The fundamental purpose of trading is survival, and profit comes second. I hope you can understand that I am an academician of the crypto and a warrior who has been protecting leeks. I wish my fans to achieve financial freedom in 2024. Let’s cheer together!

Crypto Academician: 2024.8.22 Bitcoin (BTC) Latest Market Analysis Reference

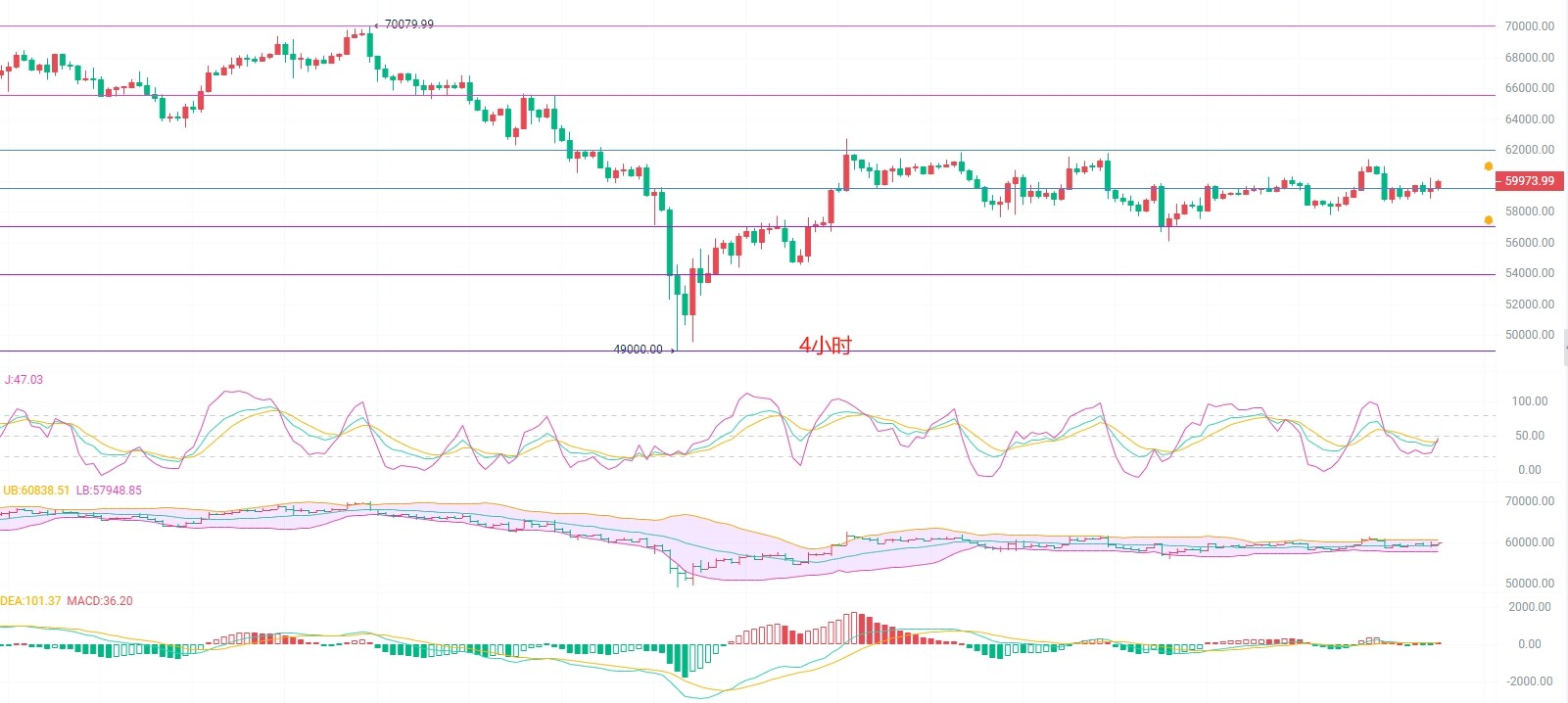

It is 2:30 am Beijing time now. The current price of Bitcoin is 60,000. The lowest point in 24 hours is around 59,000. The support below is effective. From the overall trend, our multi-order layout at 57,000 is the best entry point. The subsequent second bottoming out at 58,200 is also the second best entry point. It has been hovering below the 60,000 mark for a week. The bottom accumulation time is enough. This time, if the impact does not break the previous high, leave the market. If it breaks, continue to hold the target to look at the resistance point above 63,000.

The long-term pressure point is 62,000, the short-term resistance is 60,000, and the support point is 58,300. The daily K-line is currently shrinking, and the bottom divergence has increased. 59,000 has changed from the original resistance to the current support. This week is Thursday. If the impact does not break the previous high, you can stop profit and exit in advance. If it breaks, look at 63,000.

The four-hour and two-hour ultra-short trend K-lines have formed a golden cross, especially the four-hour fast line broke the EMA trend indicator and stood on the high point. The KDJ has a momentum of spreading upwards, plus the MACD increase mode, plus the 2-hour market trend continues to increase at the 59,000 mark. The overall trend is mainly bullish. The idea is to continue to hold long orders. The goal is to see whether the previous high can be broken. If it is not broken, leave the market. If it is broken, the goal remains unchanged.

Reference is as follows: Continue to hold at more than 57,000 on August 16, enter the market at more than 58,200 on August 19, stop loss point is 57,700, target is 61,500 to 61,800 range, if the pressure is not broken, then take the profit, if it breaks, then look at 63,000 to 63,500

The specific operation is based on the real-time data of the market. For more information and details, please contact the author. There is a delay in the release of the article. The suggestions are for reference only and the risks are borne by the user.

This article is exclusively contributed by the academician of the crypto, and only represents the exclusive views of the academician. There are in-depth studies on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the time of article push, the above views and suggestions are not real-time, for reference only, at your own risk, please indicate the source for reprinting, and reasonably control the position when making orders, and do not operate with heavy or full positions. The academician also hopes that all investors understand that the market is always right. If you are wrong, you should summarize your own problems and don't let the profits that should have been obtained fly away. There is no need to be smarter than the market in investment. When the trend comes, respond to it and follow it; when there is no trend, observe it and be quiet. It is not too late to wait for the trend to finally become clear before taking action. Tomorrow's success comes from today's choice. God rewards diligence, earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards heart. Gains and losses are inadvertent. Develop the habit of strictly taking stop loss and stop profit for each order. The academician of the crypto wishes you a happy investment!