Ethereum’s price performance has outperformed Bitcoin, especially when looking at timeframes since inception, halvings, and bullish periods. However, ETH has been underperforming since the bear markets of 2018-2019 and 2022-2023. In halving 2024, Ethereum fell significantly behind Bitcoin for the first time. In fact, it has been underperforming Bitcoin for the past three years.

ETH/BTC ratio drops to 3.5-year low

Fractals are the concept of similar patterns repeating over different time frames, and while it’s not a foolproof way to predict future outcomes, it provides valuable context for what might happen in the future.

In previous halving years, the ETH/BTC ratio broke below support around September to December, but began to rise in the first quarter of the subsequent bull run. 2024 could see a similar situation as Ethereum breaks support once again. However, this time the situation is more worrying. Unlike previous halving years, when support was relatively new, the current support level of 0.05 has remained strong for the past 3.5 years, suggesting a more bearish outlook for Ethereum.

Another point of comparison is 2019 when the Fed began cutting interest rates, a move that could happen again in September 2024. Back in 2019, the ETH/BTC ratio fell 22% from the time the Fed started cutting rates to the time it stopped.

In all of these cases, not only did the ratio decline, but the price of Ethereum itself underperformed, with the exception of 2020. However, the key question is not just whether the price is going up or down; it is also whether holding Ethereum is a better investment decision. History shows that in similar situations, holding Bitcoin has proven to be the more favorable option - a trend that will likely continue in 2024.

VX:ZLH1156

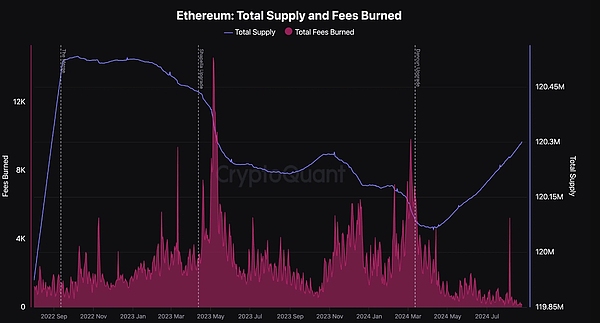

Ethereum supply reverses, triggering inflation

The supply of Ethereum has been steadily decreasing since the 2022 merger. The reduction in Ethereum's supply is achieved through a mechanism called "burning," which was introduced in August 2021 with Ethereum Improvement Proposal (EIP) 1559. Basically, a portion of transaction fees paid in ETH are burned or permanently removed from circulation. This reduces the total supply of ETH over time, especially during peak network activity when transaction fees are higher.

The reason why the supply of Ethereum began to decline after the merger in 2022 was the network's transition from a proof-of-work to a proof-of-stake consensus mechanism. Under PoW, new ETH was constantly issued to miners as a reward for validating transactions, which helped to increase the total supply of Ethereum. However, with the merger and the transition to PoS, the issuance of new ETH has decreased significantly, as validators who now secure the network receive much lower rewards than miners.

The Dencun upgrade in March 2024 marked a turning point, reversing this deflationary trend and making Ethereum’s supply inflationary again. It introduced primitive danksharding and “blobs” that optimize data storage and reduce transaction fees on layer 2 networks. While Dencun improved scalability and made transactions more cost-effective, it also led to a significant reduction in the amount of ETH burned, which has been a key factor in keeping Ethereum’s supply deflationary.

As a result, the supply of Ethereum has begun to increase, and the number of ETH in circulation has exceeded 213.5K since the Dencun upgrade. In comparison, the supply of Ethereum is now at the same level as in May 2023.

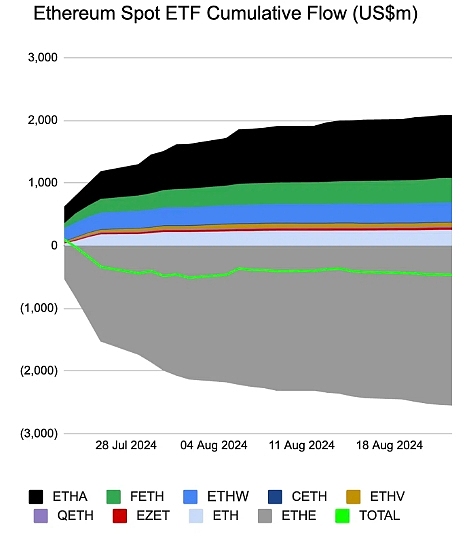

Negative ETF inflows continue

The approval of an Ethereum ETF would boost ETH by increasing demand and pushing up prices, but so far this has not been the case. Instead, ETF outflows have become a concern, with a total of $465 million in outflows since trading began. The main driver of this trend has been Grayscale's ETHE, which has seen large outflows, overshadowing the positive inflows of other Ethereum ETFs. The scale of ETHE outflows is so large that it has a net negative impact when considering all Ethereum ETFs.

An Ethereum ETF holds a certain amount of Ethereum, with each share representing a small fraction of the total amount of Ethereum it holds. When many investors want to buy ETF shares, demand may push the price of ETF shares above the actual value of the underlying Ethereum. In this case, authorized participants (APs), large financial institutions that work closely with ETF providers, step in. APs buy ETH on the open market and exchange it with the ETF provider for new ETF shares, which they then sell to investors in the market at a higher price, making a profit. This process increases the supply of ETF shares, helping to bring the stock price back in line with the value of the underlying assets.

Conversely, when ETF demand is low, the price of its shares may fall below the value of the underlying Ethereum. At this point, APs buy undervalued ETF shares from the market, return them to the ETF provider, and exchange them for Ethereum. They can then sell Ethereum at a higher price on the open market, profiting from arbitrage. This reduces the supply of ETF shares and helps the price get closer to the value of the underlying Ethereum.

In short, APs selling ETH when redeeming ETF shares may be one of the reasons why ETH prices fell and are difficult to recover.

in conclusion

While current data may indicate a bearish outlook for Ethereum, it remains a fundamentally strong asset. The number of active addresses on its mainchain and layer 2 networks continues to increase. Ethereum still leads the blockchain industry, taking the top spot in total locked value (TVL) for DeFi platforms, and many projects are being developed in its ecosystem. In addition, Ethereum continues to undergo regular development and upgrades.

However, considering the current market conditions and continued ETF outflows, Ethereum may not be the best investment in the short term, especially during the rest of 2024. However, looking ahead to 2025, starting in the first quarter, Ethereum may regain momentum and could once again outperform Bitcoin in terms of returns, as it did in previous market cycles.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156