. Its issued LBTC uses CubeSigner (a professional non-custodial key management platform) and Consortium (a quasi-alliance chain network composed of industry leader nodes) to achieve a balance between security and flexibility. Lorenzo integrates Pendle's principal and interest separation function, provides two liquidity pledge tokens, stBTC and YAT, and provides users with a dual incentive system. At present, Lorenzo's total limit is 250BTC, and there is still capacity for dozens of BTC. It is expected to be full soon, first come first served.

Conclusion

Compared with the assets and expansion direction of BTC chain, the interest generation/liquidity release of BTC is a more practical and promising direction. We can see clues from Binance's layout in this direction, especially the investment in asset entry. Among the projects mentioned above, Renzo, Puffer, Babylon, Solv and Lorenzo have all been invested by Binance. Therefore, this track deserves our high attention!